Search Market Research Report

Autonomous Delivery Robots Market Size, Share Global Analysis Report, Delivery Robots Market by Types (Semi-Autonomous Robots and Fully Autonomous Robots),by Load Carrying Capacity (Up to 10 kg, more than 50 kg), by Components (Hardware and Software), by Number of Wheels (Three wheels, Four wheels, and Six wheels), End-User Industry (Logistics, Healthcare, Food & Beverages, Retail, Postal, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Autonomous Delivery Robots Market by Types (Semi-Autonomous Robots and Fully Autonomous Robots),by Load Carrying Capacity (Up to 10 kg, more than 50 kg), by Components (Hardware and Software), by Number of Wheels (Three wheels, Four wheels, and Six wheels), End-User Industry (Logistics, Healthcare, Food & Beverages, Retail, Postal, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Industry Insights

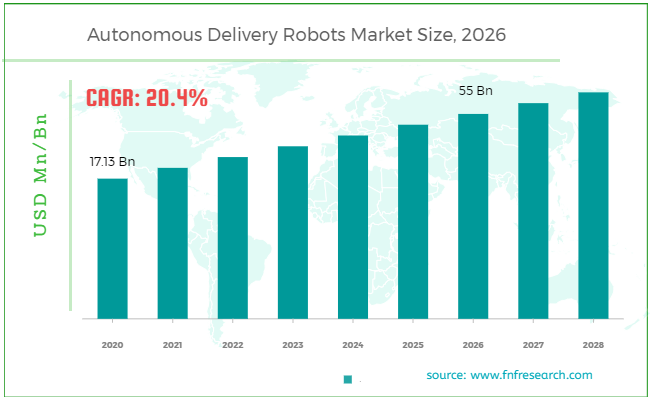

[222+ Pages Report] According to a Facts and Factors market research report, the global autonomous delivery robots market was estimated to be USD 17.13 Billion in 2020; and the revenue is expected to reach around USD 55 Billion by the end of 2026, increasing at a CAGR of around 20.4% from 2021 to 2026.

Market Overview

Market Overview

Autonomous delivery robots are electric-powered motorized vehicles that can deliver items or deliveries to customers without the assistance of a person or supervisor. The sensors and navigation technologies in the autonomous delivery robots allow them to navigate on highways and sidewalks without the need for a driver or on-site delivery workers.

These robots have been programmed to deliver various types of items from one area to another. Couriers, food, supplies, and other goods are among the items to be delivered. Delivery methods have been changed thanks to autonomous delivery robots. They have the benefit of being a very efficient and cost-effective distribution method. Retail, hospitality, healthcare, logistics, and other industries employ autonomous delivery robots the most.

The primary drivers driving the market's growth are lower delivery costs in last-mile deliveries and an increase in venture capital funding. Furthermore, drivers fuelling the market's growth include the worldwide rise of the e-commerce business.

Industry Growth Factors

Industry Growth Factors

The final phase of product delivery, from the warehouse or distribution center to the end-user, accounts for over 28% of the entire transportation cost in most supply chains. Congestion in urban areas, isolated places, erroneous or erroneous address info, difficult-to-find destinations, and a severe labour scarcity for supplying on-demand delivery services are all variables that affect last-mile delivery. All of these issues are preventing this phase's optimization. Customers in the realm of e-commerce are not just demanding, but they also like to buy high-quality goods at a reduced price. Autonomous delivery robots in e-commerce will not only provide customers with better convenience at a lower cost, but they will also fundamentally alter the competitive landscape.

The current COVID-19 pandemic has shone a spotlight on delivery robots for contactless package deliveries around the world, and strong market demand has pushed delivery robot developers to launch large-scale operations in a number of US locations. During the pandemic, the deployment and adoption of delivery robot technology are projected to strengthen the market for delivery robots. Food is also being delivered by delivery robots from restaurants. Delivery robots have been in use for several years; however, during the epidemic, end users, including restaurants, grocery stores, and other delivery service organizations, have shown a significant increase in interest in them.

Segmentation Analysis

Segmentation Analysis

On the basis of the type of autonomous delivery robots, the autonomous delivery robots market is segmented into semi-autonomous robots and fully autonomous robots. Fully Autonomous Robots held the biggest market share in 2020 and are expected to grow at the fastest rate throughout the forecast period. Fully autonomous delivery robots are fully automated delivery robots that do not require human interaction during delivery. Based onload carrying capacity of autonomous delivery robots, the autonomous delivery robots market is segmented into Up to 10 kg, more than 50 kg. On the basis of components of autonomous delivery robots, the autonomous delivery robots market is segmented into hardware and software. In 2020, hardware components accounted for a higher portion of the delivery robots’ market. The costlier components, such as LiDAR sensors and radars, account for the bigger hardware market share. However, due to the rising demand for delivery robots with auto navigation and autonomous decision-making skills, the market for software components is likely to rise at a faster CAGR during the forecast period.The autonomous delivery robot can be segmented on the basis of a number of wheels of autonomous delivery robots into 3 wheels, 4 wheels, and 6 wheels.In terms of value, the market for four-wheeled delivery robots held the highest proportion in 2020. Four-wheeled robots are available for a variety of tasks, including delivering groceries, meal orders, flowers, deliveries, and boxes. With 4-wheeled robots, reducing the distance between the front and back sets of wheels will result in improved zero-radius turning in any desired direction. As a result, four-wheeled delivery robots dominated the market. On the basis of the end-user industry of autonomous delivery robots, the autonomous delivery robots market is segmented into logistics, healthcare, food & beverages, retail, postal, and others.During the projection period, China's market is predicted to grow due to rising demand for delivery robots in the retail industry, as well as an elderly population. The lack of laws or standards for operating fully autonomous robots is projected to drive the delivery robots’ sector in South Korea to new heights.

Regional Analysis

Regional Analysis

North America, Europe, Asia Pacific, and the Rest of the World make up the Global Autonomous Delivery Robots Market. In 2020, North America held the highest market share, and it is expected to grow at a strong CAGR over the forecast period. Many of the leading market vendors are based here, and the region also includes a large number of manufacturers and start-ups devoted to the advancement of autonomous delivery robotic technology. In addition, when compared to other parts of the world, the region has a relatively high penetration of autonomous delivery robots among diverse end-users.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 17.13 Billion |

Projected Market Size in 2026 |

USD 55 Billion |

CAGR Growth Rate |

20.4% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Eliport, Boston Dynamics, Robomart, Panasonic System Solutions Asia Pacific, Savioke, Starship Technologies, JD.com, Amazon Robotics, Robby Technologies, and Nuro among others. |

Key Segment |

By Type, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

The major market players in the autonomous delivery robots market are :

- Eliport

- Boston Dynamics

- Robomart

- Panasonic System Solutions Asia Pacific

- Savioke

- Starship Technologies

- JD.com

- Amazon Robotics

- Robby Technologies

- Nuro

From January 2017 to December 2020, these companies used a variety of growth tactics to achieve growth in the delivery robots’ market, including expansions, partnerships, agreements, and collaborations, which helped them to expand their product portfolio and broaden their client base.

By Types Segmentation Analysis:

By Types Segmentation Analysis:

- Semi-Autonomous Robots

- Fully Autonomous Robots

By Load Carrying Capacity Segmentation Analysis

By Load Carrying Capacity Segmentation Analysis

- Up to 10 kg

- More than 50 kg

By Components Segmentation Analysis

By Components Segmentation Analysis

- Hardware

- Software

By Number of Wheels Segmentation Analysis

By Number of Wheels Segmentation Analysis

- Three wheels

- Four wheels

- Six wheels

By End-User Industry Segmentation Analysis

By End-User Industry Segmentation Analysis

- Logistics

- Healthcare

- Food & Beverages

- Retail

- Postal

- Others

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Table of Content

Industry Major Market Players

- Eliport

- Boston Dynamics

- Robomart

- Panasonic System Solutions Asia Pacific

- Savioke

- Starship Technologies

- JD.com

- Amazon Robotics

- Robby Technologies

- Nuro

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors