Search Market Research Report

High Heat Foam Market Size, Share Global Analysis Report, 2022 – 2028

High Heat Foam Market Size, Share, Growth Analysis Report By Type (Silicone, Polyimide, Melamine, Polyethylene, and Others), By Application (Automotive, Railway, Industrial, Aerospace, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

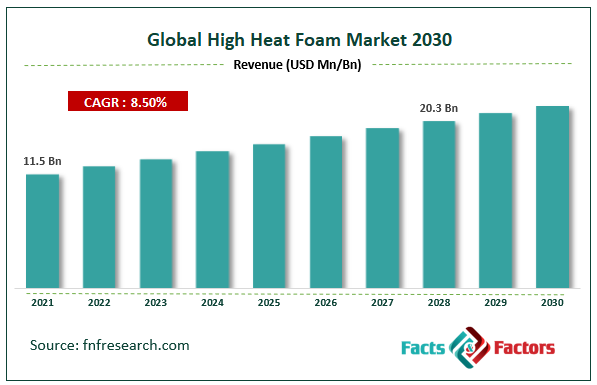

[218+ Pages Report] According to Facts and Factors, the global high heat foam market size was worth around USD 11.5 billion in 2021 and is predicted to grow to around USD 20.3 billion by 2028 with a compound annual growth rate (CAGR) of roughly 8.5% between 2022 and 2028. The report analyzes the global high heat foam market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the high heat foam market.

Market Overview

Market Overview

One kind of foam that is frequently utilized in insulation applications is high heat foam. Due to the energy-saving advantages, it imparts in buildings and automobiles, high heat foam is mostly used in the construction and automotive industries. The rising growth in these two sectors is currently reporting augur well for the worldwide high heat foam industry. Silicone foam, melamine foam, polyimide foam, and polyethylene foam are the main product categories marketed in the worldwide high heat foam market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global high heat foam market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2022-2028).

- In terms of revenue, the global high heat foam market size was valued at around USD 11.5 billion in 2021 and is projected to reach USD 20.3 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, silicone was predicted to dominate the market in the year 2021

- Based on application segmentation, the automotive industry is expected to hold the largest market share during the forecast period.

- Based on region, Asia Pacific was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

The COVID-19 pandemic significantly impacted economies as well as individuals across the globe owing to the strict lockdown imposed by the government. Various industries such as automotive, construction, manufacturing, and others halted their production to curb the cases of COVID-19. In addition, the supply chain of products & services is disrupted as well as consumer spending is limited, which in turn, impacted the growth of numerous industries. Similarly, COVID-19 negatively impacted the growth of the global high heat foam market due to the halt in the operation of the construction and automotive sector as these are the major industries that have a high requirement of high heat foam. For instance, according to the International Labor Organization's assessment, COVID-19 would have an impact on about 2.7 billion workers or 81% of the world's workforce, and it is reasonable to assume that this number includes those employed in the construction industry.

Growth Drivers

Growth Drivers

- Increasing applications of high heat foams in various industry verticals to drive market growth

The growing demand for high heat foam in various industry verticals such as construction, automotive, aerospace, and others is projected to drive market growth during the forecast period. High heat foam has different types of applications in these sectors. For example, it is used in building & construction for the applications of concrete block insulation, HVACs, thermal energy transmissions, and others. Urbanization, modular building technologies, and the government's push towards green building and infrastructure development are the main factors that contribute to the building and construction industry's growth. For instance, the US Census Bureau reports that from the Seasonally Adjusted Annual Rate (SAAR) of USD 1,524.2 billion in April 2021 to USD 1,744.8 billion in April 2022, monthly construction spending increased. Additionally, the increasing application from the aerospace industry is also one of the prominent factors that influence the growth of the global high heat foam market during the forecast period. In the aerospace industry, high heat foam is used for numerous applications such as insulation panels, foam seating, aircraft fuel efficiency, and others. Due to their excellent qualities, like energy efficiency and strength retention in adverse climatic situations, high heat foams including polyimide, melamine, silicone, and others are utilized in the aerospace industry. Moreover, the factors such as a growth in aircraft production, an increase in air traffic, and technological advancements in aviation, the aerospace business is expanding substantially. For instance, the India Brand Equity Foundation (IBEF) estimates that the Indian aircraft market will reach US$70 billion by 2030. Therefore, the growing applications of high heat foam in various industry verticals are accountable for the growth of the market.

Restraints

Restraints

- Volatility in the raw material prices is projected to hamper the market during the forecast period

Volatility in the raw material prices is expected to hinder the global high heat foam market during the forecast period. For the production of high-heat foams, raw materials including refined petroleum or petroleum-based derivatives like high-density polyethylene (HDPE), low-density polyethylene (LDPE), resins, and inorganic compounds are utilized. Because of variations in the market's supply and demand for crude oil, the price of petroleum and its derivatives is susceptible to significant volatility. For instance, as per US Energy Information Administration (EIA) report, the average monthly US refiner purchase cost of crude oil reached USD 60.53 per barrel in July 2019, USD 51.36 per barrel in January 2021, and USD 73.81 per barrel in December 2021. The price volatility of the derivatives and resins used to make high heat foams is a result of the fluctuating price of crude oil, which also affects the price of high heat foam. The market for high heat foam is also experiencing a significant disruption due to these variables.

Opportunities

Opportunities

- Increasing automotive demand coupled with the rising need for lightweight vehicles expected to offer an attractive opportunity for market growth

The increasing automotive demand coupled with the rising need for lightweight vehicles is expected to offer an attractive opportunity for the growth of the global high heat foam market during the forecast period. Foam systems have shown to be a great way to lower emissions and fulfill international fuel economy criteria because they are lightweight, strong, and resistant to extreme heat. For example, a 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement. Moreover, according to the data from the US Department of Energy, by 2030, the use of lightweight parts and high-efficiency engines made possible by new materials in a quarter of the U.S. fleet could result in yearly fuel savings of more than 5 billion gallons. Thus, the increasing automotive demand coupled with the need for light vehicles is projected to provide an attractive opportunity for the high heat foam market.

Segmentation Analysis

Segmentation Analysis

The global high heat foam market is segmented based on type, application, and region.

Based on type, the global market is bifurcated into silicone, polyimide, melamine, polyethylene, and others. The silicone segment dominated in 2021 and is expected to show its dominance during the forecast period. The segment growth is attributed to the properties such as heat resistance and thermal stability compared to the other materials such as polyimide, polyethylene, melamine, and others. In contrast to polyurethane, which is prone to toxicity during heat decomposition, silicone foams are toxin-free. Silicone-based foams are increasingly being used for insulation across a wide range of industries, which increases demand and market opportunities. Furthermore, the high flame rating and great insulation properties of silicone foams are expanding their use in buildings, automobiles, and other industries.

Based on application, the global market is segmented into automotive, railway, industrial, aerospace, and others. The automotive segment is projected to hold a significant market share over the forecast period. High heat foams are in high demand and have numerous uses in the automobile industry, including the substitution of metal sheets, and acoustic and thermal insulation. Due to the factors such as new technological advancements, an increase in the demand for passenger cars, and the expansion of OEMs & the aftermarket, the automotive industry is rapidly expanding. For instance, the overall output of automotive vehicles increased from 77,621,582 units in 2020 to 80,145,988 units in 2021, according to the International Organization of Motor Vehicle Manufacturers (OICA). These factors would lead to a significant increase in the demand for high heat foams in the automotive sector throughout the forecast period.

Recent Developments:

Recent Developments:

- In January 2022, the CHT Group introduced the latest silicone foam for EV battery packs and electronics. This launch met the requirements for moisture protection and thermal runaway prevention. It also has a wide range of uses in electronics and the automobile industries.

- In May 2021, the SEI Group LLC acquired Tailored Foam of Florid Inc., a leading foam insulation contractor. With this acquisition, the SEI Group would have a wider range of products, solid customer relationships, and a more competitive line of spray foam.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 11.5 Billion |

Projected Market Size in 2028 |

USD 20.3 Billion |

CAGR Growth Rate |

8.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Intec Foams, Sabic, UBE Industries Ltd., Sinoyqx, Armacell International S.A., Evonik Industries, Puren Gmbh, Wacker Chemie AG, Rogers Corporation., and Others |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia Pacific is projected to dominate the market during the forecast period owing to the growth in the automotive sector

The Asia Pacific region is expected to dominate the global high heat foam market during the forecast period owing to the growth in the automotive sector. Due to reasons like growing OEMs and aftermarkets, increasing vehicle production, and expanding car manufacturers, the automotive sector is expanding quickly in APAC. For instance, according to the International Organization of Motor Vehicles Manufacturers (OICA), between 2020 and 2021, the number of vehicles produced in China increased from 25,225,242 to 26,082,220 units, and those in India increased from 3,394,446 to 4,399,112 units, and those in Taiwan increased from 245,615 to 265,320 units. The demand for high heat foams is predicted to increase with the increase in automotive vehicle manufacturing for uses in energy, insulation, and other areas. During the forecast period, this is expected to accelerate the growth of high heat foams in the Asia-Pacific region.

Competitive Analysis

Competitive Analysis

- BASF SE

- Intec Foams

- Sabic

- UBE Industries Ltd.

- Sinoyqx

- Armacell International S.A.

- Evonik Industries

- Puren Gmbh

- Wacker Chemie AG

- Rogers Corporation.

The global high heat foam market is segmented as follows:

By Type

By Type

- Silicone

- Polyimide

- Melamine

- Polyethylene

- Others

By Application

By Application

- Automotive

- Railway

- Industrial

- Aerospace

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Intec Foams

- Sabic

- UBE Industries Ltd.

- Sinoyqx

- Armacell International S.A.

- Evonik Industries

- Puren Gmbh

- Wacker Chemie AG

- Rogers Corporation.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors