Search Market Research Report

Pharmaceutical Market Size, Share Global Analysis Report, 2022 – 2028

Pharmaceutical Market Size, Share, Growth Analysis Report By API Type (Synthetic API, Biotech API, Monoclonal Antibodies, Cytokines, Vaccines, Blood Factors, Hormones & Growth Factors, Fusion Proteins, and Therapeutic Enzymes), By Drug (Prescription Drugs and OTC Drugs), By Customer Base (Generic Drugs and Branded Drugs), Application (Oncology, Ophthalmology, Cardiovascular Disease, Gastrointestinal Disorders, Diabetes, Endocrinology, Central Nervous System & Neurological Disorders, Nephrology, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

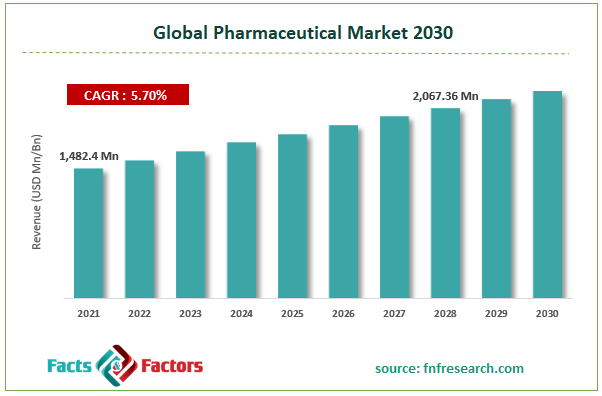

[240+ Pages Report] According to Facts and Factors, the global pharmaceutical market size was worth USD 1,482.4 million in 2021 and is estimated to grow to USD 2,067.36 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.70% over the forecast period. The report analyzes the pharmaceutical market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the pharmaceutical market.

Market Overview

Market Overview

The pharmaceuticals market comprises businesses (organizations, sole proprietorships, and partnerships) that develop drugs used to treat illnesses and sell those drugs and associated services. Pharmaceuticals can refer to any medication used to treat diseases or for medical purposes. Businesses that manufacture medicines and biologics are a part of this sector. Pharmaceutical medications and biologics are the two market segments for pharmaceuticals. Drugs are available from pharmaceutical companies for individualized, personalized therapy of many disorders. Precision medicine, another name for customized treatment, strives to deliver medical care by the patient's unique traits and genetic makeup. Precision therapies are used more frequently as businesses abandon the one-size-fits-all approach to treating common medical ailments. Over the projection period, an increase in chronic diseases, including diabetes and cancer, is anticipated to fuel the expansion of the pharmaceutical sector.

Additionally, a rise in older adults susceptible to severe diseases will spur market expansion throughout the projection period. Reduced demand for prescription medicine, Growing competition from generic pharmaceuticals, Pharmaceutical fraud, etc., are some of the restraints in the pharmaceutical sector. Low returns on investment in the pharmaceuticals sector due to price controls, cost-containing programs, and mandated cost savings will further impede corporate growth over the projection period.

COVID-19 Impact:

COVID-19 Impact:

The Covid disruption has severely hampered the worldwide market, leading to many difficulties in the supply chain of many necessities. However, a rise in the healthcare sector has considerably benefited the pharmaceutical industry. Challenges create opportunities, and this statement is valid for the pharmaceutical sector, which is currently dealing with the COVID-19 pandemic's effects and adapting to new conditions. Teams' efficacy has risen in many businesses due to high-tech implementations and R&D expenditures. With the help of cloud computing, machine learning, artificial intelligence, and other digital investments, life science organizations worldwide seek to improve the manufacturing cycle. Benefits include finding the best pharmaceuticals for particular ailments, conducting drug design trials on a budget, deciding when to start and stop medical treatments, collecting health data more effectively, and many other advantages.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, pharmaceuticals market value to grow at a CAGR of 5.70% over the forecast period.

- In terms of revenue, the pharmaceutical market size was valued at around USD 1482.4 million in 2021 and is projected to reach USD 2067.35 million by 2028.

- The increasing number of older adults, the growing use of personalized medicine, and coupled with rising in chronic disease across the globe are the major factors driving the market's growth.

- By Drug Type Analysis, Drugs dominated the market in 2021

- By Application analysis, medications for metabolic diseases dominated the sector in 2021

- North America dominated the pharmaceutical market in 2021.

Growth Drivers

Growth Drivers

- Technological Advances are helping the market grow.

Challenges create opportunities, and this statement is valid for the pharmaceutical sector, which is currently dealing with the COVID-19 pandemic's effects and adapting to new conditions. Teams' efficacy has risen in many businesses due to high-tech implementations and R&D expenditures. With the help of cloud computing, machine learning, artificial intelligence, and other digital investments, life science organizations worldwide seek to improve the manufacturing cycle. Benefits include finding the best pharmaceuticals for particular ailments, conducting drug design trials on a budget, deciding when to start and stop medical treatments, collecting health data more effectively, and many other advantages.

Restraints

Restraints

- High manufacturing cost of biologics hamper the market growth

The settings under which biological therapies are produced and handled significantly impact their sensitivity and dependability. Quality control is crucial in creating these medications because they tend to congregate during the production and purifying. Variations in the final protein can emerge from even little changes in the synthesis process, which could have disastrous consequences. Biologics are made by biopharmaceutical businesses, which must invest additional time and money. Producing biologics involves expensive research and development costs, and the testing and manufacturing procedures are intricate. A novel biologic drug underwent eight stages of development. Only around one in every 5,000 new drugs that go through this expensive process succeed.

Opportunities

Opportunities

- Development of personalized medicine to enhance opportunities for the market

Drugs are available from pharmaceutical companies for individualized, personalized therapy of many disorders. Precision medicine, another name for customized treatment, strives to deliver medical care by the patient's unique traits and genetic makeup. Precision therapies are used more frequently as businesses abandon the one-size-fits-all approach to treating common medical ailments. Major corporations are investing in creating tailored medications, including GSK, Teva Pharmaceuticals, and AstraZeneca.

Challenges

Challenges

- Increasing consumer demands and challenges in maintaining brand health hinder the market growth

Customers are paying close attention to pharmaceutical firms so brand management may be more crucial than usual for the remainder of the year. At the same time, customers have higher expectations for the pharmaceutical sector, and it is more typical for them to thoroughly analyze the financial value of medicine and compare prices before making a purchase. As supply chains continue hampered by COVID-19, pharmaceutical businesses must manage rising customer expectations and be ready to address brand crises all year.

Segmentation Analysis

Segmentation Analysis

The pharmaceutical market is segregated based on API type analysis, drug type analysis, customer base type analysis, and application analysis.

The market is divided into prescription and OTC drugs based on drug type analysis. The OTC medicines segment is anticipated to increase at the fastest rate. Compared to prescribed medications, the drugs are offered directly to the customer without needing a prescription from the healthcare professional, which is credited with the segment growth.

Based on application analysis, the market is divided into oncology, ophthalmology, cardiovascular disease, gastrointestinal disorders, diabetes, endocrinology, central nervous system & neurological disorders, nephrology, and others. The pharmaceutical pharmaceuticals market's largest category was the market for medications for metabolic diseases. The dermatology drugs segment is anticipated to develop fastest in the pharmaceutical drugs market, which is categorized by medication type.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,482.4 Million |

Projected Market Size in 2028 |

USD 2,067.36 Million |

CAGR Growth Rate |

5.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

AbbVie Inc., Aurobindo Pharma, Boehringer Ingelheim International GmbH, Eli Lilly and Company, Lupin Pharmaceuticals Inc., Abbott Laboratories, Bayer AG, F. Hoffmann-La Roche Ltd., Albemarle Corporation, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Novartis AG, Merck & Co. Inc., Bristol-Myers Squibb Company, Pfizer Inc., Sanofi, AstraZeneca, Baxter, and Others |

Key Segment |

By API Type, Drug, Customer Base, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- According to research, the United States will have severe shortages of healthcare workers during the next ten years.

Regional Landscape

Regional Landscape

In 2021, North America led the market. This is due to many strategic pharmaceutical alliances, particularly among the region's well-established and early-stage businesses. Additionally, the United States held the top spot worldwide for expenditure on prescription drugs per person. Additionally, most clinical trials and drug efficacy studies conducted worldwide were in the United States. Demand for blister packaging, including improved barrier protection and lighter weight packaging, has been driven by the increased demand for tamper-evident packaging.

Due to its sizable consumer base, rising healthcare costs, increasing disease incidence, and the existence of supportive regulatory frameworks, Asia Pacific is anticipated to see the highest growth of any regional market throughout the forecast period. Additionally, to provide sustainable patient care, the area has lately adopted new technology and experienced a digital revolution. Several national-level regulations encourage big data and Artificial Intelligence (AI) application in Asian nations. The State Council of China released rules to promote the growth of big data and AI in healthcare, focusing on its use in that sector. In addition, several western businesses are building new facilities in this area since it is more affordable.

Competitive Landscape

Competitive Landscape

Key players within the global pharmaceutical market include

- AbbVie Inc.

- Aurobindo Pharma

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- Lupin Pharmaceuticals Inc.

- Abbott Laboratories

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- Albemarle Corporation

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Merck & Co. Inc.

- Bristol-Myers Squibb Company

- Pfizer Inc.

- Sanofi

- AstraZeneca

- Baxter

The global pharmaceutical market is segmented as follows:

By API Type Analysis

By API Type Analysis

- Synthetic API

- Biotech API

- Monoclonal Antibodies

- Cytokines

- Vaccines

- Blood Factors

- Hormones & Growth Factors

- Fusion Proteins

- Therapeutic Enzymes

By Drug Type Analysis

By Drug Type Analysis

- Prescription Drugs

- OTC Drugs

By Customer Base Type Analysis

By Customer Base Type Analysis

- Generic Drugs

- Branded Drugs

By Application Analysis

By Application Analysis

- Oncology

- Ophthalmology

- Cardiovascular Disease

- Gastrointestinal Disorders

- Diabetes

- Endocrinology

- Central Nervous System & Neurological Disorders

- Nephrology

- Others

By Regional Analysis

By Regional Analysis

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- AbbVie Inc.

- Aurobindo Pharma

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- Lupin Pharmaceuticals Inc.

- Abbott Laboratories

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- Albemarle Corporation

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Merck & Co. Inc.

- Bristol-Myers Squibb Company

- Pfizer Inc.

- Sanofi

- AstraZeneca

- Baxter

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors