Search Market Research Report

Boron Carbide Market Size, Share Global Analysis Report, 2022 – 2028

Boron Carbide Market Size, Share, Growth Analysis Report By Application (Abrasive, Nozzles, Armor), By Grade (Abrasive, Nuclear), By Type (Powder, Grain, Paste), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

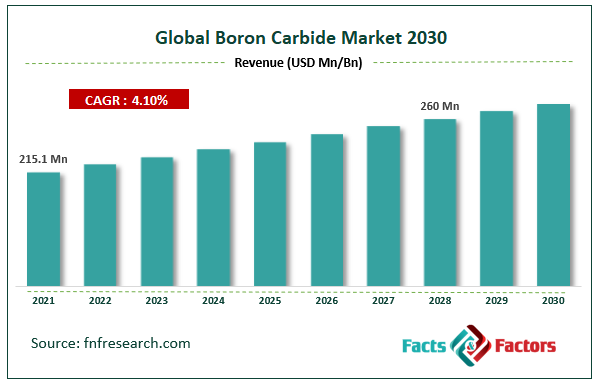

[243+ Pages Report] According to the report published by Facts & Factors, the global boron carbide market size was worth around USD 215.1 million in 2021 and is predicted to grow over USD 260 million by 2028 with a compound annual growth rate (CAGR) of roughly 4.1% between 2022 and 2028. The report analyzes the global Boron Carbide market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Boron Carbide market.

Market Overview

Market Overview

Boron carbide (B4C) is a boron–carbon covalent and ceramic substance that is used in bulletproof vests, tank armor, engine sabotage powders, and a range of other industrial uses. It is a known material and one of the hardest, second only to diamond and cubic boron nitride, with a Vickers hardness >30 GPa. Rising construction of nuclear reactors on account of making sustainable energy, particularly in developing economies is set to drive the sales. Numerous beneficial features of organic boron carbide, such as chemical inertness, hardness, and excellent absorption of neutrons in cross-section are also likely to drive the market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global boron carbide market is estimated to grow annually at a CAGR of around 4.1% over the forecast period (2022-2028).

- In terms of revenue, the global Boron Carbide market size was valued at around USD 215.1 million in 2021 and is projected to reach over USD 260 million, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, powder segment was predicted to show maximum market share in the year 2021

- Based on application segmentation, armor segment was the leading revenue-generating segment in 2021.

- On the basis of region, Asia Pacific was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

The global boron carbide market is not immune from pandemic caused by COVID-19. It had been negatively impacted owing to lockdowns which were imposed across the world. Asia-Pacific is one of the key producers of cutting tools; but, owing to the outbreak, manufacturing plants were shut down temporarily, affecting the growth of the market. Furthermore, the supply of raw material disruptions such as high-speed steel, cemented carbide, ceramics, polycrystalline diamond, stainless steel, exotic materials, and cubic boron nitride have affected the cutting tools manufacturing leading to decreasing revenues. Several industry verticals, including aerospace & defense, automotive, electronics, construction, power generation, oil & gas, have been affected owing to the broken supply chains.

Growth Drivers

Growth Drivers

- Increasing demand from nuclear energy industry to drive market growth

Rapid nuclear energy sector expansion across the globe is likely to augment the boron carbide powder sales in the forthcoming years. As per the World Nuclear Association, nearly 30 nations globally are planning, starting, or considering nuclear power programs. Turkey, Bangladesh, and Belarus have started constructing their first-ever nuclear power plants.

Thus, nuclear-grade boron carbide usage is expected to surge in future since it can perform in-core and non-core applications in the nuclear reactor. The COVID-19 pandemic has obstructed considerably armor vehicle production across the globe; however, despite the fall in the production of armor vehicle and strict locked downs, the aerospace & defense industry has witnessed substantial growth. For instance, in 2021, the world defense spending is projected to grow around 2.8%; for instance, in 2020, Japan increased its defense budget by 1.1% compared to 2019, which is likely to drive the global boron carbide market growth during the forecast period.

Increasing demand from defense to boost market expansion

Increasing demand from defense to boost market expansion

Growing production of vehicle armor systems and protective body jackets to cater to the increasing demand from the defense is set to bolster the market growth. Both developed and developing countries are likely to raise their expenditure for defense to improve their existing military forces, which is estimated to push the demand for boron carbide which is organic. In January 2020, researchers at Texas A&M University, Johns Hopkins University, Rutgers University, and the Army Research Laboratory developed a recipe that would help in preventing weakness in modern armor.

It was found that bullet-resistant gear can be made more buoyant to high-speed impacts by addition of silicon to boron carbide. Similar activities of research and development by leading educational institutions are likely to drive the market.

Segmentation Analysis

Segmentation Analysis

- The global boron carbide market is segmented based on type, application, grade, and region.

Based on type, the global market segments are powder, grain, paste. The powder segment is likely to hold a significant market share. Boron carbide powder is used commonly in gridding of hard metals, polishing, and sintering markets across the world. It is also employed in refractory applications due to its melting point and high thermal stability. It provides great ballistic performance because of its high hardness and low density. The powder is often purified and milled in order to remove metallic impurities before usage in commercial applications.

Based on application, the global market segments are abrasive, nozzles, armor. Armor held the largest share of revenue. Rising usage in protective gears, particularly ballistic vests is likely to propel the segment growth. In July 2021, SINTX Technologies, Inc. entered into an asset purchase agreement with B4C, LLC to acquire the technical processes and equipment needed to manufacture ballistic armor plates. The company aims to develop and market pure boron carbide as the material is efficient in protecting soldiers from hardened, high-velocity projectiles. Thus, the rising number of acquisitions and mergers between renowned firms is anticipated to fuel the organic boron carbide sales.

Based on grade, the global market segments are abrasive, nuclear. Abrasive held the largest share of revenue. Boron carbide coating is used extensively in polishing and lapping applications as an abrasive supported by its high hardness. It is known as an ideal material for diamond tools dressing. It is also being employed in nozzles for grit blasting, water jet cutters, and slurry pumping.

Recent Developments:

Recent Developments:

- In Feb 2022, Samsung stated that it is focusing on using boron carbide to replace silicon carbide in its focus rings. As boron carbide is durable against plasma and high temperature, the company is aiming to use it to make focus rings. These newly developed focus rings will be utilized in wafer fabrication during the etching process.

- In Feb 2022, Eti Maden announced that it will start operating its new boron carbide facility this year and lay the foundations of the facility for the production of lithium in ore and ferro boron. The company will also start investing in the production of sodium boron hydride.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 215.1 Million |

Projected Market Size in 2028 |

USD 260 Million |

CAGR Growth Rate |

4.1% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

3M Company, ABSCO Limited, American Elements, Advanced Abrasives Corporation, Bhukhanvala Industries Pvt. Ltd., China Mudanjiang Chenxi Boron Carbide Co. Ltd., UK Abrasives Inc., Dunhua Zhengxing Abrasive Co. Ltd., Dynamic-Ceramic Limited (CoorsTek), Feldco International, Electro Abrasives LLC, and Others |

Key Segment |

By Application, Grade, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia Pacific to lead owing to the well-established manufacturing of metal in China

The presence of an established metal manufacturing market in China is likely to drive the market in the forecast period. Most of the producers in China are state-owned and the new entries of private metal manufacturing enterprises in the nation is likely to propel the boron carbide fiber demand.

Boron carbide market in North America is set to account for a substantial market share in 2022. Ongoing development of the nuclear power is a key factor that is expected to drive the market in the U.S. According to the World Nuclear Association, in 2019, nuclear reactors in the U.S. produced 843 billion kWh or 19% of the total electrical output. The nation is considered to be the largest nuclear power producer in the world, accounting for more than 30% of nuclear generation of electricity worldwide. This trend is likely to continue in the forecast period, thereby propelling the boron carbide fiber demand.

Competitive Analysis

Competitive Analysis

- 3M Company

- ABSCO Limited

- American Elements

- Advanced Abrasives Corporation

- Bhukhanvala Industries Pvt. Ltd.

- China Mudanjiang Chenxi Boron Carbide Co. Ltd.

- UK Abrasives Inc.

- Dunhua Zhengxing Abrasive Co. Ltd.

- Dynamic-Ceramic Limited (CoorsTek)

- Feldco International

- Electro Abrasives LLC

The global Boron Carbide market is segmented as follows:

By Application

By Application

- Abrasive

- Nozzles

- Armor

By Grade

By Grade

- Abrasive

- Nuclear

By Type

By Type

- Powder

- Grain

- Paste

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- 3M Company

- ABSCO Limited

- American Elements

- Advanced Abrasives Corporation

- Bhukhanvala Industries Pvt. Ltd.

- China Mudanjiang Chenxi Boron Carbide Co. Ltd.

- UK Abrasives Inc.

- Dunhua Zhengxing Abrasive Co. Ltd.

- Dynamic-Ceramic Limited (CoorsTek)

- Feldco International

- Electro Abrasives LLC

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors