Search Market Research Report

Smart Fleet Management Market Size, Share Global Analysis Report, 2024 – 2032

Smart Fleet Management Market Size, Share, Growth Analysis Report By Connectivity (Cloud, Short Range Communication, and Long Range Communication), By Transportation Mode (Marine, Automotive, and Rolling Stock), By Hardware (ADAS, Optimization, Remote Diagnostics, and Tracking), and By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

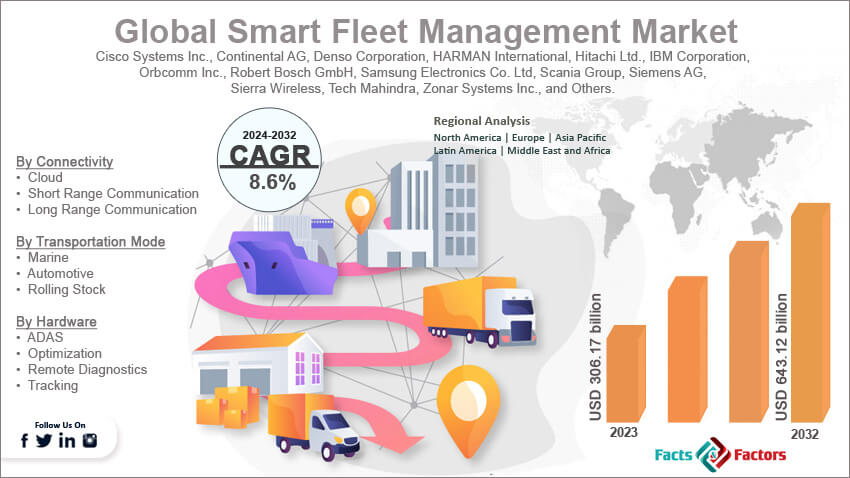

[210+ Pages Report] According to Facts & Factors, the global smart fleet management market size in terms of revenue was valued at around USD 306.17 billion in 2023 and is expected to reach a value of USD 643.12 billion by 2032, growing at a CAGR of roughly 8.6% from 2024 to 2032. The global smart fleet management market is projected to grow at a significant growth rate due to several driving factors.

.png)

Market Overview

Market Overview

Smart Fleet Management refers to the use of advanced technologies such as telematics, IoT (Internet of Things), AI (Artificial Intelligence), and big data analytics to efficiently manage a fleet of vehicles. This approach enhances the operational efficiency, safety, and productivity of fleet operations by providing real-time insights and data-driven decision-making capabilities. Smart fleet management systems typically include features like GPS tracking, vehicle diagnostics, fuel management, driver behavior monitoring, and route optimization.

The smart fleet management market is experiencing rapid growth due to increasing demand for operational efficiency, advancements in technology, and the rising need for regulatory compliance. The market encompasses various segments including fleet tracking and monitoring, telematics, predictive maintenance, and fuel management systems. These systems are widely adopted across different industries such as logistics, transportation, construction, and public transportation.

Key Highlights

Key Highlights

- The smart fleet management market has registered a CAGR of 8.6% during the forecast period.

- In terms of revenue, the global smart fleet management market was estimated at roughly USD 306.17 billion in 2023 and is predicted to attain a value of USD 643.12 billion by 2032.

- The smart fleet management market is poised for substantial growth, driven by technological advancements, the need for operational efficiency, and regulatory compliance.

- Based on the connectivity, the cloud segment is growing at a high rate and is projected to dominate the global market.

- By transportation mode, the automotive segment is projected to swipe the largest market share.

- By hardware, the ADAS segment is expected to dominate the global market.

- Geographically, Asia Pacific dominates the market due to the high adoption rate of advanced technologies, the need for efficient fleet operations, and stringent regulatory standards.

Smart Fleet Management Market: Growth Drivers

Smart Fleet Management Market: Growth Drivers

- Cost Efficiency: Smart fleet management solutions offer significant cost savings through improved fuel efficiency, optimized routes, reduced idle times, and better asset utilization. These cost benefits drive fleet operators to invest in smart technologies to enhance profitability and competitiveness.

- Enhanced Safety: Real-time tracking and driver behavior monitoring promote safer driving practices, reducing accidents and liabilities.

- Improved Maintenance: Predictive maintenance based on sensor data minimizes downtime and ensures vehicles are operating optimally.

- Regulatory Compliance: Stringent government regulations related to vehicle emissions, driver safety, and electronic logging devices (ELDs) are pushing fleet operators to adopt smart fleet management solutions. These systems help in adhering to regulatory requirements, avoiding penalties, and maintaining operational standards.

- Growing Adoption of Telematics: The increasing use of telematics technology, which transmits vehicle data wirelessly, forms the backbone of smart fleet management solutions.

Restraints:

Restraints:

- High Upfront Costs: The implementation of smart fleet management systems involves substantial initial investment in hardware, software, and training. This high upfront cost can be a major restraint for small and medium-sized fleet operators, limiting the widespread adoption of these technologies.

- Data Security Concerns: The increased reliance on data and connectivity in smart fleet management systems raises concerns about data security and privacy. Potential risks of data breaches and cyberattacks can deter organizations from adopting these solutions, fearing potential financial and reputational damage.

- Integration Challenges: Integrating smart fleet management solutions with existing systems and processes can be complex and time-consuming. Compatibility issues, lack of technical expertise, and resistance to change can pose significant challenges during the implementation phase?.

- Lack of Awareness: Smaller businesses may not be fully aware of the benefits and cost savings offered by smart fleet management solutions.

Opportunities:

Opportunities:

- Technological Advancements: The emergence of AI, big data analytics, and the Internet of Things (IoT) will lead to even more sophisticated and data-driven fleet management solutions.

- Expansion of Electric Vehicles (EVs): The growing adoption of electric vehicles (EVs) in fleet operations presents a significant opportunity for smart fleet management solutions. These systems can optimize the charging schedules, monitor battery health, and manage energy consumption, making EV fleets more efficient and sustainable.

- Expansion into New Markets: Emerging markets offer substantial growth opportunities for smart fleet management solutions. Increasing urbanization, rising demand for efficient logistics, and supportive government policies in countries like India and China are driving the adoption of advanced fleet management technologies.

Challenges:

Challenges:

- Standardization Issues: The lack of standardized protocols across different telematics and fleet management systems can create compatibility challenges.

- Maintenance and Support: The ongoing maintenance and support requirements for smart fleet management systems can be resource-intensive. Ensuring the availability of technical support, regular updates, and system maintenance can be challenging for fleet operators?.

- Infrastructure Limitations: Limited cellular connectivity in remote areas can hinder the real-time data transmission capabilities of smart fleet management systems.

Smart Fleet Management Market: Segmentation Analysis

Smart Fleet Management Market: Segmentation Analysis

The global smart fleet management market is segmented based on connectivity, transportation mode, hardware, and region.

By Connectivity Insights

By Connectivity Insights

Based on Connectivity, the global smart fleet management market is divided into cloud, short range communication, and long range communication. The cloud segment is expected to grow at the highest CAGR in the smart fleet management market. Continuous advancements in cloud computing technologies and the increasing adoption of cloud-based solutions across various industries will drive this growth. Cloud connectivity in smart fleet management involves using cloud-based platforms for data storage, processing, and analysis. These platforms provide real-time insights and facilitate efficient fleet operations by leveraging big data and advanced analytics.

Short-range communication technologies, such as Bluetooth and Wi-Fi, are used in smart fleet management for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. The short-range communication segment is essential for applications that require low-latency communication and high data transfer rates, such as collision avoidance systems and traffic management. The integration of short-range communication technologies in fleet management enhances safety and operational efficiency.

The long-range communication segment is anticipated to grow steadily, driven by the increasing need for real-time fleet management and the expansion of telecommunication networks. The deployment of 5G technology and advancements in satellite communication will further support the growth of this segment??. Long-range communication technologies, including cellular and satellite communications, are used for real-time tracking and management of fleets over large distances. These technologies enable continuous connectivity and data exchange between vehicles and central management systems.

By Transportation Mode Insights

By Transportation Mode Insights

On the basis of Transportation Mode, the global smart fleet management market is bifurcated into marine, automotive, and rolling stock. The marine segment of the smart fleet management market includes technologies and solutions designed to optimize the operations of ships and other vessels. This includes tracking systems, fuel management, maintenance scheduling, and route optimization. The marine segment is driven by the need to enhance operational efficiency, reduce fuel consumption, and comply with stringent environmental regulations.

The automotive segment is expected to continue dominating the smart fleet management market with a significant CAGR. The ongoing advancements in vehicle telematics, the rise of electric vehicles, and the integration of AI and machine learning for predictive maintenance and route optimization are key factors contributing to this growth?. The automotive segment is the largest and most mature market for smart fleet management solutions. It includes technologies and systems for managing fleets of cars, trucks, buses, and other road vehicles. Key functionalities include vehicle tracking, driver behavior monitoring, route optimization, and maintenance management.

The rolling stock segment encompasses the management of railway vehicles, including trains, trams, and subways. Smart fleet management solutions for rolling stock involve monitoring systems for tracking train locations, managing schedules, ensuring safety, and optimizing fuel consumption. The rolling stock segment is expected to grow at a steady rate, supported by increasing investments in smart rail systems and infrastructure development. The integration of advanced technologies such as IoT, AI, and big data analytics for real-time monitoring and management of railway operations will drive this segment’s growth.

By Hardware Insights

By Hardware Insights

Based on Hardware, the global smart fleet management market is categorized into ADAS, optimization, remote diagnostics, and tracking. ADAS segment includes a variety of systems designed to enhance vehicle safety and driving efficiency. These systems use sensors, cameras, radar, and software to provide real-time data and alerts to drivers, helping to prevent accidents and improve overall driving performance. The ADAS hardware segment is expected to grow at a significant CAGR, driven by continuous advancements in sensor technologies and increasing adoption of autonomous and semi-autonomous vehicles. The market growth is further supported by regulatory mandates and consumer demand for safer driving experiences??.

The optimization segment is driven by the need for cost-effective fleet management solutions. Optimization hardware includes devices and systems designed to enhance the operational efficiency of fleet vehicles. Rising fuel prices and the need to improve delivery times are pushing fleet operators to adopt advanced optimization technologies. The integration of AI and big data analytics allows for more precise and efficient optimization of routes, fuel usage, and overall fleet operations.

Remote diagnostics segment includes systems that monitor the health and performance of vehicles in real-time. The demand for remote diagnostics is driven by the need for efficient maintenance management and the reduction of operational costs. By enabling real-time monitoring of vehicle health, remote diagnostics systems help in identifying potential problems early, preventing breakdowns and costly repairs.

The tracking segment is driven by the need for real-time visibility and control over fleet operations. The adoption of telematics and GPS tracking systems helps fleet managers optimize routes, monitor driver behavior, and ensure timely deliveries. The increasing demand for fleet security and the integration of advanced tracking technologies, such as geo-fencing and real-time alerts, further boosts the market.

Recent Developments:

Recent Developments:

- February 2024: Mercedes-Benz and SAP showcase the power of collaboration. Mercedes-Benz leverages SAP's solutions to streamline its EV purchasing process, while SAP utilizes Mercedes-Benz technology to manage its own fleet in Germany – a win-win for both!

- April 2023: Continental and HERE's partnership with IVECO highlights the importance of data in smart fleets. By combining data aggregation, vehicle positioning, and geospatial content, they're developing advanced driver-assistance systems (ADAS) that can improve fuel efficiency and safety in commercial vehicles.

- February 2023: Cisco's collaboration with Mercedes-Benz focuses on driver comfort and productivity. Their partnership aims to create innovative mobile office solutions within Mercedes-Benz E-Class vehicles, allowing drivers to work securely and efficiently while on the go.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 306.17 Billion |

Projected Market Size in 2032 |

USD 643.12 Billion |

CAGR Growth Rate |

8.6% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Cisco Systems Inc., Continental AG, Denso Corporation, HARMAN International, Hitachi Ltd., IBM Corporation, Orbcomm Inc., Robert Bosch GmbH, Samsung Electronics Co. Ltd, Scania Group, Siemens AG, Sierra Wireless, Tech Mahindra, Zonar Systems Inc., and Others. |

Key Segment |

By Connectivity, By Transportation Mode, By Hardware, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Smart Fleet Management Market: Regional Analysis

Smart Fleet Management Market: Regional Analysis

- Asia-Pacific leads the market with a CAGR of around 13.08% from 2024 to 2032

Asia-Pacific holds the largest share of the global smart fleet management market and is expected to witness the highest growth rate during the forecast period. This rapid growth is attributed to increasing urbanization, a growing population, and the expanding economies of countries like China, Japan, and India. The region's substantial contribution to global revenue generation is primarily due to the rise in commercial fleets and stringent government norms regarding emissions and vehicle safety.

In North America, the market is driven by advanced infrastructure and sophisticated technologies. The presence of leading market players and high adoption rates of new technologies contribute to the region's strong market position. High rates of technological adoption, strong regulatory frameworks supporting fleet management, and advanced infrastructure and R&D activities are key growth drivers.

Europe holds a substantial share of the smart fleet management market, with countries like Germany, the UK, and France leading in the adoption of advanced fleet management technologies. The region's market growth is supported by strong government initiatives and regulatory compliance related to vehicle safety and emissions. Continuous advancements in fleet management technologies and increasing investments in smart transportation infrastructure will support steady market growth in Europe.

Latin America is emerging as a significant market for smart fleet management, with notable growth in countries like Brazil and Mexico. The region's market expansion is driven by investments in improving transportation and logistics infrastructure, increasing adoption of telematics and GPS tracking, and supportive government initiatives.

In the Middle East & Africa, the market is gradually expanding, driven by efforts to modernize transportation systems and increasing investments in healthcare infrastructure. Countries such as the UAE and South Africa are leading in the adoption of advanced fleet management technologies.

Smart Fleet Management Market: List of Key Players

Smart Fleet Management Market: List of Key Players

Some of the main competitors dominating the global smart fleet management market include;

- Cisco Systems, Inc.

- Continental AG

- Denso Corporation

- HARMAN International

- Hitachi, Ltd.

- IBM Corporation

- Orbcomm, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co Ltd

- Scania Group

- Siemens AG

- Sierra Wireless

- Tech Mahindra

- Zonar Systems, Inc.

The global smart fleet management market is segmented as follows:

By Connectivity Segment Analysis

By Connectivity Segment Analysis

- Cloud

- Short Range Communication

- Long Range Communication

By Transportation Mode Segment Analysis

By Transportation Mode Segment Analysis

- Marine

- Automotive

- Rolling Stock

By Hardware Segment Analysis

By Hardware Segment Analysis

- ADAS

- Optimization

- Remote Diagnostics

- Tracking

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Cisco Systems Inc.

- Continental AG

- Denso Corporation

- HARMAN International

- Hitachi Ltd.

- IBM Corporation

- Orbcomm Inc.

- Robert Bosch GmbH

- Samsung Electronics Co Ltd

- Scania Group

- Siemens AG

- Sierra Wireless

- Tech Mahindra

- Zonar Systems Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors