Search Market Research Report

Big Data Security Market Size, Share Global Analysis Report, 2024 – 2032

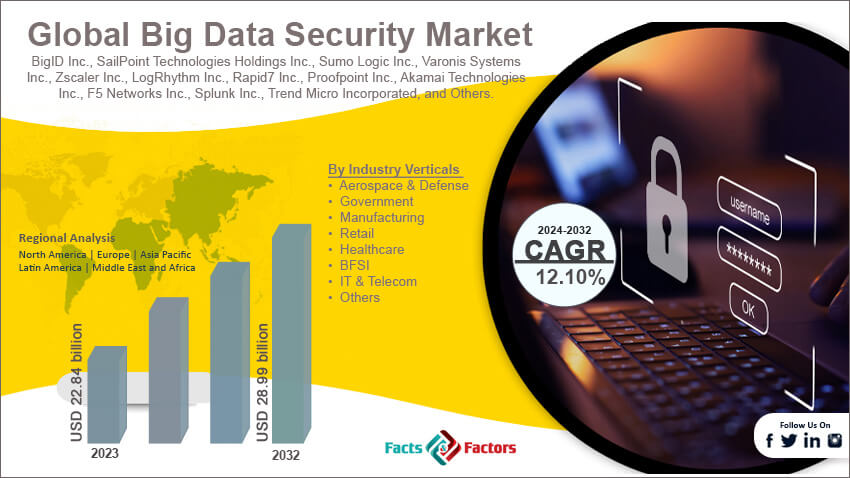

Big Data Security Market Size, Share, Growth Analysis Report By Industry Verticals (Aerospace & Defense, Government, Manufacturing, Retail, Healthcare, BFSI, IT & Telecom, And Others), By Enterprise Sizes (Large Enterprises And Small & Medium Enterprises), By Deployment Modes (Cloud And On-Premises), By Components (Data Security Analytics, Data Governance & Compliance, Data Authorization & Access, Data Auditing & Monitoring, Data Encryption, Data Discovery & Classification, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

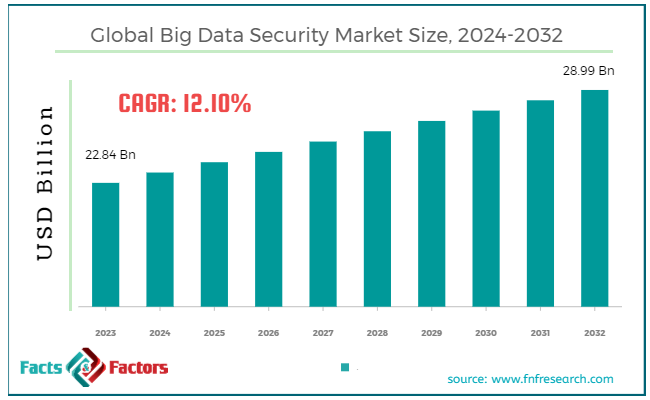

[216+ Pages Report] According to Facts & Factors, the global big data security market size was valued at USD 22.84 billion in 2023 and is predicted to surpass USD 28.99 billion by the end of 2032. The big data security industry is expected to grow by a CAGR of 12.10% between 2024 and 2032.

Market Overview

Market Overview

Big data security is a set of technologies, practices, and policies made to protect large skill data sets from unauthorized access. Big data security tools emphasize integrity and confidentiality of the available data across complex infrastructures like on-premise, cloud, or hybrid environments.

A huge amount of data is generated from different sources, and therefore, there is a high requirement for big data security solutions in the market. It helps mask data, thereby obscuring sensitive information to help prevent users from having a real-time view of data. Also, it helps with data auditing and monitoring to check for unauthorized activities and policy violations in the organizations.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global big data security market size is estimated to grow annually at a CAGR of around 12.10% over the forecast period (2024-2032).

- In terms of revenue, the global big data security market size was valued at around USD 22.84 billion in 2023 and is projected to reach USD 28.99 billion by 2032.

- Growing cyber threats are driving the growth of the global big data security market.

- Based on the industry verticals, the manufacturing industry segment is growing at a high rate and is projected to dominate the global market.

- Based on enterprise sizes, the large enterprises segment is anticipated to grow with the highest CAGR in the global market.

- Based on the deployment modes, the cloud segment is projected to swipe the largest market share.

- Based on components, the data auditing & monitoring system segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing cyber threats are driving the growth of the global market.

Increasing number of cyber-attacks is the major reason for the high growth rate of the global big data security market. However, nowadays, cyber-attacks are more advanced inside threats and data breaches that are encouraging organizations to invest in advanced security solutions.

Additionally, the growing scope of big data technologies in the market is further expected to revolutionize the industry. Data analytics offer deep insights and help in decision-making, thereby contributing heavily towards the growth of the market. The global shift to cloud computing is another major factor fueling the growth of the market.

Organizations are taking their operations over the cloud for flexibility, scalability, and cost efficiency. Developments in IoT and AI-powered devices are further anticipated to support the growth trajectory of the market in the coming years. For instance, Google Cloud came up with two new offerings, Assured Workloads, and Confidential VMs, in 2020 to help customers with advanced security tools.

Restraints

Restraints

- High implementation costs are likely to hinder the growth of the global market.

Deploying advanced big data security solutions involves high operation costs and upfront investments in hardware, software, and other infrastructure. Therefore, it is expected to hinder the growth of the big data security industry during the forecast period. Moreover, many organizations do not have enough budget to afford such solutions.

Opportunities

Opportunities

- Strict privacy regulations are expected to foster growth opportunities in the global market.

Regulatory bodies are implementing strict data protection laws to protect consumer rights and their data, which is a major factor expected to foster growth opportunities in the global big data security market.

Such regulations mandate organizations adopt proper security measures to comply with data security regulations. The surge in data volumes from different sources like customer transactions, social media, and many others is boosting the need for big data security solutions in the market.

Growing demands from BFSI, healthcare, and the government sector for strong security solutions are further expected to support the growth of the industry. For instance, Microsoft and Oracle collaborated with each other in 2020 to come up with a new cloud interconnection in the Netherlands.

Challenges

Challenges

- Resistance to change is a big challenge in the global market.

Many organizations are reluctant to adopt new security practices, which is a big challenge in the big data security industry. Implementing the advanced big data security solutions will require changes in existing workflows and systems. It may also need to revise policies and conduct employee training, which further slows down the growth of the industry.

Segmentation Analysis

Segmentation Analysis

The global big data security market can be segmented into industry verticals, enterprise sizes, deployment modes, components, and regions.

On the basis of industry verticals, the market can be segmented into aerospace & defense, government, manufacturing, retail, healthcare, BFSI, IT & telecom, and others. The manufacturing industry segment accounts for the largest share of the big data security industry during the forecast period.

Manufacturers are increasingly inclining toward industry 4.0 technology to protect their critical operations. Integration of IoT devices in manufacturing plants helps with potential risks to secure data and protect against cyber breaches.

However, the increasing complexity in supply chains facilitates data exchange between stakeholders, and therefore, there is a need for new technologies to maintain integrity and confidentiality to boost demand for big data security solutions.

On the basis of enterprise sizes, the market can be segmented into large enterprises and small & medium enterprises. Large enterprise segment is likely to dominate the global big data security market during the forecast period. Large enterprises generate huge amounts of data across different departments and geography, which is a major reason for the high growth rate of the segment. Big companies need to protect their sensitive data. Such organizations adopt robust security measures to eliminate any possible vulnerabilities.

Additionally, there is a rising chance of cyber-attacks because of the high-profile nature of these companies, which makes them prime targets for hackers. Large enterprises are needed to comply with strict regulations to protect intellectual property, consumer data, and operational information.

Also, these organizations have enough resources and budgets to deploy advanced security tools and cutting-edge technologies. These companies have global operations and, therefore, need data protection from cyber threats.

On the basis of deployment modes, the market can be segmented into cloud and on-premises. Cloud deployment is the fastest-growing segment in the big data security industry. An increasing number of organizations are moving their operations to the cloud, which is driving the demand for cloud-based models in the market.

Cloud computing helps with flexibility, scalability, and cost efficiency, which further attracts end-users. It is an ideal model for businesses of all sizes. The cloud model eliminates the hassle of investing in expensive infrastructure and hardware. Additionally, these models can scale up their operations without the need for any changes in infrastructure. Therefore, these factors are fostering heavy demand for cloud-based models in the market.

On the basis of components, the market can be segmented into data security analytics, data governance & compliance, data authorization & access, data auditing & monitoring, data encryption, data discovery & classification, and others. The data auditing & monitoring segment is anticipated to witness significant developments in the coming years. The growing requirements to comply with data privacy regulations like HIPAA, CCPA, and GDPR are helping organizations maintain transparency in data processing activities. Data auditing also helps to ensure the integrity and security of the data.

Additionally, the growing requirement for real-time threat detection and monitoring tools is further expected to foster growth in the segment. The rising trend of data governance among organizations to manage the availability and security of their data is also another crucial reason for the high growth rate of the segment. Increasing integration of machine learning and AI tools into data auditing and automated analysis monitoring systems is further likely to improve the effectiveness of monitoring and auditing efforts.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 22.84 Billion |

Projected Market Size in 2032 |

USD 28.99 Billion |

CAGR Growth Rate |

12.10% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

BigID Inc., SailPoint Technologies Holdings Inc., Sumo Logic Inc., Varonis Systems Inc., Zscaler Inc., LogRhythm Inc., Rapid7 Inc., Proofpoint Inc., Akamai Technologies Inc., F5 Networks Inc., Splunk Inc., Trend Micro Incorporated, and Others. |

Key Segment |

By Industry Verticals, By Enterprise Sizes, By Deployment Modes, By Components, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America will likely account for the largest share of the global big data security market during the forecast period. The United States is the largest market in the region because it is home to several large enterprises that deal with bulk amounts of data.

Additionally, the rising integration of AI, IoT, and other cloud technologies is another major factor fueling the growth of the industry. Also, the region has strict data and privacy laws, which in turn further encourage companies to adopt big data security to avoid any penalties or legal consequences.

Moreover, the region is known for its advanced cybersecurity infrastructure, which involves technologies like encryption detection and automated response systems, which is further anticipated to widen the scope of the regional market. Also, the region is witnessing digital transformation, which helps enterprises migrate their operations to the cloud, thereby increasing the demand for cloud-based big data security solutions.

Asia Pacific is another major region in the big data security industry that is likely to witness huge growth in the coming years. There is a growing number of cyberattacks, data breaches, and advanced persistent threats in APAC, which is fueling the demand for big data security solutions in the market.

Developing countries like Japan, China, and India are reporting increasing incidents of cyber breaches and ransomware attacks. Rapid shift towards digitalization, particularly in sectors like healthcare, banking, grid, and manufacturing, is also expected to positively impact the growth of the regional market.

Businesses are also adopting cloud-based solutions in APAC because of the high scalability and low costs, which are also likely to support the growth of the industry in the region. For instance, Microsoft collaborated with SAS in 2020 to come up with all new cloud-based industry solutions for its customers.

Competitive Analysis

Competitive Analysis

The key players in the global big data security market include:

- BigID Inc.

- SailPoint Technologies Holdings Inc.

- Sumo Logic Inc.

- Varonis Systems Inc.

- Zscaler Inc.

- LogRhythm Inc.

- Rapid7 Inc.

- Proofpoint Inc.

- Akamai Technologies Inc.

- F5 Networks Inc.

- Splunk Inc.

- Trend Micro Incorporated

For instance, IBM Security came up with Cloud Pak in 2020. It includes data security solutions that help companies to respond, help, and protect their infrastructure from any threats.

The global big data security market is segmented as follows:

By Industry Verticals Segment Analysis

By Industry Verticals Segment Analysis

- Aerospace & Defense

- Government

- Manufacturing

- Retail

- Healthcare

- BFSI

- IT & Telecom

- Others

By Enterprise Sizes Segment Analysis

By Enterprise Sizes Segment Analysis

- Large Enterprises

- Small & Medium Enterprises

By Deployment Modes Segment Analysis

By Deployment Modes Segment Analysis

- Cloud

- On-Premises

By Components Segment Analysis

By Components Segment Analysis

- Data Security Analytics

- Data Governance & Compliance

- Data Authorization & Access

- Data Auditing & Monitoring

- Data Encryption

- Data Discovery & Classification

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BigID Inc.

- SailPoint Technologies Holdings Inc.

- Sumo Logic Inc.

- Varonis Systems Inc.

- Zscaler Inc.

- LogRhythm Inc.

- Rapid7 Inc.

- Proofpoint Inc.

- Akamai Technologies Inc.

- F5 Networks Inc.

- Splunk Inc.

- Trend Micro Incorporated

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors