Search Market Research Report

Peptide Synthesis Market Size, Share Global Analysis Report, 2022 – 2028

Peptide Synthesis Market Size, Share, Growth Analysis Report By Product (Reagents, Equipment & Services), By Technology (Solid Phase Peptide Synthesis (SPPS), Liquid Phase Peptide Synthesis (LPPS) & Hybrid Technology), By Application (Therapeutics, Diagnosis & Research), By End User (Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organization/Contract Research Organization and Academic & Research Institutes), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

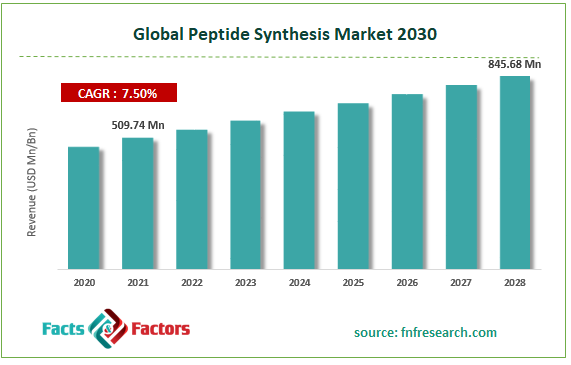

[242+ Pages Report] According to the report published by Facts Factors, the global Peptide Synthesis market size was worth around USD 509.74 million in 2021 and is predicted to grow to around USD 845.68 million by 2028 with a compound annual growth rate (CAGR) of roughly 7.5% between 2022 and 2028. The report analyzes the global Peptide Synthesis market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Global Peptide Synthesis market.

Market Overview

Market Overview

There have been numerous technological advancements to aid in the creation and synthesis of peptides, which have gained significant popularity in the healthcare and nutrition sectors. Both enzymatic and chemical peptide synthesis follow this trend. The market is growing as a result of the use of peptides in the pharmaceutical and consumer healthcare sectors. In addition to other lifestyle issues, peptides have a wide range of applications in the treatment of cancer, diabetes, and obesity. Peptide treatments are being more widely employed in oncology and metabolic illnesses as a result of the increased prevalence of these metabolic and lifestyle diseases. Approximately 463 million people worldwide have diabetes as of 2019, and that number is projected to rise to 700 million by 2045, according to a poll released by the International Diabetes Federation in 2020. Over 90% of diabetes cases globally are of type 2, making it the most prevalent kind of diabetes.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Peptide Synthesis market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2022-2028).

- In terms of revenue, the global Peptide Synthesis market size was valued at around USD 509.74 million in 2021 and is predicted to grow to around USD 845.68 million by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on product segmentation, reagents were predicted to show maximum market share in the year 2021

- Based on technology segmentation, liquid phase peptide was predicted to show maximum market share in the year 2021

- Based on application segmentation, therapeutics was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, pharmaceutical & biotechnology companies were predicted to show maximum market share in the year 2021

- On the basis of region, North America was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

Important pharmaceutical, biotechnology, and peptide synthesis market participants have increased their R&D spending in response to the COVID-19 epidemic. Peptide synthesis has gained attention due to the increased demand for vaccinations and peptide-based medicines. The peptide-based strategy marks a turning point because peptides have proven to have distinctive characteristics of selectivity and specificity toward particular targets. A peptide-based vaccination candidate called CoVac-1 is made up of SARS-CoV-2 T-cell epitopes derived from several viral proteins, along with the Toll-like receptor 1/2 agonist XS15 emulsified in Montanide ISA51 VG, with the goal of inducing strong SARS-CoV-2 T-cell immunity to fend off COVID-19. These developments have increased the need for materials and machinery for the manufacture of peptides.

Growth Drivers

Growth Drivers

- Increasing use of peptides in pharmaceutical drugs to drive market growth

Peptides are extremely potent and targeted pharmacological ingredients. They are used in a wide variety of therapeutic fields because of the diversity of their biological actions. Due to their broad chemical space, high biological activity, high specificity, relative simplicity of synthesis, ready availability, and low toxicity, peptides are increasingly being considered as possible active medicinal components. Peptides bring in billions of dollars in three important therapeutic areas: oncology, diabetes, and obesity. The need for peptides is also rising for the treatment of renal failure, uncommon disorders, and cardiovascular and neurological illnesses. There are already more than 100 peptide-based medications available. This number is expected to grow significantly, with approximately 700 peptide drugs and therapeutic peptides currently in clinical trials in preclinical development

Restraints

Restraints

- Lack of a unified set of regulations for therapeutic peptides to restrict market expansion

Peptide-based medications are within the category of biologics, both small and large molecules. Peptides have created a number of regulatory issues due to their position on the cusp between usual tiny chemicals and large proteins. The majority of these medications are produced chemically. Although diverse peptide medications have a similar production method, they all have quite different action mechanisms. Therefore, it is a difficult challenge to create a uniform set of regulatory rules that can successfully address the safety and quality requirements for such a diverse group of molecular entities with various special modes of action. There are no official regulatory agency guidelines for creating this class of treatments.

Additionally, there is a disagreement on the regulatory approval of peptide-based medicines between the European Medicines Agency (EMA) and the Food and Drug Administration (FDA). The FDA's Center for Drug Evaluation and Research (CDER) is responsible for peptide drug evaluation, however, the European Medicines Agency (EMA) prefers a centralized process to the mutual recognition system (the marketing of peptide-based drugs is allowed throughout the European Union under the centralized procedure). Therapeutic peptides are finding it difficult to obtain permits due to the fragmented nature of the laws, which in turn is limiting their potential uses. This is regarded as one of the main factors hindering the expansion of the global peptide synthesis market.

Opportunity

Opportunity

- Development of personalized medicines to bring market growth opportunities

The idea of individualized therapy with the best response and largest safety margin to assure improved patient care has stoked interest in personalized treatment. Proteomic analysis is an appealing and effective method for identifying the molecular profiles of distinct tissues, whether they are healthy or afflicted. The next significant advancement in customized medicine is personalized proteomics or proteome profiling, which sheds light on disease pathomechanisms. As part of the EU-funded ElectroMed project, researchers suggested creating a user-friendly platform to program electrochemically guided peptide synthesis based on a microfluidic multiplexing system that is managed by software in order to increase the use of proteomics in personalized medicine. Then, label-free sensors based on nanomaterials will be used to identify and quantify the ligand-receptor complexes.

The technology will make it possible to apply proteomics for personalized treatment by enabling the automated injection of the various reagents required for the ligand synthesis for the personalized and controlled synthesis of peptides. Growing investments in personalized medicine can be primarily due to the increased prevalence of diseases like cancer and cardiovascular disease (CVD) and the growing demand for cutting-edge treatments with few adverse effects. Personalized medicine has the potential to raise healthcare quality while also cutting expenses. Players in the peptide synthesis market will have growth opportunities as a result of such advancements in the realm of customized medicine.

Challenges

Challenges

- Issues associated with the route of administration of peptide drugs

Due to inadequate absorption from the gastrointestinal tract, the bulk of therapeutic peptides are supplied parenterally. The use of regular injections during long-term treatment has serious disadvantages, and peptide medicines are typically advised for chronic illnesses. The oral route of medication administration offers benefits including self-administration with a high degree of patient acceptability and compliance in contrast to this difficult and sometimes problematic mode of drug delivery. Pre-systemic enzymatic breakdown and inadequate penetration of the intestinal mucosa are the main causes of the limited oral bioavailability of peptide medicines. Additionally, the molecular weight, lipophilicity, and charged functional groups of these medicines are often high, which hinders absorption. These properties cause the majority of orally given peptides to have low bioavailability and brief half-lives. The problem of absorption is solved by intravenous or subcutaneous delivery of these therapeutics, but other factors, such as systemic proteases, rapid metabolism, opsonization, conformational changes, dissociation of subunit proteins, non-covalent complexation with blood products, and destruction of labile side-groups, limit the bioavailability of peptide and protein therapeutics.

Segmentation Analysis

Segmentation Analysis

The global Peptide Synthesis market is segmented based on product, technology, application, end-use, and region.

Based on product, the market is segmented into reagents, equipment & services. Due to the increasing use of peptides in therapeutics, drug design, and gene synthesis, as well as the frequent purchase of reagents over equipment, the rising number of ongoing research projects involving peptide synthesis, and the availability of various peptide synthesis reagents on the market, the reagents segment is expected to dominate the market share of the global peptide synthesis market during the forecast period.

Based on technology, the market is segmented into solid phase peptide synthesis (SPPS), liquid phase peptide synthesis (LPPS) & hybrid technology. Due to the fact that the cost of peptide synthesis has significantly decreased as a result of technological advancements and the incorporation of automation in liquid phase peptide synthesis, the liquid phase peptide synthesis segment is anticipated to dominate the market share of the global peptide synthesis market during the forecast period. This is expected to increase the use of peptide synthesis globally, which will increase revenue generated globally throughout the projection period. According to standard research, SPPS is a good strategy for developing API processes and GMP manufacturing since it may be used to synthesize long peptide sequences (more than 10 amino acids) at a lower cost.

Based on application, the market is segmented into therapeutics, diagnosis & research. Due to the rise in metabolic disorders, such as infectious diseases, pain, dermatological, CNS, renal, and other conditions, the therapeutics segment is predicted to have the lion's share of the worldwide peptide synthesis market in 2021. Because there are several peptide candidates for type 2 diabetes treatment and a strong pipeline. It is anticipated that recently discovered peptides with important roles in metabolic regulation would help in the creation of effective therapeutic strategies.

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, contract development & manufacturing organizations/contract research organizations and academic & research institutes. Given that peptide treatments are more widely used since they are more affordable, effective, and have lower toxicity, the pharmaceutical & biotechnology firm category is predicted to hold the largest market share during the forecast period. The study of COVID-19 now makes considerable use of these peptides. As part of the FDA's Coronavirus Treatment Acceleration Program, Relief Therapeutics, a Swiss company, is examining the effectiveness of Aviptadil, a patented synthetic version of a human vasoactive intestinal polypeptide (VIP), for COVID-19-related ARDS at New York University Langone (NYU Langone Health) (CTAP). New oral drugs are being developed by numerous pharmaceutical and biotechnology companies, which is expected to increase demand for this market.

Recent Developments:

Recent Developments:

- In August 2021, Bachem Holding AG (Switzerland) and Novo Nordisk (Denmark) collaborated to develop a greener technology for solid-phase peptide synthesis (SPPS), under which two studies were conducted to find solvent alternatives to replace the reprotoxic N, N-dimethylformamide (DMF), dichloromethane (DCM), and N-methyl-2-pyrrolidone (NMP).

- In February 2021, Thermo Fisher Scientific introduced novel capillary chromatography columns for proteomics, clinical peptides, and biopharmaceutical research laboratories performing high throughput, high-performance liquid chromatography (HPLC), or liquid chromatography-mass spectrometry (LC-MS) analysis.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 509.74 Million |

Projected Market Size in 2028 |

USD 845.68 Million |

CAGR Growth Rate |

7.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Bachem Holding AG , Thermo Fisher Scientific , Merck KGaA , GenScript Biotech Corporation , Kaneka Corporation , Biotage AB , Syngene International Ltd. , Mesa Laboratories inc. , CEM Corporation , ProteoGenix , Bio-Synthesis Inc. , Dalton Pharma Services, AAPPTec , Vivitide , AnyGen Co. Ltd. , CSBio , Advanced Chemtech , Luxembourg Bio Technologies Ltd. , JPT Peptide Technologies GmbH , AmbioPharm Inc. , Aurigene Pharmaceutical Services Ltd. , Corden Pharma International , ChemPep Inc. , CPC Scientific Inc. , Purolite Pvt Ltd., and others. |

Key Segment |

By Product, Technology, Application, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead the market growth during the projection period

Due to the rising number of new cancer cases in the region, North America is anticipated to have a dominating position in the global peptide synthesis market. For instance, the American Cancer Association estimates in an article from 2018 that there were around 1,735,350 new cancer cases diagnosed and 609,640 cancer deaths in the United States.

Additionally, the rising accessibility of cutting-edge healthcare infrastructure and significant investments made by the major companies in this region to develop novel peptide synthesis technologies are projected to fuel the market's expansion. For instance, Imcivree (setmelanotide), a pro-opiomelanocortin-derived peptide, was approved by the US Food and Drug Administration (US FDA) in 2020 for chronic weight management (weight loss and weight maintenance for at least one year) in patients aged six and older with obesity brought on by rare genetic conditions. This region's excellent market position in the global market for peptide synthesis is projected to be boosted during the forecast period by the US FDA's drive for expedited drug approval.

Competitive Analysis

Competitive Analysis

- Bachem Holding AG

- Thermo Fisher Scientific

- Merck KGaA

- GenScript Biotech Corporation

- Kaneka Corporation

- Biotage AB

- Syngene International Ltd.

- Mesa Laboratories inc.

- CEM Corporation

- ProteoGenix

- Bio-Synthesis Inc.

- Dalton Pharma Services

- AAPPTec

- Vivitide

- AnyGen Co. Ltd.

- CSBio

- Advanced Chemtech

- Luxembourg Bio Technologies Ltd.

- JPT Peptide Technologies GmbH

- AmbioPharm Inc.

- Aurigene Pharmaceutical Services Ltd.

- Corden Pharma International

- ChemPep Inc.

- CPC Scientific Inc.

- Purolite Pvt Ltd.

The global Peptide Synthesis market is segmented as follows:

By Product

By Product

- Reagents

- Equipment

- Services

By Technology

By Technology

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

By Application

By Application

- Therapeutics

- Diagnosis

- Research

By End User

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organization/Contract Research Organization

- Academic & Research Institutes

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bachem Holding AG

- Thermo Fisher Scientific

- Merck KGaA

- GenScript Biotech Corporation

- Kaneka Corporation

- Biotage AB

- Syngene International Ltd.

- Mesa Laboratories inc.

- CEM Corporation

- ProteoGenix

- Bio-Synthesis Inc.

- Dalton Pharma Services

- AAPPTec

- Vivitide

- AnyGen Co. Ltd.

- CSBio

- Advanced Chemtech

- Luxembourg Bio Technologies Ltd.

- JPT Peptide Technologies GmbH

- AmbioPharm Inc.

- Aurigene Pharmaceutical Services Ltd.

- Corden Pharma International

- ChemPep Inc.

- CPC Scientific Inc.

- Purolite Pvt Ltd.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors