Search Market Research Report

Robotics Technology Market

Robotics Technology Market Size, Share, Growth Analysis Report By Component (Hardware, Software, Service), By Robot Type (Cobots, Professional Service Robots, Traditional Industrial Robots, and Others), By Application (Manufacturing, Healthcare, Aerospace and Defense, Media and Entertainment, Logistics, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

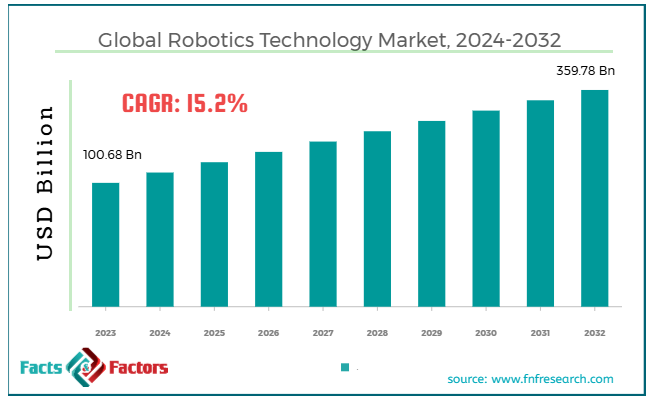

[213+ Pages Report] According to Facts & Factors, the global robotics technology market size was worth around USD 100.68 billion in 2023 and is predicted to grow to around USD 359.78 billion by 2032, with a compound annual growth rate (CAGR) of roughly 15.2% between 2024 and 2032.

Market Overview

Market Overview

Robotics technology comprises designing, construction, operation, and the use of robots. Automated machines or robots can efficiently perform multiple human tasks or tasks that are complex in nature, repetitive, or dangerous for humans. Robotics incorporates domains like electrical engineering, mechanical engineering, artificial intelligence, and computer science to design machines that can think, sense, and act. The global robotics technology market is driven by rising technological improvements like the use of ML and AI and its expanding use due to the lack of labor to increase workforce efficiency.

Artificial intelligence allows robots to perform more challenging tasks, adapt to new situations, learn from experiences, and make wise decisions in real-time. Robots are increasingly used to improve workforce efficiency. Robots resolve labor scarcity by physically demanding and automating repetitive tasks, mainly in logistics and manufacturing. This enables industries to maintain optimum productivity despite barriers to seeking professional labor.

Nonetheless, the global market is negatively impacted by technical complexity and job displacement issues. Integrating and designing robots in current operations could be challenging, technically. The intricacy of programming, maintenance of robotic machinery, and system integration need dedicated skills and competency. This might not be available, mainly in the developing economies.

Furthermore, the automation of tasks undertaken by humans previously increases concerns regarding job displacement. Most workforce are concerned about losing their jobs due to robots, resulting in resistance against broader implementation in specific domains, essentially manufacturing.

Yet, the global market is projected to witness a remarkable share over the forecast period owing to the expanding use of robots in healthcare, agriculture, and more. The healthcare industry offers ample opportunities for robotics from surgical robots to robots that assist in elderly rehabilitation and care.

Agricultural robots are designed for tasks, such as planning, crop monitoring, harvesting, and pest control. These machines or robots can notably reduce labor costs, increase efficiency in farming, and enhance resource utilization, thus contributing to the rise of precision agriculture.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global robotics technology market is estimated to grow annually at a CAGR of around 15.2% over the forecast period (2024-2032)

- In terms of revenue, the global robotics technology market size was valued at around USD 100.68 billion in 2023 and is projected to reach USD 359.78 billion by 2032.

- The robotics technology market is projected to grow significantly owing to the rising integration of IoT and 5G, benefits like efficiency gains and cost reduction, growing demand for automation, and rising focus on health and safety.

- Based on component, the hardware segment is expected to lead the market, while the software segment is expected to register considerable growth.

- Based on robot type, the traditional industrial robots segment is the dominating segment among others, while the cobots segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the healthcare segment is expected to lead the market as compared to the logistics segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Automation needs and labor shortages boost the robotics technology market

As industries witness a major scarcity of labor, robotic technology is progressing as an essential solution for resolving this challenge. The labor scarcity, mainly in professional roles, is a key factor fueling the use of robots, as industries aim for better automation to maintain their productivity.

As per reports, the number of industrial robots adopted on a global scale has expanded from 1.6 million in 2018 to 3 million in 2023. This denotes a notable growth as industries and companies look to replace humans in numerous sectors.

Amazon’s huge robot integration has also notably propelled the robotic technology market. The company’s continued investment in the domain is predicted to save nearly USD 10 billion yearly to the company by 2030. The company has adopted more than 7,50,000 robots in fulfillment centers, aiding perilous tasks like packing, picking, and sorting. With AI robots, Amazon projects more automation due to the rising costs of labor.

- Growing demand for precision and safety to fuel the market growth

Robots are becoming important for high-precision jobs in diverse sectors like electronics, healthcare, and aerospace. Their competency to perform various tasks with optimum accuracy and prevent errors results in enhanced outcomes and decreases risk in dangerous settings.

As per ILO (International Labor Organization), robots are majorly reducing factory injuries by efficiently managing tasks like heavy lifting, welding, and material handling in logistics and manufacturing industries. A leading robotic-assisted surgery, named Da Vinci Surgical System, has been contributing to performing less invasive surgeries.

In 2023, more than 1 million procedures were operated with the help of the Da Vinci Surgical System, thus improving patient recovery times and precision.

Restraints

Restraints

- Challenges in maintenance and integration negatively impact the robotics technology market growth

Robots need well-developed systems to integrate into the current infrastructure and processes. These challenges may be complex and need expert knowledge, which might hamper the smaller companies with no specialized technical teams. As per PwC, nearly 45% of the producers reported challenges in updating and maintaining the robotic systems owing to the complexity of their hardware and software integration.

Tesla's issues with robotic integration are one of the recent incidences in the global robotic technology market. The company’s Gigafactories experienced integration problems with their robotic systems. Despite heavy funding in automation domains, Tesla witnessed numerous downtimes due to the integration of robots in their current production lines. This highlighted the present obstacles in smooth automation.

Opportunities

Opportunities

- Growth in AVs (Autonomic Vehicles) to affect the robotics technology market growth

The robotics technology industry offers major prospects in the development of AVs, and autonomous vehicles, which comprise trucks, drones, and self-driving cars. These technologies hold the ability to transform logistics and transportation industries by reducing human errors and enhancing efficiency.

A prominent leader in AV technology, Waymo, freshly introduced that its self-driving vehicles have offered more than 20 million miles of driving in real-world scenarios.

Moreover, Tesla continues to make modernizations in AV space with its total self-driving abilities, which has grown and appealed to users across the United States. The company plans to adopt level 5 autonomy, completely removing the need for human drivers.

Also, a subsidiary of Alphabet Inc., named Waymo, expanded its self-driving ride-hailing service to more cities, showcasing the practical utilization of autonomous vehicles in urban regions.

Challenges

Challenges

- Lack of training and a professional workforce restrict the growth of the robotics technology market

As robots are becoming more integrated with the IoT, data privacy issues and cybersecurity are gaining notable significance. Connected robots are susceptible to cyberattacks, which may compromise confidential data or disturb business operations. Moreover, the huge data collected by the robots may be misused, resulting in privacy desecration.

In a prominent case, a famous German automobile company, Volkswagen experienced hacking in 2022. This resulted in the manipulation of their robotic machinery in the production line. This attack disturbed their production for many days, underscoring the demand for stringent cybersecurity actions in robotics.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 100.68 Billion |

Projected Market Size in 2032 |

USD 359.78 Billion |

CAGR Growth Rate |

15.2% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

ABB Robotics, KUKA Robotics, Universal Robots, Yaskawa Electric Corporation, Boston Dynamics, iRobot Corporation, Intuitive Surgical, Rethink Robotics, Cyberdyne Inc., Aethon, Omron Robotics, Honda Robotics, DJI Innovations, Amazon Robotics, Mobile Industrial Robots (MiR), and Others. |

Key Segment |

By Component, By Robot Type, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global robotics technology market is segmented based on component, robot type, application, and region.

Based on component, the global robotics technology industry is divided into hardware, software, and service. In 2023, the hardware segment held a notable share of the market and is expected to lead over the estimated period owing to its increasing significance in robot functionality and growing investment in hardware development. Robotic hardware comprises vital elements like actuators, robotic arms, effectors, sensors, motors, and more. Without hardware, a robot cannot efficiently perform its tasks, irrespective of its software competencies. Also, the advancement and complexity of robotic hardware like LiDAR, high-precision sensors, motors, strong actuators, and more have increased investment. The demand for superior hardware to improve performance is increasing, as robotics technology is becoming more developed.

Based on robot type, the global robotics technology industry is segmented into cobots, professional service robots, traditional industrial robots, and others. The traditional industrial robots segment is projected to lead the market over the forecast period owing to its significance in manufacturing and the rising demand for automation. Traditional robots like robotic arms used for painting, assembly, welding, and material handling have been a focus of automation in domains like electronics, consumer goods, and automotive manufacturing. They are broadly adopted in large-scale manufacturing settings. Moreover, as industries are aiming to automate their product lines for quality control, efficiency, and cost reduction, these robots hold a considerable share of the market. Moreover, their rising use in multiple industries along with ease of use are propelling the segment’s growth.

Based on application, the global market is segmented as manufacturing, healthcare, aerospace and defense, media and entertainment, logistics, and others. The healthcare segment registered a substantial market share in 2023 and is anticipated to continue its dominance over the coming years as well. Enhanced accuracy and precision in medical surgeries and rising demand for less-invasive surgeries are a few key propellants of the segment. Several advanced robotic-assisted surgery platforms allow doctors to perform minimally invasive and highly precise procedures. This leads to reduced blood loss, smaller incisions, and improved recovery times for patients. Also, MIS, or minimally invasive surgeries simplified by robotics, comprise less pain, smaller incisions, quick recovery, and fewer risks. As healthcare providers and patients aim to reduce the stress of traditional procedures, the implementation of robotic-aided systems in diverse medical specialties has remarkably increased.

Regional Analysis

Regional Analysis

- Asia Pacific to witness significant growth over the forecast period

Asia Pacific held a substantial share of the global robotics technology market in 2023 and is projected to lead over the estimated period majorly owing to the strong manufacturing base and government investments and initiatives. The region uses robots at a larger scale, with key nations like South Korea, Japan, and China, holding a strong manufacturing base. Among others, Japan ranks first for the highest density on a global scale with nearly 1,200 to 10,000 staff in the manufacturing domain.

Furthermore, nations like South Korea and China have strictly adopted national strategies to boost the use of automation, robotics, and artificial intelligence in manufacturing. For instance, South Korea's Manufacturing Innovation 3.0 and China's Made in China 2025 strategy.

Europe is the second-leading region in the robotics technology industry owing to leading research and innovation, automation in diverse sectors, and strong policies and government backing. Europe heavily invests in robotics R&D, mainly in industrial automation, robotics in healthcare, and service robots. The European Union Horizon 2020 event is among the biggest funding initiatives backing robotic modernization in the continent.

Also, the region is actively using robotics in the medical field, with key nations like the United Kingdom, Italy, and France. In addition, the EU has established stringent policies to increase the use of robotics like several funding programs and the EU Robotics Roadmap. This policy allows the rise of the robotics industry, mainly in research and automation.

Competitive Analysis

Competitive Analysis

The global robotics technology market is led by players like:

- ABB Robotics

- KUKA Robotics

- Universal Robots

- Yaskawa Electric Corporation

- Boston Dynamics

- iRobot Corporation

- Intuitive Surgical

- Rethink Robotics

- Cyberdyne Inc.

- Aethon

- Omron Robotics

- Honda Robotics

- DJI Innovations

- Amazon Robotics

- Mobile Industrial Robots (MiR)

Key Market Trends

Key Market Trends

- Rise of cobots (collaborative robots):

Collaborative robots are actively used along with humans in diverse industries, mainly in SMEs and manufacturing. This is because cobots are comparatively safer, cost-effective, highly flexible, and easier to operate than conventional industrial robots. Their ability to work without safety barriers is fueling their use in logistics, healthcare, and electronics.

- Growth of service robots:

The use of robotics in the healthcare sector continues to rise, especially in surgical robots, robotic-assisted therapies, and rehabilitation devices. Robotics provides improved precision, faster recovery times, and better patient outcomes. With the rising global population, the need for robotic technology in healthcare is projected to rise, mainly in medical diagnostics and eldercare.

The global robotics technology market is segmented as follows:

By Component Segment Analysis

By Component Segment Analysis

- Hardware

- Software

- Service

By Robot Type Segment Analysis

By Robot Type Segment Analysis

- Cobots

- Professional Service Robots

- Traditional Industrial Robots

- Others

By Application Segment Analysis

By Application Segment Analysis

- Manufacturing

- Healthcare

- Aerospace and Defense

- Media and Entertainment

- Logistics

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ABB Robotics

- KUKA Robotics

- Universal Robots

- Yaskawa Electric Corporation

- Boston Dynamics

- iRobot Corporation

- Intuitive Surgical

- Rethink Robotics

- Cyberdyne Inc.

- Aethon

- Omron Robotics

- Honda Robotics

- DJI Innovations

- Amazon Robotics

- Mobile Industrial Robots (MiR)

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors