29-Oct-2020 | Facts and Factors

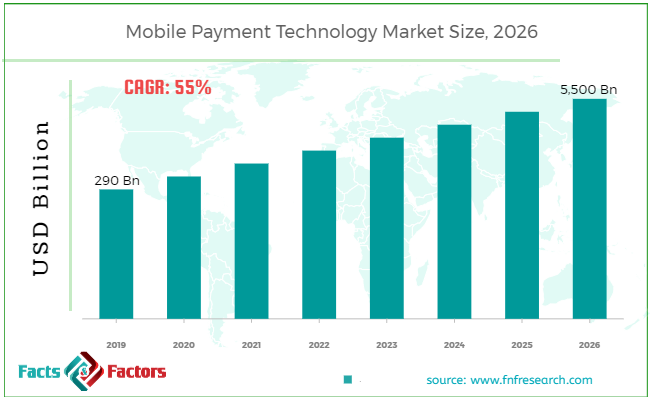

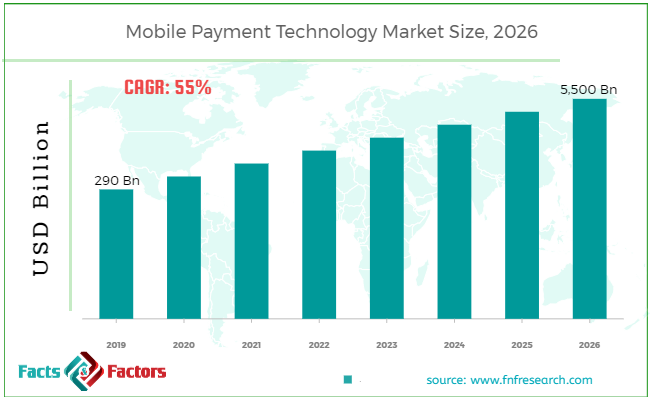

Findings from Facts and Factors report “Mobile Payment Technology Market By Payment Mode(Proximity Payment and Remote Payment), By Technology (NFC, QR Code, WAP & Card-Based, Digital Wallet, Banking App-based, SMS-based/DCB, and Others), By Application (BFSI, Retail, Healthcare, Entertainment, IT and Telecom, Energy & Utilities, Hospitality & Tourism, and Others): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecasts, 2020–2026” states that the global Mobile Payment Technology market in 2019 was approximately USD 290 billion. The market is expected to grow above a CAGR of 55% and is anticipated to reach over USD 5,500 billion by 2026.

Mobile payment is known as a payment done via mobile devices and smartphones. Using digital payment platforms, consumers make digital payment instead of cash, cards, cheque, etc. Mobile payments are becoming a key part of the global payment process as such processes enhance operational efficiency, which results in a reduction in operational cost and increased business. Some of the types of mobile payment models are mobile wallets, direct carrier billing, credit or debit card-based payments, intra as well as inter-bank transfers, etc. Banking and financial institutions, credit, and debit card companies and software companies have developed mobile payment methods that can help replace existing payment methods such as cash, traditional cards, etc. Some of the popular mobile wallets available in the market are Alipay, Apple Pay, Google Pay, Gyft, Touch 'n Go eWallet, Line Pay, etc.

Browse the full “Mobile Payment Technology Market By Payment Mode(Proximity Payment and Remote Payment), By Technology (NFC, QR Code, WAP & Card-Based, Digital Wallet, Banking App-based, SMS-based/DCB, and Others), By Application (BFSI, Retail, Healthcare, Entertainment, IT and Telecom, Energy & Utilities, Hospitality & Tourism, and Others): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecasts, 2020–2026" report at https://www.fnfresearch.com/mobile-payment-technology-market

In recent years, the smartphone penetration rate has been increasing rapidly owing to the introduction of low-cost smartphones into the market. The smartphone penetration rate was nearly 36% in the year 2017 and is expected to reach a value of around 45% by the end of 2025. The number of smartphone users around the world has also increased at a rapid rate, with the number expected to reach a value of 3.8 billion people by the end of 2021.

The rise of smartphone users and has led to an increase in the number of transactions done through mobile payment apps, which has led to a decrease in the need for credit and debit cards. This soaring increase in the number of smartphone users has been driving the global mobile payment technology market. Moreover, the rise of third-party mobile payment service providers and the use of mobile apps in online shopping and mobile point of sale has also boosted the global mobile payment technology market. Further, the rise of artificial intelligence and online KYC and biometric authentication is expected to enhance the consumer experience during mobile payments, which is expected to create new opportunities for the global mobile payment technology market.

In terms of the payment mode, the remote payment segment dominated the global mobile payment technology market in 2019 and is expected to record the fastest growth over the forecasted period. The growing use of mobile wallets from consumers has been driving the remote mobile payment technology market.

On the basis of technology, the mobile or digital wallet segment is expected to have the highest CAGR over the projected period. This growth is driven by the use of mobile wallets for safe mobile payment. Moreover, companies offer coupons, rewards, discounts, etc. when a transaction is made from a mobile wallet. In terms of application, the retail segment held a major share in the global mobile payment technology market, owing to the use of mobile payments on online shopping sites and applications.

On the basis of region, Asia Pacific dominated the global mobile payment technology market. The growth in the market is due to a large number of smartphone users in countries such as China, India, and Japan. Further, the adoption of mobile payment apps among small and medium-sized businesses, retailers, shops, etc. has also boosted the Asia Pacific mobile payment technologies sector.

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 290 Billion |

Projected Market Size in 2026 |

USD 5,500 Billion |

CAGR Growth Rate |

55% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

MasterCard International Inc., Fortumo, Bharti Airtel Ltd., American Express Co., Visa Inc., Boku Inc., Microsoft Corporation, AT&T Inc., and PayPal Inc., and Others |

Key Segment |

By Payment, Technology, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

Some of the leading players in the global market include

MasterCard International Inc., Fortumo, Bharti Airtel Ltd., American Express Co., Visa Inc., Boku Inc., Microsoft Corporation, AT&T Inc., and PayPal Inc.

This report segments the global Mobile Payment Technology market as follow:

By Payment Mode Segmentation Analysis

- Proximity Payment

- Remote Payment

By Technology Segmentation Analysis

- NFC

- QR Code

- WAP & Card-Based

- Digital Wallet

- Banking App-based

- SMS-based/DCB

- Others

By Application Segmentation Analysis

- BFSI

- Retail

- Healthcare

- Entertainment

- IT and Telecom

- Energy & Utilities

- Hospitality & Tourism

- Others

By Regional Segmentation Analysis

- North America

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1 (347) 690-0211

Email: [email protected]

Web: https://www.fnfresearch.com