Search Market Research Report

Pet Insurance Market Size, Share Global Analysis Report, 2020–2026

Pet Insurance Market By Policy Coverage Type (Accident and Illness, Only Accident, Others), By Animal Type (Cat, Dog, and Others), and By Provider Type (Public, and Private): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

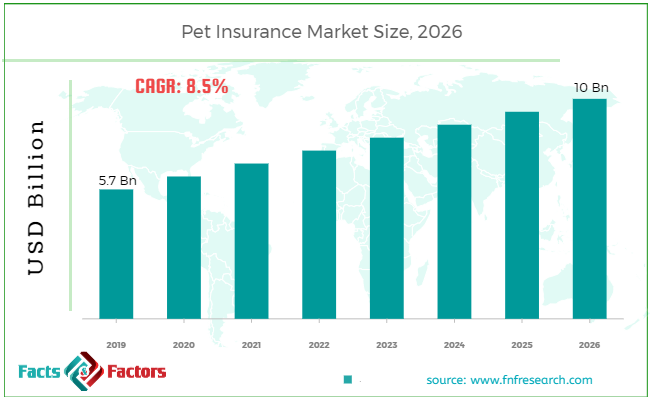

[188+ Pages Report] According to the report published by Facts Factors, the global pet insurance market size was worth around USD 5.7 billion in 2019 and is predicted to grow to around USD 10 billion by 2026 with a compound annual growth rate (CAGR) of roughly 8.5% between 2020 and 2026. The report analyzes the global pet insurance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pet insurance market.

This specialized and expertise oriented industry research report scrutinizes the technical and commercial business outlook of the pet insurance industry. The report analyzes and declares the historical and current trends analysis of the pet insurance industry and subsequently recommends the projected trends anticipated to be observed in the pet insurance market during the upcoming years.

The pet insurance market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire pet insurance market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Billion) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- According to the primary CXO’s of the global pet insurance market, the market is estimated to witness a substantial growth of nearly 8.5% over the forecast period.

- The market was valued at USD 5.7 billion, in 2019 and is expected to be valued over USD 10 billion.

- By policy coverage type, the accident and illness policy dominated the market in 2019, and it is expected to grow over the forecast period owing to its ability to provide reimbursement for different types of illness including accidents.

- On the basis of animal type, dog category led the market in 2019, attributed to high adoption of dog and lucrative dog insurance policies which cover wide range of dogs hunting dogs, cross bred, etc.

- By provider segment, private insurance category is the largest growing segment due to the rising number of private insurance provider and attractive schemes provided by the private insurance companies.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend that the North America is the largest growing segment over the forecast period owing to the high adoption of the animals and awareness about the pet insurance policies.

- Europe is also anticipated to shoe robust growth in the pet insurance market attributed to presence of major market players in this region and high penetration of insurance coverage for animals.

- The cat category is projected to grow in the future years attributed to the adoption of cats and availability of cat breeds.

- Due to the increasing adoption of pet animals and lucrative schemes in insurance policies is expected to boost the market in the future years.

- Owing to the rising awareness about the cost of the pet medical expenses may produce lucrative opportunities in the market.

Market Attractiveness by Animal Segment Analysis

Market Attractiveness by Animal Segment Analysis

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the pet insurance industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the pet insurance industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the pet insurance market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the pet insurance industry. The pet insurance market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the pet insurance sector. Key strategic developments in the pet insurance market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the pet insurance market are appropriately highlighted in the report.

The pet insurance market research report delivers an acute valuation and taxonomy of the pet insurance industry by practically splitting the market on the basis of different types, category and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

The regional segmentation of the pet insurance industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Further, country-wise data for the pet insurance industry is provided for the leading economies of the world.

The pet insurance policy is bought by the pet owner to control the pet medical expenses including vaccination of the animal, heartworm testing, routine dental cleaning and curing of many diseases. This policy is similar as the health insurance policy for humans. However, the cost of policy is depend upon the various factors such as type of the animal weather it is dog, cat, horse or other type of animal including reptiles, birds, etc. , length of the policy, and type of the insurance.

The efficient reimbursement policies and lucrative schemes in pet insurance provided by the pet insurance companies are driving the market growth.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 5.7 Billion |

Projected Market Size in 2026 |

USD 10 Billion |

CAGR Growth Rate |

8.5% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Anicom Holdings Inc, Embrace Pet Insurance Agency, LLC, Figo Pet Insurance LLC., Hartville Group, Health for Pet, Hollard, Nationwide, Oneplan, Petfirst Healthcare LLC, Pethealth, Petplan, Protectaplan, Royal & Sun Alliance, The Oriental Insurance Company Ltd., Trupanion, and Others |

Key Segment |

By Policy, Animal, Provider, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Moreover, due to the changing lifestyle in many emerging countries, and increasing per capita income the adoption of pet animals is also increasing, is expected to boost the market in the future years. However, lack of standard animal health code for reimbursement policies and the lack of awareness about the pet insurance policies in many developing countries may impede the market growth. On the other hand, rising pet diseases and increasing cost of pet medical expenses may produce lucrative opportunities in the market.

The pet insurance market is segmented based on policy coverage type, animal type, provider and region. On the basis of policy coverage type segmentation, the market is classified into accident and illness, only accident, and others. In term of animal type, the market is divided into cat, dog and others. And by providers, the market is bifurcated into public and private.

Some of the essential players operating in the pet insurance market, but not restricted to include

Some of the essential players operating in the pet insurance market, but not restricted to include

- The Oriental InInsurance surance Company Ltd.

- Embrace Pet Insurance Agency

- Anicom Holdings Inc LLC

- Hartville Group

- Health for Pet

- Figo Pet Insurance LLC.

- Hollard

- Nationwide

- Oneplan

- Pethealth

- Petfirst Healthcare LLC

- Petplan

- Protectaplan

- Royal & Sun Alliance

- Trupanion

The taxonomy of the pet insurance industry by its scope and segmentation is as follows:

By Policy Coverage Type Segmentation Analysis

By Policy Coverage Type Segmentation Analysis

- Accident and Illness

- Only Accident

- Others

By Animal Coverage Type Segmentation Analysis

By Animal Coverage Type Segmentation Analysis

- Cat

- Dog

- Others

By Provider Type Segmentation Analysis

By Provider Type Segmentation Analysis

- Public

- Private

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- The Oriental Insurance Company Ltd.

- Embrace Pet Insurance Agency

- Anicom Holdings Inc LLC

- Hartville Group

- Health for Pet

- Figo Pet Insurance LLC.

- Hollard

- Nationwide

- Oneplan

- Pethealth

- Petfirst Healthcare LLC

- Petplan

- Protectaplan

- Royal & Sun Alliance

- Trupanion

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors