Search Market Research Report

Magnesite Market Size, Share Global Analysis Report, 2022 – 2028

Magnesite Market Size, Share, Growth Analysis Report By Type (Magnesite Ore, Dead Burned Magnesia, Fused Magnesia and Others), By Application (Construction, Industrial, Chemical, Agriculture, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

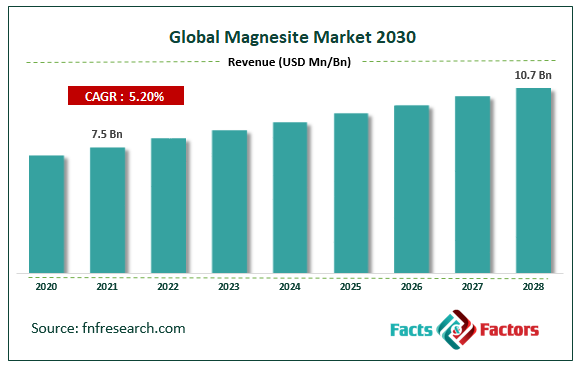

[222+ Pages Report] According to Facts and Factors, the global magnesite market size was worth around USD 7.5 billion in 2021 and is predicted to grow to around USD 10.7 billion by 2028 with a compound annual growth rate (CAGR) of roughly 5.2% between 2022 and 2028. The report analyzes the global magnesite market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the magnesite market.

Market Overview

Market Overview

Magnesite is now a crucial component of modern production techniques and materials. Magnesite is present in almost all products, from paper and cement to animal feeds. Magnesite, also known as magnesium carbonate (MgCO3), is typically found as veins created when magnesium-rich rocks come into contact with carbonate-rich material and undergo low-level metamorphism. Depending on the mineral's purity, magnesite can vary in color from white to colored brown and tinted yellow. The material is brittle and contains roughly 50% magnesium in its finest state. The mineral's high magnesium content makes it perfect for producing magnesium. Many products, including laptops, power tools, vehicle seats, and camera bags, include magnesium. Additionally, magnesium metal is used in numerous end-use sectors for a wide range of applications.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global magnesite market is estimated to grow annually at a CAGR of around 5.2% over the forecast period (2022-2028).

- In terms of revenue, the global magnesite market size was valued at around USD 7.5 billion in 2021 and is projected to reach USD 10.7 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, dead burned magnesia was predicted to dominate the market in the year 2021

- Based on application, the construction segment held the largest market share in 2021

- Based on region, Asia Pacific held the largest revenue share in 2021

Covid-19 Impact

Covid-19 Impact

The COVID-19 pandemic has caused a shocking loss of life on a global scale and poses an unprecedented threat to food systems, public health, and the workplace. The COVID-19 pandemic negatively impact various industries such as construction, manufacturing, and others owing to strict lockdown imposed by the government across the globe to curb the spread of the virus. Due to the lockdown, the supply chain of products and services is disrupted which is the major reason for the decline of industrial growth. Similarly, Lower mining activity is a result of the COVID-19 pandemic. Due to the closure of the mining industry as a result of social isolation and other issues, there is currently an insufficient supply of the mineral to meet demand. This aspect has limited the entire mining industry, resulting in a detrimental impact on the production of the market to a large extent. Furthermore, the COVID-19 pandemic negatively impacted the construction sector, which in turn, decline the demand for magnesite. The magnesite is used as an additive in cement and ceramic tiles. This impacted the growth of the market in the COVID-19 era.

Growth Drivers

Growth Drivers

- The growing construction industry to drive the market

The expanding construction industry is a key factor in the expansion of the global magnesite market. The worldwide construction market is expected to increase by USD 8 trillion by 2030, reaching a total value of USD 17.5 trillion and growing at an average annual rate of 3.9% from 2015 to 2030, according to Global Construction Perspectives and Oxford Economics. The need for cement and other building materials like magnesite is increasing, which is assisting in the expansion of the worldwide magnesite market.

Restraints

Restraints

- Stringent environmental and government regulations hampering the market growth

Magnesite producers confront a significant difficulty because it is one of the most important refractory materials. Strict environmental and governmental rules are being developed to limit environmental contamination resulting from the production of steel. This is a significant barrier to the expansion of the worldwide magnesite market. For instance, according to a research document titled "Air and Leaching Pollution Scenario by Iron and Steel Plants, in Central India," iron and steel industries are among the 17 industrial sectors in India that the Central Pollution Control Board has recognized as being the most polluting (CPCB).

Opportunities

Opportunities

- The use of renewable energy for mining provides an opportunity for the market

Companies that mine magnesite are using less energy and reducing emissions owing to the usage of renewable energy. The cost of connecting to the electricity grid is also decreased as solar or wind projects are built close to the mine sites. Renewable energy sources that are acceptable for a certain area are reliable, consistent, and affordable. For instance, in March 2021, Fusion Fuel Green signed a memorandum of understanding with Spain-based mining company Magnesitas De Rubian SA to jointly explore the feasibility of combining green hydrogen and carbon capture technology to reduce the carbon intensity of mining operations and processing. The longer-term ambition of the partnership is to accelerate the timeline to climate neutrality of mining activity and develop new mining solutions based on zero-emissions hydrogen. Therefore, this kind of initiative from the major players is expected to provide a lucrative opportunity for market expansion.

Segmentation Analysis

Segmentation Analysis

The global magnesite market is segmented based on type, application, and region.

Based on the type, the global market is bifurcated into magnesite ore, dead burned magnesia, fused magnesia, and others. The dead burned magnesia segment had the largest market share in 2021 and is expected to be dominant over the forecast period. The main use of dead-burned magnesia is as a refractory material. Comparatively to other commonly used refractory oxides, it has the maximum melting point. The best material for use in high-temperature operations for heat containment, particularly in the steel industry, is dead-burned magnesia. Fused magnesia is superior to other materials in terms of abrasion resistance, strength, and chemical stability. The European Union (EU), which accounts for 10% of global production, extracts about 2.9 million tons of primary material (represented as magnesite ore), according to the European Association of Mining Industries, Metal Ores, and Industrial Minerals.

Based on the application, the global magnesite market is categorized into construction, industrial, chemical, agriculture, and others. The construction segment held the largest market share and is expected to grow significantly during the forecast period. Magnesite, a significant mineral made of magnesium carbonate (MgCO3), has a wide range of uses. One of the main industries that have traditionally used high-performance magnesia materials is the construction industry. Industrial floors, building boards, abrasive stones, grinding wheels, phosphate cement mortars, wall stabilization, road construction, drilling muds, ceramic tile manufacturing, and use as a cement additive are just a couple of the applications for magnesite. The properties of magnesite have led to its widespread use in the construction sector. Excellent adhesion, self-leveling, fire resistance, strong bonding strength, and high hydration reaction are some of the properties. Thus, these factors propel the segmental growth during the forecast period.

Recent Developments:

Recent Developments:

- In February 2022, Grecian Magnesite announced that it has obtained the renewal of its ISO 9001: 2015 quality management system certification. The ISO 9001:2015 Standard for Quality Management System applies to all their processes including design/development, sales, production, etc.

- In April 2021, RHI Magnesita partnered with Microsoft. Through this partnership, the company aims to significantly enhance their business model and increase their competitiveness. The partnership also enables the company to respond more effectively and faster to customer requests as well as changing market requirements.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 7.5 Billion |

Projected Market Size in 2028 |

USD 10.7 Billion |

CAGR Growth Rate |

5.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Grecian Magnesite, Magnezit, Houying Group, Calix, Baymag, Magnesium Group, Liaoning Wancheng, Haicheng Xiyang Magnesium Ltd., Queensland Magnesia Ltd., Ramakrishna Magnesite Mines, Liaoning Jinding Magnesite Group, BeiHai Group, Haicheng Magnesite, and Others |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

The Asia Pacific dominates the market during the forecast period

The Asia Pacific region is expected to dominate the global magnesite market during the forecast period owing to the growing construction as well as the chemical industry, especially in China and India. The growth is also attributed to the increasing demand from the agriculture sector coupled with increasing government investment in the region. For instance, the data for "China's investments and cooperation in countries along the Belt and Road" for January to December 2021 were made public by the Chinese Ministry of Commerce (MOFCOM) on January 21, 2022. These figures show that non-financial direct investments by Chinese companies amounted to roughly USD 20.3 billion in nations "along the Belt and Road." In addition, 560 new projects with contract values over USD 100 million were been signed. Thus, the growing investment in the infrastructure in countries supported the market growth in the region. Moreover, the growing chemical industry in the region is one of the essential factors that propel the magnesite market growth.

Competitive Analysis

Competitive Analysis

- Grecian Magnesite

- Magnezit

- Houying Group

- Calix

- Baymag

- Magnesium Group

- Liaoning Wancheng

- Haicheng Xiyang Magnesium Ltd.

- Queensland Magnesia Ltd.

- Ramakrishna Magnesite Mines

- Liaoning Jinding Magnesite Group

- BeiHai Group

- Haicheng Magnesite

The global magnesite market is segmented as follows:

By Type

By Type

- Magnesite Ore

- Dead Burned Magnesia

- Fused Magnesia

- Others

By Application

By Application

- Construction

- Industrial

- Chemical

- Agriculture

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Grecian Magnesite

- Magnezit

- Houying Group

- Calix

- Baymag

- Magnesium Group

- Liaoning Wancheng

- Haicheng Xiyang Magnesium Ltd.

- Queensland Magnesia Ltd.

- Ramakrishna Magnesite Mines

- Liaoning Jinding Magnesite Group

- BeiHai Group

- Haicheng Magnesite

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors