Search Market Research Report

Real Estate Crowdfunding Market Size, Share Global Analysis Report, 2024 – 2032

Real Estate Crowdfunding Market Size, Share, Growth Analysis Report By Property Type (Commercial and Residential), By Investor Type (Institutional and Individual), By Platform (Equity-based Crowdfunding, Debt-based Crowdfunding, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

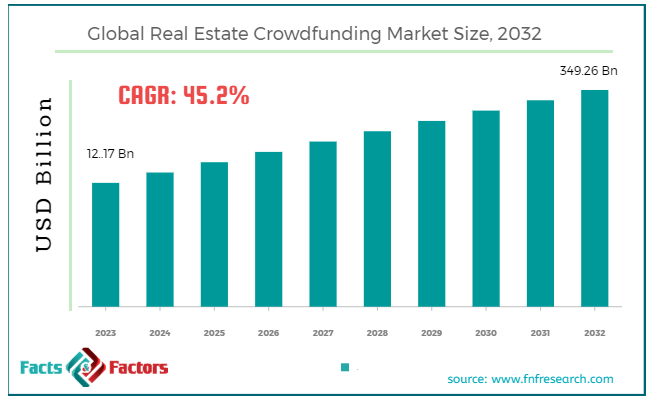

[230+ Pages Report] According to Facts & Factors, the global real estate crowdfunding market size in terms of revenue was valued at around USD 12.17 billion in 2023 and is expected to reach a value of USD 349.26 billion by 2032, growing at a CAGR of roughly 45.2% from 2024 to 2032. The global real estate crowdfunding market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Real estate crowdfunding is a method of raising capital for real estate investments by pooling funds from a large number of investors, typically via online platforms. This innovative approach allows individual investors to participate in real estate ventures with relatively small amounts of capital, democratizing access to real estate markets that were previously the domain of wealthy individuals and institutions. The process generally involves investors choosing specific properties or real estate projects to fund, often with a minimum investment amount as low as a few hundred dollars. Returns are typically generated through rental income, property appreciation, or both, and are distributed to investors proportionally to their investment.

The real estate crowdfunding market has grown significantly in recent years, driven by technological advancements, increased investor interest in real estate, and the need for alternative investment avenues. The market enables developers to access a larger pool of capital and offers investors the opportunity to diversify their portfolios with real estate investments that might have been previously inaccessible.

Key Highlights

Key Highlights

- The real estate crowdfunding market has registered a CAGR of 45.2% during the forecast period.

- In terms of revenue, the global real estate crowdfunding market was estimated at roughly USD 12.17 billion in 2023 and is predicted to attain a value of USD 349.26 billion by 2032.

- The real estate crowdfunding market is poised for substantial growth, driven by technological advancements, increased investor interest, and supportive regulatory changes.

- Based on the property type, the residential segment is growing at a high rate and is projected to dominate the global market due to their accessibility and stable returns, appealing primarily to individual investors.

- In terms of investors type, the institutional segment is projected to swipe the largest market share. Institutional investors contribute large capital inflows and professional management, ensuring the funding of large-scale projects and adding credibility to the market.

- Based on the platform, the equity-based platforms dominate the market due to their potential for high returns and property ownership appeal.

- By region, North America lead in market size and growth rates, driven by technological adoption and regulatory support.

Real Estate Crowdfunding Market: Growth Drivers

Real Estate Crowdfunding Market: Growth Drivers

- Increased Accessibility: Online platforms make real estate investment accessible to a broader audience with lower minimum investment amounts compared to traditional methods.

- Portfolio Diversification: Crowdfunding allows investors to spread their risk by investing in multiple projects across different locations and property types.

- Attractive Returns: The potential for rental income and property appreciation can generate competitive returns for investors.

- Favorable Regulatory Landscape: Many governments are enacting regulations that encourage and support the growth of crowdfunding as an alternative investment option.

Restraints:

Restraints:

- Risk & Regulation: Real estate crowdfunding carries inherent risks like property vacancy, project delays, and potential fraud. Regulatory frameworks for crowdfunding can vary by region, requiring thorough due diligence from investors.

- Limited Liquidity: Real estate investments can be illiquid, meaning investors may not have easy access to their funds for extended periods. This can be a drawback for some investors seeking more flexible investment options.

- Lack of Transparency: Not all platforms offer complete transparency about project details, potential risks, or developer track records. Careful platform selection and investor education are crucial.

Opportunities:

Opportunities:

- Technological Advancements: Blockchain technology and artificial intelligence can enhance due diligence, streamline transactions, and improve overall security within the crowdfunding ecosystem.

- Expansion into New Markets: Crowdfunding platforms can expand into underserved markets or cater to specific investor niches, such as sustainable or impact-focused real estate projects.

- Development of New Investment Products: Innovation in investment structures can cater to different risk tolerances and investment goals, attracting a wider range of investors.

Challenges:

Challenges:

- Competition: As the market grows, competition among crowdfunding platforms intensifies. This can lead to pressure on fees and highlights the need for platforms to differentiate themselves through unique offerings and strong investor support.

- Investor Education: Many potential investors lack awareness of real estate crowdfunding or the intricacies of different investment types. Educational initiatives are essential to build trust and attract new participants.

- Economic Fluctuations: Economic downturns can negatively impact property values and rental income, potentially affecting the returns for investors in real estate crowdfunding projects.

Real Estate Crowdfunding Market: Segmentation Analysis

Real Estate Crowdfunding Market: Segmentation Analysis

The global real estate crowdfunding market is segmented based on property type, investor type, platform, and region.

By Property Type Insights

By Property Type Insights

Based on Property Type, the global real estate crowdfunding market is divided into commercial and residential.

Residential properties are the dominant segment in the real estate crowdfunding market. This category includes single-family homes, multi-family units, condominiums, townhouses, and apartments. The dominance of residential properties is attributed to their wide market appeal, lower investment risks, and predictable returns. Residential real estate is generally more accessible to individual investors, which drives higher participation rates.

The market for residential crowdfunding is particularly attractive because of the consistent demand for housing and the relative stability of rental incomes. The residential segment in the real estate crowdfunding market is projected to grow at a significant rate due to the increasing demand for housing and the rising number of investors seeking diversified investment portfolios.

Commercial properties, including office buildings, retail spaces, industrial properties, and mixed-use developments, represent a substantial portion of the real estate crowdfunding market. These investments tend to require higher capital but can offer higher returns and long-term capital appreciation. Commercial real estate crowdfunding appeals to institutional investors and high-net-worth individuals who can afford the higher minimum investments and are looking for substantial returns. The commercial real estate crowdfunding market is expected to grow at a robust CAGR as more investors recognize the potential for high returns and diversification benefits offered by commercial properties. The growth is also driven by increasing urbanization and the development of new commercial spaces globally

By Investor Type Insights

By Investor Type Insights

On the basis of Investor Type, the global real estate crowdfunding market is bifurcated into institutional and individual.

Institutional investors, including insurance companies, pension funds, and large financial institutions, hold a significant share of the real estate crowdfunding market. These investors bring substantial capital and expertise, which helps in underwriting large projects and ensuring due diligence. Institutional participation not only adds credibility to crowdfunding platforms but also helps in scaling operations and attracting more projects. Institutional investors are expected to hold around 63.7% of the global real estate crowdfunding market by 2032, driven by their increasing investments in crowdfunding platforms and the continuous search for alternative investment opportunities?.

Individual investors, often referred to as retail investors, form the backbone of the real estate crowdfunding market. These investors typically contribute smaller amounts compared to institutional investors but collectively represent a significant portion of the market.

The accessibility and democratization of real estate investments through crowdfunding platforms have attracted a broad base of individual investors. The individual investors segment is expected to continue growing robustly as more people become aware of and comfortable with investing through crowdfunding platforms. The convenience and potential for high returns make real estate crowdfunding an attractive option for retail investors

By Platform Insights

By Platform Insights

Based on Platform, the global real estate crowdfunding market is categorized into equity-based crowdfunding, debt-based crowdfunding, and others.

Equity-based crowdfunding is a prominent segment in the real estate crowdfunding market. In this model, investors purchase shares of a property or a portfolio of properties, becoming partial owners. Returns are typically generated through rental income, property appreciation, or profits from the sale of the property. Equity-based crowdfunding platforms dominate the market due to their potential for high returns and the attractive proposition of property ownership. This segment is expected to continue growing as more investors seek higher returns and diversification??.

Debt-based crowdfunding, also known as peer-to-peer lending, involves investors providing loans to real estate developers in exchange for regular interest payments. The principal is repaid at the end of the loan term. Debt-based crowdfunding is a significant segment in the market, particularly attractive to risk-averse investors. The segment is expected to maintain steady growth as it appeals to investors seeking predictable returns and lower risk.

Recent Developments:

Recent Developments:

- June 2022: Arrived Homes, a U.S.-based real estate investment platform, is rapidly expanding its acquisitions in response to growing demand from retail investors for fractional real estate ownership. The company has recently acquired 59 single-family rental homes across 17 markets, with a total value of USD 23 million.

- June 2022: Foxstone, an online real estate investing platform, has successfully closed its CHF 10 million Series A financing round, marking the largest funding round for the company to date.

- January 2022, Brikkapp unveiled a groundbreaking marketplace, ingeniously uniting over 200 property marketplaces from around the globe into a single, seamless platform. This pioneering tool grants users unparalleled access to an extensive array of real estate investment opportunities worldwide, all in one unified location, revolutionizing how investors explore and engage with global real estate markets.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 12.17 Billion |

Projected Market Size in 2032 |

USD 349.26 Billion |

CAGR Growth Rate |

45.2% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

AHP Servicing LLC, BrickFunding, Crowdestate AS, CrowdStreet Inc., DiversyFund Inc., EstateGuru, Fundrise LLC, Groundbreaker Technologies Inc., Groundfloor Finance Inc., M2CROWD, RealCrowd Inc., ReInvest24, RM Technologies LLC, and Others. |

Key Segment |

By Property Type, By Investors Type, By Platform, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Real Estate Crowdfunding Market: Regional Analysis

Real Estate Crowdfunding Market: Regional Analysis

- North America dominates the global market during the forecast period

North America, particularly the United States, remains the most significant player in the real estate crowdfunding market. This region is expected to maintain its dominance through the forecast period. The well-established legal framework, strong investment culture, and stable economy contribute to this leadership. The U.S. market benefits from a high degree of investor confidence and advanced technological platforms that facilitate real estate investments.

The Asia Pacific region is poised to be the fastest-growing market for real estate crowdfunding. This region is propelled by rapid urbanization, increasing industrialization, and the adoption of digital payment technologies. Countries like China, India, and South Korea are leading this growth due to their large population bases and booming real estate sectors.

Europe offers substantial opportunities in the real estate crowdfunding market, with a diverse range of investment prospects across both established and emerging markets. Western European countries like the UK, Germany, and France have well-established real estate markets, while Eastern European nations are presenting new growth avenues.

Latin America is an emerging market in the real estate crowdfunding space, with growing interest from both local and international investors. Countries such as Brazil and Argentina are seeing increased activity in real estate investments facilitated by crowdfunding platforms.

The Middle East and Africa are still in the nascent stages of adopting real estate crowdfunding. However, there is significant potential due to the region's ongoing urban development and infrastructure projects.

Real Estate Crowdfunding Market: Competitive Landscape

Real Estate Crowdfunding Market: Competitive Landscape

Some of the main competitors dominating the global real estate crowdfunding market include;

- AHP Servicing LLC

- BrickFunding

- Crowdestate AS

- CrowdStreet, Inc.

- DiversyFund, Inc.

- EstateGuru

- Fundrise, LLC

- Groundbreaker Technologies, Inc.

- Groundfloor Finance Inc.

- M2CROWD

- RealCrowd, Inc.

- ReInvest24

- RM Technologies LLC

The global real estate crowdfunding market is segmented as follows:

By Property Type Segment Analysis

By Property Type Segment Analysis

- Commercial

- Hospitals

- Industrial Buildings

- Shopping Centers

- Schools

- Others

- Residential

By Investors Type Segment Analysis

By Investors Type Segment Analysis

- Institutional

- Individual

By Platform Segment Analysis

By Platform Segment Analysis

- Equity-based Crowdfunding

- Debt-based Crowdfunding

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- AHP Servicing LLC

- BrickFunding

- Crowdestate AS

- CrowdStreet, Inc.

- DiversyFund, Inc.

- EstateGuru

- Fundrise, LLC

- Groundbreaker Technologies, Inc.

- Groundfloor Finance Inc.

- M2CROWD

- RealCrowd, Inc.

- ReInvest24

- RM Technologies LLC

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors