Search Market Research Report

Inertial Navigation System Market Size, Share Global Analysis Report, 2022 – 2028

Inertial Navigation System Market Size, Share, Growth Analysis Report By Product Type (Navigation, Tactical, Commercial, and Marine), By Technology (Micro electro-mechanical Systems, Fiber Optic Gyros, Ring Laser Gyros, Mechanical, And Vibrating Gyro), By Application (Naval, Airborne, Commercial, and Land), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

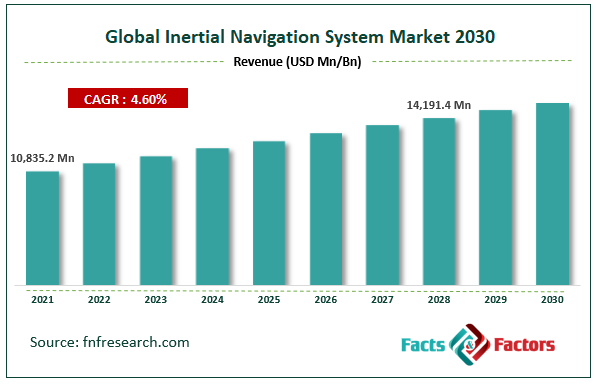

[218+ Pages Report] According to Facts and Factors, the global inertial navigation system market size was worth USD 10,835.2 million in 2021 and is estimated to grow to USD 14,191.4 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.6% over the forecast period. The report analyzes the inertial navigation system market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the inertial navigation system market.

Market Overview

Market Overview

An electrical device called an inertial navigation system continuously determines the position, speed, and acceleration of moving objects without using any outside measurements. An inertial navigation system comprises two independent components: an inertial measurement unit (IMU) and a navigation computer. The IMU helps the navigation computer acquire measurements, which it then utilizes to determine the INS's relative velocity, orientation, and position. In the past, inertial navigation systems were first developed for rockets. Submarines, ships, aircraft, guided missiles, and spacecraft all frequently use inertial navigation systems, as do civil uses like robotics and surveying well bores below the earth.

The market for inertial navigation systems is fueled by navigational technology developments, the expanding aerospace industry, and the availability of durable and compact components. The development of MEMS (micro-electro-mechanical systems) technology and the usage of satellite navigation are other reasons driving the rise of inertial navigation systems (commercial application). The inertial navigation system market is constrained by the high cost of developing such sophisticated positioning systems and their maintenance.

COVID-19 Impact:

COVID-19 Impact:

Commercial operations are currently prohibited due to the pandemic crisis. With the process disruption, fewer system components are readily available, and demand for unmanned vehicles for use in commercial operations, including oil tank testing, pipeline inspection, windmill inspection, and field mapping, is declining. Additionally, during the lockdown, critical production facilities around the world are shut down. Hence this pandemic impacts the creation of inertial navigation system components, which harms the expansion of this market. The negative consequences of the coronavirus are already widespread and will have a substantial impact on the market in 2020. However, it is anticipated that there will be a significant need for next-generation navigation systems in the upcoming years due to the growing use of unmanned vehicles for commercial and military surveillance purposes.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global smart hospitals market value is expected to grow at a CAGR of 4.6% over the forecast period

- In terms of revenue, the global inertial navigation system market size was valued at around USD 10,835.2 million in 2021 and is projected to reach USD 14,191.4 million by 2028.

- The need for inertial navigation systems is anticipated to increase over time due to rising passenger air traffic and technical developments in the global aerospace industry.

- By technology, the micro-electro-mechanical systems category dominated the market in 2021

- By application, the naval category dominated the market in 2021

- North America dominated the global inertial navigation system market in 2021

Growth Drivers

Growth Drivers

- Increased requirement for navigational accuracy will drive the market growth

In the current state of warfare, the need for precise location information, including altitude and orientation of military equipment, is of the utmost importance. These specifics are necessary for efficient target planning and implementation. Accelerometers and gyroscopes are two examples of the sensors used in inertial navigation systems, which provide information about the position, orientation, and speed of a moving body. Since inertial navigation systems can provide precise location information, their use in the defense industry has increased. Thus, the market for inertial navigation systems has expanded as a result of the expanding firepower of the military throughout the world and the increased requirement for navigational accuracy.

Restraints

Restraints

- Reduction in developed countries' defense spending will restrict the growth of the market

Defense ships, guided munitions, military and special purpose helicopters, fighter aircraft, submarines, and short, medium, and long-range missiles all use inertial navigation systems. The decrease in defense spending in affluent nations like Sweden, Switzerland, Finland, Brussels, and Canada has impacted the market for inertial navigation systems by reducing the demand for these systems. As a result, the drop in the purchase of defense hardware due to inadequate defense spending is holding back the market for inertial navigation systems.

Opportunity

Opportunity

- Commercial autonomous vehicle development will provide new opportunities in the market

Robotic vehicles that can reach their destinations without human assistance are known as driverless vehicles. Machine learning and sensor technology advances drive the demand for commercial autonomous vehicles. Driverless technology for commercial cars is currently being developed by businesses including Tesla, Google, Ford, and BMW. According to Ford and BMW, fully autonomous commercial vehicles are expected to hit the market by 2022. Several important businesses in the automotive sector are funding the development of driverless cars.

Challenges

Challenges

- Error propagation will pose a huge market challenge

The operation of stable platform inertial navigation systems depends on various mechanical components at multiple joints. To prevent any form of measuring inaccuracy, these joints must be frictionless. These systems' performance is hampered due to the friction error that develops with extended use and system wear and tear. A few computing errors are introduced by noise and drifts in addition to friction. For instance, MEMS inertial sensors contain minimal mechanical parts that weigh just a few micrograms. Due to their lightweight, these components can fail to respond to slight alterations in orientation. Therefore, measurement error is caused by friction and drifts, which propagates over time.

Segmentation Analysis

Segmentation Analysis

The global inertial navigation system market has been segmented into product type, technology, and application.

Based on product type, the worldwide inertial navigation system market is segmented into navigation, tactical, commercial, and marine. In 2021, navigation products acquired the largest market share. Globally, navigation systems are being used more frequently due to the growing demand for real-time information in several applications, from the automotive industry to autonomous robotics. As technology has developed, these systems have changed to provide a variety of services and facilities for navigation, resulting in the development of a sizable service ecosystem surrounding navigation technologies.

Based on technology, the worldwide inertial navigation system market is segmented into micro-electro-mechanical systems, fiber optic gyros, ring laser gyros, mechanical, and vibrating gyros. In 2021, micro-electro-mechanical systems technology acquired the largest market share. With the greater integration of MEMS sensors in the navigation system, the technology of micro-electro-mechanical systems is developing faster. The main goals of this are accuracy improvement and system weight reduction. The advantages of MEMS sensors include their low price, excellent performance, high dependability, and lightweight. With these characteristics, the MEMS accelerometer and MEMS gyroscope are heavily utilized to create INS. In addition, line-of-sight communication, targeting, and autonomous navigation have all been improved using quartz MEMS over previous SWaP-c limitations.

Based on application, the worldwide inertial navigation system market is segmented into naval, airborne, commercial, and land. In 2021, the naval application of an inertial navigation system dominated the market. The segment for naval inertial navigation systems is driven by the need for reliable navigation systems in marine, tactical, and space studies and applications. The three main drivers anticipated to fuel the expansion of the naval navigation system market are an increase in seaborne trade, military spending, and cruise tourism. Lightweight and compact naval inertial navigation systems have been developed thanks to technological developments and innovations in the military and naval applications of fiber optic gyro, ring laser gyro, and micro-electro-mechanical systems (MEMSs).

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 10,835.2 Million |

Projected Market Size in 2028 |

USD 14,191.4 Million |

CAGR Growth Rate |

4.6% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Honeywell International, Safran, Northrop Grumman, Thales Group, KVH Industries, Teledyne, Systron Donner Inertial, VectorNav, TASC Gmbh, ETLG Aerosystems, and Others |

Key Segment |

By Product Type, Technology, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In August 2020, VectorNav offered the Tactical Embedded, a tiny, board-mount solution for the VectorNav Tactical Series line of IMU/AHRS, GNSS/INS, and Dual GNSS-Aided INS devices. The Tactical Embedded provides tactical-grade IMU performance in a minimal design, giving applications with limited SWaP-C a level of power never before possible.

Regional Landscape

Regional Landscape

- North America dominated the inertial navigation system market in 2021

A sizeable portion of the global market is anticipated to be accounted for by the North American region. Providing precise navigation and positioning data to combat platforms on missions is the main application for inertial systems in the region's defense industry. The U.S. Army has used inertial tactical navigation systems successfully in combat. The market for INS systems is anticipated to rise quickly as the military sector demands solutions for reliable location and navigation. Inertial systems are also in demand in the U.S. maritime industry, mainly because of the increased focus on oil exploration activities. In addition, high-performance gyroscopes and accelerometers are needed for oil rig exploration activities to provide the proper self-contained sensing system. Inertial gyroscopes also provide precise platform stabilization solutions in applications like offshore oil rigs, where outstanding bias stability is crucial.

Competitive Landscape

Competitive Landscape

Key players within the global inertial navigation system market include

- Honeywell International

- Safran

- Northrop Grumman

- Thales Group

- KVH Industries

- Teledyne

- Systron Donner Inertial

- VectorNav

- TASC Gmbh

- ETLG Aerosystems

The global Inertial Navigation System market is segmented as follows:

By Product Type

By Product Type

- Navigation

- Tactical

- Commercial

- Marine

By Technology

By Technology

- Micro electro-mechanical systems

- Fiber Optic Gyro

- Ring Laser Gyro

- Mechanical

- Vibrating Gyro

By Application

By Application

- Naval

- Airborne

- Commercial

- Land

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Honeywell International

- Safran

- Northrop Grumman

- Thales Group

- KVH Industries

- Teledyne

- Systron Donner Interial

- VectorNav

- TASC Gmbh

- ETLG Aerosystems

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors