Search Market Research Report

Automotive Ceramics Market Size, Share Global Analysis Report, 2024 – 2032

Automotive Ceramics Market Size, Share, Growth Analysis Report By End-Users (Heavy Commercial Vehicles, Light Commercial Vehicles, Passenger Vehicles, And Others), By Applications (Fluid Seals, Lighting Systems, Sensors, Spark Plug Insulators, Electronic Components, Glow Plugs, Vehicle Exhaust Systems, Valve Systems, Valve Sensors, And Others), By Materials (Zirconia Oxide, Alumina Oxide, Titanate Oxide, And Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

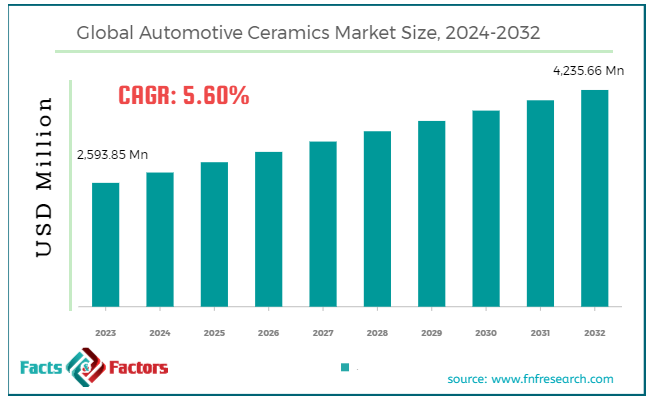

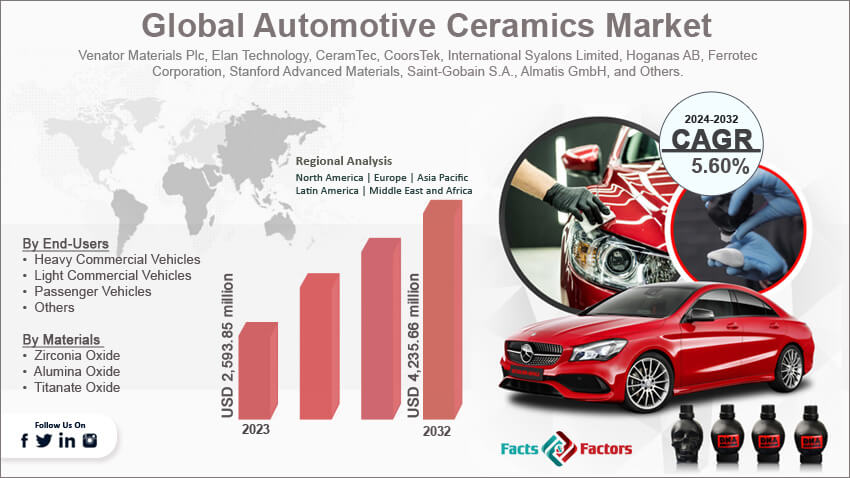

[212+ Pages Report] The global automotive ceramics market size was valued at USD 2,593.85 million in 2023 and is predicted to surpass USD 4,235.66 million by the end of 2032. The automotive ceramics industry is expected to grow by a CAGR of 5.60% between 2024 and 2032.

Market Overview

Market Overview

Automotive ceramics are advanced ceramic materials used to improve the efficiency and performance of vehicles. These materials are known for their exceptional properties. These materials can withstand extreme temperatures without degrading and are, therefore, helpful in automobile components that are exposed to high heat.

Also, these are lightweight and water resistant, and therefore, they are ideal for components that are exposed to mechanical friction and stress. Some of the major kinds of automotive ceramics used in the market include silicon carbide, alumina-zirconia, and many others.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global automotive ceramics market size is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2024-2032).

- In terms of revenue, the global automotive ceramics market size was valued at around USD 2,593.85 million in 2023 and is projected to reach USD 4,235.66 million by 2032.

- Growth in hybrid and electric vehicles is driving the growth of the global automotive ceramics market.

- Based on the end-users, the passenger vehicles segment is growing at a high rate and is projected to dominate the global market.

- Based on the applications, the automotive segment is projected to swipe the largest market share.

- Based on materials, the alumina oxide segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growth in hybrid and electric vehicles is driving the growth of the global market.

Ceramics offer great advantages to electric powertrains, battery systems, and charging infrastructure, thereby making them crucial components in the automotive sector. These offer lightweight properties and high thermal conductivity.

Moreover, these components help in improving the performance and efficiency of power electronics and inverters for EVS. Ceramic brakes and disks offer excellent braking performance and longer lifespan compared to traditional materials, thereby helping manufacturers align with the requirement of reliability and safety in high-performance vehicles. Ceramic sensors offer comfort and convenience features like advanced driver-assistance systems and adaptive cruise control in vehicles, which in turn is also expected to foster growth in the global automotive ceramics market.

However, the rising vehicle production in emerging markets like Asia Pacific is also anticipated to support the growth of the market. Expansion of automotive manufacturing facilities all across the globe is also likely to accentuate the demand for ceramics in the market. For instance, Advanced Nanotech Lab unveiled its private label manufacture of 9H and 10H ceramic coatings for all the hybrid variants of the automotive sector in Asia Pacific, thereby contributing to its portfolio in the automotive sector.

Restraints

Restraints

- Complex manufacturing processes are likely to affect the growth of the global market.

The production of high-performance ceramic components fosters the need for specialized equipment which is a big challenge in the automotive ceramics industry. Moreover, quality control measures are important because of the complex nature of ceramics. Therefore, these are further adding to the overall cost and complexity which is expected to slow down the growth of the industry.

Opportunities

Opportunities

- Technological advancements are likely to foster growth opportunities in the global market.

Continuous research and development activities in material science are one of the major factors driving the growth of the global automotive ceramics market. Advanced technologies like additive manufacturing facilitate the production of complex ceramic components with more precision.

Also, the integration of automotive ceramics and new applications beyond traditional usage is driving the growth of the industry. Strict emission regulations are also another important factor boosting the adoption of ceramic materials. Automakers are prompted to increase the use of ceramics in order to withstand high temperatures and harsh chemical environments and align with strict emission norms. All these factors are likely to support the growth trajectory of the industry in the coming years.

For instance, ANT LAB came up with a diverse range of new automotive ceramic coating products namely, MATTE, PPF, 10H, and other kinds of ceramic coatings. These are the benchmark of ultra-luxury ceramic coatings.

Challenges

Challenges

- Competition from alternative materials is a big challenge in the global market.

Metal and metal alloys are known for their good performance at lower cost. Similar competition from more metal substitutes is a big challenge in the automotive ceramics industry. Also, some manufacturers are adopting high-performance metal alloys because of its cost-effectiveness and lightweight properties in the automotive components, thereby replacing automotive ceramics.

Segmentation Analysis

Segmentation Analysis

The global automotive ceramics market can be segmented into end-users, applications, materials, and regions.

On the basis of end-users, the market can be segmented into heavy commercial vehicles, light commercial vehicles, passenger vehicles, and others. The passenger vehicles segment accounts for the largest share of the automotive ceramics industry. Passenger vehicles have the largest sales in the market, and therefore, to cater to this high volume, there is a greater demand for ceramic components used in these vehicles. This segment includes a broad range of vehicles, from luxury sedans to compact cars, which utilize ceramics for many applications.

However, the growing consumer demand for vehicles with better safety, reliability, and performance metrics is also driving the growth in the segment. Additionally, the rise of hybrid and electric vehicles is significantly boosting the demand for durable and efficient materials, particularly for applications in power electronics and batteries. Therefore, all these factors are likely to contribute to the growth of the segment.

On the basis of applications, the market can be segmented into fluid seals, lighting systems, sensors, spark plug insulators, electronic components, glow plugs, vehicle exhaust systems, valve systems, valve sensors, and others. The automotive segment is likely to dominate the global automotive ceramics market. Automotive ceramics have wide applications in the automotive sector. These are used in manufacturing valves, pistons, and other engine parts because of their high durability and thermal resistance. Ceramic brake pads and discs also require automotive ceramics to provide superior performance and longevity. These are also used in actuator sensors and electronic control units, which are important in modern vehicle functionalities.

The growing market for hybrid and electric vehicles is further fostering developments in the segment. Ceramics are important in power electronics, battery components, and charging systems because of their excellent electrical and thermal properties. Also, the demand for high-performance and fuel-efficient vehicles from the consumer end is further propelling the growth of the segment in the coming years.

On the basis of materials, the market can be segmented into zirconia oxide, alumina oxide, titanate oxide, and others. The alumina oxide segment is expected to take the largest share of the automotive ceramics industry during the forecast period. Alumina oxide is a widely used ceramic material in the automotive sector because of its efficient electrical insulation, thermal conductivity, and high hardness.

Such properties make it an ideal material for diverse automotive applications. Alumina oxide is water-resistant and, therefore, ideal for components that work under mechanical friction and stress, like engine parts or brake pads. However, its high stability further facilitates excellent performance under extreme temperatures.

Moreover, it is further used in manufacturing pistons, cylinders, and other engine parts that need components that are resistant to heat and wear. It is also used in exhaust systems like particulate filters and catalytic converters to withstand high chemical reactions and exhaust temperatures. Alumina oxide is quite cost-effective when compared to other ceramics like zirconia or silicon carbides.

Therefore, it is used in the automotive sector. The ongoing developments in the production and processing of alumina oxide are meant to boost its performance by expanding its application scope in the automotive sector. Moreover, the advancements in manufacturing techniques like creative manufacturing further make it easy and cost-effective to produce complex alumina oxide.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 2,593.85 Million |

Projected Market Size in 2032 |

USD 4,235.66 Million |

CAGR Growth Rate |

5.60% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Venator Materials Plc, Elan Technology, CeramTec, CoorsTek, International Syalons Limited, Hoganas AB, Ferrotec Corporation, Stanford Advanced Materials, Saint-Gobain S.A., Almatis GmbH, and Others. |

Key Segment |

By End-Users, By Applications, By Materials, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America will account for the largest share of the global automotive ceramics market during the forecast period. Restricting emission regulations in the region is the primary factor for the high growth rate of the regional market. Ceramics are important in catalytic converters. These help in lowering harmful emissions, thereby aligning with the emission regulations in the region.

Moreover, the technological advancements in ceramic materials like alumina and silicon carbides are further expected to expand the scope of applications in the regional market. Improvements in manufacturing techniques like advanced ceramic processing and 3-D printing are making the process feasible and also offering high-performance ceramic parts. The growing adoption of electric and hybrid vehicles in North America is propelling the demand for ceramics, particularly in thermal management systems, power electronics, and battery components. Ceramics play a crucial role in improving the performance of electric vehicles, which further drives the growth of the regional market. However, consumers in the region are demanding performance and safety, which further pose a huge requirement for ceramic components in order to achieve these goals.

The US is the largest market in North America because of the strong growth in the automotive sector in the region. Investments in the US market are increasing the rate of its adoption. The government is incentivizing the demand for electric vehicles, which is further boosting the adoption of automotive ceramics in the regional market. Canada is also witnessing significant growth in the coming years because of the increasing investment and R&D activities in automotive manufacturing.

Asia Pacific is another major region likely to see significant developments in the coming years. China is the largest market because of the extensive production and sales of vehicles. Furthermore, regional government policies encourage people to adopt electric vehicles, which, in turn, is expected to expand the scope of the industry. Japan is also leading the regional market because of the country's ongoing technological advancements. Restricting emission regulations in high demand for advanced and high-performance vehicles is another major factor propelling the country's growth. India is also likely to contribute significantly towards the growth of the national market because of its economic growth and rising disposable income.

The country is witnessing a growing number of production and sales in the automotive sector, which is further expected to accentuate the growth of the market manifolds in the coming years. For instance, JSG Subsidiary successfully acquired the ceramics business of SDMC in 2022. Its intent is to boost the product portfolio in semiconductor, automotive, and other sectors.

Competitive Analysis

Competitive Analysis

The key players in the global automotive ceramics market include:

- Venator Materials Plc

- Elan Technology

- CeramTec

- CoorsTek

- International Syalons Limited

- Hoganas AB

- Ferrotec Corporation

- Stanford Advanced Materials

- Saint-Gobain S.A.

- Almatis GmbH

For instance, Zircoted came up with Primary Gunmetal Grey in 2023. It is all-new heat management ceramic coating finish designed to be an all-rounder. It can lower the surface temperature of exhaust systems.

The global automotive ceramics market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Fluid Seals

- Lighting Systems

- Sensors

- Spark Plug Insulators

- Electronic Components

- Glow Plugs

- Vehicle Exhaust Systems

- Valve Systems

- Valve Sensors

- Others

By Materials Segment Analysis

By Materials Segment Analysis

- Zirconia Oxide

- Alumina Oxide

- Titanate Oxide

Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Venator Materials Plc

- Elan Technology

- CeramTec

- CoorsTek

- International Syalons Limited

- Hoganas AB

- Ferrotec Corporation

- Stanford Advanced Materials

- Saint-Gobain S.A.

- Almatis GmbH

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors