Search Market Research Report

Medical Devices Outsourcing Market Size, Share Global Analysis Report, 2024 – 2032

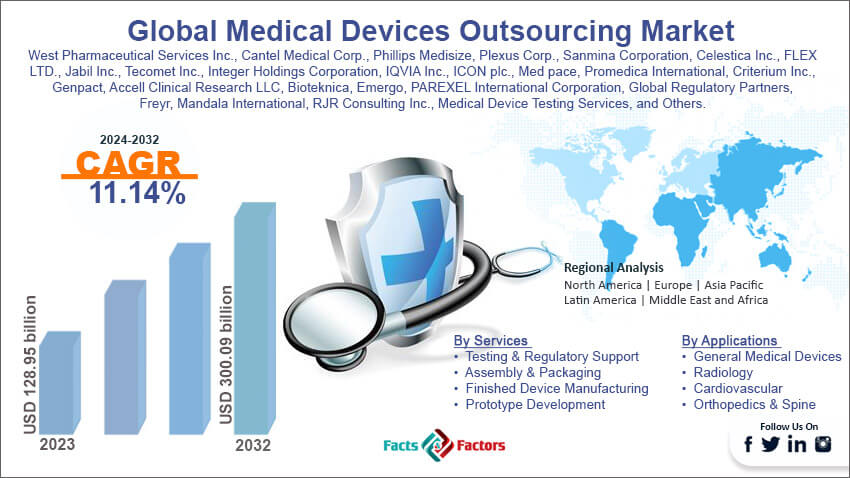

Medical Devices Outsourcing Market Size, Share, Growth Analysis Report By Services (Testing & Regulatory Support, Assembly & Packaging, Finished Device Manufacturing, And Prototype Development), By Applications (General Medical Devices, Radiology, Cardiovascular, Orthopedics & Spine, And Others), By Device Types (Class 1 Devices, Class 2 Devices, And Class 3 Devices), By Products (Raw Materials, Electronics, And Finished Goods), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

[213+ Pages Report] According to Facts and Factors, the global medical devices outsourcing market size was valued at USD 128.95 billion in 2023 and is predicted to surpass USD 300.09 billion by the end of 2032. The medical devices outsourcing industry is expected to grow by a CAGR of 11.14% between 2024 to 2032.

Market Overview

Market Overview

Medical device outsourcing is contracting out the process of developing medical devices, manufacturing, and other associated processes to external organizations. It helps medical device companies enhance efficiency, reduce cost, and leverage specialist expertise in different stages of the product life cycle.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global medical devices outsourcing market size is estimated to grow annually at a CAGR of around 11.14% over the forecast period (2024-2032).

- In terms of revenue, the global medical devices outsourcing market size was valued at around USD 128.95 billion in 2023 and is projected to reach USD 300.09 billion by 2032.

- Growing difficulties in manufacturing engineered products are driving the growth of the global medical devices outsourcing market.

- Based on the services, the finished device manufacturing segment is growing at a high rate and is projected to dominate the global market.

- Based on the application, the general medical devices segment is projected to swipe the largest market share.

- Based on the device type, the class 2 devices segment is projected to witness a high CAGR during the forecast period.

- Based on the product, the finished goods segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing difficulties in manufacturing engineered products are driving the growth of the global market.

The ongoing technological advancements are making it difficult for one organization to manufacture, market, and legalize medical devices quickly. However, the presence of outsourcing companies gives access to specialized expertise that may not be available with in-house talent.

These organizations encompass all kinds of services that help medical device companies focus on their core competencies like innovation, development, and research while outsourcing non-core functions like manufacturing and logistics to service providers.

Therefore, such a landscape helps in regulatory compliance, quality, testing, and other needed processes. Therefore, all these factors lead to the growth of the global medical devices outsourcing market. For instance, Eurofins extended its testing, inspection, and regulation services to Asia, the US, and Europe in April 2020.

Restraints

Restraints

- Intellectual property issues are likely to hamper the growth of the global market.

Intellectual property protection is a major concern among medical device companies. It restricts companies from outsourcing their product development to service providers, which is expected to hamper the growth of the medical devices outsourcing industry.

Opportunities

Opportunities

- Globalization of healthcare industries is expected to foster growth opportunities in the global market.

Globalization of healthcare services has significantly accentuated the requirement for outsourcing services. Companies step into the resources and expertise available in different areas to align with the global nature of the market. Also, rapid technological advancements foster the requirement for specialized knowledge, which is another major reason for the high demand for outsourcing services in the market.

Therefore, the scope of the global medical devices outsourcing market is expected to widen during the anticipated period. For instance, BREATHE partnered with IQVIA to speed up the early diagnosis and treatment of respiratory conditions in July 2021.

Challenges

Challenges

- Communication and coordination are a big challenge in the global market.

Lack of proper coordination and communication between the teams and the companies leads to unsuccessful collaboration, which is a big barrier to the growth of the medical devices outsourcing industry. Sometimes, it is cultural nuances, time zone differences, language barriers, and several others that delay the production process and lead to misunderstanding and coordination problems between the companies.

Segmentation Analysis

Segmentation Analysis

The global medical devices outsourcing market can be segmented into services, applications, device types, products, and regions.

On the basis of service, the market can be segmented into testing & regulatory support, assembly & packaging, finished device manufacturing, and prototype development. Finished device manufacturing accounts for the largest share of the medical devices outsourcing industry. Finish device manufacturing helps vendors cover the entire product life-cycle from start to end, including designing, prototyping, developing, production, and regulatory compliance. Outsourcing manufacturing processes helps in cost savings.

Also, the presence of specialized manufacturers in the market with expertise in optimizing the production processes helps scale economies and improve the flow of the process. Moreover, the finished device manufacturing providers are skilled in dealing with the complex regulatory landscape of the medical device sector. Therefore, these factors are likely to foster growth opportunities in the segment.

On the basis of application, the market can be segmented into general medical devices, radiology, cardiovascular, orthopedics & spine, and others. The general medical devices segment is poised to witness huge developments in the market in the coming years. General medical devices include a large number of products for medical usage, like diagnostic equipment, patient monitoring devices, surgical instruments, and many others.

One of the major reasons boosting the growth of the global medical devices outsourcing market is the ongoing technological advancements. Integration of digital health solutions, robotics, and artificial intelligence is expected to revolutionize the global marketplace.

These advancements are likely to enhance the accessibility, accuracy, and efficiency of medical devices. Also, the changes in regulatory framework and standards are likely to influence the approval of medical devices, which is another reason for the segment's high growth rate.

On the basis of device type, the market can be segmented into class 1 devices, class 2 devices, and class 3 devices. The class 2 devices segment is likely to swipe the largest market share during the anticipated period. Class 2 medical devices possess moderate levels of risk, and therefore, they are in high demand in the market. The class devices include blood pressure monitors, infusions, pumps, and other diagnostic devices.

Also, the regulatory process of these devices involves a premarket notification clearance, which is less regressive than the class three devices, thereby allowing more time for marketing. Therefore, these are expected to lead the market.

On the basis of product, the market can be segmented into raw materials, electronics, and finished goods. The finished goods segment is expected to dominate the medical devices outsourcing industry during the forecast period. Finished goods represent the end-to-end products for both healthcare providers and consumers.

Nowadays, the market is shifting towards comprehensive solutions in place of services, which, in turn, is a primary reason for the domination of the segment in the market. The finished devices are convenient for consumers because they do not need any further integration or installation process.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 128.95 Billion |

Projected Market Size in 2032 |

USD 300.09 Billion |

CAGR Growth Rate |

11.14% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

West Pharmaceutical Services Inc., Cantel Medical Corp., Phillips Medisize, Plexus Corp., Sanmina Corporation, Celestica Inc., FLEX LTD., Jabil Inc., Tecomet Inc., Integer Holdings Corporation, IQVIA Inc., ICON plc., Med pace, Promedica International, Criterium Inc., Genpact, Accell Clinical Research LLC, Bioteknica, Emergo, PAREXEL International Corporation, Global Regulatory Partners, Freyr, Mandala International, RJR Consulting Inc., Medical Device Testing Services, Charles River Laboratories, Sterigenics U.S. LLC, North American Science Associates LLC, WuXiAppTec, Intertek Group plc, Pace Analytical Services Inc., Euro fins Scientific, Laboratory Corporation of America Holdings, SGS SA, and Others. |

Key Segment |

By Services, By Applications, By Device Types, By Products, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market

North America accounts for the largest share of the global medical devices outsourcing market because of the presence of strong companies and skilled workforce in the region. Also, the market is highly driven by the high requirement for more time to market.

Moreover, the specialized companies with expertise in one area help the medical device companies to achieve better products at affordable cost, which is another major reason for the high growth rate of the region. Contract manufacturing organizations offer all kinds of services like prototyping, development, or full-scale production of medical devices, which further attracts medical device companies.

Moreover, the increasing demand for medical devices because of the growing patient population in the region is also expected to contribute heavily towards the growth of the regional market. The increasing burden of chronic and infectious diseases is further fuelling the market’s growth.

Asia Pacific is another major reason expected to see huge developments in the coming years because of the heavy outsourcing of manufacturing processes of medical devices in the region. Outsourcing helps medical device companies with cost-effectiveness.

Also, the outsourcing companies hold a large skilled workforce, which helps in facilitating a perfectly manufactured medical device that can navigate regulatory compliance easily, thereby helping companies with fast approval and long marketing time. Emerging markets like China and India are becoming hubs in the medical device outsourcing sector, which is likely to help Asia Pacific gain a competitive edge in the global marketplace.

Moreover, medical device companies are entering collaboration and partnerships with outsourcing partners in Asia because of their high production capabilities and regional expertise. All these factors are expected to positively impact the growth trajectory of the regional market in the forthcoming years.

Competitive Analysis

Competitive Analysis

The key players in the global medical devices outsourcing market include:

- West Pharmaceutical Services Inc.

- Cantel Medical Corp.

- Phillips Medisize

- Plexus Corp.

- Sanmina Corporation

- Celestica Inc.

- FLEX LTD.

- Jabil Inc.

- Tecomet Inc.

- Integer Holdings Corporation

- IQVIA Inc.

- ICON plc.

- Med pace

- Promedica International

- Criterium Inc.

- Genpact

- Accell Clinical Research LLC

- Bioteknica

- Emergo

- PAREXEL International Corporation

- Global Regulatory Partners

- Freyr

- Mandala International

- RJR Consulting Inc.

- Medical Device Testing Services

- Charles River Laboratories

- Sterigenics U.S. LLC

- North American Science Associates LLC

- WuXiAppTec

- Intertek Group plc

- Pace Analytical Services Inc.

- Euro fins Scientific

- Laboratory Corporation of America Holdings

- SGS SA

For instance, the life sciences company successfully took over Toxikon Inc. in December 2021 to expand its offerings for pharmaceuticals, medical devices, and some other industries.

The global medical devices outsourcing market is segmented as follows:

By Services Segment Analysis

By Services Segment Analysis

- Testing & Regulatory Support

- Assembly & Packaging

- Finished Device Manufacturing

- Prototype Development

By Applications Segment Analysis

By Applications Segment Analysis

- General Medical Devices

- Radiology

- Cardiovascular

- Orthopedics & Spine

- Others

By Device Types Segment Analysis

By Device Types Segment Analysis

- Class 1 Devices

- Class 2 Devices

- Class 3 Devices

By Products Segment Analysis

By Products Segment Analysis

- Raw Materials

- Electronics

- Finished Goods

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- West Pharmaceutical Services Inc.

- Cantel Medical Corp.

- Phillips Medisize

- Plexus Corp.

- Sanmina Corporation

- Celestica Inc.

- FLEX LTD.

- Jabil Inc.

- Tecomet Inc.

- Integer Holdings Corporation

- IQVIA Inc.

- ICON plc.

- Med pace

- Promedica International

- Criterium Inc.

- Genpact

- Accell Clinical Research LLC

- Bioteknica

- Emergo

- PAREXEL International Corporation

- Global Regulatory Partners

- Freyr

- Mandala International

- RJR Consulting Inc.

- Medical Device Testing Services

- Charles River Laboratories

- Sterigenics U.S. LLC

- North American Science Associates LLC

- WuXiAppTec

- Intertek Group plc

- Pace Analytical Services Inc.

- Euro fins Scientific

- Laboratory Corporation of America Holdings

- SGS SA

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors