Search Market Research Report

Credit Card Payments Market Size, Share Global Analysis Report, 2024 – 2032

Credit Card Payments Market Size, Share, Growth Analysis Report By Product Type (General Purpose Credit Cards, Specialty Credit Cards, and Others), By Application (Food and Groceries, Health and Pharmacy, Restaurants and Bars, Consumer Electronics, Media and Entertainment, Travel and Tourism, and Others), By Provider (Visa, MasterCard, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

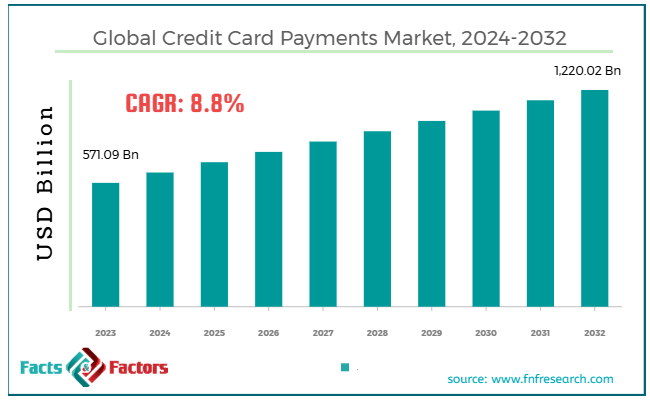

[214+ Pages Report] According to Facts & Factors, the global credit card payments market size was worth around USD 571.09 billion in 2023 and is predicted to grow to around USD 1220.02 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.8% between 2024 and 2032.

Market Overview

Market Overview

Credit card payment services allow users to buy goods and services by borrowing money from credit card issuers, usually banks. On purchase, the card issuer lends cash or funds to the user, and the cardholder is obliged to repay the amount, generally with interest, if the payment is not made by the due date.

Credit cards are convenient, rewarding, and offer consumer protection, but they may result in heavy interest if managed irresponsibly. The credit card payments market has witnessed substantial growth owing to the rising consumer spending power, growth of e-commerce, and heavy adoption of digital payments. Rising disposable incomes have let consumers rely on credit cards for long-term services and everyday purchases. This ultimately drives the need for credit card payment services.

Moreover, the growth of digital services and online shopping has surged the use of credit cards as the secure, easy, and broadly accepted mode of payment.

Nonetheless, a few concerns hampering the market's growth comprise security concerns and high interest rates. Credit cards normally hold high interest on pending balances. This possibly leads to users gathering higher debts, thus discouraging its use among people. Identity theft, credit card fraud, and data breaches are a few major and common risks for cardholders.

Since security measures like tokenization and EMV chips have enhanced security for users and their credit cards, most other concerns regarding cyber threats continue to prevail. Yet, incorporation with smartphone payments like Samsung Pay, Apple Pay, and Google Pay and growth in developing economies are some areas of opportunities in the credit card payments market.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global credit card payments market is estimated to grow annually at a CAGR of around 8.8% over the forecast period (2024-2032)

- In terms of revenue, the global credit card payments market size was valued at around USD 571.09 billion in 2023 and is projected to reach USD 1220.02 billion by 2032.

- The credit card payments market is projected to grow at a substantial rate owing to the speedy adoption of contactless payments, the rising spending power of consumers, and the growth of online shopping and e-commerce.

- Based on product type, the general purpose credit cards segment is leading as compared to the specialty credit cards segment.

- Based on application, the food and groceries segment is projected to register a notable market share than others.

- Based on provider, the Visa segment is anticipated to lead a maximum market share over MasterCard and others.

- Based on region, North America is anticipated to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- Technological improvements in payment systems to fuel the market growth

Modernizations in payment technology like mobile wallets, contactless payments, and biometric authentication have majorly improved the security of transactions. These modernizations encourage users to use credit cards for online purchases and in-store purchases. Contactless credit cards embedded with NFC (Near Field Communication) technology have gained popularity in less period.

By 2024, above 70% of global transactions were contactless in well-developed economies. Mobile wallets have streamlined users to preserve and use their cards on mobiles, thus simplifying the payment process. Both the leading companies, MasterCard and Visa, launched biometric payment and advanced encryption techniques with fingerprints.

- Financial inclusion in the progressing markets to drive the market

The rising middle-class population and growing financial inclusion in developing markets are the leading drivers of the use of credit cards. Since more consumers are gaining access to credit, the need for credit cards in these economies is rising, thus driving major growth prospects for the credit card payments market.

In the prominent regions of Asia Pacific like India, the amount of credit card holders rose by 15% by 2023, bringing the sum of consumers to above 50 million, as stated by the Reserve Bank of India. Credit card use is also rising in Africa and Latin America, where digital financial services and mobile payment systems are speedily expanding. As per MasterCard, the issuing of credit cards in Africa rose by 12%, fueled by the growing mobile payment systems and several accessible services.

Restraints

Restraints

- Growing competition from alternate methods emerging as a leading obstacle

The growth of alternate payment techniques like BNPL (buy now pay later), digital wallets, and cryptocurrency are posing a major challenge to the credit card industry. Users, mainly the younger generations, are actively inclined towards these substitutes since they offer comparatively low cost and higher flexibility. The rise of BNPL services and digital wallets has notably restrained the growth of the credit card payments industry. Mobile wallets like Google Pay, Apple Pay, and Samsung Pay have experienced major traction, thus representing an inclination from conventional credit card payment methods.

Furthermore, BNPL platforms like Afterpay, Klarna, and Affirm have gained significant traction, mainly in Europe and the U.S. In 2023, the Buy Now Pay Later transactions were anticipated to account for USD 300 billion, with BNPL use projected to rise by 26% yearly. Google Pay and Apple Pay have witnessed speedy implementation in the developing and the developed regions, with Apple Pay leading with 400 million consumers in 2023. This rise is challenging conventional credit card platforms or networks to shift to mobile wallets for simplified payments.

Opportunities

Opportunities

- Digital integration and technological improvements are some opportunistic areas for market growth

Technological improvements in AI, blockchain technology, and mobile wallets offer opportunities for bettering the experience for consumers, reducing friction, and enhancing security. These technologies will possibly impact consumer drive to use credit cards, mainly in contactless and digital transactions. As per Statista, users of mobile wallet on a global scale are projected to touch 2.8 billion soon. This denotes a rising trend of e-payments incorporated with credit card services. Also, the use of artificial intelligence in personalized financial services and fraud detection is burgeoning. Significant investments by JPMorgan Chase in AI to enhance transaction security and user services.

In 2024, Visa launched biometric authentication for credit card transactions, enabling users to confirm payments with fingerprints and facial recognition, thus increasing simplified usage and reducing fraud. Furthermore, in 2023, MasterCard also launched blockchain-enabled cross-border payments, decreasing the cost and time of transactions, mainly in areas with high payment volumes.

Challenges

Challenges

- Growing levels of credit card debt presents substantial challenges

The rising levels of credit card debt, especially in well-developed regions, denote a major challenge to the credit card payments market. The increasing levels of consumer debt may result in a rising number of defaults and stringent regulatory inquiries. In 2023, the credit card debt in the United States reached an all-time high of USD 1 trillion, as sourced by the Federal Reserve. This denotes a major rise from the past years since the rising inflammatory pressures and interest rates have challenged users to pay their dues.

Also, the charge-off rate (percent of the debt that is doubtful to be repaid) in the United States recorded 3.5%, as per (FDIC) Federal Deposit Insurance Corporation. In 2023, the Federal Reserve raised their interest rates, resulting in a greater cost of borrowing, which exacerbates the pressure on consumers with pending dues, thus increasing their credit card debts.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 571.09 Billion |

Projected Market Size in 2032 |

USD 1,220.02 Billion |

CAGR Growth Rate |

8.8% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Visa Inc., MasterCard Incorporated, American Express Company, Discover Financial Services, JCB Co. Ltd., UnionPay International (China UnionPay), Capital One Financial Corporation, Bank of America (Credit Cards Division), Citigroup (Citibank Credit Cards), Wells Fargo (Credit Cards Division), Chase (JPMorgan Chase & Co.), Barclays PLC (Barclaycard), Synchrony Financial, PayPal Holdings Inc., Square Inc. (now Block Inc.), and Others. |

Key Segment |

By Product Type, By Application, By Provider, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global credit card payments market is segmented based on service, airport, provider, and region.

Based on product type, the credit card payments industry is divided into general purpose credit cards, specialty credit cards, and others. The general purpose credit cards segment registered a considerable share of the market owing to its broader acceptance, flexibility and convenience, and dominance in e-commerce. MasterCard, Visa, and American Express are a few examples of widely accepted general purpose credit cards, making them ideal for international and domestic transactions.

Furthermore, they offer flexible payment choices for users, enabling them to make in-store and online purchases. These cards are usually linked to widespread rewards, cash back, and attractive promotional offers, increasing their popularity among regular consumers. General purpose credit cards have sustained their dominance due to higher payments for e-commerce, which have boosted on a global scale.

Based on application, the global credit card payments industry is segmented into food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and others. The food and groceries segment led the market compared to others owing to frequent purchases, inclination to digital payments, and rewards and cashback programs. Groceries and food are the essentials required daily by users. Credit cards are the most common choice for these daily purchases owing to their ability to earn cashback or rewards and convenience. Most food retailers and grocery stores have incorporated digital payment systems owing to which they have gained huge consumer attraction for the said payment method.

Based on provider, the global credit card payments market is segmented into Visa, MasterCard, and others. Visa holds a larger network of financial institutions and merchants with more than 200 nations and territories. With over 61 million dealer locations on a global scale, Visa offers unmatched convenience and access for credit card holders. It has also gained trust and partnerships with financial institutions and payment processors worldwide.

Moreover, Visa has also majorly invested in payment technologies for speedy, safe, and convenient transactions. This technological advantage ensures the security of credit cards, their efficiency, and user-friendliness for online and in-person payments.

Regional Analysis

Regional Analysis

- North America to register substantial growth during the forecast period

North America, especially the United States holds the maximum credit card rates among other regions. 2023 recorded above 500 million credit card holders just in the United States, more than the population in the region. The region also benefits from secure payment and well-established systems with exhaustive incorporation of credit card networks like MasterCard, Visa, and American Express, increasing the smooth functioning of payments for merchants and users.

Furthermore, North America holds a vibrant e-commerce market, which witnessed online sales exceeding USD 1 trillion in the U.S. in 2023. The trend of credit card payments still tops the list as the highly chosen method for online transactions.

Asia-Pacific accounts for the second leading region in the adoption and use of credit card payments. Nations like India, China, and Japan have witnessed strong economic growth, thus increasing consumer spending and the use of credit cards. China held over 500 million credit card users in 2023, one of the leading global credit card markets. The region’s rising middle-class population, mainly in Southeast Asia and India is buying credit cards for access to credit and convenience.

The growth of digital wallets and mobile payments in economies like India and China is boosting the adoption of credit cards, with prominent platforms like WeChat Pay and Alipay incorporating credit card payment facilities. India also witnessed a nearly 45% hike in credit card use from 2021 to 2023.

Competitive Analysis

Competitive Analysis

The global credit card payments market is led by players like:

- Visa Inc.

- MasterCard Incorporated

- American Express Company

- Discover Financial Services

- JCB Co. Ltd.

- UnionPay International (China UnionPay)

- Capital One Financial Corporation

- Bank of America (Credit Cards Division)

- Citigroup (Citibank Credit Cards)

- Wells Fargo (Credit Cards Division)

- Chase (JPMorgan Chase & Co.)

- Barclays PLC (Barclaycard)

- Synchrony Financial

- PayPal Holdings Inc.

- Square Inc. (now Block Inc.)

Key Market Trends

Key Market Trends

- Growing adoption of contactless payments:

The inclination towards contactless payments is among the most attractive trends in the credit card payments market. Users worldwide are actively availing the benefits and choosing the convenience of using mobile for speedy and smooth payments without needing to physically insert or swipe cards.

- Greater emphasis on fraud prevention and security:

Since fraudulent activities and cybercrimes are posing threats to credit card holders, there is a greater emphasis on improved security measures. This comprises tokenization, biometric authentication, EMV chip technology, and AI-based fraud detection.

The global Credit Card Payments market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- General purpose credit cards

- Specialty credit cards

- Others

By Application Segment Analysis

By Application Segment Analysis

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Others

By Provider Segment Analysis

By Provider Segment Analysis

- Visa

- MasterCard

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Visa Inc.

- MasterCard Incorporated

- American Express Company

- Discover Financial Services

- JCB Co. Ltd.

- UnionPay International (China UnionPay)

- Capital One Financial Corporation

- Bank of America (Credit Cards Division)

- Citigroup (Citibank Credit Cards)

- Wells Fargo (Credit Cards Division)

- Chase (JPMorgan Chase & Co.)

- Barclays PLC (Barclaycard)

- Synchrony Financial

- PayPal Holdings Inc.

- Square Inc. (now Block Inc.)

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors