Search Market Research Report

India Tea Market Size, Share Global Analysis Report, 2024 – 2032

India Tea Market Size, Share, Growth Analysis Report By Types of Tea (Black Tea, Green Tea, White Tea, Herbal Tea, Oolong Tea, and Others), By Packaging (Paper Boards, Aluminium Tin, Plastic Containers, Tea Bags, Loose Tea, and Others), By Application (Commercial and Residential), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

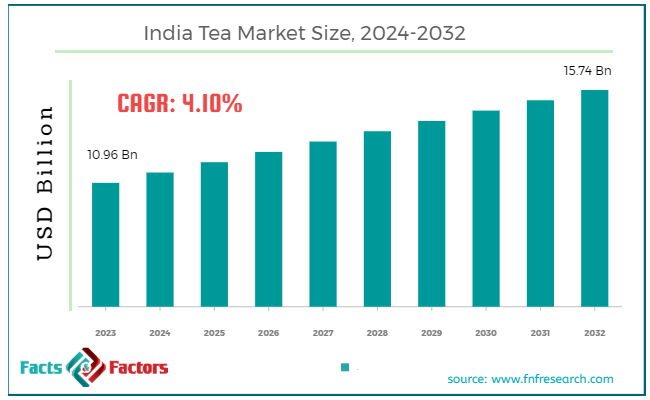

[224+ Pages Report] According to Facts & Factors, the India tea market size in terms of revenue was valued at around USD 10.96 billion in 2023 and is expected to reach a value of USD 15.74 billion by 2032, growing at a CAGR of roughly 4.10% from 2024 to 2032. The Indian tea market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India tea refers to a wide variety of teas produced and consumed in India, including Assam, Darjeeling, Nilgiri, and various regional and herbal blends. Tea is a fundamental part of Indian culture and daily life, with the country being one of the largest producers and consumers of tea globally. The Indian tea market is extensive, catering to both domestic and international markets. India’s diverse climatic conditions and rich soil allow for the cultivation of distinct tea varieties, each with unique flavors and characteristics.

The market is characterized by a mix of large-scale plantations and smallholder farmers, contributing to a robust supply chain. The Indian tea industry also benefits from well-established auction systems and export channels, making Indian tea a significant player on the global stage. Additionally, the increasing trend towards health and wellness has boosted the demand for green tea and herbal teas, further diversifying the market.

Government initiatives and support for tea cultivation and marketing, along with innovations in packaging and branding, have also played a crucial role in the market's growth. The rise of specialty tea cafes and e-commerce platforms has made quality Indian tea more accessible to consumers worldwide. As a result, the India tea market is poised for continued growth, driven by domestic consumption, expanding export opportunities, and evolving consumer preferences towards health-conscious and premium tea varieties.

Key Highlights

Key Highlights

- The India tea market has registered a CAGR of 4.10% during the forecast period.

- In terms of revenue, the India tea market was estimated at roughly USD 10.96 billion in 2023 and is predicted to attain a value of USD 15.74 billion by 2032.

- The growth of the India tea market is being propelled by [content].

- On the basis of types of tea, black tea remains the most dominant segment due to its widespread consumption and cultural significance.

- Based on the packaging, the tea bags segment is growing at a high rate and dominates due to their convenience.

- By application, the residential segment is projected to swipe the largest market share.

- Regionally, Assam remains the dominating region in terms of production volume due to its extensive tea gardens and favorable growing conditions.

Key Varieties:

Key Varieties:

- Assam Tea: Known for its strong, robust flavor and bright color, Assam tea is grown in the northeastern state of Assam. It is the world's largest tea-growing region and contributes a significant portion of India's tea production??.

- Darjeeling Tea: Often referred to as the "Champagne of Teas," Darjeeling tea is grown in the hilly regions of West Bengal. It is highly prized for its delicate flavor, unique muscatel notes, and light color?.

- Nilgiri Tea: Produced in the southern part of India, particularly in the Nilgiri hills, this tea is known for its fragrant aroma and brisk, fruity flavor. It is often used in blends and as a base for flavored teas.

India Tea Market Dynamics: Key Growth Drivers

India Tea Market Dynamics: Key Growth Drivers

- Rising Disposable Incomes and Changing Lifestyles: The expanding middle class with increased disposable income is driving a shift towards premium tea varieties, such as Darjeeling and Assam, and ready-to-consume formats like tea bags and bottled tea.

- Health and Wellness Consciousness: A growing emphasis on healthy living has fueled demand for green, black, and herbal teas, perceived as functional beverages with various health benefits.

- Urbanization and Consumer Preferences: The increasing urban population, particularly among young professionals, is driving a preference for convenience and variety in tea consumption, leading to a surge in demand for instant and flavored tea options.

- E-commerce Penetration: The rapid growth of online retail channels has expanded market reach for tea brands, enabling access to a wider consumer base and facilitating the sale of premium and niche tea varieties.

Restraints

Restraints

- Price Volatility: Fluctuations in tea prices due to factors such as weather conditions, input costs, and global demand pose challenges for tea producers and retailers, affecting profitability.

- Intense Competition: The presence of numerous players, including large organized tea companies and a fragmented unorganized sector, creates a highly competitive market with price wars and margin pressures.

- Climate Change Impact: The adverse effects of climate change, such as erratic rainfall patterns and soil degradation, threaten tea cultivation and production yields.

- Adulteration and Quality Concerns: The prevalence of adulterated tea in the market erodes consumer trust and hampers the overall reputation of the Indian tea industry.

Opportunities

Opportunities

- Product Innovation and Diversification: Developing new tea blends, flavors, and formats, such as tea-based beverages and ready-to-drink tea, can create new market segments.

- Premiumization and Niche Markets: Targeting high-income consumers with premium tea offerings, including organic, specialty, and artisanal teas, can drive higher margins.

- Omnichannel Retail Strategy: Integrating online and offline sales channels to reach a wider customer base and enhance brand visibility.

- Global Market Expansion: Leveraging India's strong tea heritage to increase exports of high-quality Indian teas to international markets.

Challenges

Challenges

- Shifting Consumer Tastes: Adapting to evolving consumer preferences, such as a growing preference for convenience and health-focused products, is essential for market success.

- Supply Chain Disruptions: Challenges related to tea procurement, processing, and distribution can impact product availability and costs.

- Labor Shortages: A shortage of skilled labor in tea plantations and processing facilities can affect production efficiency and quality.

- Sustainability and Ethical Sourcing: Increasing consumer awareness of environmental and social issues necessitates adopting sustainable practices and ensuring ethical sourcing.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The India tea market is segmented based on types of tea, packaging, application, distribution channel, and region.

By Types of Tea Analysis

By Types of Tea Analysis

Based on Types of Tea, the India tea market is divided into black tea, green tea, white tea, herbal tea, oolong tea, and others.

Black tea is the most popular and widely consumed type of tea in India. It is known for its strong flavor and high caffeine content. Assam and Darjeeling are the primary regions producing black tea. Assam tea is robust and malty, while Darjeeling tea is lighter with a distinct muscatel flavor. Black tea is commonly used in traditional Indian chai, which includes spices like cardamom, cinnamon, and ginger. The large domestic consumption and export demand make black tea a significant segment of the market??.

Green tea has gained immense popularity in recent years due to its health benefits, including weight management and antioxidant properties. It is minimally processed and retains more natural compounds compared to black tea. The rise in health consciousness among consumers has driven the demand for green tea, which is often marketed for its detoxifying and calming effects. Major brands like Tata and Unilever have expanded their green tea portfolios to cater to this growing segment??.

White tea is the least processed type of tea, made from young tea leaves and buds. It is known for its delicate flavor and high antioxidant content. While white tea is not as widely consumed as black or green tea, it is gaining popularity among health-conscious consumers and tea connoisseurs. The production of white tea is limited to select regions, contributing to its premium pricing and niche market appeal?.

Herbal tea, also known as tisane, is made from a variety of herbs, spices, flowers, and fruits, rather than traditional tea leaves. Popular herbal teas in India include blends with ingredients like tulsi (holy basil), ginger, peppermint, and chamomile. Herbal teas are often consumed for their therapeutic benefits, such as aiding digestion, reducing stress, and improving sleep. The demand for herbal tea is growing as consumers seek caffeine-free alternatives with added health benefits?.

Oolong tea is partially fermented, offering a flavor profile that lies between black and green tea. It is less common in India compared to other tea types but has a dedicated following among tea enthusiasts. Oolong tea is appreciated for its complex flavor and potential health benefits, such as aiding in weight loss and improving metabolism. Its production is more labor-intensive, contributing to its higher cost and limited availability?.

By Packaging Analysis

By Packaging Analysis

On the basis of Packaging, the India tea market is bifurcated into paper boards, aluminium tin, plastic containers, tea bags, loose tea, and others.

Paper boards are commonly used for packaging tea due to their eco-friendly nature and cost-effectiveness. They are often used for bulk packaging and can be found in various sizes. Paper board packaging is preferred by consumers who are environmentally conscious and seek sustainable packaging options. It provides good protection against light and moisture, ensuring the freshness of the tea.

Aluminium tins are a premium packaging option that offers excellent protection against light, air, and moisture. This packaging type is often used for high-end tea products, including specialty and artisanal teas. Aluminium tins are durable and can be reused, making them a popular choice for gift packaging and premium tea brands. They help in preserving the flavor and aroma of the tea for a longer period??.

Plastic containers are widely used due to their durability, lightweight nature, and cost-effectiveness. They are commonly used for both loose tea and tea bags. Plastic containers provide a good barrier against moisture and contamination, making them suitable for everyday use. However, the increasing environmental concerns regarding plastic use are leading some consumers to seek alternative packaging options?.

Tea bags are the most convenient packaging type, offering ease of use and quick preparation. They are particularly popular among urban consumers who prefer a hassle-free tea experience. Tea bags are available in various materials, including paper and biodegradable options, catering to the growing demand for eco-friendly products. This packaging type dominates the market due to its convenience and widespread availability??.

Loose tea is often packaged in flexible materials such as paper pouches, foil-lined bags, or plastic bags. This packaging type is preferred by traditional tea drinkers. Loose tea packaging allows for a more authentic tea-drinking experience and is commonly used for bulk purchases?.

By Application Analysis

By Application Analysis

Based on Application, the India tea market is categorized into commercial and residential.

The commercial segment includes tea consumption in hotels, restaurants, cafes, offices, and other public venues. This segment is driven by the growing number of tea cafes and lounges, such as Chaayos and Wagh Bakri Tea Lounge, which offer a variety of tea blends and innovative tea-based beverages. The commercial sector also encompasses the use of tea in hospitality services, catering, and corporate settings.

The residential segment includes tea consumed at home. This segment constitutes a large portion of the market, driven by the daily consumption habits of Indian households. Tea is a staple beverage in Indian homes, enjoyed multiple times a day.

Recent Developments:

Recent Developments:

- Coca-Cola's Entry into Ready-to-Drink Tea: In November 2023, Coca-Cola expanded its beverage portfolio by launching Honest Tea, marking its entry into the ready-to-drink tea segment.

- Tata Consumer Products' Focus on Regional Flavors: Tata Consumer Products introduced Tata Tea Premium - Street Chais of India in March 2023, offering a range of teas inspired by iconic Indian cities. This move aimed to capture the essence of local tea experiences.

- Dabur's Ayurvedic Tea Launch: Recognizing the growing demand for health and wellness products, Dabur India launched Dabur Vedic Tea in November 2022. This premium tea, infused with Ayurvedic herbs, targets health-conscious consumers seeking immunity benefits.

- Tata Consumer Products Expands Green Tea Offerings: Tata Consumer Products, a leading player in India's tea market, capitalized on the growing popularity of green tea by expanding its Tetley green tea range in November 2022. The introduction of Tetley Green Tea with Tulsi Flavor catered to the increasing consumer preference for products combining traditional Indian flavors with the health benefits associated with green tea.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 10.96 Billion |

Projected Market Size in 2032 |

USD 15.74 Billion |

CAGR Growth Rate |

4.10% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Amar Tea Pvt. Ltd, Assam Company India Limited, Brooke Bond Taj Mahal, Darjeeling Tea Boutique, Duncans Industries Ltd., Girnar Chaayos, Goodricke Group Limited, Hindustan Unilever Limited, Jayshree Tea & Industries Ltd, Lipton, Makaibari Tea Estate, Marvel Group, Pataka Group of Companies, Patanjali Ayurved Limited, R. Twining and Company Limited, Ramesh Tea Traders, Rossell India Ltd., Society Tea, Tata Tea, Teabox, Tetley, Typhoo Tea, Vahdam Teas, Wagh Bakri Tea Group, and Others. |

Key Segment |

By Types of Tea, By Packaging, By Application, By Distribution Channel, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Assam and Darjeeling region is expected to dominate the market during the forecast period

The North region, particularly Assam and Darjeeling, is renowned for its premium quality teas. Assam, known for its robust and malty teas, dominates in terms of production volume. Darjeeling, often referred to as the "Champagne of Teas," produces delicate and aromatic teas highly sought after in both domestic and international markets. This region is crucial for orthodox tea production, catering to a niche market that appreciates high-quality, hand-processed teas.

West Bengal, including the Dooars and Terai regions, is a significant producer of CTC (Crush, Tear, Curl) tea, which is a staple for the Indian market due to its strong flavor and affordability. The Central region, although not as prominent as other areas, contributes to the overall tea production with emerging tea gardens aiming to enhance quality and yield.

The South region, particularly Tamil Nadu, is notable for its Nilgiri tea, which is known for its fruity and floral notes. This area focuses on both CTC and orthodox tea production, supplying a considerable portion of India’s domestic tea consumption. The South region also sees a growing trend towards specialty teas, catering to a more discerning clientele.

In the West region, states like Maharashtra and Gujarat are seeing a rise in boutique tea gardens producing artisanal and specialty teas. This region is also becoming a hub for innovative tea blends and premium products aimed at niche markets and tea connoisseurs.

Competitive Landscape

Competitive Landscape

The analysis-intensive report provides key insights into companies and organizations operating in the India tea market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India tea market include;

- Amar Tea Pvt. Ltd

- Assam Company India Limited

- Brooke Bond Taj Mahal

- Darjeeling Tea Boutique

- Duncans Industries Ltd.

- Girnar Chaayos

- Goodricke Group Limited

- Hindustan Unilever Limited

- Jayshree Tea & Industries Ltd

- Lipton

- Makaibari Tea Estate

- Marvel Group

- Pataka Group of Companies

- Patanjali Ayurved Limited

- R. Twining and Company Limited

- Ramesh Tea Traders

- Rossell India Ltd.

- Society Tea

- Tata Tea

- Teabox

- Tetley

- Typhoo Tea

- Vahdam Teas

- Wagh Bakri Tea Group

The India tea market is segmented as follows:

By Types of Tea

By Types of Tea

- Black Tea

- Green Tea

- White Tea

- Herbal Tea

- Oolong Tea

- Others

By Packaging

By Packaging

- Paper Boards

- Aluminium Tin

- Plastic Containers

- Tea Bags

- Loose Tea

- Others

By Application

By Application

- Commercial

- Residential

By Distribution Channel

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- Amar Tea Pvt. Ltd

- Assam Company India Limited

- Brooke Bond Taj Mahal

- Darjeeling Tea Boutique

- Duncans Industries Ltd.

- Girnar Chaayos

- Goodricke Group Limited

- Hindustan Unilever Limited

- Jayshree Tea & Industries Ltd

- Lipton

- Makaibari Tea Estate

- Marvel Group

- Pataka Group of Companies

- Patanjali Ayurved Limited

- R. Twining and Company Limited

- Ramesh Tea Traders

- Rossell India Ltd.

- Society Tea

- Tata Tea

- Teabox

- Tetley

- Typhoo Tea

- Vahdam Teas

- Wagh Bakri Tea Group

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors