04-Aug-2022 | Facts and Factors

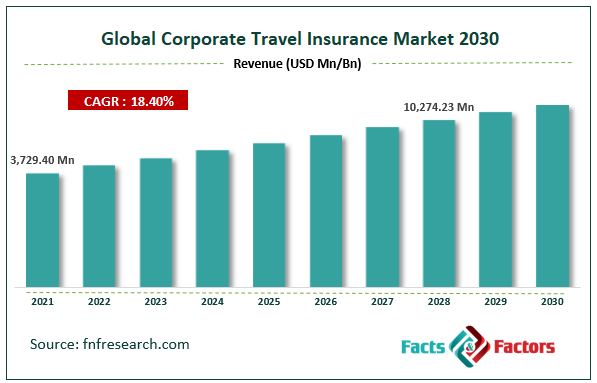

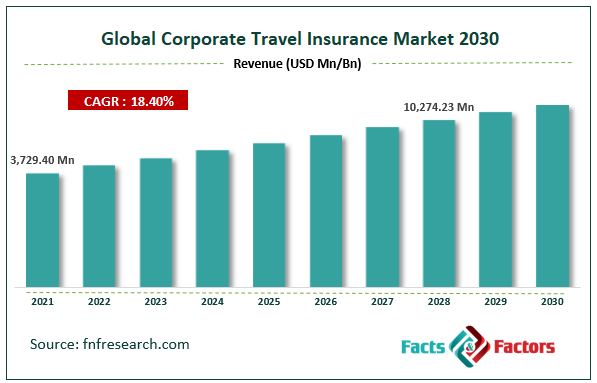

According to Facts and Factors, the global corporate travel insurance market size was worth USD 3,729.40 million in 2021 and is estimated to grow to USD 10,274.23 million by 2028, with a compound annual growth rate (CAGR) of approximately 18.40% over the forecast period. The report analyzes the corporate travel insurance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the corporate travel insurance market.

Corporate Travel Insurance is a market-leading business travel insurance program for today's busy business travelers. An increasing number of employees, from top firm executives to basic sales personnel, work in an ever-widening range of businesses, both large and small, and corporate travel is a regular part of their jobs. There are several travel risks for business travelers and difficulties for companies if their workers become ill or are hurt while working abroad. In some cases, an immediate departure from a nation with insufficient medical facilities or a politically risky area is necessary. Therefore, corporate travel insurance covers these risks in addition to the frequent ones like airline delays, misplaced luggage, and missing travel papers. Emergency help is only a phone call away with access to a high-quality assistance service available around the clock.

Browse the full “Corporate Travel Insurance Market Size, Share, Growth Analysis Report By Coverage Type (Single-Trip Travel Insurance and Annual Multi-Trip Travel Insurance), By Distribution Channels (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, and Others), By End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/corporate-travel-insurance-market

The demand for travel insurance from businesses has also increased because it offers immediate coverage for personal belongings and business equipment as well as delivers coverage against damage caused by the insured to a third party, which fuels the expansion of the business travel insurance market globally. Additionally, tailored coverages are included in corporate insurance policies and are offered at an additional premium cost based on customer needs and requests, which promotes the expansion of the global market for business travel insurance. The market for business travel insurance is growing, but business owners' ignorance of travel insurance policies is impeding its expansion. The adoption of digital tools like artificial intelligence (A.I.), application program interface (API), a global positioning system (G.P.S.), and data analytics for the delivery of affordable insurance policies, on the other hand, is expected to create lucrative opportunities for the growth of the global business travel insurance market.

Segmental Overview

Coverage type, distribution channels, and end users are the segments used to analyze the global business travel insurance market. The market is divided into annual multi-trip travel insurance and single-trip travel insurance based on the kind of coverage. In 2021, the single-trip travel insurance category dominated the global market. It is divided into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators based on the distribution channels. In 2021, insurance brokers had a significant share. The market is segmented on the end user into senior citizens, students, business travelers, family travelers, and others. In 2021, the travel insurance market's largest revenue share was obtained by the Family Travelers sector.

Regional Overview

With the largest revenue share, Europe has emerged as the market's dominant region for travel insurance. The sector is expanding as a result of growing tourism patterns in the European region as well as regional requirements for health, safety, and hygiene. Along with that, the area travel insurance market is expanding due to the presence of numerous historical monuments, significant businesses, and institutions. This is explained by the fact that during the COVID-19 outbreak, the majority of enterprises in the UK, Germany, and France bought business travel insurance, which accelerated the market's growth.

However, Asia-Pacific is anticipated to have considerable growth throughout the projected period due to the presence of numerous travel insurance providers throughout Asian nations, including Chubb, TATA AIG, and Bajaj Allianz.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,729.40 Million |

Projected Market Size in 2028 |

USD 10,274.23 Million |

CAGR Growth Rate |

18.40% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ALLIANZ, AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., A.X.A., Insure and Go Insurance Services Limited, Seven Corners Inc., Trip Mate Inc., Travel Insured International, Travel Safe Insurance, USI INSURANCE SERVICES LLC, and Others |

Key Segment |

By Coverage Type, Distribution Channel, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Prominent Vendors

The report contains qualitative and quantitative research on the global corporate travel insurance market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Key players functioning in the global corporate travel insurance market include Allianz, AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., A.X.A., Insure and Go Insurance Services Limited, Seven Corners Inc., Trip Mate Inc., Travel Insured International, Travel Safe Insurance, USI INSURANCE SERVICES LLC

Recent developments:

- In November 2021, A.I.G. Canada and Goose Insurance Services, a cutting-edge provider of insurance technology, partnered. The goal of this agreement was to make A.I.G. products available via the Goose Insurance Super-App. Additionally, it takes less than a minute for Canadians to purchase products from A.I.G. Canada.

- Nov. 2021 saw Zurich and travel insurance guru InsureandGo strike a contract with AllClear. Through this collaboration, Zurich would invest in travel-related products from AllClear and InsureandGo as well as its partner businesses.

The corporate travel insurance market is segmented as follows:

By Coverage Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

By Distribution Channel

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

By End User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com