Search Market Research Report

Liquid Fertilizers Market Size, Share Global Analysis Report, 2022 – 2028

Liquid Fertilizers Market Size, Share, Growth Analysis Report By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others (turf, ornamentals, and nursery plants)), By Compounds (Calcium Ammonium Nitrate (CAN), Urea-Ammonium Nitrate (UAN), Potassium Nitrate, Phosphorus Pentoxide (P205), Others (boron, chloride, and iron)), By Application (Soil, Foliar, Fertigation, Others (starter solutions and aerial applications)), By Type (Nitrogen, Phosphorus, Potash, Micronutrients), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

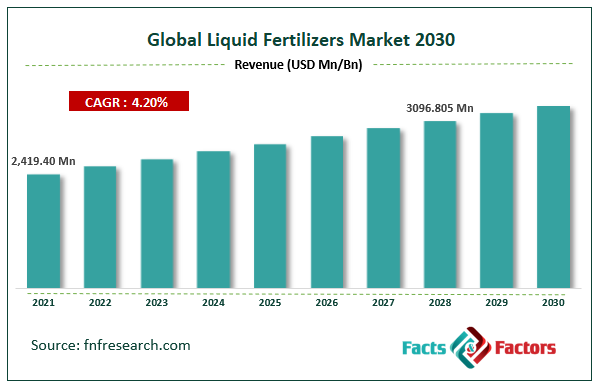

[231+ Pages Report] According to Facts and Factors, the global liquid fertilizers market size was worth USD 2,419.40 million in 2021 and is estimated to grow to USD 3096.805 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.20% over the forecast period. The report analyzes the liquid fertilizers market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the liquid fertilizers market.

Market Overview

Market Overview

Compounds derived from synthetic or natural sources, known as liquid fertilizers, supply nutrients essential for plant development. By changing the soil's ability for water retention and aeration, liquid fertilizers increase the efficiency of the soil. Important macronutrients like nitrogen, phosphate, and potassium are added to the soil or directly to the crops in the form of liquid fertilizers to increase crop yield. Growing consumer demand for improved, high-efficiency fertilizers is driving the market. Improved, effective liquid fertilizer application ensures that plants and crops receive the nutrients they require in the appropriate amount, at the right time, in the right location, and with the least amount of waste. Increased use of enhanced efficiency fertilizers, or EEF, in agriculture, especially for cereal grains and industrial crops, has led to the creation of novel urease inhibitors and low-cost polymer coating technologies. The harmful impact of nutrients seeping into water reservoirs is lessened by using high-efficiency fertilizers. Major barriers to the growth of the liquid fertilizers market are the high installation cost and the rising cost of liquid fertilizer storage. When using liquid fertilizers, water is soluble. Due to the need for specialized storage and handling facilities, liquid fertilizers have high transportation costs and high costs to combine the nutrients in the liquid. Global market expansion is being hampered, particularly in areas like the Middle East and Africa, by a lack of information and understanding about the application of liquid fertilizers. Like various other businesses, the fertilizer industry is governed by laws and other state restrictions, which can help and hinder its expansion.

Covid-19 Impact:

Covid-19 Impact:

The majority of sectors across several nations have suffered as a result of the COVID-19 pandemic's worldwide catastrophe. Import-export limitations, which led to hold-ups and cancellations at national borders, had a detrimental effect on the world fertilizer market. The agri-food supply chain faced various difficulties due to restrictions on the movement of persons and products. Furthermore, given that different nations and states are working to address COVID-19 with various strategies, the challenges faced by exporters of liquid fertilizer are likely to endure for the foreseeable future. As a result, during the pandemic, the market value for liquid fertilizer dropped significantly.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global liquid fertilizers market value is expected to grow at a CAGR of 4.20% over the forecast period.

- In terms of revenue, the global liquid fertilizers market size was valued at around USD 2,419.40 million in 2021 and is projected to reach USD 3096.805 million by 2028.

- Some of the reasons anticipated to drive the market's growth include the rise in demand for improved high-efficiency fertilizers, the simplicity of use and application of liquid fertilizers, and the adoption of precision farming and protected agriculture.

- By crop type, the fruits & vegetable category dominated the market in 2021.

- By compounds, the calcium ammonium nitrate (CAN) category dominated the market in 2021.

- Asia-Pacific dominated the global liquid fertilizers market in 2021.

Growth Drivers

Growth Drivers

- Demand for improved high-efficiency fertilizers is rising, driving the market growth

Liquid fertilizers are applied more effectively and efficiently, ensuring that plant and crops receive the correct amount of nutrients at the correct time and location with the least amount of waste. Due to the development of novel urease inhibitors and low-cost polymer coating technologies, the use of enhanced efficiency fertilizers (EEF) in many agricultural sectors, including cereals and industrial crops, is increasing significantly. Utilizing fertilizers with increased efficiency also helps to lessen the detrimental effects of nutrients that seep into water reservoirs.

Restraints

Restraints

- High handling costs may hinder the market growth

The high installation cost and liquid fertilizer storage significantly impact the market growth for these products. Water dissolves fertilizers in liquid form. Due to the special handling and storage requirements for fertilizers in the liquid form, combining the nutrients in the water and transporting them are both expensive processes. A lack of knowledge about liquid fertilizers is impeding market expansion, especially in places like Africa and the Middle East.

Opportunity

Opportunity

- Newly emerging countries present market opportunities

The world's growing population has increased the need for food, which will cause fertilizer use to rise even higher. The main issues are soil degradation, contamination, and the negative consequences on both people and the ecosystem. Governments are placing a strong emphasis on the usage of fertilizers that are less damaging to the soil to prevent these negative consequences. As a result, farmers are becoming more aware of liquid fertilizers, particularly in China and India. NGOs and manufacturers work together to inform farmers about their products' possible short- and long-term advantages.

Challenges

Challenges

- Unfavorable regulatory requirements may hinder the market growth

Like other business, the fertilizer sector experiences regulatory and state-level interventions that advance and halt its growth. Policies that are adverse to the sector, such as limitations on sourcing, manufacturing, and distribution standards, the termination of subsidy assistance, the setting of a maximum retail price, and rules governing the scope and direction of end use, have a significant influence on the sector as a whole.

Segmentation Analysis

Segmentation Analysis

The global liquid fertilizers market is segregated based on crop type, compounds, application, and type.

Based on crop type, the market is segmented into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others (turf, ornamentals, and nursery plants). The fastest-growing crop category in the liquid fertilizers market is predicted to be fruits and vegetables over the forecasted period. Over the past two decades, there has been a growth in fruit consumption, and it is anticipated that this trend will continue in the years to come. According to FAO, China is the world's top producer of fresh fruit and vegetables, surpassing U.S. and Indian growth in output. Fruit and vegetable exports have increased, which has also increased the area planted with crops, raising agricultural output levels. As a result, it is anticipated that the market for plant protection ingredients in fruits and vegetables will expand dramatically. Consequently, market growth is projected.

Based on compounds, the market is segmented into Calcium Ammonium Nitrate (CAN), Urea-Ammonium Nitrate (UAN), Potassium Nitrate, and Phosphorus Pentoxide (P205), and Others (boron, chloride, and iron). The most used nitrogen fertilizer is calcium ammonium nitrate (CAN), which has a relatively high nutritional content and physical characteristics like high solubility that aid in fast soil absorption. It has calcium and magnesium, which improve nitrogen absorption efficiency by the roots, lower nitrogen losses, and protect subsurface fluids from nitrogen compound contamination. These factors increase fertilizer profitability. Since CAN doesn't make the soil any more acidic, it is utilized more often with acidic soils. It is mostly utilized for fruits, vegetables, wheat, and barley. During the projection period, a rise in drip and sprinkler irrigation is anticipated to boost demand for CAN fertilizers.

Based on application, the market is segmented, Soil, Foliar, Fertigation, and Others (starter solutions and aerial applications). Fertigation is a farming practice that entails the irrigation-based application of fertilizer and water. This procedure offers the chance to increase production while reducing environmental contamination. A farmer can also evenly administer nutrients throughout the field using fertigation. Due to the widespread implementation of effective irrigation systems, this industry is expected to expand. Fertigation has the benefit of requiring less work, effort, water, and time. Due to its dependability and effectiveness, this application method is becoming increasingly popular. To use this strategy, you must thoroughly understand the system and effective management. Row crops, horticultural crops, fruit and vegetable crops, and decorative and floral crops all need fertilization in their fields.

The market is segmented based on type: Nitrogen, Phosphorus, Potash, and Micronutrients. The nitrogen segment dominates the market in 2021. Among all the macro and micro elements necessary for plant growth, nitrogen is one of the most commonly ingested nutrients. It is necessary to synthesize amino acids, which result in proteins and are involved in practically every biochemical process carried out by plants. Having insufficient nitrogen (N) available in the soil is a typical issue that farmers frequently experience. To solve this issue, more liquid nitrogen fertilizer is necessary. Common nutrition sources for liquid nitrogen include urea, ammonium nitrate, sulfate, and calcium nitrate. Additionally, different nutrient mixtures are produced and utilized to feed plants. As a result, there is still a large market for liquid nitrogen fertilizers worldwide.

Recent Development:

Recent Development:

- March 2021: ICL purchased the South American Plant Nutrition division of Compass Minerals, and the liquid fertilizer manufacturer Compass Minerals America do Sul S.A.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2,419.40 Million |

Projected Market Size in 2028 |

USD 3096.805 Million |

CAGR Growth Rate |

4.20% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Nutrien Ltd., Yara International ASA, Israel Chemical Ltd., K+S Aktiengesellschaft, Sociedad Química Y Minera De Chile, The Mosaic Company, EuroChem Group, C.F. Industries Holdings Inc., OCP Group, OCI Nitrogen, Wilbur-Ellis, Compass Minerals, Kugler, Haifa Group, COMPO Expert GmbH, AgroLiquid, Plant Food Company Inc., Foxfarm Soil and Fertilizer Company, Agro Bio Chemicals and Agzon Agro, Brandt, Nufarm, Plant Fuel Nutrients LLC, Nutri-tech solutions, Valagro SPA., and Others |

Key Segment |

By Crop Type, Compound, Application, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the liquid fertilizers market in 2021

In the Asia-Pacific region, the market for liquid fertilizer is particularly important. Three factors—high crop yields, automated irrigation system advancements, and a rise in global food demand—are significantly responsible for the Asia-Pacific region's requirement for liquid fertilizers. China already has the largest stake in the region, but Australia is expected to grow the fastest in the coming years. Due to the growing prices of traditional fertilizers and their detrimental effects on the environment, the usage of high-efficiency fertilizers in agriculture, notably liquid potassium fertilizers, has increased dramatically. The Asia-Pacific area is experiencing a rise in the need for liquid fertilizers due to expanding food consumption, high crop yields, and improvements in automated irrigation systems.

China now has the largest market share in the region, while Australia is anticipated to grow the fastest in the next years. Asia-Pacific is the largest and fastest-growing market for liquid fertilizers due to the region's extraordinary economic and population growth as well as government and national and international association support for increased agricultural production of fruits, oil, grains, and vegetables to meet the region's demand for food products.

Competitive Landscape

Competitive Landscape

- Nutrien Ltd.

- Yara International ASA

- Israel Chemical Ltd.

- K+S Aktiengesellschaft

- Sociedad Química Y Minera De Chile

- The Mosaic Company

- EuroChem Group

- C.F. Industries Holdings Inc.

- OCP Group

- OCI Nitrogen

- Wilbur-Ellis

- Compass Minerals

- Kugler

- Haifa Group

- COMPO Expert GmbH

- AgroLiquid

- Plant Food Company Inc.

- Foxfarm Soil and Fertilizer Company

- Agro Bio Chemicals

- Agzon Agro

- Brandt

- Nufarm

- Plant Fuel Nutrients LLC

- Nutri-tech solutions

- Valagro SPA.

Global Liquid Fertilizers Market is segmented as follows:

By Crop Type

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others (turf, ornamentals, and nursery plants)

By Compound

By Compound

- Calcium Ammonium Nitrate (CAN)

- Urea-Ammonium Nitrate (UAN)

- Potassium Nitrate

- Phosphorus Pentoxide (P205)

- Others (boron, chloride, and iron)

By Application

By Application

- Soil

- Foliar

- Fertigation

- Others (starter solutions and aerial applications)

By Type

By Type

- Nitrogen

- Phosphorus

- Potash

- Micronutrients

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Nutrien Ltd.

- Yara International ASA

- Israel Chemical Ltd.

- K+S Aktiengesellschaft

- Sociedad Química Y Minera De Chile

- The Mosaic Company

- EuroChem Group

- C.F. Industries Holdings Inc.

- OCP Group

- OCI Nitrogen

- Wilbur-Ellis

- Compass Minerals

- Kugler

- Haifa Group

- COMPO Expert GmbH

- AgroLiquid

- Plant Food Company Inc.

- Foxfarm Soil and Fertilizer Company

- Agro Bio Chemicals

- Agzon Agro

- Brandt

- Nufarm

- Plant Fuel Nutrients LLC

- Nutri-tech solutions

- Valagro SPA.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors