Search Market Research Report

Melt Blown Nonwovens Market Size, Share Global Analysis Report, 2022 – 2028

Melt Blown Nonwovens Market Size, Share, Growth Analysis Report By Product (Fine Fibers and Dual Texture), By Material (Polypropylene, Polyester, Polystyrene, Polyurethane, Polyamides, Polycarbonate and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

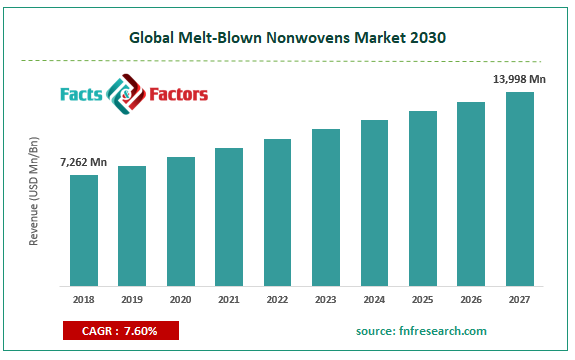

[229+ Pages Report] According to Facts and Factors, the global melt blown nonwovens market size was worth around USD 8273.40 million in 2021 and is estimated to grow to about USD 11278.58 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.30% over the forecast period. The report analyzes the melt blown nonwovens market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the melt blown nonwovens market.

Market Overview

Market Overview

In making microfiber nonwoven fabrics, called melt blowing, thermoplastic resin is blown into fine, fibrous, and self-bonding webs using high-velocity air. Since melt blown materials have excellent characteristics, including fine fiber diameter (0.5 to 10 microns), random & fine fiber orientation, low to moderate web strength, low weight, and large surface area, they are frequently employed in filtration applications. A melt blown nonwoven is used in many different industries, such as insulation equipment, medical, filtration, electrical & electronics, and hygiene.

Increased demand for consumer electronics, medical equipment, home appliances, hygiene goods, textiles, and insulating products. Governments throughout the world have made wearing masks in public areas required. Meltblown nonwoven fabric is a crucial filter element in N95 respirators and surgical masks. A significant driver of the expansion of the melt blown nonwovens market is the demand for covers and PPE kits.

COVID-19 Impact:

COVID-19 Impact:

The onset of the COVID-19 pandemic has substantially impacted product demand in 2020 and is projected to do so again in 2021 and 2022. Billions of people worldwide are now required to wear masks outside due to the COVID-19 epidemic. 2020 saw a sharp increase in the demand for melt blown nonwoven textiles because of the unexpected rise in mask demand. Before the pandemic, the world's manufacturing capacity was constrained and insufficient to meet the incredible increase in demand.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global melt blown nonwovens market value to grow at a CAGR of 5.30% over the forecast period.

- In terms of value, the global melt blown nonwovens market size was valued at around USD 8273.40 million in 2021 and is projected to reach USD 11278.58 million by 2028

- The growing demand for hygiene goods in developing nations is another factor that can boost product demand in the coming years.

- By product, the fine fibers segment dominated the market in 2021.

- By material, the polypropylene segment dominated the market in 2021.

- The Asia Pacific dominated the global melt blown nonwovens market in 2021.

Growth Drivers

Growth Drivers

- Growing demand from the healthcare industry is likely to pave the way for global market growth.

In the upcoming years, it is anticipated that a rapidly expanding medical infrastructure and an increase in surgical operations will drive the market. Meltblown nonwovens are in high demand in the medical industry for face masks, clothing, surgical gowns, disposable drapes, and sterilizer wraps. Increased demand for consumer electronics, medical equipment, home appliances, hygiene goods, textiles, and insulating products will increase the market share of melt-blown nonwovens. The growing demand for hygiene goods in developing nations is another factor that can boost product demand in the coming years.

Restraints

Restraints

- Fluctuating prices of polymers may hamper the global market growth.

The market's expansion is projected to be hampered by price volatility for polymers like polyester, polyamide, polycarbonate, polyethylene, and polypropylene. The supply and demand for raw ingredients influence these polymers' costs. The global melt-blown nonwovens industry is further hampered by the volatile producer margins caused by the changing pricing of these raw ingredients.

Opportunities

Opportunities

- Rising hygiene awareness and lifestyle changes bring up several growth opportunities.

The demand for melt-blown nonwovens is rising as people become more conscious of their cleanliness. Including sanitary towels, tampons, infant diapers, and napkin liners, nonwoven fabrics are used in personal hygiene goods. They prevent cross-infection and allow for high levels of hygiene maintenance, which is why their use in unique hygiene products is expanding.

Segmentation Analysis

Segmentation Analysis

The global melt blown nonwovens market is segregated based on product, material, and region.

By product, the market is divided into fine fibers and dual textures. Among these, the fine fibers segment dominated the market in 2021. Products for hygiene, medicine, and liquid filtration all use fine fibers. Market expansion will be fueled by rising demand for masks, PPE kits, and filters in the medical and other industries. As more people become infected with COVID-19, more countries are enforcing rules on wearing masks in public places.

By material, the market is divided into polypropylene, polyester, polystyrene, polyurethane, polyamides, polycarbonate and others. Over the forecast period, the polypropylene segment will dominate the market in 2021. The primary raw material, polypropylene, has a fiber diameter of just 1 to 5 microns, making it an ideal choice for filtration applications. In medical textiles, melt-blown polypropylene is utilized as an absorbent dressing material. Melt blown polypropylene nonwoven webs are also commonly employed in air filtration applications due to their excellent filtering effectiveness.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 8273.40 Million |

Projected Market Size in 2028 |

USD 11278.58 Million |

CAGR Growth Rate |

5.30% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Kimberly-Clarke, Mogul, Dow Chemicals, Atex, PFNonwovens (Pegas Nonwovens), DuPont, Irema Ireland, Don & Low, Fiberweb Technical Nonwovens, Toray, Xiamen Xiyao Trading Co. Ltd., Freudenberg Performance Materials, Oerlikon, Jinan Xinghua Nonwoven Fabric, and Others |

Key Segment |

By Product, Material, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Development-

Recent Development-

- In April 2020 - In response to COVID-19, Ahlstrom-munksjo increased the manufacturing of nonwoven materials across the board. The business has expanded the range of protective products it offers for the three types of face masks: respiratory, surgical, and civil acts.

Regional Landscape

Regional Landscape

- The booming filtration sector will likely help the Asia Pacific dominate the global market.

Asia Pacific region dominated the global melt blown nonwovens market in 2021. The demand is rising because of the booming filtration sector in the Asia Pacific region. The decreasing air quality in the region's major urban areas led to a sharp rise in the demand for air filters. Due to the region's increased need for clean drinking water, there will also be an increase in the need for melt blown nonwovens. The rise is due to the product's rising popularity in the healthcare industry. Increased company R&D spending would result in broader market expansion across the region. The rising incidence of COVID-19 cases and an increase in the population of working-class females are expected to fuel regional market expansion throughout the projection period.

Competitive Landscape

Competitive Landscape

Key players within the global melt blown nonwovens market include

- Kimberly-Clarke

- Mogul

- Dow Chemicals

- Atex

- PFNonwovens (Pegas Nonwovens)

- DuPont

- Irema Ireland

- Don & Low

- Fiberweb Technical Nonwovens

- Toray

- Xiamen Xiyao Trading Co. Ltd.

- Freudenberg Performance Materials

- Oerlikon

- Jinan Xinghua Nonwoven Fabric

Global melt blown nonwovens market is segmented as follows:

By Product

By Product

- Fine Fibers

- Dual Texture

By Material

By Material

- Polypropylene

- Polyester

- Polystyrene

- Polyurethane

- Polyamides

- Polycarbonate

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Kimberly-Clarke

- Mogul

- Dow Chemicals

- Atex

- PFNonwovens (Pegas Nonwovens)

- DuPont

- Irema Ireland

- Don & Low

- Fiberweb Technical Nonwovens

- Toray

- Xiamen Xiyao Trading Co. Ltd.

- Freudenberg Performance Materials

- Oerlikon

- Jinan Xinghua Nonwoven Fabric

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors