Search Market Research Report

Molding Compounds Market

Molding Compounds Market Size, Share, Growth Analysis Report By Resin Type (Polyester, Phenolic, Epoxy, and Others), By Application (Aerospace, Automotive, Electrical and Electronics, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

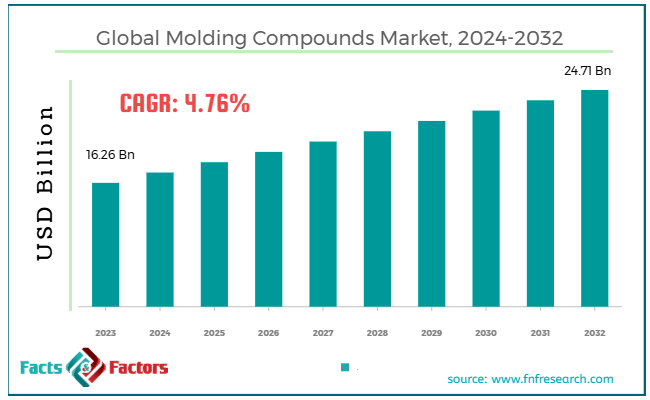

[227+ Pages Report] According to Facts & Factors, the global molding compounds market size was worth around USD 16.26 billion in 2023 and is predicted to grow to around USD 24.71 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.76% between 2024 and 2032.

Market Overview

Market Overview

Molding compounds are the materials used in the molding process to create various components by shaping them in different molds. These compounds comprise fillers, a base resin, and additives that improve properties like thermal stability, strength, and electrical insulation. They hold key applications in industries like automotive, electronics, and electrical engineering for parts like connectors, circuit boards, and diverse enclosures.

The global molding compounds market is significantly driven by the rising demand in the automotive industry, the growth of the electronics industry, and improvements in manufacturing technologies. The mounting demand for durable, efficient, and lightweight automotive components is fueling the use of molding compounds.

Essentially, the thermosetting types of molding compounds are broadly used to make components that provide better heat resistance and strength. The demand for these compounds is also increasing due to the expansion of the telecommunications, consumer electronics, and electrical equipment sectors.

Nonetheless, the market is negatively impacted by barriers like high production costs and growing environmental concerns. The cost of molding compounds, mainly with specialized characteristics like electrical insulation, flame retardancy, and high thermal resistance could be high. This may notably restrict the adoption of molding compounds for budget-conscious uses.

In addition, several molding components, mainly thermosetting resins, cannot be reused, thus contributing to ecological pollution. This propels the need for the development of eco-friendly substitutes. Yet, improvements in molding compounds and the growing demand for environment-friendly alternatives are expected to impact the growth of the molding compounds industry.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global molding compounds market is estimated to grow annually at a CAGR of around 4.76% over the forecast period (2024-2032)

- In terms of revenue, the global molding compounds market size was valued at around USD 16.26 billion in 2023 and is projected to reach USD 24.71 billion by 2032.

- The molding compounds market is projected to grow at a significant rate owing to the growing demand for consumer electronics, improvements in manufacturing technologies, and heavy demand in the automotive sector.

- Based on resin type, the phenolic segment is the dominating segment, while the polyester segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the electrical and electronics segment is expected to lead the market, while the automotive segment is expected to be the fastest growing.

- Based on region, Asia Pacific is anticipated to dominate the global market over the forecast period, followed by North America.

Growth Drivers

Growth Drivers

- Technological advancements in molding techniques spur market growth

Improvements in molding technologies like compression molding, injection molding, and transfer molding have significantly affected the efficiency and capabilities of developing complex components from molding compounds. These modernizations enable manufacturers to develop unique shapes with the least wastage, enhanced consistency, and faster production cycles. Automation, digitalization, and robotics in molding are also majorly reducing costs and enhancing precision.

In 2022, General Electric Company, a leader in manufacturing and developing electric equipment and devices, adopted 3D printing to develop superior polymer components. This resulted in reduced wastage and faster production. This modernization notably impacted the growth of the molding compounds industry with the use of modern techniques to develop complex parts efficiently.

In 2023, a leading supplier of industrial automation, KUKA Robotics, introduced a novel robotic system dedicated to automating the molding process. This helped manufacturers to increase output and decrease production time, aiding the use of molding compounds in diverse industries.

- Growing demand for sustainable and lightweight materials fuels the industry growth

With rising ecological concerns and rising protocols about carbon emissions and fuel efficiency, there is a growing need for lightweight materials in the aerospace, construction, and automotive industries. Molding compounds, mainly based on thermosetting and thermoplastic composites, are suitable for developing lightweight and strong parts. In addition, there is a major inclination to create recyclable and sustainable molding compounds that comply with sustainability goals.

In 2023, BMW was actively engaged in integrating extremely lightweight composite materials in its cars, with an aim to lower the total by 20%. The company focused on using advanced molding compounds and sustainable materials to meet this goal.

Restraints

Restraints

- Recycling issues and environmental concerns limit the market growth

Molding compounds, mainly thermosetting resins, cannot be easily recycled, thus increasing environmental concerns. Since sustainability is a crucial factor for consumers and manufacturers, there is an increasing demand to create environment-friendly alternatives. Nonetheless, several former molding compounds are not degradable and are complexly recycled, resulting in ecological impact and wastage.

Responding to this wastage, leading companies like BASF and SABIC launched their initiative, 'TRUCIRCLE,' in 2023. It comprises the creation of circular polymers for diverse molding applications to decrease plastic waste. Conversely, these novel sustainable solutions are quite expensive, and hence, the molding compounds market growth is majorly hampered.

Opportunities

Opportunities

- Rising adoption of electric vehicles across the globe will boost the market growth

The growth of EVs or electric vehicles offers a major opportunity for the molding compounds industry. The electric vehicle manufacturers are actively emphasizing high-performing and lightweight materials to enhance driving range and battery efficiency. Specialized molding compounds like thermoplastic are the best for reducing key car components like interior parts, structural elements, and enclosures.

As per IEA, electric car sales exceeded 10 million in 2022 compared to 2021, which was nearly 55% of the overall car sales. The IEA also forecasts that electric vehicle sales will boost by 30% by 2030. With the market's growth, the demand for low-weight components with modern molding methods will also rise.

Tesla is also actively exploring the use of improved molding compounds for its fresh electric vehicle units, comprising high-performing composites and thermoplastics for non-structural and structural components to improve vehicle efficiency.

- Expansion of telecommunications and 5G infrastructure

The introduction of 5G networks is impressively creating demand for improved materials to be used for telecommunications infrastructure. Molding compounds help develop circuit boards, connectors, and enclosures for 5G antennas, base stations, and several other telecom devices. These materials should essentially meet the needs for thermal stability, high performance, and durability.

In 2023, Qualcomm, a leading semiconductor company, declared its plans to increase spending on 5G-associated technologies, including the creation of improved molding compounds for 5G components. Qualcomm's expansion in the 5G industry is projected to open avenues for molding compound suppliers.

Challenges

Challenges

- Manufacturing and technological complexities act as a barrier

The development of high-performing molding compounds needs accurate control of manufacturing processes like molding time, temperature, and pressure. The complexity of creating complex superior quality parts, mainly for automotive, aerospace, and electronics, could be challenging. Variants in the molding process like improper cutting or inconsistent leading may lead to defects like shrinkage, warping, or poor mechanical characteristics. This may increase the number of rejected batches and higher production costs, thereby challenging the expansion of the molding compounds industry.

In 2023, a GE company, GE Aviation underlined that although advancements in injection molding techniques and 3D printing have been made, challenges in gaining uniformity in composite molding still need heavy spending in process control technology.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 16.26 Billion |

Projected Market Size in 2032 |

USD 24.71 Billion |

CAGR Growth Rate |

4.76% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

BASF SE, Huntsman Corporation, SABIC, DuPont, Covestro AG, Lanxess AG, Sumitomo Bakelite Co. Ltd., Mitsubishi Chemical Corporation, Toray Industries Inc., Polynt Group, Kraton Polymers, Nanya Plastics Corporation, Momentive Performance Materials, Westlake Chemical Corporation, DSM Engineering Materials, and Others. |

Key Segment |

By Resin Type, By Application, By End Use, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global molding compounds market is segmented based on resin type, application, and region.

Based on resin type, the global molding compounds market is divided into polyester, phenolic, epoxy, and others. The phenolic segment is projected to hold a significant share of the market owing to its characteristics, broad applications, and cost-effectiveness. These resins present the best thermal resistance and thermal stability, increasing their applications for high temperatures in aerospace, automotive, and electrical industries.

Phenolic molding compounds hold high dimensional stability and mechanical strength. This makes them ideal for use in areas that demand long-lasting performance and durability. This essentially includes automotive and electrical components. Moreover, they are comparatively more affordable than other types of resins, hence the segmental growth.

Based on application, the global molding compounds industry is segmented as aerospace, automotive, electrical and electronics, and others. The electrical and electronics segment is projected to witness a sizeable share of the market as compared to others owing to its heavy demand in producing a number of components and rising demand from consumer electronics.

Molding compounds are broadly used to develop electronic and electrical components. These components need materials with superior-quality insulation, mechanical strength, and thermal stability. Specialized molding compounds efficiently meet these requirements, making them vital for modern electronic devices.

Furthermore, the ever-increasing penetration of smartphones, wearable devices, and smart home equipment has notably boosted the demand for advanced molding compounds in the industry.

Regional Analysis

Regional Analysis

- Asia-Pacific to hold significant growth during the estimated period

Asia Pacific is anticipated to hold a considerable share of the global molding compounds market over the forecast period owing to its strong manufacturing sector, speedy growth in the electronics and automotive industry, and government investment.

Key economies like South Korea, India, Japan, and China hold a strong manufacturing industry that is highly dependent on molding compounds for developing electronics, automotive parts, and several industrial components. The region avails advantages from skilled labor, low production costs, and large-scale manufacturing, thus making it a pivot for molding compounds production.

Moreover, the expansion of the electronic and automotive industry in the region majorly demands molding compounds, thus contributing to the market growth. Also, the governments in the region are actively spending on manufacturing and infrastructure, comprising the development of molding compounds. These factors, along with supportive incentives and policies, are aiding the market growth.

North America is the second leading region in the global market, owing to the region being a hub for R&D and innovations. The region also has several prominent companies that focus on advanced molding compounds for numerous high-performing uses in diverse industries.

Moreover, manufacturers in the region are increasing spending on sustainable processes and materials. The rising focus on recyclable and eco-friendly materials, mainly in electronics and automotive, is boosting the demand for molding compounds. In 2023, North America held nearly 25% of the total molding compounds market, impacted by the electronics and automotive sectors.

Competitive Analysis

Competitive Analysis

The global molding compounds market is led by players like:

- BASF SE

- Huntsman Corporation

- SABIC

- DuPont

- Covestro AG

- Lanxess AG

- Sumitomo Bakelite Co. Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Polynt Group

- Kraton Polymers

- Nanya Plastics Corporation

- Momentive Performance Materials

- Westlake Chemical Corporation

- DSM Engineering Materials

Key Market Trends

Key Market Trends

- Rising trend of automotive light-weighting:

The trend for low-weight components in the automotive sector is substantially fueling the use of advanced molding compounds, mainly for lightweight and durable components. This aids in reducing fuel emissions and enhancing efficiency, mainly in electric vehicles and internal combustion.

- Improvements in additive manufacturing and 3D printing:

The incorporation of 3D printing technologies in manufacturing processes is one of the leading trends. Molding compounds that are companionable with additive manufacturing enable the development of lightweight, complex, and customized components with the least material wastage.

The global molding compounds market is segmented as follows:

By Resin Type Segment Analysis

By Resin Type Segment Analysis

- Polyester

- Phenolic

- Epoxy

- Others

By Application Segment Analysis

By Application Segment Analysis

- Aerospace

- Automotive

- Electrical and Electronics

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Huntsman Corporation

- SABIC

- DuPont

- Covestro AG

- Lanxess AG

- Sumitomo Bakelite Co. Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Polynt Group

- Kraton Polymers

- Nanya Plastics Corporation

- Momentive Performance Materials

- Westlake Chemical Corporation

- DSM Engineering Materials

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors