Search Market Research Report

AMOLED Display Market Size, Share Global Analysis Report, 2022 – 2028

AMOLED Display Market Size, Share, Growth Analysis Report By Material (Glass, Polymer), By Product Type, Transparent, Flexible, 3D, Conventional, By Application (Automotive, Retail, Consumer Electronics, Military), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

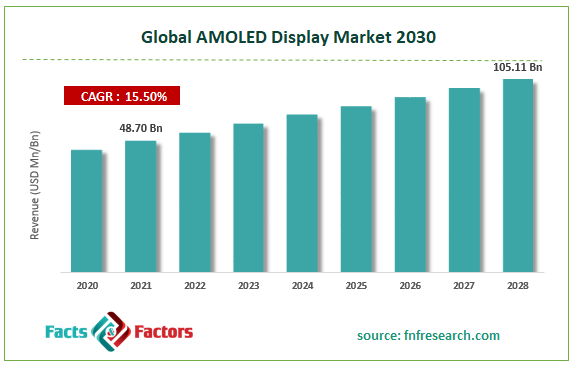

[220+ Pages Report] According to Facts and Factors, the global AMOLED display market size was valued at USD 48.70 billion in 2021 and is predicted to increase at a CAGR of 15.50% to USD 105.11 billion by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global AMOLED display market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the AMOLED display market.

Market Overview

Market Overview

AMOLED is a form of organic light-emitting diode (OLED) display technology that is utilized in tablets, smartwatches, gaming consoles, digital cameras, portable music players, and music production tools. It employs a thin-film transistor (TFT) with a storage capacitor to retain the line pixel states. AMOLED screens are substantially faster than passive matrix organic light-emitting diode (PMOLED) rivals and may be simply incorporated into any size display. Aside from that, they use less electricity, have a more vivid picture quality and a wider viewing angle, and provide faster motion response than other display technologies.

Growth Drivers

Growth Drivers

Rapid urbanization, rising income levels, and increased demand for entertainment and leisure are all positively influencing consumer electronics sales around the world. This is one of the most important elements boosting the growth of the AMOLED display industry. Due to inflation in many regions, for instance, Sudan, Syria, Zimbabwe, etc., the manufacturing operational costs are expected to increase. However, AMOLED displays have a number of advantages over other display technologies, including improved image quality and a high-resolution display, both of which are driving the market growth.

Since they use less energy and are more cost-effective than other displays, flexible AMOLED displays are frequently utilized in the production of mobile phones, monitors and wearable devices. Due to inflation in many regions, for instance, Sudan, Syria, India, etc., the manufacturing operational costs are expected to increase.

COVID-19 Impact

COVID-19 Impact

The onset of the coronavirus pandemic in 2020 has a substantial impact on AMOLED display adoption. Due to online education and work-from-home trends, the global industry has seen a significant increase in laptop and smartphone sales. However, due to movement restrictions and lockdowns, a reduction in the workforce and a halt in production during the first half of 2020 had a negative impact on the consumer electronics sector. Steps tried to stop the virus from spreading have aggravated the problem and harmed the growth of a number of industries. The market has been harmed by the rapid loss of operational efficiencies and value chain disruptions caused by the unanticipated closure of national and international borders.

Nevertheless, Post-COVID-19 the growing acceptance of the work-from-home norm, as well as the increasing attention of regional financial institutions on designing fiscal strategies to keep the display market afloat during the COVID-19 crisis, are driving the expansion of the display panel market. Other factors influencing market expansion include increased investments in the building of new AMOLED and LCD panel manufacturing facilities.

The complete research study looks at both the qualitative and quantitative aspects of the AMOLED Display market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global AMOLED Display market is segregated based on material, product type, application, and region.

In the forecast years, application segments are projected to be market leaders. The subject is undergoing continual research and development, which could result in new developments in a short period of time. The introduction of smartphones into the market and their widespread use, as well as other aspects such as the growing use of Wi-Fi, internet multimedia, tablets, and similar devices, are all major forces used by consumer electronics, automotive, military, and retail industries boosting AMOLED Display market.

The product type sector is divided into four categories: conventional, transparent, flexible, and 3D. Due to the sheer conventional display technology utilized in these screens, conventional displays had a large proportion in 2021. Furthermore, in the coming years, flexible and 3D type displays are predicted to be the fastest increasing sub-segments. This is mostly due to the rising use of these displays in consumer electronic applications such as smartphones, tablets, televisions, and other similar devices. Over the projected period, advancements in 3D display technology are expected to boost the category's growth.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 48.70 Billion |

Projected Market Size in 2028 |

USD 105.11 Billion |

CAGR Growth Rate |

15.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

LG Electronics Inc., Sharp Corporation, Panasonic Corporation, AU Optronics Corp., Chimei Innolux Corp., Sony Corporation, Japan Display Inc., SAMSUNG ELECTRONICS CO., LTD., Universal Display Corporation, Dresden Microdisplay, and Others |

Key Segment |

By Material, Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

In 2021, due to the presence of developed infrastructure in nations such as Japan, China, and South Korea, Asia-Pacific holds the largest share of the worldwide AMOLED display market. For instance, In-cell touch panels were developed by Samsung Group, a South Korean multinational business centered in the Asia Pacific. Furthermore, the North American AMOLED Display Market is likely to provide considerable revenue shares owing to the increased demand for cutting-edge technology. Similarly, to its demand for non-OLED display solutions, Europe is expected to be a significant contributor.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global AMOLED display market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global AMOLED Display Market:

- LG Electronics Inc.

- Sharp Corporation

- Panasonic Corporation

- AU Optronics Corp.

- Chimei Innolux Corp.

- Sony Corporation

- Japan Display Inc.

- SAMSUNG ELECTRONICS CO., LTD.

- Universal Display Corporation

- Dresden Microdisplay

The global AMOLED display market is segmented as follows:

By Material Segment Analysis

By Material Segment Analysis

- Glass

- Polymer

By Product Type Segment Analysis

By Product Type Segment Analysis

- Transparent

- Flexible

- 3D

- Conventional

By Application Segment Analysis

By Application Segment Analysis

- Automotive

- Retail

- Consumer Electronics

- Military

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- LG

- Electronics Inc.

- Sharp Corporation

- Panasonic Corporation

- AU Optronics Corp.

- Chimei Innolux Corp.

- Sony Corporation

- Japan Display Inc.

- SAMSUNG ELECTRONICS CO. LTD.

- Universal Display Corporation

- Dresden Microdisplay

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors