30-Sep-2022 | Facts and Factors

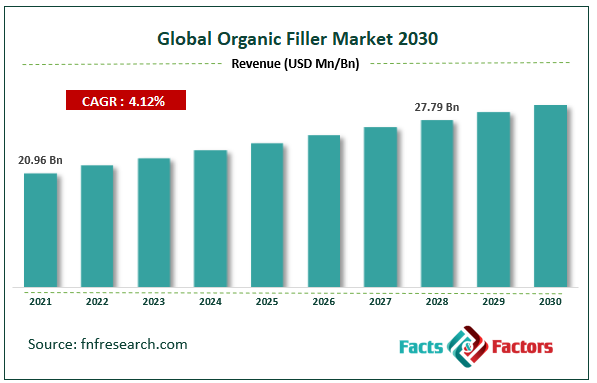

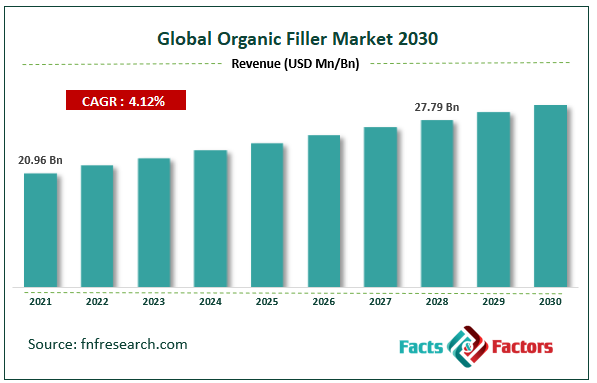

According to Facts and Factors, the global organic filler market size was worth around USD 20.96 billion in 2021 and is predicted to grow to around USD 27.79 billion by 2028 with a compound annual growth rate (CAGR) of roughly 4.12% between 2022 and 2028.

Organic fillers are irregular, acicular, fibrous, flakey, or solid fibers and particulates, which are used in significant quantities in polymers such as thermoplastic, thermoset, and elastomer. Organic fillers enhance various mechanical, thermomechanical, and load-bearing characteristics of these polymer products. Some of the key organic fillers are natural fiber, such as bamboo flour, wood flour, clamshell flour, and tree bark flour, among others; carbon; and synthetic organic fillers, such as synthetic cellulose fibers, powdered fluorinated polymers, and others.

Browse the full “Organic Filler Market Size, Share, Growth Analysis Report By Product Type (Natural Fiber, Carbon, Other Organic Fillers), By Polymer Type (Thermoplastic, Thermoset, and Elastomer), By End-user Industry (Automotive, Building & Construction, Electrical & Electronics, Aerospace & Defense, and Other End-user Industries), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/organic-filler-market

Furthermore, the cost of these organic fillers is very low. Also, organic fillers are biodegradable in nature, thereby, delivering less environmental impact and contributing to an eco-friendly society. Rising consciousness about a clean environment is favoring the usage of organic fillers, instead of inorganic fillers.

Various natural organic fillers are available for being used in different polymer product manufacturing. However, the key challenge is to match the right natural organic filler with the right application. This is a short-term issue only. Already various R&D has been carried out and many of them are in the initiation phase, to find the right application and overcome this issue. For example, researchers have used rice husk ash as fillers in the natural rubber industry. The use of rice husk ash in natural rubber enhanced hardness but decreased tensile strength and tear strength. Researchers have also tested corn starch, potato starch, sago starch, sisal fibers, and kenaf fibers, as organic fillers in various applications. Such developments are likely to overcome the challenges faced due to unawareness related to the right application of natural fibers.

Covid-19 had a considerable impact on the global market size. In 2020, the global organic filler demand decreased, considering the onset of the COVID-19 pandemic. Considering the government-imposed lockdowns, such that to stop the new COVID-19 cases, various industry (automotive and construction) activities were stopped temporarily. However, the demand from the IT and computer segment of electrical and electronics increased in 2020, as various firms offered work-from-home models to their employees, which further enhanced the demand for organic filler-based polymers, used in the parts for the IT and computer products. Furthermore, in 2021, these end-user industries recovered significantly. The construction industry grew significantly in 2021, owing to the various order backlogs fulfillment for the construction industry and rising demand for office and commercial spaces, across the globe.

The global organic filler market growth is expected to be driven by growing demand from the automotive industry. The global organic filler market cap may grow owing to the rising trend of using organic filler-based polymer parts in the automotive sector, including the electric vehicle segment. Organic fillers are used in polymer products, such that to enhance the characteristics of end products and reduce the overall cost of the product. The demand for automobiles has increased, which also supported the production of vehicles and related polymer parts. According to the OICA, global automotive sales accounted for 82.68 million units in 2021, witnessing a growth rate of 5% compared to 78.77 million units sold in 2020.

Apart from conventional vehicles, the sales of electric vehicles greatly increased in the current scenario, which also supported the demand for the organic filler market, as these fillers are also used in electric vehicle parts, similar to conventional vehicles. According to the EV Volumes, around 4.3 million new battery electric vehicles (BEVs) and plugin hybrid electric vehicles (PHEVs) were sold during the first half of 2022, registering a growth rate of 62% compared to the H1 2021. Further, as per EV Volumes, the total electric vehicle sales are likely to reach 10.6 million units in full-year 2022, witnessing a growth of 57%, over 2021. All such factors are supporting the demand for organic fillers used in various automotive parts manufacturing.

The availability of various inorganic substitutes may restrict global market expansion. Various types of inorganic fillers are being used in polymer products of different end-user sectors. Some of the key types of inorganic fillers include oxide, hydro-oxide, silicate, salt, metal, and other inorganic fillers. Specifically, glass fiber, talc, mica, kaolin, clay, nano clay, silver nanoparticles, and calcium carbonate are among the common inorganic fillers. Most of the inorganic fillers are abundantly available for end-use applications, after required processing. Inorganic fillers such as aluminum trihydrate, calcium carbonate, talc, and others, are also widely used due to their low cost, continuous supplies, and ability, after surface treatment, to improve selected resin properties.

The global organic filler market is segmented based on product type, polymer type, end-user industry, and region.

Based on product type, the global market segments are natural fiber, carbon, and synthetic organic fillers. Currently, the global market is dominated by carbon, however, there is a significant increase in the adoption rate of natural fibers too, in recent years. Carbon product types include carbon fibers, graphite fibers & flakes, carbon nanotubes, carbon black, and others. These organic fillers are widely used in the automotive, aerospace & defense, and construction industry. In natural fiber, cellulosic filler materials are generally used, which can be mixed with polymers to improve their mechanical and physicochemical properties.

Based on polymer type, the global market is segmented into thermoplastic, thermoset, and elastomer. Meanwhile, thermoplastic accounted for a major share in the studied market. The growing thermoplastic industry is likely to retain the largest market share in the coming years too. According to Plastics Europe, the production of plastics in primary forms in the European Union (EU)-27 countries increased in 2021, after a significant decline in 2020. The production of plastics in primary forms in EU-27 countries increased by 4.2% in Q4 2021, over Q3 2021.

Based on the end-user industry, the global market segments are automotive, building & construction, electrical & electronics, aerospace & defense, and other end-user industries. Currently, the global market is dominated by building and construction. According to the IEA, the building and construction industry declined by 2% to USD 6 trillion in 2020. Furthermore, the construction market was valued at USD 7.28 trillion in 2021 and is predicted to reach USD 14.41 trillion by 2030. China and the United States of America are among the key countries involved in construction activities. According to the U.S. Census Bureau, the annual value for construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

The global organic filler market is anticipated to be dominated by Asia-Pacific led by China, India, and Japan. One of the major reasons for regional growth is the higher investments as well as rising production value of various end-user industries, including, building & construction, automotive, and electrical & electronics. In China, according to the National Bureau of Statistics of China, the construction output value in the country was valued at CNY 29.31 trillion in 2021, compared to CNY 26.39 trillion in 2020. The growing trend increased the demand for organic fillers from the Chinese construction sector. Moreover, in India, according to OICA, the country produced 4,399,112 units of vehicles in 2021, compared to 3,381,819 units of vehicles in 2020, with a growth rate of 30%.

North America and Europe may also register high CAGR. North America, majorly, will be driven by the United States which had a significant global market share in 2021. The regional growth may be attributed to the rising consumption of polymer products from domestic end-user markets.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 20.96 Billion |

Projected Market Size in 2028 |

USD 27.79 Billion |

CAGR Growth Rate |

4.12% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Birla Carbon (Aditya Birla Group), Cabot Corporation, Chengdu Organic Chemicals Co. Ltd., Eastman Chemical Company, Hexcel Corporation, JELU-WERK J. Ehrler GmbH & Co. KG, LG Chem, Orion Engineered Carbons, Pollen AM inc., SGL Carbon, TORAY INDUSTRIES INC., and others. |

Key Segment |

By Product Type, Polymer Type, End-user Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The global organic filler market is dominated by players like BASF SE, Birla Carbon (Aditya Birla Group), Cabot Corporation, Chengdu Organic Chemicals Co. Ltd., Eastman Chemical Company, Hexcel Corporation, JELU-WERK J. Ehrler GmbH & Co. KG, LG Chem, Orion Engineered Carbons, Pollen AM inc., SGL Carbon, and TORAY INDUSTRIES, INC., among others.

Recent Developments:

- In March 2022, Cabot Corporation completed the acquisition of Tokai Carbon’s carbon black plant based in Tianjin, China. Carbon black is significantly used as organic filler material. The site has a production capacity of 50 kilotons of carbon black annually.

- In March 2022, Orion Engineered Carbons announced the commercial sale of carbon black from its new plant based in Italy, with a production capacity of 25 kilotons of specialty and technical rubber carbon blacks per annum.

The global organic filler market is segmented as follows:

By Product Type

- Natural Fiber

- Carbon

- Synthetic Organic Fillers

By Polymer Type

- Thermoplastic

- Thermoset

- Elastomer

By End-user Industry

- Automotive

- Building and Construction

- Electrical and Electronics

- Aerospace and Defense

- Other End-user Industries

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1 (347) 690-0211

Email: [email protected]

Web: https://www.fnfresearch.com