Search Market Research Report

Oleic Acid Market Size, Share Global Analysis Report, 2022 – 2028

Oleic Acid Market Size, Share, Growth Analysis Report By Origin (Plant and Animal), By Grade (Food, Pharmaceutical, and Technical), By End Use (Food & Beverages, Textiles & Leather, Cosmetics & Personal Care, Pharmaceuticals, Chemical Intermediates, Automotive, Paints & Coatings, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

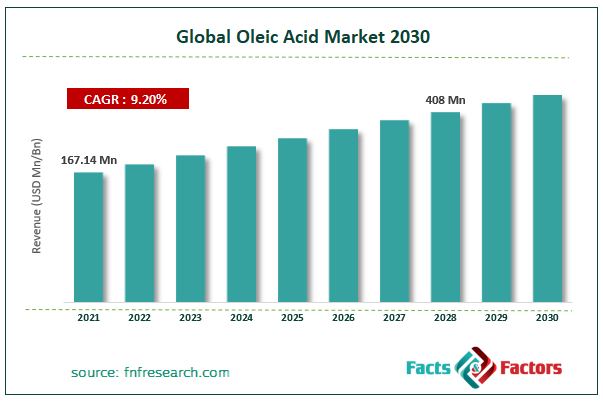

[232+ Pages Report] According to the report published by Facts Factors, the global oleic acid market size was worth around USD 167.14 million in 2021 and is predicted to grow to around USD 408 million by 2028 with a compound annual growth rate (CAGR) of roughly 9.2% between 2022 and 2028. The report analyzes the global oleic acid market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the oleic acid market.

Market Overview

Market Overview

As the demand for natural and organic products continues to grow, so too does the demand for oleic acid. It has been shown to have anti-inflammatory properties, which makes it a popular ingredient in skin care products. This growth is attributed to the increasing demand for natural oils and fatty acids, especially from the pharmaceutical and cosmetic industries. In the last few years, both industries have witnessed significant growth.

Oleic acid is also desired for use in foods owing to its high content of monounsaturated fatty acids (MUFA). In addition, rising awareness about the health benefits of MUFA has led to increased demand for oleic acid-rich foods.

Growing demand for oleic acid is driving up prices and making it a more valuable commodity. Oleic acid is an essential oil that is derived from olive oil, sunflower oil, and other oils. It has many uses in the food industry, including as a flavorant and emulsifier. Demand for oleic acid is increasing because it is used to make biodiesel and other renewable fuels. The World Health Organization has identified oleic acid as a key nutrient for the prevention of cardiovascular disease, obesity, and cancer. Oleic acid also helps to reduce the risk of macular degeneration and cataracts.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global oleic acid market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2022-2028).

- In terms of revenue, the global oleic acid market size was valued at around USD 167.14 million in 2021 and is projected to reach USD 408 million, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on origin segmentation, the plants segment held maximum market share in the year 2021

- Based on grade segmentation, the food segment was the leading revenue-generating grade in 2021.

- Based on region, Asia Pacific was the leading revenue generator in 2021.

Covid Impact

Covid Impact

The Covid pandemic is having a significant impact on the production of oleic acid, an essential fatty acid found in vegetable oils. Oleic acid is used in a wide variety of products, including food and pharmaceuticals. The pandemic has led to a shortage of oleic acid, as manufacturers have had to switch to other ingredients to meet demand. The impact on the global market is prominent, which led to the higher product price.

Growth Driver

Growth Driver

- There is a growing demand for oleic acid due to its wide range of potential applications across several industries

The demand for oleic acid is growing rapidly due to its many benefits. Oleic acid is a common monounsaturated fatty acid found in many plant-based foods and cosmetics. It is also used as a natural emulsifier and as a feedstock for the production of biodiesel. Oleic acid has been shown to have numerous health benefits, including reducing the risk of heart disease and Alzheimer’s disease.

There is a growing demand for oleic acid due to its wide range of potential applications across several industries. Oleic acid is used in food processing, pharmaceuticals, and cosmetic ingredients, among others. Additionally, there continues to research on how oleic acid can be used to improve human health. All these factors are likely contribute to the growth of the global oleic acid market growth.

Restraints

Restraints

- High cost of oleic acid compared to other fats to hamper market expansion

The demand for oleic acid is likely to be hampered by a number of factors. One obstacle has been the perception that omega-3 fatty acids are more beneficial than omega-9 fatty acids. This perception has led to limited interest in products containing oleic acid, even though research suggests that the two types of fatty acids are equally beneficial. Another challenge has been the high cost of oleic acid compared to other fats. As demand for oleic acid grows, ways to reduce the cost of its production will need to be developed.

Opportunities

Opportunities

- Oleic acid can only be produced sustainably providing growth opportunities for market

For years, the oil industry has been searching for a sustainable and cheaper way to produce oleic acid, one of the most important fatty acids. However, recent research suggests that this could be easier said than done.

Experts say that oleic acid can only be produced sustainably through fermentation processes, which are slow and costly. In contrast, a new process developed by researchers at the University of Texas at Austin can reportedly produce oleic acid from algae in just 24 hours using relatively inexpensive and common facilities.

Although the research is still in its early stages, if it can be proven to be reliable and affordable, this would represent a major breakthrough in the search for sustainable oil production methods.

Challenges

Challenges

- Oleic Acid has strong antioxidant effects posing a challenge for market growth

Current research indicates that oleic acid, a monounsaturated fatty acid, has strong antioxidant effects. This has led to an interest in using oleic acid in cosmetics and food products because of its potential to protect skin and tissue from damage caused by the sun and other environmental agents. However, there are several challenges that need to be addressed before oleic acid can become a mainstream cosmetology ingredient.

Segmental Analysis

Segmental Analysis

The global oleic acid market is segmented by origin, end-use, grade, and region.

By origin, the global market is segmented into plant and animal. Wherein, the plant-based product is dominating the market and witnessing high demand. With health and environmental concerns increasingly driving the demand for sustainable, cruelty-free products, the market for plant-based oleic acid is growing rapidly. Oleic acid is a type of fatty acid that is mostly found in plants, and its production has been linked to a number of benefits for human health. It has been shown to help lower bad cholesterol levels, protect against heart disease, and reduce inflammation. Plant-based oleic acid also boasts a host of environmental benefits, as it doesn't require destructive processing to produce.

By grade, the global market is divided into food, pharmaceutical, and technical. The market is dominated by the food segment. Recently, food producers have turned to oleic acid as a replacement for unhealthy saturated and polyunsaturated fats. Oleic acid has a lower melting point than unsaturated fats, so it can be used as a fat substitute in products like ice cream and margarine. This high demand has led to a severe shortage of oleic acid, which has created problems for the food industry and consumers.

Recent Developments

Recent Developments

- In May 2019, the Indian Council of Agricultural Research developed 2 varieties of oleic acid-rich peanuts.

- In 2018, Farmer in South India developed a variety of oleic acid-rich peanuts for commercial applications.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 167.14 Million |

Projected Market Size in 2028 |

USD 408 Million |

CAGR Growth Rate |

9.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Wilmar International Limited, Emery Oleochemicals (M) Sdn Bhd., Oleon NV, Klk Oleo Sdn. Bhd., Godrej Industries (Chemicals), VVF L.L.C. , and others. |

Key Segment |

By Origin, Grade, End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific to lead global market owing to the dominance in consumption rate

Asia Pacific is the largest producer and consumer of oleic acid. In the past decade, the production of oleic acid in Asia Pacific increased 10-fold. This is due to increasing demand for this oil-based ingredient in a range of applications such as cosmetics, food, and pharmaceuticals. Oleic acid is especially important because it can be used as a replacement for hardened fats and oils in food products. Its wide range of applications means that it has the potential to play an important role in economic development across the Asia Pacific region.

The region consumes over 47% of the world's total production, with China accounting for over half of that intake. Oleic acid is a monounsaturated fatty acid found in vegetable oils & meat and is beneficial as a dietary component.

China, Japan, India, and Thailand are the top producers of oleic acid.

Competitive Analysis

Competitive Analysis

There are many producers of oleic acid, and the demand for this natural molecule is growing rapidly. Oleic acid is a key commodity in the food and beverage industries, where it is used to produce numerous products, including snack foods and salad dressings.

In the competitive environment of the global oleic acid market, many different players strive to establish themselves as leaders in the global market. With high demand for this essential fatty acid and stiff competition, companies must ensure that they are able to produce high-quality oleic acid products in order to stay ahead of their rivals. In this article, we will provide a competitive analysis of the oleic acid industry, outlining the major players and their strengths and weaknesses.

Among the key players in the global oleic acid market are Wilmar International Limited, Emery Oleochemicals (M) Sdn Bhd., Oleon NV, Klk Oleo Sdn. Bhd., Godrej Industries (Chemicals), and VVF L.L.C. are leading manufacturer of oleic acid products and has a strong presence in China and India. Godrej Industries is one of the world's leading chemicals companies and has a significant share in the European and Asia Pacific market for oleic acid products. Cargill Inc. is one of the largest food processors in the world and manufactures a wide range of food products including oils and fats.

Key players within global Oleic Acid market include :

Key players within global Oleic Acid market include :

- Wilmar International Limited

- Emery Oleochemicals (M) Sdn Bhd.

- Oleon NV

- Klk Oleo Sdn. Bhd.

- Godrej Industries (Chemicals)

- VVF L.L.C.

Global oleic acid market is segmented as below:

By Origin

By Origin

- Plant

- Animal

By Grade

By Grade

- Food

- Pharmaceutical

- Technical

By End Use

By End Use

- Food & Beverages

- Textiles & Leather

- Cosmetics & Personal Care

- Pharmaceuticals

- Chemical Intermediates

- Automotive

- Paints & Coatings

- Others (including Carbon Paper and Inks)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Wilmar International Limited

- Emery Oleochemicals (M) Sdn Bhd.

- Oleon NV

- Klk Oleo Sdn. Bhd.

- Godrej Industries (Chemicals)

- VVF L.L.C.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors