en

en  en

en  en

en  en

en

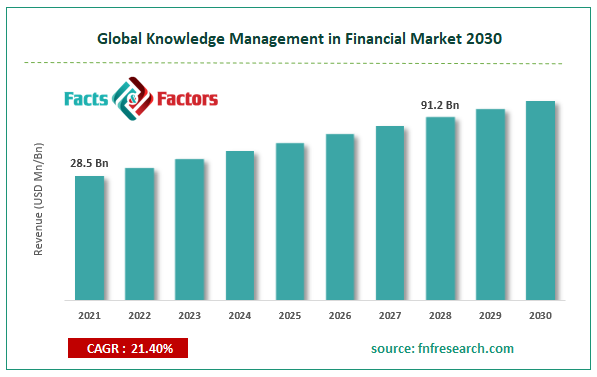

[226+ Pages Report] According to the report published by Facts & Factors, the global knowledge management in the financial market size was worth USD 28.5 billion in 2021 and is estimated to grow to USD 91.2 billion by 2028, with a compound annual growth rate (CAGR) of approximately 21.40% over the forecast period. The report analyzes the knowledge management of the financial market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in knowledge management in the financial market.

Market Overview

Market OverviewThe process of creating, disseminating, utilizing, and managing a company's knowledge and information is known as knowledge management. Knowledge management, in short, refers to a multidisciplinary approach to achieving corporate goals through the best possible use of knowledge. Organizations in the financial services industry use knowledge management tools to share data internally. Additionally, the financial market benefits from knowledge management by having a lower chance of financial crises. For instance, knowledge management can be a powerful strategy to prevent financial crises like banking crises. Organizations might develop and exchange information in real-time with staff members thanks to the adoption of cloud-based knowledge management systems. The demand for knowledge management solutions is also anticipated to rise as firms collect more data. Businesses are shifting to a 24/7 e-business model, creating a great demand for high-quality customer assistance. Thus, knowledge management in finance assists organizations in providing the best services to their clientele. All the above factors are expected to impact the industry's growth throughout the forecast timeframe.

COVID-19 Impact:

COVID-19 Impact:Knowledge management in financial solutions has benefited greatly from the COVID-19 epidemic and the ensuing phenomenon of remote working. The future need for knowledge management in financial solutions is anticipated to rise as the remote working pattern becomes more commonplace. Most businesses are anticipated to continue using the work-from-home model at least into the foreseeable future, despite the COVID-19 curve flattening and mass immunization programs still being far off. Knowledge management in financial systems is ideal for a company that might need to operate with staff from other departments in the absence of suitable personnel (either due to layoff or COVID-19-related absenteeism). The pandemic also prompted several businesses to adopt cloud-based software, which gives their operations flexibility. Those who had already implemented such technologies would have an advantage over those who made the switch later.

Key Insights

Key Insights Growth Drivers

Growth DriversFor organizations to expand today, customer retention and satisfaction are essential. Knowledge management in finance helps staff members learn new information to serve consumers better. In addition, businesses are moving toward a 24/7 e-business model, which has created a huge need for high-quality customer support. Thus, knowledge management in finance helps businesses provide their clients with the finest services possible. Over the projected timeframe, all of the factors above are anticipated to influence the industry's growth.

Furthermore, knowledge management in finance has shown to be the most effective method for increasing staff productivity and effectiveness by transferring the finest knowledge to them. Knowledge management in finance also enhances employee engagement, communication, and business profits. Technological advancements and growing banking and insurance sectors can provide the market with lucrative growth opportunities, negating the effect of the challenges to the global knowledge management in financial market expansion over time.

Restraints

RestraintsIn small businesses, a lack of expertise regarding knowledge management in finance can obstruct the projected expansion of the company.

Segmentation Analysis

Segmentation AnalysisGlobal knowledge management in the financial market has been segmented into offerings, organization size, and region.

Based on the offerings, knowledge management in the financial market is segregated into infrastructure, processes, mechanisms & technologies, and knowledge management systems. Among these, the knowledge management systems segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period due to an increase in the company's financial value due to treating employee knowledge as an asset. Additionally, by adding context and data relationships to stored documents, knowledge management systems can improve the quality of the information.

Based on organization size, knowledge management in the financial market is segregated into small & medium-sized enterprises and large enterprises. Among these, the small & medium-sized enterprises segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. The enormous need to educate the workforce following the standards of the enterprises is linked with segmental growth. Additionally, a significant amount of digitalization that has been observed globally will fuel segmental growth throughout the forecast year.

Report Scope

Report ScopeReport Attribute |

Details |

Market Size in 2021 |

USD 28.5 Billion |

Projected Market Size in 2028 |

USD 91.2 Billion |

CAGR Growth Rate |

21.40% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

EduBrite Systems, Open Text Corporation, Computer Sciences Corporation(APQC), EGain Ernst & Young, IBM Global Services, Moxie Software, Bloomfire, Callidus Software Inc., Chadha Software Technologies, ComAround, Igloo, KMS Lighthouse, Knosys, ProProfs, Right Answers, Transversal, Yonyx. |

Key Segment |

By Offerings, Organization Size, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional LandscapeIn 2021, North America dominated global knowledge management in the financial market. Due to an increase in financing for knowledge management systems by large corporations in nations like the U.S., the regional market is expected to grow significantly throughout the projected period. Global businesses are investing heavily in creating cutting-edge methods and tactics for contending successfully in a knowledge-based economy. These cutting-edge business methods, which lead to the creation of knowledge-intensive goods and services, are common in North American companies.

Knowledge Management in the Financial Market: Competitive Landscape

Knowledge Management in the Financial Market: Competitive Landscape Global knowledge Management in Financial Market is segmented as follows:

By Offerings

By Offerings By Organization Size

By Organization Size  By Regional Segment Analysis

By Regional Segment Analysis

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors

en

en  en

en