Search Market Research Report

Air Compressor Market Size, Share Global Analysis Report, 2023 – 2030

Air Compressor Market Size, Share, Growth Analysis Report By Type (Portable and Stationary), By Product (Reciprocating/Piston, Rotary/Screw and Centrifugal), By Lubrication (Oil-Filled and Oil-Free), By Application (Manufacturing, Semiconductors & Electronics, Food & Beverage, Healthcare/Medical, Home Appliances, Energy, Oil & Gas, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

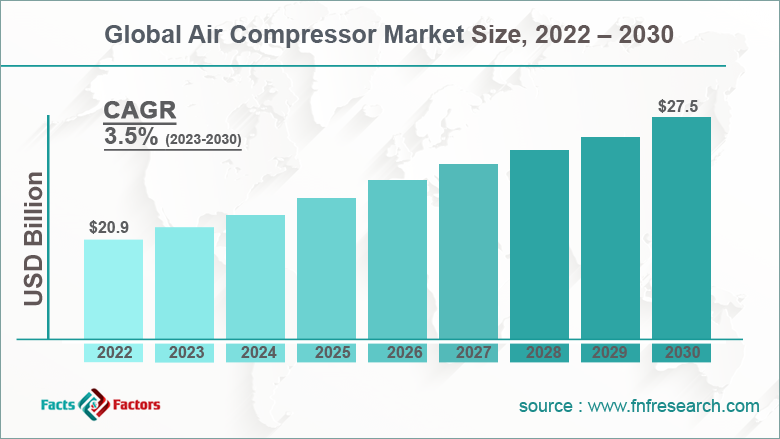

[228+ Pages Report] According to the report published by Facts and Factors, the global air compressor market size was worth around USD 20.9 billion in 2022 and is predicted to grow to around USD 27.5 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.5% between 2023 and 2030. The report analyzes the global air compressor market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the air compressor market.

Market Overview

Market Overview

A compressor is a mechanical device that lowers the volume of a gas to raise pressure. On the other hand, an air compressor is presumed as a gas compressor that is used for a specific purpose, such as providing HP clean air to fill gas cylinders, providing clean air with moderate pressure to drive HVAC control s/y valves, powering pneumatic tools like jackhammers and HPA, as well as in the case of large-scale industrial processes like petroleum coking oxidation, etc. Both pumps and compressors have features that are comparable in that they both work to raise a fluid's pressure level and transport it through a pipe.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global air compressor market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2023-2030).

- In terms of revenue, the global air compressor market size was valued at around USD 20.9 billion in 2022 and is projected to reach USD 27.5 billion, by 2030.

- The growing demand for air compressors from various end-use industries such as manufacturing, automotive, and others is expected to drive the growth of the air compressor industry during the forecast period.

- Based on the type, the stationary segment is expected to hold the largest market share during the forecast period.

- Based on the product, the rotary/screw segment is expected to dominate the market over the forecast period.

- Based on region, the Asia Pacific is expected to hold the largest revenue share during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for air compressors from various end-use industries drives the market growth

Air compressor demand has grown across a variety of sectors. For instance, air compressors are used in the automotive industry for a variety of tasks including tire inflation, automobile finishing, air-operated robots, plasma cutting, and welding. The International Organization of Motor Vehicle Manufacturers (OICA) reports that from 2016 to 2018, India's output of cars and commercial vehicles grew from 4.48 million to 5.17 million units. The need for air compressors has increased as vehicle output has increased.

According to the Central Statistics Office's Energy Statistics, India has a total installed capacity of about 344,002.39 MW across its hydro, thermal, and nuclear power plants. Additionally, during the 2017–2018 period, both electricity production and consumption increased by 5.71% and 7.39%, respectively. The electricity demand is growing profitably as a result of the rising population and rapid urbanization. This increased demand for electricity leads to increased power generation, which in turn increases demand for air compressors—an essential component of a power plant—and propels the air compressor market's expansion.

Restraints

Restraints

- The high cost of installation and maintenance acts as a major restraint

Depending on the use, air compressors can cost anywhere between $100 and $600. The air compressor industry's expansion is hampered by additional hidden costs like those connected with installation and operation. Furthermore, air turbines are very prone to overheating. The heat produced by compressed air must be expelled before it hits the warning temperature because it could harm the system if it does not. Identification of a temperature issue early on is crucial because high temperatures can gradually harm an air turbine. Therefore, the market expansion for air compressors has been hampered by expensive maintenance costs.

Opportunities

Opportunities

-

Growing technological advancement provides a lucrative opportunity

The innovation that goes into newer models of air compressors on the market is the reason for their rising appeal. New kinds of reciprocating and rotary screw air compressors have been developed by Indian makers, making them stronger, simpler to use, and better suited for some of the most demanding tasks in a variety of industrial settings. More industries are utilizing compressed air as an alternative source of energy as a result of technological advancements, and air compressor users are upgrading to newer models of machinery. Air compressors with new and improved technology can replace older equipment, resulting in increased efficiency, easier operation, and total cost savings. These features have encouraged air compressor users to replace their equipment frequently, which has fueled the global air compressor market expansion.

Challenges

Challenges

- Stringent regulation poses a major challenge

New industrial emission standards for air compressors have been introduced in several nations, including the U.S., Canada, the UK, and other European nations, to reduce the discharge of contaminants and improve air quality. Due to the implementation of these new and updated emission standards, manufacturers all over the world must stay current and make significant changes and modifications to the design and functionality of this equipment. Additionally, because compressed air plays a crucial role in increasing productivity and influences overall production costs, it is a serious worry for many industries, including those in the healthcare, food and beverage, chemical, and pharmaceutical industries.

Segmentation Analysis

Segmentation Analysis

The global air compressor industry is segmented based on type, product, lubrication, application, and region.

Based on the type, the global market is bifurcated into portable and stationary. The stationary segment is expected to hold the largest market share during the forecast period. The growth in the segment is attributed to the high adoption of these compressors in the manufacturing sector. These compressors are also frequently used in the oil and gas industry to power pneumatic machinery for the pipeline, oil extraction and refining, and other operations. Besides, the portable segment is growing at the highest CAGR over the forecast period due to the increased use of these goods in mining and construction projects. Portable air compressors are a stable source of power for equipment and tools in a variety of sectors, including construction. Additionally, these compressors are simple to use and require less maintenance, which is why their demand is rising in low-duty uses.

Based on the application, the air compressor industry is bifurcated into manufacturing, semiconductors & electronics, food & beverage, healthcare/medical, home appliances, energy, oil & gas, and others.

Based on the lubrication, the global market is bifurcated into oil-filled and oil-free.

Based on the product, the global air compressor industry is segmented into reciprocating/piston, rotary/screw, and centrifugal. The rotary/screw segment is expected to dominate the market over the forecast period. This is due to the widespread use of rotary air compressors in significant industrial uses, including those for mechanical and electrical machinery, electric power, electronic and electrical equipment, papermaking and printing, metallurgy and mining, and electrical and mechanical power.

On the other hand, the centrifugal segment is expected to grow at the highest CAGR during the forecast period. These compressors have a greater airflow than other compressors, use less energy, and have fewer rubbing parts. They are also extensively used in industries like gas turbines, chemical plants, oil refineries, and petrochemicals. Over the projection period, all of these factors are expected to boost segment development.

Recent Developments:

Recent Developments:

- In June 2021, to assist in the development of hydrogen fuel cell systems, Bosch signed a long-term deal with Daimler Truck AG and Volvo Group AB to provide electric air compressors with integrated power electronics.

- In June 2021, Atlas Copco AB, with its headquarters in Stockholm, Sweden, announced the acquisition of S.T.E.R.I srl (STERI), a major Italian distributor and service company for compressor equipment. Atlas Copco AB is a leading manufacturer of compressors, vacuum solutions, generators, pumps, power tools, and assembly systems. Compressors, filters, and related equipment are mainly supplied to industrial businesses in the Piedmont and Valle d'Aosta regions of Italy by S.T.E.R.I. srl (STERI). Atlas Copco AB will be able to increase its market share in northern Italian industrial regions as a result of this acquisition.

- In February 2022, M.R. Organization, headquartered in Ahmedabad, Gujarat, India, had previously announced plans to buy StandardAir, a provider of air compressor parts with headquarters in the United Kingdom. Both businesses will provide air compressor parts to all significant businesses around the globe. While StandardAir serves all major air compressor brands in Europe and the Middle East, M.R. Organization serves 72 nations. Additionally, this acquisition strengthens the M.R. Organization's position throughout all of Europe, one of the key markets for the company's expansion.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 20.9 Billion |

Projected Market Size in 2030 |

USD 27.5 Billion |

CAGR Growth Rate |

3.5% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Aerzener Maschinenfabrik GmbH, Ciasons Industrial Inc., Doosan Corporation (Doosan Infracore Portable Power), Atlas Copco AB, Berkshire Hathaway Inc. (Campbell Hausfeld), Ebara Corporation, Gardner Denver Holdings Inc., Hitachi Ltd.( Sullair LLC), Stanley Black & Decker Corporation (Porter Cable), Suzler Ltd, Kobe Steel Ltd., Desran Compressor (Shanghai) Co. Ltd., Elgi Equipments Limited, Indo-Air Compressors Pvt. Ltd., NINGBO XINDA GROUP CO. LTD (AUGUST Screw Air Compressor), Kirloskar Pneumatic Company Limited, Ingersoll-Rand plc, VMAC Global Technology Inc, Mitsubishi Heavy Industries Ltd., and others. |

Key Segment |

By Type, Product, Lubrication, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to hold the largest revenue share during the forecast period

The Asia Pacific is expected to hold the largest revenue share in the global air compressor market during the forecast period. Demand in this region is being driven by an increase in construction work and automobile production in nations like China, Japan, and India. Additionally, increasing demand for oil-free air compressors from sectors like chemicals and food & drinks to avoid food contamination has boosted air compressor demand. China accounted for the highest revenue share in this region due to the existence of a sizable manufacturing hub. Industrial air compressors have been used primarily in manufacturing, and this is what is anticipated to fuel growth over the forecast period.

North America is expected to hold a significant market share over the forecast period. One of the key factors propelling market development in this region is rising consumer awareness of the numerous advantages of using air compressors for industrial operations. Additionally, the growth of industrial air compressors in this region has been fueled by expanding infrastructure development projects and increasing Internet of Things (IoT) penetration.

Due to the increasing demand for centrifugal air compressors from various end-use sectors, the U.S. held the largest revenue share in this regional market. Because this equipment uses cutting-edge technologies and demands exceptional expertise for its operation, the U.S. also has a broad availability of technically skilled professionals who can manage it effectively.

Competitive Analysis

Competitive Analysis

- Aerzener Maschinenfabrik GmbH

- Ciasons Industrial Inc.

- Doosan Corporation (Doosan Infracore Portable Power)

- Atlas Copco AB

- Berkshire Hathaway Inc. (Campbell Hausfeld)

- Ebara Corporation

- Gardner Denver Holdings Inc.

- Hitachi Ltd.( Sullair LLC)

- Stanley Black & Decker Corporation (Porter Cable)

- Suzler Ltd

- Kobe Steel Ltd.

- Desran Compressor (Shanghai) Co. Ltd.

- Elgi Equipments Limited

- Indo-Air Compressors Pvt. Ltd.

- NINGBO XINDA GROUP CO. LTD (AUGUST Screw Air Compressor)

- Kirloskar Pneumatic Company Limited

- Ingersoll-Rand plc

- VMAC Global Technology Inc

- Mitsubishi Heavy Industries Ltd.

The global air compressor market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Portable

- Stationary

By Product Segment Analysis

By Product Segment Analysis

- Reciprocating/Piston

- Rotary/Screw

- Centrifugal

By Lubrication Segment Analysis

By Lubrication Segment Analysis

- Oil-Filled

- Oil-Free

By Application Segment Analysis

By Application Segment Analysis

- Manufacturing

- Semiconductors & Electronics

- Food & Beverage

- Healthcare/Medical

- Home Appliances

- Energy

- Oil & Gas

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Aerzener Maschinenfabrik GmbH

- Ciasons Industrial Inc.

- Doosan Corporation (Doosan Infracore Portable Power)

- Atlas Copco AB

- Berkshire Hathaway Inc. (Campbell Hausfeld)

- Ebara Corporation

- Gardner Denver Holdings Inc.

- Hitachi Ltd.( Sullair LLC)

- Stanley Black & Decker Corporation (Porter Cable)

- Suzler Ltd

- Kobe Steel Ltd.

- Desran Compressor (Shanghai) Co. Ltd.

- Elgi Equipments Limited

- Indo-Air Compressors Pvt. Ltd.

- NINGBO XINDA GROUP CO. LTD (AUGUST Screw Air Compressor)

- Kirloskar Pneumatic Company Limited

- Ingersoll-Rand plc

- VMAC Global Technology Inc

- Mitsubishi Heavy Industries Ltd.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors