Search Market Research Report

Bitumen Market Size, Share Global Analysis Report, 2022 – 2028

Bitumen Market By Product Type (Paving Grade, Hard Grade, Oxidized Grade, Bitumen Emulsions, Polymer Modified Bitumen, Other Product Types). By Application (Road Construction, Waterproofing, Adhesives, Other Applications), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022 – 2028

Industry Insights

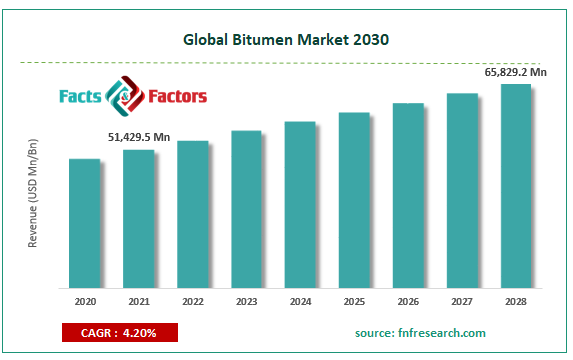

[219+ Pages Report] According to Facts and Factors, the Global Bitumen Market was worth around USD 51,429.5 million in 2021 and is estimated to grow to about USD 65,829.2 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.2% over the forecast period. The report analyzes the Bitumen Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Bitumen Market.

Market Overview

Market Overview

Bitumen is a polycyclic aromatic hydrocarbon that is extremely condensed and soluble in carbon disulfide. It is a thick, black, and highly sticky mixture of organic liquids. Bitumen's rising use in a variety of applications such as highways, waterproofing, insulation, and adhesives is likely to boost the market during the forecast period. In addition, rapid urbanization in emerging nations has fuelled an increase in infrastructure activity. As a result, the product's demand has increased. The asphalt (bitumen) binder is a vital element in various roadways applications because of its superior strength, durability, and resilience. Concrete contains a small percentage of asphalt, which acts as a binder to improve its resistant qualities, and this is predicted to increase demand throughout the forecast period.

The growing need for infrastructure as a result of population increase and improved living standards is expected to drive bitumen market growth over the forecast period. Increasing awareness of climate change, as well as global warming, will promote roofing demand, which is expected to drive product demand in the approaching years. Moreover, increasing government spending and policies for road and infrastructure development through Public Private Partnership models in both established and emerging markets will drive bitumen market share in the future.

COVID-19 Impact:

COVID-19 Impact:

COVID-19 had an adverse impact on the market in 2020. The construction sector's performance is predicted to be moderately impacted by the influence on cash flow as a result of the affected income of a comparatively wider segment of society, which is expected to affect the market analyzed. Declining expenditures in the road and building construction segments resulted in lower consumption of bitumen in applications such as road construction, waterproofing of building roofs and basements, sealant, filler, and adhesive, which harmed the bitumen market.

Growing environmental concerns about bitumen, as well as unfavorable conditions caused by the impact of COVID-19, are impeding industry expansion. With a nationwide lockdown imposed by the central governments, the supply chain of Bitumen got disturbed, which in turn affected the market growth. However, with the slowing removal of the Covid-19 restriction, the market is expected to grow at a considerable rate.

Growth Drivers

Growth Drivers

- Bitumen is becoming more widely used in waterproofing applications.

Due to its highly sticky and viscous nature, bitumen is commonly employed as a waterproofing agent on the roofs of commercial and residential buildings. Bituminous waterproofing is used to protect roof decks from the rain before roofing or installation because it prevents seepage and water leakage. It also acts as an additional barrier against water penetration or blow-offs and is thus frequently employed by the construction industry, which is a major growth factor for the bitumen market.

- Increasing Bitumen Use as a Chemical Additive

Bitumen is commonly employed as a chemical ingredient in a variety of applications, including solvents and black paints. Bitumen, as a chemical additive, improves the efficiency of paints and coatings, as well as the viscosity of waterproofing agents. Other factors boosting bitumen usage across multiple industries worldwide include the use of chemically-modified bitumen in road building and waterproofing, as well as a candy-coated chemical ingredient in emulsions.

Restraint

Restraint

- Strict environmental laws and regulations

Strict environmental rules governing uses and manufacturing processes will limit the growth of the bitumen industry in the coming years. The occupational exposure limit has a substantial influence on the industry. The restriction is set at 5mg/m3 in Australia, China, Belgium, and France. Because the commodity is derived from petrochemicals and crude oil, its pricing dynamics are comparable to those of crude oil, and it has shown similar sluggish growth in recent years. Over the projection period, fluctuating oil and petrochemical prices may have an impact on bitumen pricing trends. Nonetheless, the emergence of bio-based bitumen is being studied in order to offer new growth potential for industry players.

Segmentation Analysis

Segmentation Analysis

The Bitumen Market is segregated based on Product Type, and Application.

By Product Type, the market is classified into Paving Grade, Hard Grade, Oxidized Grade, Bitumen Emulsions, Polymer Modified Bitumen, and Other Product Types. Paving bitumen will have the biggest market share in terms of value in the forecast period. Due to its durability and ability to be rebuilt rapidly, bitumen is used as a binder in asphalt concrete for roads, parking lots, airport runways, and footways. Bitumen penetration grade 60/70 is obtained from precisely selected crude oils through highly controlled refining procedures and utilized as paving grade bitumen. Asphalt concrete is often made by combining fine and coarse materials, such as gravel or crushed stone, with asphalt, which acts as a binding agent. The cheap cost and simple availability of paving grade bitumen would raise the value of the bitumen market in road building activities across the world. The demand for paving-based bitumen is predicted to rise due to its numerous applications.

By Application, the market is classified into Road Construction, Waterproofing, Adhesives, and Other Applications. The Road Construction segment accounted for the largest share in the forecast period. The most widespread application of bitumen is in road construction, where it is employed as a binder in the production of asphalt concrete. This category includes the use of bitumen in road and pavement maintenance as well as the construction of airport runways, roads, flyovers, and platforms. Increasing vehicle traffic around the world, spurred by rising Purchase Power Parity (PPP) in emerging nations, would necessitate the construction of a larger road and highway network with numerous lanes to accommodate all cars during peak hours. Moreover, increased urbanization and modernization would improve communication between rural and urban areas, increasing the demand for road development operations.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 51,429.5 Million |

Projected Market Size in 2028 |

USD 65,829.2 Million |

CAGR Growth Rate |

4.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ATDM CO. LTD, Bouygues, BP PLC, BMI Group, China Petroleum & Chemical Corporation, ENEOS Corporation, Exxon Mobil Corporation, Indian Oil Corporation Ltd, KRATON CORPORATION, Marathon Petroleum Corporation, Nynas AB, Royal Dutch Shell PLC, and Suncor Energy Inc., among others |

Key Segment |

By Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The Asia Pacific region would be the most dominant market throughout the projected period, with growth driven by expanding construction sector growth in India, China, Thailand, and Vietnam. Additionally, the existence of key market participants in the region will boost bitumen industry expansion in the next years. Due to the obvious region's enormous road network, Asia Pacific will expand its bitumen use. China is one of the world's major rising economies, and the country's market growth continues strong.

The region's road and highway construction business is quickly expanding, with factors such as rising urbanization and an increasing number of automobile owners playing important roles. All of this has resulted in a quick expansion in manufacturing activity in the region, as well as an increase in freight and road transportation activity. As a result, there is a high demand for bitumen in the region.

North American bitumen markets are expected to register steady growth Because of increased investment in construction operations in the region. The increasing number of property rehabilitation projects and new building systems with waterproofed flat roofs, particularly in North America, would boost product demand in the regions. Furthermore, in order to strengthen their market position, big market actors have sought to develop strategic alliances with local or small enterprises. Thus, mergers and acquisitions in the bitumen industry help market growth.

Recent Developments

Recent Developments

- In 2021, ExxonMobil has restarted the manufacturing of bitumen in Singapore. The factory has a bitumen production capacity of 100,000-120,000 tonnes per month.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the Bitumen Market include -

- ATDM CO. LTD

- Bouygues

- BP PLC

- BMI Group

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Indian Oil Corporation Ltd

- KRATON CORPORATION

- Marathon Petroleum Corporation

- Nynas AB

- Royal Dutch Shell PLC

- Suncor Energy Inc.

The Bitumen Market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Paving Grade

- Hard Grade

- Oxidized Grade

- Bitumen Emulsions

- Polymer Modified Bitumen

- Other Product Types

By Application Segment Analysis

By Application Segment Analysis

- Road Construction

- Waterproofing

- Adhesives

- Other Applications

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- ATDM CO. LTD

- Bouygues

- BP PLC

- BMI Group

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Indian Oil Corporation Ltd

- KRATON CORPORATION

- Marathon Petroleum Corporation

- Nynas AB

- Royal Dutch Shell PLC

- Suncor Energy Inc.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors