Search Market Research Report

Automotive Wrap Films Market Size, Share Global Analysis Report, 2021 – 2026

Automotive Wrap Films Market: By Film Type (Window Films, Wrap Films, & Pain Protection Films), By Vehicle Type (Passenger Cars, Commercial Vehicles, & Heavy Commercial Vehicles), And By Regions ¬ Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

The latest finding surrounding the “Global Automotive Wrap Films Market” published by Facts & Factors offers a neatly packaged and comprehensive read. In this study, the market is estimated to reach a projected value of USD 10.9 Billion by 2026 growing at a CAGR of 19.5% from an initial value of USD 4.2 Billion in the year 2020.

Market Overview

Market Overview

An automotive wrap film is a form of vinyl film that is used for covering certain parts of a vehicular painted portion that would make the area look more attractive and shiny. These films are often used for additional benefits such as protecting the appearance of vehicles from dust and safeguarding the actually painted parts from dust and corrosion. Studies have often quoted the the usage of single-coated automotive wrap films for increasing their shelf life by a few years.

Key Insights from Primary Research

Key Insights from Primary Research

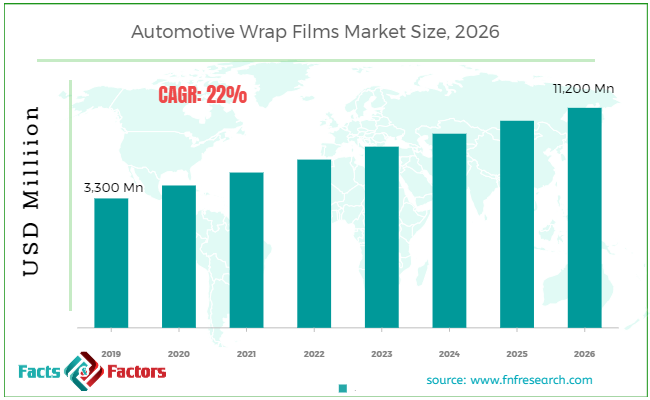

- According to the primary respondents, the global automotive wrap films market is set to grow annually at a rate of around 22%

- The market was valued at around USD 3,300 million, in 2019 and is projected to reach around USD 11,200 million, in 2026.

- In 2019, the “vinyl resin” category dominated the type segmentation of the market and is projected to grow at the fastest rate in the upcoming years as well.

- Based on the application segmentation, the “light-duty vehicles” category held the largest market share, in 2019.

- North America accounted for the largest market share of the global automotive wrap films market, in 2019.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the global automotive wrap films market is estimated to grow significantly in the upcoming years. The growing adoption of wrap films by light-duty vehicle manufacturers is boosting the growth of the market.

- The surge in the application of automotive wrap films by racing car manufacturers is expected to offer lucrative growth opportunities in the forecast period.

- The Asia Pacific is the potential region for the global automotive wrap films market. The surging popularity of colored vehicles is increasing the consumption of automotive wrap films.

- The global automotive wrap film market is growing at a growth rate of nearly 22%, which is offering several opportunities for resin suppliers and distributors.

- Our analysts have identified the “light duty vehicles” category is the major consumers of the automotive wrap films, globally.

Industry Growth Factors

Industry Growth Factors

The global automotive wrap films market is expected to be driven by a rising industry dedicated to the graphic sector coupled with increasing demand for mobile advertising measures to name a few. Additionally, the increasing modernization of consumer lifestyle coupled with rising demand for personalization of automobiles in terms of luxurious add-ons will increase the footprint of the global automotive wrap films market during the advent of the forecast period. Moreover, rising living standards among consumers, increasing disposable income, and rising per capita income on a global purview will boost the growth of the global automotive wrap films market during the advent of the forecast period.

The global automotive wrap films market is expected to hold a higher market share during the advent of the forecast period due to a cost-effective measure for customization solutions coupled with increasing acceptance of solid film colors such as matte black, orange, and pink to name a few. Rising demand for long-term protection of automobiles coupled with increasing demand for automotive wrap films from heavy-duty, light-duty, and medium-duty vehicles will fuel the growth of the global automotive wrap films market during the advent of the forecast period. However, technical difficulties associated with the installation of these films and a higher cost of implementation are expected to hamper the growth of the global automotive wrap films market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global automotive wrap films market is segmented into film type, vehicle type, and region.

On the basis of vehicle type, the global automotive wrap films market is divided into window films, wrap films, and paint protection films. The segment pertaining to window films is expected to witness the largest market share during the advent of the forecast period owing to increasing demand for modernization coupled with a rapid shift in consumer lifestyles to name a few. Additionally, factors pertaining to heavy demand for automobile customization and increasing disposable income will cement the dominant market share during the advent of the forecast period. On the basis of vehicle type, the global automotive wrap films market is classified into passenger cars, commercial vehicles, and heavy commercial vehicles.

The light-duty vehicles segment is expected to witness the largest market share during the advent of the forecast period owing to rising demand for colorful graphics for SUVs, personal vans, and automobiles coupled with rising opportunities for advertisement firms in the form of blank canvases associated with automobiles to name a few. The segment pertaining to heavy commercial vehicles is expected to occupy a substantial market share during the advent of the forecast period owing to increasing demand for advertising and marketing purposes coupled with rising awareness among consumers regarding personalized branding measures to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 3,300 Million |

Projected Market Size in 2026 |

USD 11,200 Million |

CAGR Growth Rate |

22% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Avery Dennison Corporation, Arlon Graphics LLC, 3M Company, Ritrama S.p.A., Hexis S.A., JMR Graphics, Inc., Vvivid Vinyl, Kay Premium Marking Film Ltd, Eastman Chemical Company, and Ads Window Films Limited, among others. |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast period owing to early adoption and modernization of the latter technology coupled with a higher adoption rate of personalization of cars to name a few. Additionally, rising safety awareness among consumers coupled with rising emphasis on regional regulatory body-related services will increase the footprint of the automotive wrap films market during the advent of the forecast period.

Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast period owing to the increasing popularity of paint protection films in the region coupled with low-cost maintenance measures to name a few. Moreover, the improved resale value of vehicles upon carefully implementing automotive wrap films coupled with changing consumer lifestyles will boost the growth of the automotive wrap films market during the advent of the forecast duration.

The key market participants in the global automotive wrap films market

The key market participants in the global automotive wrap films market

- Avery Dennison Corporation

- Arlon Graphics LLC

- 3M Company

- Ritrama S.p.A.

- Hexis S.A.

- JMR Graphics Inc.

- Vvivid Vinyl

- Kay Premium Marking Film Ltd

- Eastman Chemical Company

- Ads Window Films Limited

- Avery Dennison Corporation

- Garware Polyester Company

- Madico Inc.

By Film Type Segment Analysis

By Film Type Segment Analysis

- Window Films

- Wrap Films

- Pain Protection Films

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Passenger Cars

- Commercial Vehicles

- Heavy Commercial Vehicles

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Avery Dennison Corporation

- Arlon Graphics LLC

- 3M Company

- Ritrama S.p.A.

- Hexis S.A.

- JMR Graphics Inc.

- Vvivid Vinyl

- Kay Premium Marking Film Ltd

- Eastman Chemical Company

- Ads Window Films Limited

- Avery Dennison Corporation

- Garware Polyester Company

- Madico Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors