Search Market Research Report

India UAV Market

India UAV Market Size, Share, Growth Analysis Report By Type (Rotary-wing, Fixed-wing, Hybrid UAVs, and Others), By Point of Sale (OEM and Aftermarket), By Application (Military, Commercial, Consumer, Government, and Others), By End-User (Agriculture, Logistics, Construction & Mining, Defense, Energy, Media & Entertainment, and Others), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

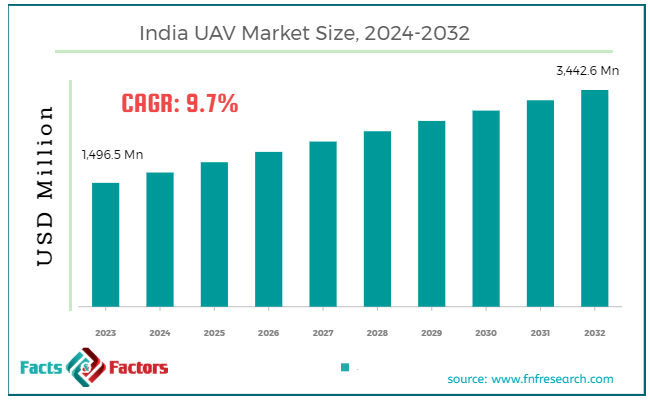

[225+ Pages Report]According to Facts & Factors, the India UAV market size in terms of revenue was valued at around USD 1,496.5 million in 2023 and is expected to reach a value of USD 3,442.6 million by 2032, growing at a CAGR of roughly 9.7% from 2024 to 2032. The India UAV market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Unmanned Aerial Vehicles (UAVs), commonly known as drones, are aircraft systems that operate without a human pilot onboard. In India, UAVs are utilized across various sectors including defense, agriculture, surveillance, and logistics. The India UAV market has been experiencing significant growth due to advancements in technology, increasing adoption in commercial applications, and supportive government policies.

The India UAV market is poised for rapid expansion, driven by both military and civilian applications. The military segment remains the largest consumer, with UAVs being used for intelligence, surveillance, reconnaissance (ISR), and combat missions. The defense sector’s focus on modernizing the armed forces and enhancing border security has led to increased investments in UAV technology.

Key Highlights

Key Highlights

- The India UAV market has registered a CAGR of 9.7% during the forecast period.

- In terms of revenue, the India UAV market was estimated at roughly USD 1,496 million in 2023 and is predicted to attain a value of USD 3,442.6 million by 2032.

- The growth of the India UAV market is being propelled by government support, agriculture needs, disaster management, infrastructure development, defense, and e-commerce.

- Based on the type, the rotary-wing segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the military segment is projected to swipe the largest market share due to its critical applications in defense and security.

- In terms of end-user, the agriculture segment is expected to dominate the market due to the modernization of farming practices.

- Regionally, Western India is expected to dominate the market during the forecast period.

Key Growth Drivers

Key Growth Drivers

- Government Initiatives: The Indian government's proactive stance, exemplified by initiatives like Drone Shakti, has created a conducive ecosystem for UAV development and deployment. This has instilled confidence among investors and entrepreneurs.

- Agricultural Transformation: The vast agricultural sector is undergoing a digital revolution, with UAVs emerging as indispensable tools for precision farming, crop monitoring, and spraying, thereby enhancing productivity and reducing costs.

- Disaster Management and Humanitarian Aid: UAVs have proven to be invaluable assets in disaster response, aiding in search and rescue, damage assessment, and logistics management. Their swift deployment capabilities are revolutionizing relief efforts.

- Infrastructure Development: The nation's ambitious infrastructure projects, such as smart cities and highways, are leveraging UAV technology for surveying, monitoring, and inspection, accelerating project timelines.

- Defense and Homeland Security: The armed forces are increasingly adopting UAVs for surveillance, reconnaissance, and intelligence gathering, enhancing national security.

Restraints

Restraints

- Regulatory Challenges: The evolving regulatory landscape, while necessary, poses challenges for UAV operators and manufacturers, hindering market growth and investment.

- Infrastructure Limitations: The absence of dedicated UAV infrastructure, including airspace management systems and landing zones, hampers widespread UAV operations.

- Privacy and Safety Concerns: Public apprehension regarding data privacy and UAV safety incidents can impede market acceptance.

- High Operational Costs: The initial investment in UAVs, along with ongoing maintenance and operational expenses, can be prohibitive for some users.

- Skill Shortage: A shortage of skilled professionals for UAV operation, maintenance, and data analysis can hinder industry growth.

Opportunities

Opportunities

- Drone-as-a-Service (DaaS): The burgeoning DaaS model offers immense potential for entrepreneurs and established players to provide drone-based services to various sectors.

- Data Analytics and Artificial Intelligence: Integrating UAV data with advanced analytics can generate valuable insights for agriculture, urban planning, and disaster management.

- Beyond Visual Line of Sight (BVLOS) Operations: Expanding UAV operations beyond visual range will significantly enhance their utility in various applications.

- Exports: India has the potential to emerge as a global UAV manufacturing and services hub, capitalizing on its cost-effective talent pool and growing expertise.

- New Applications: Exploring innovative UAV applications, such as drone delivery, aerial mapping, and environmental monitoring, can open up new market segments.

Challenges

Challenges

- Battery Technology Limitations: The limited flight time of UAVs due to battery constraints restricts their operational capabilities.

- Cybersecurity Threats: Protecting UAV systems from cyberattacks is crucial to maintain data integrity and operational security.

- Competition: The increasing number of domestic and international players intensifies competition, impacting pricing and market share.

- Economic Downturns: Economic fluctuations can influence UAV demand, especially in sectors reliant on discretionary spending.

Segmentation Analysis

Segmentation Analysis

The India UAV market is segmented based on type, point of sale, application, end-user, and others.

- By Type Insights

Based on Type, the India UAV market is divided into rotary-wing, fixed-wing, hybrid UAVs, and others.

Rotary-wing UAVs, commonly known as drones or quadcopters, are highly versatile and widely used across various applications, including surveillance, agriculture (such as crop monitoring and spraying), aerial photography, infrastructure and industrial inspections, and delivery services. Their maneuverability and ability to hover and perform vertical take-offs and landings make them ideal for use in confined spaces. Despite their limited flight duration and range compared to fixed-wing UAVs, rotary-wing UAVs hold the largest market share due to their extensive.

Fixed-wing UAVs, designed like traditional aircraft with wings providing lift for sustained flight, are more suitable for long-range missions and efficient area coverage. These UAVs are commonly employed in long-range surveillance, mapping, environmental monitoring, disaster management, and defense operations. The advantages of fixed-wing UAVs include longer flight durations, higher speeds, greater range, and larger payload capacities. However, they require runways or catapult launch systems for take-off and landing. Fixed-wing UAVs maintain a significant market share for applications demanding extensive area coverage and endurance.

Hybrid UAVs, combining features of both rotary-wing and fixed-wing UAVs, offer vertical take-off and landing (VTOL) capabilities along with efficient long-range flight. This versatility makes them suitable for a wide range of applications, including surveillance, agriculture, delivery, and inspection in both confined and open areas. While hybrid UAVs present technological complexities and higher costs compared to their pure rotary-wing or fixed-wing counterparts, they are an emerging segment with increasing adoption.

- By Application Insights

On the basis of Application, the India UAV market is bifurcated into military, commercial, consumer, government, and others.

The military segment dominates the Indian UAV market, driven by the increasing adoption of UAVs for surveillance, reconnaissance, target acquisition, and intelligence gathering. The Indian Armed Forces leverage UAVs for border security, counter-terrorism operations, and maritime surveillance. The advantages of UAVs in providing real-time data, reducing human risk, and enhancing operational efficiency have led to significant investments in this sector.

The commercial segment is rapidly expanding as various industries recognize the benefits of UAVs in improving operational efficiency and reducing costs. Key applications include agriculture (precision farming, crop monitoring, and spraying), logistics and delivery services, infrastructure inspection (power lines, pipelines, and bridges), and aerial photography. The commercial UAV market is driven by the increasing adoption of UAVs in smart city projects, environmental monitoring, and disaster management.

Consumer UAVs are primarily used for recreational purposes, such as aerial photography and videography, and personal hobbies. The segment has seen substantial growth due to the availability of affordable, user-friendly drones and the rising popularity of drone-based photography and social media content creation. While consumer UAVs represent a smaller share of the overall market, the increasing demand for high-quality, easy-to-operate drones continues to drive growth.

Government applications of UAVs include law enforcement, disaster management, environmental monitoring, and infrastructure development. UAVs are used for surveillance, traffic management, search and rescue operations, and monitoring environmental changes. The government's focus on leveraging technology for public safety and infrastructure development has led to increased adoption of UAVs in this segment.

- By End-User Insights

Based on End-User, the India UAV market is categorized into agriculture, logistics, construction & mining, defense, energy, media & entertainment, and others.

The agriculture sector is increasingly adopting UAVs for precision farming, crop monitoring, irrigation management, pesticide spraying, and soil analysis. UAVs enable farmers to enhance crop yields, optimize resource use, and detect issues early. The adoption of advanced UAV technologies in agriculture is driven by the need to improve productivity and reduce costs.

Logistics In the logistics sector, UAVs are used for parcel delivery, inventory management, and warehouse operations. The ability of UAVs to provide quick and efficient delivery solutions, especially in remote or congested areas, is a significant driver. Companies like Amazon and logistics firms are exploring UAVs for last-mile delivery to improve efficiency and reduce delivery times.

Construction & Mining The construction and mining industries utilize UAVs for site surveying, mapping, progress monitoring, and safety inspections. UAVs provide high-resolution imagery and data, enabling better project planning and management. They help in identifying potential issues, improving safety, and enhancing productivity. The growing infrastructure development and mining activities in India are fueling the demand for UAVs in this sector.

Defense The defense sector remains one of the largest end-users of UAVs in India. UAVs are crucial for surveillance, reconnaissance, target acquisition, and intelligence operations. The Indian Armed Forces deploy UAVs for border security, counter-terrorism, and maritime surveillance. The strategic importance of UAVs in enhancing national security and the ongoing modernization of defense capabilities drive this segment.

Energy In the energy sector, UAVs are used for inspecting power lines, wind turbines, solar panels, and oil and gas pipelines. UAVs enable quick and safe inspections, reducing downtime and maintenance costs. They help in detecting faults, monitoring infrastructure, and ensuring operational efficiency. The adoption of UAVs in renewable energy projects and traditional energy sectors is on the rise, driven by the need for efficient maintenance and monitoring solutions.

Media & Entertainment The media and entertainment industry employs UAVs for aerial photography, filmmaking, live event coverage, and sports broadcasting. UAVs offer unique perspectives and high-quality visuals, enhancing the production value of media content. The demand for innovative and engaging content drives the adoption of UAVs in this sector.

Recent Developments:

Recent Developments:

- In March 2024: BEML's partnership with Garuda Aerospace in March 2024 signifies a significant step towards domestic drone manufacturing. This collaboration aims to establish a robust domestic UAV ecosystem.

- In 2024: Adani Group's introduction of the Drishti 10 'Starliner' in 2024 showcases India's capability to develop high-end drones with extended endurance and heavy payload capacity. This drone's potential for surveillance and reconnaissance missions is substantial.

- In September 2023: The collaboration between GalaxEye and ideaForge in September 2023 highlights the growing importance of UAVs in defense and security. The development of a drone equipped with foliage penetration radar underscores the focus on advanced surveillance capabilities.

- In 2023r: Delair SAS's contract with the French Defense Ministry to supply drones to Ukraine in 2023 demonstrates the potential for Indian companies to participate in global UAV markets. Such collaborations can facilitate technology transfer and enhance domestic capabilities.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 1,496.5 Million |

Projected Market Size in 2032 |

USD 3,442.6 Million |

CAGR Growth Rate |

9.7% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Aarav Unmanned Systems Ltd., Adani Defense and Aerospace, Aero360 Innovations Ltd., Airpix Geoanalytics Ltd., Asteria Aerospace Limited, Avian UAVs Ltd., Dhaksha Unmanned Systems, Garuda Aerospace, General Aeronautics, Hubblefly Technologies, ideaforge Technology Ltd., Indrone Systems Ltd., Iotechworld, Marut Dronetech Private Limited, Newspace Research Technologies Pvt. Ltd., Omnipresent Robot Tech Ltd., Paras Aerospace, Quidich Innovation Labs Ltd., Skylark Drones Ltd., Tata Advanced Systems Limited, Thanos, Throttle Aerospace Systems Pvt. Ltd., and Others. |

Key Segment |

By Type, By Point of Sale, By Application, By End-User, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Western India, comprising states like Maharashtra, Gujarat, and Goa, currently dominates the Indian UAV market

Western India, particularly Maharashtra with cities like Mumbai and Pune, dominates the UAV market. This region is a hub for both commercial and industrial UAV applications, including agriculture, infrastructure inspection, and logistics. The high level of industrial activity and the presence of major corporate headquarters contribute to the significant demand for UAV services. The region's emphasis on technological innovation and investment in smart city projects also drives UAV adoption.

North India, including Delhi and surrounding states, is a significant region for the UAV market. This region benefits from a high concentration of government institutions and defense organizations that heavily invest in UAV technologies for surveillance, border security, and intelligence operations. The presence of numerous UAV startups and technology hubs in cities like Delhi further accelerates market growth in this region.

Southern India, with states like Karnataka and Tamil Nadu, is rapidly emerging as a key player in the UAV market. Bangalore, known as the Silicon Valley of India, hosts a multitude of tech companies and startups focused on UAV innovations. The region's strong IT and aerospace sectors facilitate the development and deployment of advanced UAV solutions for various applications, including environmental monitoring, disaster management, and urban planning.

Eastern India, including West Bengal and Odisha, is witnessing growing interest in UAV technologies, particularly for agricultural and mining applications. The vast agricultural lands and mining operations in these states create a demand for UAVs to enhance productivity and operational efficiency. Government initiatives to modernize agriculture and improve infrastructure are also driving the adoption of UAV technologies in this region.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India UAV market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India UAV market include;

- Aarav Unmanned Systems Ltd.

- Adani Defense and Aerospace

- Aero360 Innovations Ltd.

- Airpix Geoanalytics Ltd.

- Asteria Aerospace Limited

- Avian UAVs Ltd.

- Dhaksha Unmanned Systems

- Garuda Aerospace

- General Aeronautics

- Hubblefly Technologies

- ideaforge Technology Ltd.

- Indrone Systems Ltd.

- Iotechworld

- Marut Dronetech Private Limited

- Newspace Research Technologies Pvt. Ltd.

- Omnipresent Robot Tech Ltd.

- Paras Aerospace

- Quidich Innovation Labs Ltd.

- Skylark Drones Ltd.

- Tata Advanced Systems Limited

- Thanos

- Throttle Aerospace Systems Pvt. Ltd.

The India UAV market is segmented as follows:

By Type

By Type

- Rotary-wing

- Fixed-wing

- Hybrid UAVs

- Others

By Point of Sale

By Point of Sale

- OEM

- Aftermarket

By Application

By Application

- Military

- Commercial

- Consumer

- Government

- Others

By End-User

By End-User

- Agriculture

- Logistics

- Construction & Mining

- Defense

- Energy

- Media & Entertainment

- Others

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- Aarav Unmanned Systems Ltd.

- Adani Defense and Aerospace

- Aero360 Innovations Ltd.

- Airpix Geoanalytics Ltd.

- Asteria Aerospace Limited

- Avian UAVs Ltd.

- Dhaksha Unmanned Systems

- Garuda Aerospace

- General Aeronautics

- Hubblefly Technologies

- ideaforge Technology Ltd.

- Indrone Systems Ltd.

- Iotechworld

- Marut Dronetech Private Limited

- Newspace Research Technologies Pvt. Ltd.

- Omnipresent Robot Tech Ltd.

- Paras Aerospace

- Quidich Innovation Labs Ltd.

- Skylark Drones Ltd.

- Tata Advanced Systems Limited

- Thanos

- Throttle Aerospace Systems Pvt. Ltd.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors