en

en  en

en  en

en  en

en

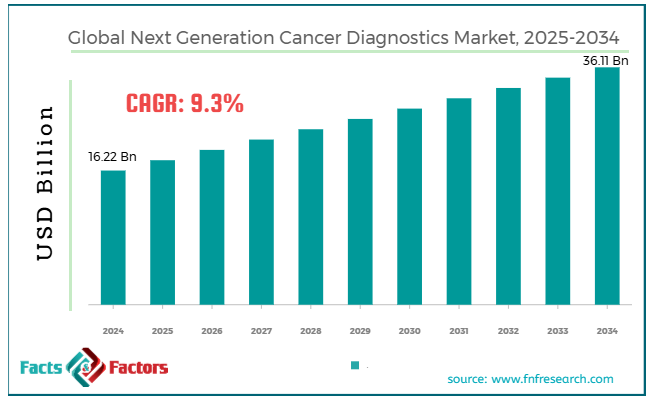

[221+ Pages Report] According to Facts & Factors, The global next generation cancer diagnostics market size was worth around USD 16.22 billion in 2024 and is predicted to grow to around USD 36.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.3% between 2025 and 2034.

Market Overview

Market OverviewNext-generation cancer diagnostics comprises advanced solutions that enhance cancer detection, analysis, and monitoring. They include methods that examine blood samples for cancer-associated genetic mutations and AI-based imaging that improves cancer detection precision.

The global next generation cancer diagnostics market is projected to flourish remarkably over the coming years owing to the rising cancer cases, improvements in diagnostic technologies, and the growing trend towards precision medicine.

The global rise in cancer cases and mortality is majorly fueling the demand for highly effective diagnostic solutions. Early detection is essential for enhancing survival rates, thus boosting the need for improved diagnostic techniques for cancer.

Also, modernizations like liquid biopsy, NGS, and AI diagnostic systems enable faster, more accurate, and painless detection, which boosts the adoption of enhanced diagnostic tools.

Furthermore, the growing trend towards precision and personalized medicine is increasing the need for next-gen diagnostics.

Nonetheless, the global market is restrained by costly advanced diagnostics and regulatory challenges. Several next-gen diagnostic tools like AI-based imaging systems and MGS are costly. Expensive technology implementation and development may prevent low-income and middle-income nations from adopting these tools.

Also, the regulatory approval procedure for novel diagnostic tools, comprising liquid biopsies and molecular diagnostics, may be time-consuming and challenging. This may delay the broader adoption of modern technologies.

Yet, the market will progress substantially owing to opportunistic factors like the growth of liquid biopsy use and the integration of ML and AI. Liquid biopsy holds key potential as a painless method for cancer detection. The rising applications of the process, comprising early detection, prognosis, and treatment monitoring, are key opportunities.

In addition, the integration of ML and AI in cancer diagnostics may help in image analysis, prediction of treatment reactions, and patient stratification, thus offering vital opportunities.

Key Insights:

Key Insights: Growth Drivers

Growth DriversThe rising burden of cancer cases is a major propeller for the expansion of the next generation cancer diagnostics market. With growing incidences on a global scale, there is an increased need for early cancer diagnosis, which may considerably enhance survival rates.

As per WHO, cancer is among the top causes of mortality, accounting for almost 10 million deaths in the past years.

Early detection technologies like blood tests for cancer markers are gaining traction in clinical settings, with leading companies like Exact Sciences and Guardant Health fueling innovations. These liquid biopsy techniques are specially designed to identify cancer at the early stage, thus improving survival rates.

Machine learning and artificial intelligence notably improve cancer diagnosis's speed, accuracy, and efficacy. By evaluating massive quantities of medical imagery and data, AI-based platforms can efficiently predict cancer and identify patterns with better accuracy. This reduces the risk of human error and offers precise results.

DeepMind and Google Health have launched an artificial intelligence tool with the potential of diagnosing breast cancer via mammograms with enhanced accuracy compared to radiologists in several cases.

Moreover, a specializing company, PathAI, received clearance from the FDA for its AI-based system, which helps pathology experts diagnose breast cancer with enhanced precision.

Restraints

RestraintsWhile the next-gen diagnosis offers significant improvements over the conventional techniques, they still lack technical accuracy. This comprises challenges with accuracy, generalization of diagnostic algorithms in diverse populations, false negatives or positives, and cancer forms.

AI-based diagnostics for imaging, like CT scans and mammograms, show better accuracy levels, but performance differs among different population groups. Studies denote that AI systems may hold less accuracy in some ethnic groups or for uncommon cancer forms.

In February 2024, Guardant Health announced that liquid biopsy solution is not globally applicable for all cancer forms, especially for early-stage cancers where the genetic material in the blood may not be sufficient for precise detection.

Opportunities

OpportunitiesSince cancer treatment is becoming more personalized and targeted, the demand for diagnostic tests to detect biomarkers or specific genetic mutations is fueling. Personalized medicine enables treatments to be modified to the unique genetic profiles of every individual, thus enhancing treatment results and decreasing side effects.

Caris Life Sciences extended its ‘Caris Molecular Intelligence’ tool in March 2024 to provide better insights into matching patients and tumors with targeted treatments depending on their genetic makeup. This approach is projected to be broadly adopted in the oncology domain.

Challenges

ChallengesOne key challenge in the next generation cancer diagnostics industry is the lack of standardization in diagnostic platforms. Inconsistency in test performance, such as false negatives or false positives, is still a leading issue.

The consistency and reliability of certain technologies like liquid biopsy and AI diagnostic systems may differ among diverse clinical settings. This may result in compromised patient results and inconsistent outcomes.

A study made by Lancet Oncology in 2023 revealed that AI-powered tools for detecting lung cancer functioned better than conventional techniques. The regional variations in functioning increased issues on the broader adoption in different populations.

Report Scope

Report ScopeReport Attribute |

Details |

Market Size in 2024 |

USD 16.22 Billion |

Projected Market Size in 2034 |

USD 36.11 Billion |

CAGR Growth Rate |

9.3% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2032 |

Key Market Players |

Guardant Health, Illumina Inc., Roche Diagnostics, Thermo Fisher Scientific, Bio-Rad Laboratories Inc., QIAGEN N.V., Agilent Technologies, Exact Sciences Corporation, Abbott Laboratories, Caris Life Sciences, Freenome Inc., Tempus Labs Inc., Veracyte Inc., NeoGenomics Laboratories, Bristol-Myers Squibb, and others. |

Key Segment |

By Cancer Type, By Function, By Technology, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation AnalysisThe global next generation cancer diagnostics market is segmented based on cancer type, function, technology, application, and region.

Based on cancer type, the global next generation cancer diagnostics industry is divided into lung cancer, breast cancer, colorectal cancer, cervical cancer, and others. The lung cancer segment held a notable share in 2024. It will continue to lead over the forecast period owing to early detection difficulties, high prevalence, and the elevated need for modernized diagnostic techniques.

The growing mortality rate related to lung cancer, along with the growth of non-intrusive liquid biopsy tools and AI-based imaging systems, increases the emphasis on lung cancer diagnostics.

In the U.S., lung cancer is projected to cause more than 1,28,000 deaths yearly, thus increasing the need for early diagnosis and detection solutions. The breast cancer segment is the second-leading market owing to the rising emphasis on personalized medicine via biomarker profiling and genetic testing.

Based on technology, the global next generation cancer diagnostics industry is segmented as next-generation sequencing, qPCR & multiplexing, Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR), protein microarrays, and DNA microarrays.

The next-generation sequencing (NGS) segment is projected to witness a significant share. It enables exhaustive genomic profiling and has transformed cancer diagnostics by allowing the detection of biomarkers, genetic mutations, and mutations in tumor DNA. The technology is vital in precision oncology, where treatment is modified to the patient's genetic makeup.

However, the qPCR and the multiplexing segment are also expected to hold a notable market share since they enable the quantification and amplification of specific DNA sequences. This increases its significance in detecting biomarkers, genetic mutations, and viral load cancers.

Based on application, the global market is segmented as biomarker development, CTC analysis, proteomic analysis, epigenetic analysis, and genetic analysis. The genetic analysis segment held a substantial share of the market in 2024 and is expected to lead in the future. It plays a key role in detecting genetic alterations, mutations, and variations in cancer.

Depending on the patient's genotype, genetic profiling enables more precise diagnosis, risk examination, and personalized treatment strategies.

On the other hand, the biomarker development segment will hold a leading position in the coming years. The validation and identification of biomarkers are vital for detecting the early stages of cancer, monitoring the progression, and evaluating treatment response.

Regional Analysis

Regional AnalysisNorth America dominated the global next generation cancer diagnostics market in 2024. It will continue to lead over the estimated period as well, owing to its developed healthcare infrastructure, significant R&D investments, and early adoption of improved diagnostic technologies.

North America, mainly the U.S., brags about its well-developed healthcare system that aids the growing use of superior technologies like AI-powered and NGS diagnostics.

Also, high investments in cancer research, comprising investments by the private sector and government initiatives, majorly contribute to the constant modernization of diagnostic tools.

Moreover, due to supportive regulatory environments, the region quickly adopts and implements next-gen diagnostic technologies in clinical settings like NGS and liquid biopsy.

The regional growth is also fueled by the high prevalence of cancer that ultimately demands enhanced diagnostic technologies, impacting the development of the next-generation cancer diagnostics market.

Asia Pacific is the second-leading region in the global market due to rising cancer cases, growing healthcare investments, enhanced healthcare access, and the adoption of improved technologies. Asia Pacific is witnessing a speedy rise in cancer incidences owing to lifestyle changes, environmental factors, and an aging population. This ultimately increases the need for improved diagnostic tools.

Moreover, private sectors and governments are investing in enhancing cancer diagnostics and healthcare infrastructure, mainly in nations like India and China.

Furthermore, countries like South Korea, Japan, and India actively use AI-powered and NGS diagnostics and liquid biopsy technologies. These improved solutions enhance the capabilities of cancer diagnostics.

Competitive Analysis

Competitive AnalysisThe global next generation cancer diagnostics market is led by players like:

Key Market Trends

Key Market TrendsLiquid biopsy is gaining huge traction owing to its painless nature, which allows the detection of ctDNA or CTCs in blood specimens. It is used for early cancer diagnosis, treatment response, and recurrence tracking.

NGS technology is remarkably expanding, enabling exhaustive genomic profiling allowing clinicians to identify a broader range of genetic markers and mutations in diverse cancer types. It is revolutionizing early detection of cancer, monitoring, and targeted treatment.

The global next-generation cancer diagnostics market is segmented as follows:

By Cancer Type Segment Analysis

By Cancer Type Segment Analysis By Function Segment Analysis

By Function Segment Analysis By Technology Segment Analysis

By Technology Segment Analysis By Application Segment Analysis

By Application Segment Analysis By Regional Segment Analysis

By Regional Segment Analysis

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors

en

en  en

en