Search Market Research Report

ATM Market Size, Share Global Analysis Report, 2021 – 2026

ATM Market By Solution (Deployment & Managed Services), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

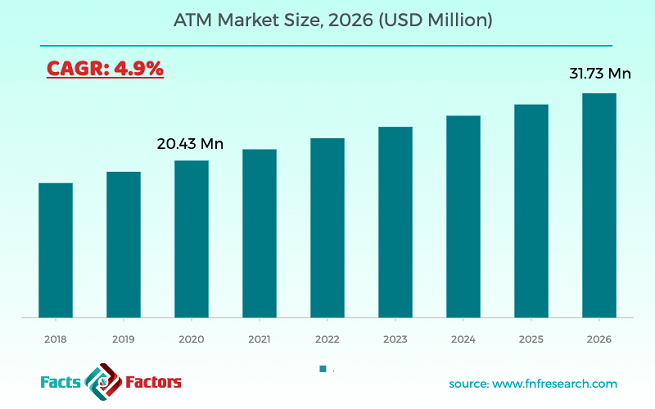

[210+ Pages Report] The latest finding surrounding the “Global ATM Market” published by Facts & Factors offers a neatly packaged and comprehensive read. According to the organization, the global ATM market will reach a projected value of USD 31.73 Billion by 2026 with a growth rate of 4.9% CAGR from an initial value of USD 20.43 Billion in the year 2020.

Automated teller machine or ATM or cash machines are an electronic equipment that allow consumers for enabling financial institutions in the form of cash, withdrawals, deposits, funds transfers, balance inquiries, or account information inquiries. These functions are often performed without the help of an employee from the bank and are often extremely intuitive to perform by the layman. The current generation of ATMs has the ability to instill cash in any given forms of denomination.

The global ATM market is occupied by contributing factors such as increased reliance in terms of fund transfers, withdrawal, deposits and 24x7 availability coupled with rising advancements in technology in terms of safety and security measures to name a few. Additionally, rapid operations and integration of biometric and one-time password authentications systems will increase the footprint of the global ATM market during the advent of the forecast period. Moreover, the rising demands for automation in the banking sector coupled with increasing demands from the urban and rural areas will fuel the growth of the global ATM market during the advent of the forecast period.

Key Insights from Primary Research

Key Insights from Primary Research

- The global ATM market is expected to grow at a rate of about 8% per year, according to our primary interviews.

- It was established through primary research that the ATM market was valued at around USD 20.43 Billion in 2020

- North America is presently holding the largest revenue share among all the regions and is further expected to maintain its position throughout the forecast period.

- The “conventional bank/ATMs” category, on the basis of type segmentation, was the leading revenue-generating category accounting for around 45% share, in 2019

- On the basis of application, the “Banking” industry segment held the leading market share of around 80% as retail banking is nascent in the industry.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the global ATM market is expected to grow significantly over the forecast period owing to its rise in the integration of more features in its traditional machines.

- The strategic and competitive advantage provided by the Banking industry due to technological advancements adoptions is anticipated to be the key factor driving this market globally.

- Our team of analysts has identified, Smart ATM type will create potential opportunities for the players operating in this market in the future ahead.

- In recent years, North America holds the largest market share owing to its easy availability of technology providers.

- Our analysts have identified that the Asia Pacific region has the potential to grow over the forecast period.

Market Demand Volume Share– By Type

Market Demand Volume Share– By Type

The global ATM market will be driven by an easy flow of cash, rising number of transactional benefits, easy and rapid withdrawal measures, and rapid and prompt services to name a few. Factors pertaining to rising number of offline ATMs coupled with growing urbanization solutions will boost the growth of the global ATM market during the advent of the forecast period. However, the ongoing pandemic imposing increased sanitation requirements coupled with stringent restrictions on movements will decrease the market share of the global ATM market to some extent.

On the basis of solution, the global ATM market is divided into deployment and managed services. The deployment category is further classified into onsite ATM, offline ATM, worksite ATM, and mobile ATM. The segment pertaining to deployment is expected to witness the largest market share during the advent of the forecast period owing to the latter segment pertaining to functions such as installing, testing, setting up, and implementing an ATM to name a few.

Furthermore, the online ATMs segment among its counterpart will witness the largest market share during the advent of the forecast period owing to reducing pressure from employees due to the latter being installed directly on the premises coupled with reducing errors while withdrawals and deposit measures to name a few. Mobile ATMs will witness the fastest growing CAGR among the latter owing to reducing traffic in terms of volume from trade fairs, social gatherings, and sports events coupled with flexibility and enhanced branding and promotions offered by banking institutions to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 20.43 Billion |

Projected Market Size in 2026 |

USD 31.73 Billion |

CAGR Growth Rate |

4.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Diebold Nixdorf, Fujitsu Limited, G4S plc., GRGBanking, Hitachi-Omron Terminal Solutions Corp, NCR Corporation, OKI Electric Industry Co. Ltd, and Others |

Key Segments |

By Solution, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to rising deployment of ATMs in emerging economies such as China and India coupled with lack of awareness in terms of digital payments measures to name a few. Additionally, the region is home to the largest consumer pool associated with the banking sector and increasing penetration of international players will increase the footprint of the ATM market during the forecast period.

The region of Europe will occupy a substantial market share during the advent of the forecast period owing to major technological advancements in the banking sector coupled with a cash positive economy to name a few.

Some of the leading players in the global market include

Some of the leading players in the global market include

- Diebold Nixdorf

- Fujitsu Limited

- G4S plc.

- GRGBanking

- Hitachi-Omron Terminal Solutions Corp

- NCR Corporation

- OKI Electric Industry Co. Ltd.

- Guangzhou KingTeller Technology Co. Ltd

- Source Technologies

- Triton Systems of Delaware LLC

- Nautilus Hyosung Corp

- HESS Cash Systems GmbH

- Intertech Bilgi

By Solution Segment Analysis

By Solution Segment Analysis

- Deployment

- Onsite ATM

- Offline ATM

- Worksite ATM

- Mobile ATM

- Managed Services

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Diebold Nixdorf

- Fujitsu Limited

- G4S plc.

- GRGBanking

- Hitachi-Omron Terminal Solutions Corp

- NCR Corporation

- OKI Electric Industry Co. Ltd.

- Guangzhou KingTeller Technology Co. Ltd

- Source Technologies

- Triton Systems of Delaware LLC

- Nautilus Hyosung Corp

- HESS Cash Systems GmbH

- Intertech Bilgi

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors