Search Market Research Report

India Respiratory Devices Market Size, Share Global Analysis Report, 2024 – 2032

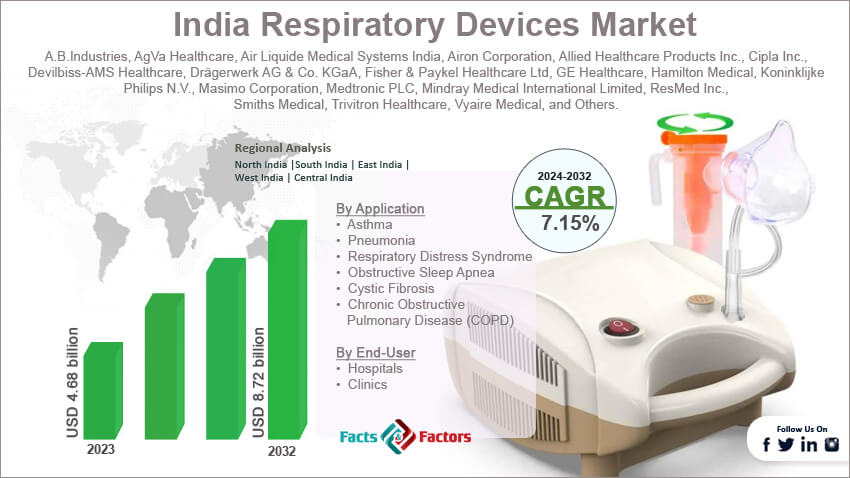

India Respiratory Devices Market Size, Share, Growth Analysis Report By Product Type (Disposables, Therapeutic Devices, and Diagnostic & Monitoring Devices), By Application (Asthma, Pneumonia, Respiratory Distress Syndrome, Obstructive Sleep Apnea, Cystic Fibrosis, and Chronic Obstructive Pulmonary Disease), By End-User (Hospitals and Clinics), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

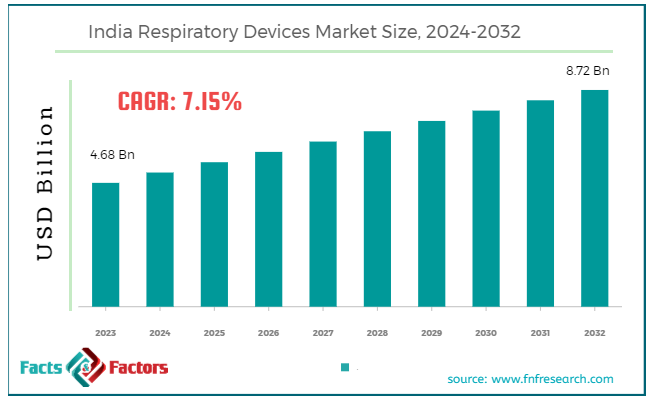

[220+ Pages Report] According to Facts & Factors, the India respiratory devices market size in terms of revenue was valued at around USD 4.68 billion in 2023 and is expected to reach a value of USD 8.72 billion by 2032, growing at a CAGR of roughly 7.15% from 2024 to 2032. The India respiratory devices market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India respiratory devices refer to a range of medical devices designed to assist patients with respiratory conditions such as asthma, chronic obstructive pulmonary disease (COPD), sleep apnea, and other respiratory ailments. These devices include inhalers, nebulizers, ventilators, oxygen concentrators, and continuous positive airway pressure (CPAP) machines. The India respiratory devices market has seen significant growth due to increasing prevalence of respiratory diseases, rising pollution levels, and growing awareness about respiratory health. The market is characterized by a mix of domestic and international manufacturers offering innovative and cost-effective solutions.

Additionally, the COVID-19 pandemic has highlighted the critical importance of respiratory devices in managing respiratory complications, further boosting market demand. Government initiatives to improve healthcare infrastructure and the rising adoption of advanced medical technologies also support market growth. As a result, the India respiratory devices market is poised for continued expansion, driven by technological advancements, increasing healthcare access, and the growing burden of respiratory diseases.

Key Highlights

Key Highlights

- The India respiratory devices market has registered a CAGR of 7.15% during the forecast period.

- In terms of revenue, the India respiratory devices market was estimated at roughly USD 4.68 billion in 2023 and is predicted to attain a value of USD 8.72 billion by 2032.

- The growth of the India respiratory devices market is being propelled by the increasing prevalence of respiratory diseases, rising awareness about early diagnosis and management, and advancements in medical technology.

- Based on the product type, the therapeutic devices segment is growing at a high rate and is projected to dominate the market.

- Based on the application, the chronic obstructive pulmonary disease (COPD) segment is projected to swipe the largest market share.

- In terms of end-user, the hospital segment is expected to grow at a significant rate over the forecast period.

- By region, North India is expected to dominate the market during the forecast period.

Growth Drivers:

Growth Drivers:

- Rising Respiratory Diseases: Increasing prevalence of chronic respiratory diseases like asthma, COPD, and sleep apnea fuels demand for respiratory devices.

- Growing Geriatric Population: The aging population is more susceptible to respiratory ailments, driving demand for respiratory care.

- Increasing Awareness: Growing awareness about respiratory health and the importance of early diagnosis and treatment boosts market growth.

- Government Initiatives: Government programs and policies supporting healthcare infrastructure and affordable access to medical devices accelerate market expansion.

Restraints:

Restraints:

- Limited Healthcare Infrastructure: Inadequate healthcare infrastructure, especially in rural areas, hinders access to respiratory care devices.

- High Cost of Devices: Expensive respiratory devices pose a financial burden for many patients, limiting market penetration.

- Lack of Awareness: Limited awareness about the availability and benefits of respiratory devices in certain regions restricts market growth.

- Counterfeit Products: The presence of counterfeit respiratory devices compromises patient safety and erodes trust in the market.

Opportunities:

Opportunities:

- Rising Disposable Incomes: Growing disposable incomes enable more people to afford respiratory devices, expanding the market.

- Telemedicine Integration: Integrating respiratory devices with telemedicine platforms can improve patient care and access in remote areas.

- Focus on Home Care: Increasing emphasis on home-based care creates opportunities for home-use respiratory devices.

- Product Innovation: Developing advanced, portable, and user-friendly respiratory devices can capture market share.

Challenges:

Challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability and pricing of respiratory devices.

- Stringent Regulatory Environment: Complying with stringent regulatory requirements can be time-consuming and costly for manufacturers.

- Skilled Manpower Shortage: A lack of trained healthcare professionals to operate and maintain respiratory devices can hinder market growth.

Segmentation Analysis

Segmentation Analysis

The India respiratory devices market is segmented based on product type, application, end-user, and region.

- By Product Type Insights

Based on Product Type, the India respiratory devices market is divided into disposables, therapeutic devices, and diagnostic & monitoring devices.

The disposables segment includes products such as masks, tubes, and filters used in conjunction with other respiratory devices. These items are essential for maintaining hygiene and preventing cross-contamination, particularly in clinical settings. The increasing awareness about infection control and the rising number of respiratory disease cases have driven the demand for disposable respiratory devices. Their usage is particularly high in hospitals and clinics where patient turnover is high, and the need for sterile equipment is critical??.

Therapeutic devices form the largest segment in the India respiratory devices market. This category includes devices such as ventilators, nebulizers, oxygen concentrators, and continuous positive airway pressure (CPAP) devices. The demand for therapeutic devices is driven by the increasing prevalence of chronic respiratory diseases such as COPD and asthma. Ventilators, in particular, have seen a surge in demand due to the COVID-19 pandemic, highlighting their critical role in managing severe respiratory conditions. Additionally, oxygen concentrators and nebulizers are widely used for home care settings, providing patients with convenient and effective treatment options??.

The diagnostic and monitoring devices segment includes spirometers, peak flow meters, pulse oximeters, and polysomnography devices. These devices are essential for the early diagnosis and continuous monitoring of respiratory conditions, which is crucial for effective management and treatment. The increasing awareness about the importance of early diagnosis, coupled with advancements in technology, has led to the widespread adoption of these devices. Healthcare providers rely on diagnostic and monitoring devices to assess lung function and oxygen saturation levels, enabling them to tailor treatment plans effectively??.

- By Application Insights

On the basis of Application, the India respiratory devices market is bifurcated into asthma, pneumonia, respiratory distress syndrome, obstructive sleep apnea, cystic fibrosis, and chronic obstructive pulmonary disease (COPD).

Asthma is one of the most significant applications for respiratory devices in India. The high prevalence of asthma, driven by factors such as pollution, allergens, and genetic predisposition, has created substantial demand for devices like inhalers, nebulizers, and peak flow meters. These devices are crucial for managing asthma symptoms and preventing exacerbations. Inhalers and nebulizers are commonly used for delivering medication directly to the lungs, providing quick relief and effective long-term management of asthma??.

Pneumonia, an infectious disease that affects the lungs, necessitates the use of respiratory devices such as oxygen concentrators, ventilators, and nebulizers. The management of pneumonia often requires supplemental oxygen and respiratory support, especially in severe cases. The increasing incidence of pneumonia, particularly among the elderly and those with weakened immune systems, drives the demand for these devices in both hospital and home care settings??.

Respiratory Distress Syndrome (RDS) is a severe condition that primarily affects premature infants and requires immediate and intensive respiratory support. Devices such as ventilators and continuous positive airway pressure (CPAP) machines are essential for providing the necessary respiratory assistance to these vulnerable patients. The rise in premature births and advancements in neonatal care have increased the demand for these specialized respiratory devices??.

Obstructive Sleep Apnea (OSA) is a common disorder characterized by repeated interruptions in breathing during sleep. CPAP devices are the standard treatment for OSA, providing a continuous flow of air to keep the airways open. The increasing awareness of sleep disorders and their impact on overall health has led to a growing market for CPAP devices and other sleep apnea management tools. The convenience and effectiveness of these devices make them a popular choice for patients diagnosed with OSA??.

Cystic Fibrosis (CF) is a genetic disorder that affects the lungs and other organs, leading to severe respiratory complications. Managing CF requires a range of respiratory devices, including nebulizers, oxygen concentrators, and chest physiotherapy vests. These devices help clear mucus from the lungs, deliver medications, and provide supplemental oxygen to patients. Advances in CF care and the increasing availability of specialized respiratory devices have improved the quality of life for patients with this condition??.

Chronic Obstructive Pulmonary Disease (COPD) is a major application area for respiratory devices. The management of COPD often involves the use of inhalers, nebulizers, oxygen concentrators, and ventilators. COPD is prevalent among the aging population and those with a history of smoking, leading to a high demand for respiratory support devices. These devices are essential for improving breathing, delivering medications, and providing long-term oxygen therapy to manage COPD symptoms effectively.

Recent Developments:

Recent Developments:

- GE Healthcare's Major Investment (March 2024): Global healthcare giant GE Healthcare announced a substantial investment of USD 959 million in India to boost medical device manufacturing. This move underscores the growing importance of the Indian market for medical device production and R&D.

- Medtronic's Expansion (February 2023): Medtronic, a leading medical device company, opened a new facility in Hyderabad with an investment of USD 300 million. This expansion highlights the company's commitment to the Indian market and its growth potential.

- Innovative Respiratory Device Launch (November 2022): Xplore Health Technologies, in collaboration with Airofit, Denmark, introduced Airofit PRO, a pioneering respiratory muscle training device. This launch signifies the increasing focus on preventive respiratory care and innovative product offerings.

- Strategic Partnerships (October 2022): AirPhysio partnered with Apollo Hospitals Group and Medsmart to expand the reach of its respiratory devices in India. This collaboration highlights the growing importance of strategic partnerships for market penetration.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 4.68 Billion |

Projected Market Size in 2032 |

USD 8.72 Billion |

CAGR Growth Rate |

7.15% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

A.B.Industries, AgVa Healthcare, Air Liquide Medical Systems India, Airon Corporation, Allied Healthcare Products Inc., Cipla Inc., Devilbiss-AMS Healthcare, Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Ltd, GE Healthcare, Hamilton Medical, Koninklijke Philips N.V., Masimo Corporation, Medtronic PLC, Mindray Medical International Limited, ResMed Inc., Smiths Medical, Trivitron Healthcare, Vyaire Medical, and Others. |

Key Segment |

By Product Type, By Application, By End-User, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North India holds the largest market share in the India respiratory devices market.

North India, especially Delhi, faces a high prevalence of respiratory diseases due to severe air pollution and high population density. The region benefits from a relatively better healthcare infrastructure, with numerous hospitals and healthcare facilities equipped with advanced respiratory devices. Increasing awareness about respiratory health and government efforts to combat air pollution drive the growth in this region.

South India, particularly Tamil Nadu and Karnataka, leads the market due to its advanced healthcare infrastructure, higher healthcare expenditure, and strong presence of medical device manufacturers. Cities like Chennai and Bangalore serve as major healthcare hubs, fostering robust demand for respiratory devices. Government initiatives aimed at improving air quality and healthcare accessibility further support the region's dominance.

West India, particularly Maharashtra, has a high demand for respiratory devices driven by its large urban population and industrial activities contributing to air pollution. Mumbai, as a major metropolitan city, has a significant number of hospitals and healthcare facilities with specialized respiratory care units. The region's growth is supported by the concentration of medical device companies and expanding healthcare facilities.

East India, with Kolkata as a major urban center, is an emerging market for respiratory devices. The region faces challenges such as lower healthcare infrastructure and high levels of air pollution, particularly in urban areas. Growth is driven by improving healthcare infrastructure, increased awareness about respiratory health, and government initiatives to enhance healthcare access and reduce air pollution.

Central India, including states like Madhya Pradesh and Chhattisgarh, represents a smaller market for respiratory devices but is witnessing gradual growth due to rising urbanization and increasing healthcare awareness. Government efforts to improve healthcare services and address respiratory health challenges contribute to the region's growth.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India respiratory devices market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India respiratory devices market include;

- A.B.Industries

- AgVa Healthcare

- Air Liquide Medical Systems India

- Airon Corporation

- Allied Healthcare Products Inc.

- Cipla Inc.

- Devilbiss-AMS Healthcare

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Ltd

- GE Healthcare

- Hamilton Medical

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic PLC

- Mindray Medical International Limited

- ResMed Inc.

- Smiths Medical

- Trivitron Healthcare

- Vyaire Medical

The India respiratory devices market is segmented as follows:

By Product Type

By Product Type

- Disposables

- Breathing Circuits

- Masks

- Others

- Therapeutic Devices

- Ventilators

- Oxygen Concentrators

- Inhalers

- Nebulizers

- Humidifiers

- BiPAP Devices

- CPAP Devices

- Others

- Diagnostic & Monitoring Devices

- Pulse Oximeters

- Peak Flow Meters

- Sleep Test Devices

- Capnographs

- Spirometers

- Other

By Application

By Application

- Asthma

- Pneumonia

- Respiratory Distress Syndrome

- Obstructive Sleep Apnea

- Cystic Fibrosis

- Chronic Obstructive Pulmonary Disease (COPD)

By End-User

By End-User

- Hospitals

- Clinics

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- A.B.Industries

- AgVa Healthcare

- Air Liquide Medical Systems India

- Airon Corporation

- Allied Healthcare Products Inc.

- Cipla Inc.

- Devilbiss-AMS Healthcare

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Ltd

- GE Healthcare

- Hamilton Medical

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic PLC

- Mindray Medical International Limited

- ResMed Inc.

- Smiths Medical

- Trivitron Healthcare

- Vyaire Medical

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors