Search Market Research Report

Orthokeratology Lens Market Size, Share Global Analysis Report, 2022 – 2028

Orthokeratology Lens Market Size, Share, Growth Analysis Report By Product Type (Day-time Ortho-K Lenses, Overnight Ortho-K Lenses), By Indication (Myopia, Presbyopia, Hypermetropia, Astigmatism), By Distribution Channel (Hospitals, Optometry Clinics, Ophthalmology Clinics, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

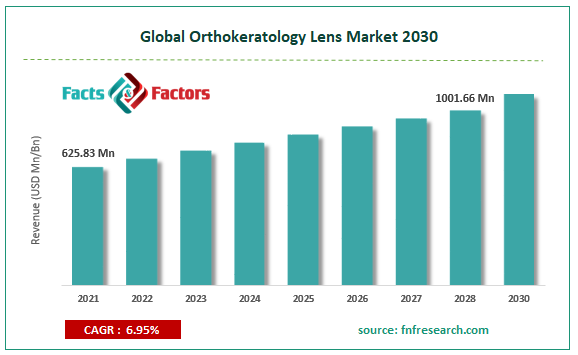

[236+ Pages Report] According to the report published by Facts Factors, the global Orthokeratology Lens market size was worth around USD 625.83 million in 2021 and is predicted to grow to around USD 1001.66 million by 2028 with a compound annual growth rate (CAGR) of roughly 6.95% between 2022 and 2028. The report analyzes the global Orthokeratology Lens market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Global Orthokeratology Lens market.

Orthokeratology Lens Market: Overview

Orthokeratology Lens Market: Overview

Orthokeratology, also known as Ortho-K, OK, corneal reshaping, corneal refractive therapy, and vision shaping treatment, is a different approach to treating refractive problems that use hard inflexible lenses that are specially made to temporarily alter the cornea's curvature. To enable quicker and more effective corneal reshaping, modern Ortho-K technology reverses geometry designs and employs breathable stiff lens material. Modern reverse geometry designs for myopia correction are characterized by a central base curve that is fitted significantly flatter relative to the central corneal curvature and one or more surrounding steeper secondary or "reverse" curves that enable a smooth transition from one to the other. This is in contrast to traditional Ortho-K designs, which use a series of gradually flattening concentric curves surrounding a central base curve fitting in alignment with the central cornea. Ortho-K is currently used most frequently in clinical settings to flatten the cornea in order to reduce myopia. The concept of corneal replacement underlies orthokeratology (Ortho-K), a non-invasive treatment option for myopia, hyperopia, astigmatism, and presbyopia. Vision Shaping Treatment (VST) and Corneal Refractive Therapy are two Ortho-K treatments that have received FDA approval (CRT).

By helping to eliminate vision defects brought on by contact lenses, orthokeratology enables patients to lead active lives. This significant aspect is anticipated to drive the growth of the global orthokeratology market. Additionally, the worldwide orthokeratology market is anticipated to grow in the coming years due to rising online education and information about Ortho-K as well as an increase in recent orthokeratology lens success stories.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Orthokeratology Lens market is estimated to grow annually at a CAGR of around 6.95% over the forecast period (2022-2028).

- In terms of revenue, the global Orthokeratology Lens market size was valued at around USD 625.83 million in 2021 and is predicted to grow to around USD 1001.66 million by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on product type segmentation, overnight ortho-K-lenses was predicted to show maximum market share in the year 2021

- Based on indication segmentation, myopia was predicted to show maximum market share in the year 2021

- Based on distribution channel segmentation, hospital was predicted to show maximum market share in the year 2021

- On the basis of region, North America was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

COVID-19 has not been nice to anyone on a physical, intellectual, or emotional level. People have to deal with the emotional pain of seeing loved ones perish as a result of the pandemic. Lockdowns in the workplace led to work-from-home scenarios, and a variety of early morning, midday, and night shifts have an impact on people's eyesight. Governmental agencies are aiming to raise the caliber of the medications and facilities that will support the treatment of persons with vision impairments. Additionally, in order to serve the target market and capitalize on the potential for worldwide expansion, providers of orthokeratology lenses are developing and marketing solutions on a global scale. The market for orthokeratology lenses is anticipated to expand in the upcoming years as a result of the manufacturing businesses utilizing automation to increase their production capacity.

Orthokeratology Lens Market: Growth Drivers

Orthokeratology Lens Market: Growth Drivers

- Increasing prevalence of myopia and high myopia worldwide are expected to drive growth of the orthokeratology market

Myopia and high myopia are becoming more and more commonplace on a global scale. Myopia is a significant public health issue, and excessive myopia is the second-leading factor in visual impairment globally. In East Asia, the prevalence of myopia was around 90% among students and affected close to 50% of the urban population, according to 2016 research from the National Center for Biotechnology Information (NCBI).

Additionally, because myopia's visual difficulties begin earlier than other causes of blindness like cataract, its effects on quality of life are also seen earlier. The cost of eye illnesses in the United States is estimated to be over USD 139 billion, with close to USD 16 billion going toward myopia correction alone, according to a 2018 study published in the Eye Contact Lens journal. Myopia prevention and control techniques are therefore highly sought after on a global scale.

Furthermore, prolonged use of laptops, cellphones, and tablets results in digital eye strain, which damages children's and young people's eyes permanently. The best candidates for orthokeratology are young persons whose nearsightedness is steadily getting worse. Together, these reasons are raising the demand for ortho-K, which will eventually fuel the expansion of the global orthokeratology lens market.

Orthokeratology Lens Market: Restraints

Orthokeratology Lens Market: Restraints

- High cost of orthokeratology lens may hamper the market growth

The adoption of orthokeratology may be hindered by factors like the development of microbial keratitis, a lack of training for practitioners and wearers, poor compliance with lens care regimens, improper fitting techniques, and missed scheduled follow-up appointments, according to the NCBI 2016 report. Orthokeratology lens fitting takes more time and requires more skill than standard contact lens fitting. A number of office visits and possibly several sets of lenses are necessary for ortho-K lenses. As a result, it raises the overall cost of care, which may be a major issue restricting the expansion of the orthokeratology market. Additionally, the price of ortho-k, including follow-up care, can differ greatly based on the kind and severity of refractive error as well as the length of time it takes to correct myopia. Ortho-k costs in the US in 2016 ranged from USD 1,000 to USD 2,000 (for both eyes). Depending on the complexity of the case, this amount could rise to USD 4,000. Additionally, vision insurance coverage does not totally cover orthokeratology.

Orthokeratology Lens Market: Opportunity

Orthokeratology Lens Market: Opportunity

- Emerging markets likely to create strong growth opportunities

Around the world, high myopia and myopia are becoming more prevalent. High myopia is the second leading global cause of vision impairment, making it a critical public health concern. According to a National Center for Biotechnology Information (NCBI) 2016 research, myopia affects 90% of students and around 50% of the urban population in East Asia. Myopia affects the quality of life earlier than other types of blindness, such as cataracts, because it results in vision deficits early. The expense of eye diseases in the United States is over USD 139 billion, according to a 2018 study that was published in the Eye Contact Lens journal, with over USD 16 billion going toward myopia correction alone. As a result, orthokeratology lenses and other techniques for preventing myopia and controlling its progression are highly sought after globally. Furthermore, children and teenagers' eyes suffer long-term harm from using cellphones, laptops, and tablets for extended periods of time.

Orthokeratology Lens Market: Challenges

Orthokeratology Lens Market: Challenges

- Application and removal of lens to pose challenge for market growth

The largest obstacle to wearing lenses may be how to put on and take off ortho-k lenses. It can be challenging to introduce handling and lens care to kids as young as 7. There are two million justifications and a million distinct strategies. Training for application and removal begins during the consultation rather than the dispensing visit. Give the patient and parent some homework when all the specifics have been resolved and the contracts have been signed. Prior to the dispensing visit, the patient must practice touching their own eyes as part of their assigned homework.

Orthokeratology Lens Market: Segmentation

Orthokeratology Lens Market: Segmentation

The global Orthokeratology Lens market is segmented based on product type, indication, distribution channel, and region.

The global market has been further divided into daytime ortho-K-lens and nocturnal ortho-K-lens based on product kinds. In 2021, the nightly ortho-K-lenses product type category held the most market share and dominated the world. This expansion was attributable to the ortho-K-lens' rapid adoption and efficiency. Any discomfort that patients may have felt while wearing regular contact lenses is considerably lessened with overnight ortho-K lenses. For folks who don't enjoy wearing contacts or glasses all day or who do sports, an overnight ortho-K lens can make things easier.

Thus, a number of advantages of overnight ortho-K lenses are anticipated to boost the segment's growth. The FDA's growing approval of orthokeratology lenses for the treatment of refractive problems and improvements in lens design is expected to drive market expansion. For instance, the U.S. FDA authorized the first ortho-k lens for the management of myopia in May 2021. In 2021, the daytime ortho-K-lens sector had a sizable market share.

The global market is divided into myopia, presbyopia, hypermetropia, astigmatism, and others based on indications. In 2021, the myopia category was the dominant one. The market for orthokeratology lenses is anticipated to benefit from the rising prevalence of myopia during the study period. For instance, roughly 27% of the world's population, or approximately 1.9 billion people, have myopia, according to the journal Investigative Ophthalmology and Visual Science. Myopia can result in significant ocular morbidity and high medical expenses. During the forecast period, it is anticipated that the prevalence of myopia would increase even more. During the forecast period, myopia will rank among the major causes of permanent blindness in the world.

The market is divided into hospitals, ophthalmology clinics, optometry clinics, and others based on the distribution channels used. In 2021, the hospitals sector was the largest. The market is developing as a result of hospitals continuously increasing their investments in orthokeratology lenses as eye-related illnesses including cataracts and glaucoma are becoming more common. According to estimates, the expansion of the hospitals segment will be fueled by an increase in the use of orthokeratology lenses in hospitals due to better treatment facilities. However, different institutions may use orthokeratology lenses differently, which could limit market expansion. During the predicted period, the ophthalmic clinics segment experienced a considerable CAGR.

Recent Developments:

Recent Developments:

- In January 2019, Contamac introduced Optimum infinite high-oxygen gas permeable contact lenses with a strong mix of processability and elastic strength.

- In March 2019, Alcon, Inc. purchased PowerVision, Inc., a medical equipment development firm based in the United States. With this agreement, the company will be able to focus on developing a fluid-based corneal lens surgery. This will enhance the overall engagement of the company.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 625.83 Million |

Projected Market Size in 2028 |

USD 1001.66 Million |

CAGR Growth Rate |

6.95% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Bausch & Lomb Inc., Euclid Systems Corp., CooperVision, Johnson & Johnson Vision Care Inc., Alpha Corporation (Menicon Group), Brighten Optix Co., GP Specialists, TruForm Optics Inc., Art Optical Contact Lens Inc., MiracLens L.L.C., and others. |

Key Segment |

By Product Type, Indication, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Orthokeratology Lens Market: Regional Analysis

Orthokeratology Lens Market: Regional Analysis

- North America to lead the market growth during the projection period

In 2021, North America led the global orthokeratology lens market. Recent developments in orthokeratology lenses, the introduction of nighttime ortho-K lenses, flexibility, and choice are some of the elements anticipated to drive market expansion. It is predicted that there would be significant development prospects in the U.S. due to rising orthokeratology lens usage and an increase in cases of vision impairment. Additionally, it is anticipated that the local presence of significant market participants in the U.S., including CooperVision, Johnson & Johnson Vision, and Bausch & Lomb Inc., will probably promote regional growth. The region of Europe, which had the second-highest revenue share, is anticipated to grow significantly over the course of the projected period.

It is anticipated that the use of orthokeratology lenses among medical practitioners will increase because to the rising prevalence of ocular illnesses such myopia and presbyopia. According to estimates, technological developments and the rise in the number of items getting CE clearance will promote regional growth. Over the course of the forecast period, Asia Pacific is expected to develop significantly at CAGR. The market is expected to develop as a result of rising healthcare costs and rising awareness of eye problems. The market is expected to be stimulated by the rising elderly population and the rising use of orthokeratology lenses in China and India. Furthermore, it is anticipated that over the projection period, the demand for orthokeratology lenses would increase due to the rising number of ophthalmic clinics and hospitals in Asian nations.

Competitive Analysis

Competitive Analysis

- Bausch & Lomb Inc.

- Euclid Systems Corp.

- CooperVision

- Johnson & Johnson Vision Care Inc.

- Alpha Corporation (Menicon Group)

- Brighten Optix Co.

- GP Specialists

- TruForm Optics Inc.

- Art Optical Contact Lens Inc.

- MiracLens L.L.C.

The global Orthokeratology Lens market is segmented as follows:

By Product Type

By Product Type

- Day-time Ortho-K Lenses

- Overnight Ortho-K Lenses

By Indication

By Indication

- Myopia

- Presbyopia

- Hypermetropia

- Astigmatism

By Distribution Channel

By Distribution Channel

- Hospitals

- Optometry Clinics

- Ophthalmology Clinics

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bausch & Lomb Inc.

- Euclid Systems Corp.

- CooperVision

- Johnson & Johnson Vision Care Inc.

- Alpha Corporation (Menicon Group)

- Brighten Optix Co.

- GP Specialists

- TruForm Optics Inc.

- Art Optical Contact Lens Inc.

- MiracLens L.L.C.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors