Search Market Research Report

India Hair Styling Products Market Size, Share Global Analysis Report, 2024 – 2032

India Hair Styling Products Market Size, Share, Growth Analysis Report By Type (Hair Spray, Hair Mousse, Hair Gel, Hair Serum, Hair Wax, and Others), By Type of Hair (Straight Hair, Wavy Hair, Curly Hair, and Coily Hair), By End User (Men and Women), By Distribution Channel (Online Retail and Offline), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

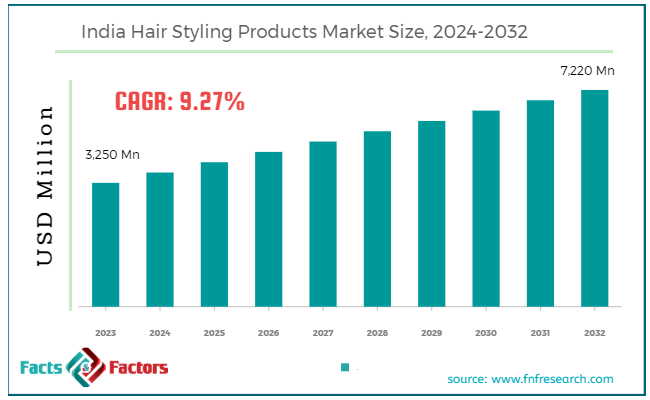

[219+ Pages Report] According to Facts & Factors, the India hair styling products market size in terms of revenue was valued at around USD 3,250 million in 2023 and is expected to reach a value of USD 7,220 million by 2032, growing at a CAGR of roughly 9.27% from 2024 to 2032. The Indian hair styling products market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India hair styling products are a wide range of products that style and maintain hair, including gels, waxes, sprays, creams, mousses, and serums. These products cater to diverse hair types and styling needs, helping individuals achieve various looks, from sleek and straight to curly and voluminous. The India hair styling products market has seen significant growth due to increasing beauty consciousness, rising disposable incomes, and the influence of global fashion trends. The market is characterized by a mix of international and domestic brands offering innovative products tailored to Indian consumers' preferences.

Additionally, the growing popularity of personal grooming and the influence of social media and celebrity endorsements have further driven the demand for hair styling products. As a result, the Indian hair styling products market is poised for continued expansion, supported by urbanization, evolving fashion trends, and increasing consumer awareness about hair care and styling.

Key Highlights

Key Highlights

- The India hair styling products market has registered a CAGR of 9.27% during the forecast period.

- In terms of revenue, the India hair styling products market was estimated at roughly USD 3,250 million in 2023 and is predicted to attain a value of USD 7,220 million by 2032.

- The growth of the India hair styling products market is being propelled by a growing focus on personal grooming, rising disposable income, and exposure to trends.

- Based on the type, the hair spray segment is growing at a high rate and is projected to dominate the market.

- Based on the type of hair, the curly hair segment is projected to swipe the largest market share.

- Based on the end user, the women segment is expected to dominate the market.

- By region, South India is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Rising disposable income: A growing middle class with increasing spending power fuels demand for a wider variety of personal care products, including hair styling options.

- Evolving beauty standards: Exposure to global trends and media influences a growing desire for experimentation with hairstyles, leading to a need for diverse styling products.

- Urbanization and Westernization: Urban lifestyles and the influence of Western culture promote a focus on personal grooming, including hair styling.

- Increasing awareness: Growing awareness about hair care and styling techniques, along with the influence of social media beauty trends, creates a more informed and engaged consumer base.

- Expansion of organized retail: The increasing presence of supermarkets, hypermarkets, and specialty beauty stores provides greater accessibility to a wider range of hair styling products.

Restraints:

Restraints:

- Price sensitivity: Price remains a major concern for many Indian consumers. Balancing affordability with product quality is crucial for market growth.

- Limited product awareness: While awareness is growing, there's still a segment of the population unfamiliar with the benefits and application methods of various hair styling products.

- Traditional mindsets: Some traditional mindsets may view extensive hair styling as unnecessary or even damaging, creating a hurdle for market penetration.

- Availability of substitutes: The use of natural ingredients and home remedies for hair styling can act as substitutes for commercially available products.

Opportunities:

Opportunities:

- Focus on natural and organic products: The growing demand for natural and organic beauty products presents an opportunity for brands to cater to health-conscious consumers.

- Rising male grooming segment: The increasing focus on male grooming opens doors for the development and marketing of hair styling products specifically targeted towards men.

- Regional customization: Developing products that cater to specific hair types and cultural preferences prevalent in various regions of India can unlock new market potential.

- E-commerce boom: The growing popularity of online shopping platforms creates a convenient channel for consumers to discover and purchase hair styling products.

Challenges:

Challenges:

- Counterfeiting and duplication: The presence of counterfeit and duplicate products can erode consumer trust and brand loyalty. Implementing stricter quality control measures is essential.

- Competition from international brands: Well-established international brands pose significant competition in the Indian market. Local players need to differentiate themselves through innovation and effective marketing strategies.

- Logistics and distribution challenges: Ensuring efficient distribution networks across diverse regions of India can be a logistical hurdle, particularly for smaller players.

- Lack of standardization: A lack of standardized labeling and product information can create confusion for consumers and hinder informed purchasing decisions.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The India hair styling products market is segmented based on type, type of hair, end user, distribution channel, and region.

- By Type Insights

Based on Type, the India hair styling products market is divided into hair spray, hair mousse, hair gel, hair serum, hair wax, and others. Hair spray is a popular styling product used to hold hair in place and maintain specific hairstyles. Hair spray is favored for its convenience and effectiveness in providing a lasting hold. The demand for hair sprays is driven by increasing consumer awareness about hairstyling products and a growing preference for well-groomed looks. This segment is expected to continue growing as more consumers incorporate hair sprays into their daily grooming routines.

Hair mousse is a lightweight foam product that adds volume, texture, and shine to hair. The hair mousse segment is gaining popularity due to its versatility and ease of use. It is especially favored by consumers looking to enhance the natural texture of their hair. As hairstyling trends evolve, the demand for hair mousse is expected to grow, supported by its ability to provide volume and a natural look.

Hair gel is a widely used styling product known for its strong hold and ability to create defined hairstyles. Hair gel remains a staple in the hairstyling products market due to its effectiveness in creating and maintaining structured hairstyles. The segment continues to attract a broad consumer base, particularly among men. As new formulations with added benefits like hydration and shine are introduced, the demand for hair gel is expected to remain strong.

Hair serum is a liquid product that adds shine, reduces frizz, and improves the overall texture of hair. Hair serums are becoming increasingly popular due to their ability to address common hair issues such as frizz and dryness. The segment is driven by a growing awareness of hair care and the desire for smooth, shiny hair.

Hair wax is a pliable styling product that provides a medium to strong hold with a natural finish. Hair wax is particularly popular among younger consumers and those with short to medium-length hair. The segment benefits from its versatility and ability to create trendy, modern hairstyles. With the growing trend of textured and casual hairstyles, the demand for hair wax is expected to increase.

- By Type of Hair Insights

On the basis of Type of Hair, the India hair styling products market is bifurcated into straight hair, wavy hair, curly hair, and coily hair. Straight hair is characterized by its smooth texture and lack of curl. The demand for hair styling products for straight hair is driven by the need to add volume and manageability. Products such as volumizing sprays, lightweight serums, and frizz-control creams are popular in this segment.

Wavy hair has a natural wave pattern that falls between straight and curly hair. Wavy hair styling products are in high demand due to the increasing popularity of natural, beachy wave styles. Products such as texturizing sprays, lightweight mousses, and curl-enhancing creams are popular in this segment. As trends continue to favor natural and effortless looks, the wavy hair segment is expected to grow significantly.

Curly hair has more defined curls and requires products that provide moisture, definition, and frizz control. The curly hair segment is driven by the need for specialized products that cater to the unique requirements of curly hair. Products like curl-defining creams, hydrating gels, and leave-in conditioners are essential for maintaining healthy, bouncy curls. As awareness about curly hair care grows and more consumers embrace their natural curls, this segment is poised for robust growth.

Coily hair, also known as kinky or afro-textured hair, has tight curls or coils and often requires intensive moisture and definition. The coily hair segment is experiencing growing demand for highly moisturizing and defining products. Products such as rich leave-in conditioners, butters, and creams specifically formulated for coily hair are essential for maintaining its health and appearance.

- By End User Insights

Based on End User, the India hair styling products market is categorized into men and women. Men's hair styling products are designed to cater to specific styling needs and preferences. Common products in this segment include hair gels, waxes, pomades, and styling creams that provide hold, texture, and shine. The men's hair styling products segment is driven by increasing grooming awareness and the rising importance of personal appearance among men. The influence of celebrities, social media, and fashion trends has significantly boosted the demand for hair styling products in this segment.

Women's hair styling products encompass a wide range of options to address diverse styling needs, including volumizing sprays, hair serums, curling creams, straightening balms, and more. Women often seek products that provide versatility, enhance natural hair texture, and offer protection from heat and environmental damage. The women's hair styling products segment is the larger of the two, driven by a strong focus on beauty and personal care.

The influence of beauty influencers, fashion magazines, and social media platforms has played a significant role in shaping consumer preferences and driving demand for various styling products. Women look for products that not only style their hair but also provide added benefits such as hydration, frizz control, and heat protection. As the beauty and personal care industry continues to grow, this segment is expected to see robust growth with ongoing innovation and new product launches catering to women's diverse hair styling needs.

Recent Developments:

Recent Developments:

- Myntra Boosts Beauty Offerings (2023): Leading Indian e-commerce platform Myntra broadens its beauty offerings by partnering with L'Oreal Professional. This collaboration brings shampoos, conditioners, hair oils, and more to Myntra's platform, catering to the rising demand for diverse hair care options.

- Oribe Launches Limited-Edition Styling Spray (2022): Luxury hair care brand Oribe (by Kao Corporation) introduces a limited-edition dry texturizing spray to the Indian market in 2022. This innovative product offers instant shine, volume, and a textured "rough-luxe" look for hairstyles. It also absorbs oil and dirt, extending the time between washes.

- Medimix Unveils Natural Hair Care Solution (2022): AVA Group's Medimix brand expands its offerings with a new Total Care Shampoo. This all-hair-type shampoo is formulated with nine natural herbs (including rosemary oil, neem, and tea tree oil) and enriched with wheat protein and wild ginger for comprehensive care. This launch reflects the growing interest in natural hair care solutions in India.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 3,250 Million |

Projected Market Size in 2032 |

USD 7,220 Million |

CAGR Growth Rate |

9.27% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

AVA Group, Bajaj Consumer Care Ltd., Dabur India Ltd., Emami Ltd., Garnier India, Godrej Consumer Products Ltd., Himalaya, Hindustan Unilever Ltd., Jovees Herbal Care India Ltd., L’Oréal India Pvt. Ltd., Marico Ltd., Patanjali Ayurved, Procter & Gamble India, VLCC, and Others. |

Key Segment |

By Type, By Type of Hair, By End User, By Distribution Channel, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

The India hair styling products market exhibits significant regional variations influenced by cultural preferences, economic conditions, urbanization, and lifestyle changes.

- South India leads the India hair styling products market

South India, particularly cities like Bangalore, Chennai, and Hyderabad, dominates the market. This region benefits from a large urban population, a thriving IT industry, and a cosmopolitan lifestyle that embraces global beauty trends. High consumer spending on personal care products and the increasing influence of social media and celebrities in promoting hair styling products further bolster South India's leading position in the market.

North India, with key states like Delhi, Punjab, and Haryana, shows strong demand for hair styling products. Metropolitan areas such as Delhi and Chandigarh are characterized by high beauty consciousness and a significant urban population influenced by Western fashion trends. The region's growth is supported by rising disposable incomes, a growing number of working professionals, and increasing awareness of personal grooming.

West India, including Maharashtra, Gujarat, and Goa, also plays a crucial role in the market, with Maharashtra, particularly Mumbai, being a major hub due to its status as a fashion and entertainment center. This region has a high concentration of beauty and wellness salons, further driving demand for hair styling products. The region's affluent population, high urbanization rate, and significant number of fashion-conscious consumers contribute to its strong market presence.

East India, with Kolkata as its primary urban center, is an emerging market for hair styling products. The region is gradually catching up with other parts of the country in terms of beauty and grooming awareness. Increasing disposable incomes, urbanization, and the growing influence of beauty and fashion trends among younger consumers are driving the growth in this region.

Central India, encompassing states like Madhya Pradesh and Chhattisgarh, represents a smaller market for hair styling products. However, it is witnessing gradual growth due to rising urbanization and increasing consumer awareness about personal grooming. Emerging urban centers and the penetration of beauty and personal care brands into smaller cities and towns are key factors contributing to the market's expansion in Central India.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India hair styling products market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India hair styling products market include;

- AVA Group

- Bajaj Consumer Care Ltd.

- Dabur India Ltd.

- Emami Ltd.

- Garnier India

- Godrej Consumer Products Ltd.

- Himalaya

- Hindustan Unilever Ltd.

- Jovees Herbal Care India Ltd.

- L’Oréal India Pvt. Ltd.

- Marico Ltd.

- Patanjali Ayurved

- Procter & Gamble India

- VLCC

The India hair styling products market is segmented as follows:

By Type

By Type

- Hair Spray

- Hair Mousse

- Hair Gel

- Hair Serum

- Hair Wax

- Others

By Type of Hair

By Type of Hair

- Straight Hair

- Wavy Hair

- Curly Hair

- Coily Hair

By End User

By End User

- Men

- Women

By Distribution Channel

By Distribution Channel

- Online Retail

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Salons

- Others

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- Chargehound

- Vindicia

- Ordergroove

- Chargeback

- Riskified

- Chargeback Gurus

- Midigator

- Accertify (by American Express)

- Kount

- Chargebacks911

- Verifi

- Signifyd

- Ethoca

- Sift

- Forter.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors