Search Market Research Report

Next Generation Sequencing Market Size, Share Global Analysis Report, 2020 – 2026

Next Generation Sequencing Market By Application (Oncology, Clinical Investigation, Reproductive Health, Metagenomics, Epidemiology & Drug Development, Consumer Genomics, Agrigenomics & Forensics and HLA Typing/Immune System Monitoring) By Technology(Whole Genome Sequencing, Whole Exome Sequencing and Targeted Sequencing & Resequencing)By End Use(Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities and Other users): Global Industry Perspective, Comprehensive Analysis, and Forecast 2020 – 2026

Industry Insights

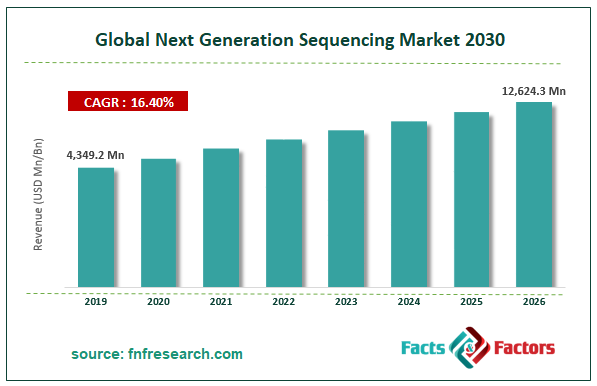

[195+ Pages Report] According to the report published by Facts and Factors, the global Next Generation Sequencing market was valued at approximately USD 4,349.2 Million in 2019, and is expected to generate revenue of around USD 12,624.3 Million by end of 2026, growing at a CAGR of around 16.4% between 2020 and 2026.

Market Overview

Market Overview

Next-generation sequencing technologies make it possible to sequence RNA and DNA in a reliable and cost-effective manner. These technologies are widely used in functional genomics to test DNA and RNA samples. The demand for next-generation sequencing will grow across all clinical applications. Next-generation sequencing (NGS) refers to large-scale DNA sequencing methods that assist in genome exploration. The term "next-generation sequencing," also known as "high-throughput sequencing," refers to a variety of modern sequencing technologies.

Industry Growth Factors

Industry Growth Factors

Because of technical advances in NGS, an increase in NGS applications, and an increase in alliances and collaborations, the global next generation sequencing market is growing. Furthermore, the increase in genome mapping programs propels the global next generation sequencing market forward. However, concerns about standardization in NGS-based diagnostics, a shortage of qualified clinicians, and ethical and legal constraints are expected to stymie the market's growth. On the other hand, lucrative prospects in developing markets, as well as cloud computing as a future data management service, are expected to pay off handsomely for market participants.

Segmentation Analysis

Segmentation Analysis

The global next generation sequencing market is segregated based application, technology and end-use and regions.

Oncology, clinical investigation, reproductive health, metagenomics, epidemiology & drug development, consumer genomics, agrigenomics & forensics and HLA typing/immune system monitoring are the application segment of global next generation sequencing market. In 2019, oncology brought in the most revenue, accounting for over 31.3% of total sales. The combination of next-generation sequencing (NGS) and bioinformatics tools has the ability to transform oncology discovery, diagnosis, and treatment. Advances in NGS technology have resulted in advancements in cancer science, signaling the start of cancer's "molecular era." The technology segment is categorized into whole genome sequencing, whole exome sequencing and targeted sequencing & resequencing. Moreover, the report is also categorized end use segment into academic research, clinical research, hospitals & clinics, pharma & biotech entities and other users

Regional Analysis

Regional Analysis

With a sales share of 47.85% in 2019, North America dominated the global market. The regional market is driven by the involvement of many clinical laboratories that use NGS to provide genetic testing services. In addition, main companies in North America are developing and launching new products, which is boosting business growth. For example, Quest Diagnostics launched the Automated NGS Engine in August 2020 to power AncestryHealth, Ancestry's consumer genetics offering. Genetic screening for blood disorders, bowel cancer, breast cancer, and heart disease is available via the platform.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 4,349.2 Million |

Projected Market Size in 2026 |

USD 12,624.3 Million |

Growth Rate |

CAGR 16.4% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Genomatix GmbH, PierianDx; DNASTAR, Inc., Eurofins GATC Biotech GmbH, Illumina, QIAGEN, Thermo Fisher Scientific, Inc., F. Hoffman-La Roche Ltd., Oxford Nanopore Technologies, Perkin Elmer, Inc., Bio-Rad Laboratories, Inc. and BGI amongst others. |

Key Segment |

By Application, By Technology, By End Use |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Due to increased technological advances and funding provided by the government and private organizations, Asia-Pacific is expected to have the highest CAGR during the forecast era. Furthermore, increased investment by biotechnology and pharmaceutical companies is expected to boost consumer demand.

Competitive Players

Competitive Players

Some main participants of the Next Generation Sequencing market are

- Genomatix GmbH

- PierianDx; DNASTAR Inc.

- Eurofins GATC Biotech GmbH

- Illumina

- QIAGEN

- Thermo Fisher Scientific Inc.

- F. Hoffman-La Roche Ltd.

- Oxford Nanopore Technologies

- Perkin Elmer Inc.

- Bio-Rad Laboratories In

- BGI

The global Next Generation Sequencing market is segmented as follows:

By Application:

By Application:

- Oncology

- Clinical Investigation

- Reproductive Health

- Metagenomics

- Epidemiology & Drug Development

- Consumer Genomics

- Agrigenomics & Forensics

- HLA Typing/Immune System Monitoring

By Technology:

By Technology:

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

By End Use:

By End Use:

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other users

Industry Major Market Players

- Genomatix GmbH

- PierianDxDNASTAR Inc.

- Eurofins GATC Biotech GmbH

- Illumina

- QIAGEN

- Thermo Fisher Scientific Inc.

- F. Hoffman-La Roche Ltd.

- Oxford Nanopore Technologies

- Perkin Elmer Inc.

- Bio-Rad Laboratories Inc.

- BGI

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors