Search Market Research Report

Ceramic Matrix Composites Market Size, Share Global Analysis Report, 2022 – 2028

Ceramic Matrix Composites Market Size, Share, Growth Analysis Report By Fiber Type (Continuous, Woven, and Others (Chopped, Felt/Mat, Twills, and Braided)), By Matrix Type (C/C, C/SIC, Oxide/Oxide, SIC/SIC), By End-use Industry (Aerospace & Defense, Automotive, Energy & Power, Industrial, and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

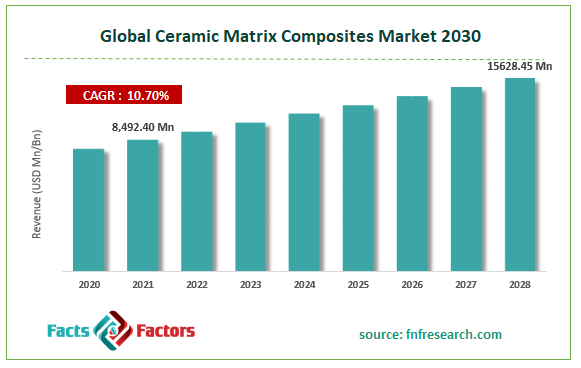

[230+ Pages Report] According to Facts and Factors, the global ceramic matrix composites market size was worth USD 8,492.40 million in 2021 and is estimated to grow to USD 15628.45 million by 2028, with a compound annual growth rate (CAGR) of approximately 10.70% over the forecast period. The report analyzes the ceramic matrix composites market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the ceramic matrix composites market.

Market Overview

Market Overview

Ceramic fiber is encased in a ceramic matrix to create ceramic matrix composite (CMC). It is a substance made up of a ceramic matrix mixed with a dispersed phase of oxide and carbides. They are created using procedures for vapor phase infiltration or deposition. These matrices are employed in manufacturing components for jet and rocket engines, internal combustion automotive engines, gas turbines, process equipment, furnaces, refractory components, nuclear components, spacecraft re-entry shielding, welding nozzles and tools, and brazing fixtures. The ceramic matrix composites market is anticipated to be driven by increased demand from the aerospace & military, automotive, and energy & power end-use industries.

Additionally, the market is anticipated to grow in the next years due to government rules governing fuel economy and the capacity to withstand extreme temperatures. The market is anticipated to be driven by superior mechanical characteristics, the use of CMC for strong constructions, and enhanced performance throughout the anticipated period. Certain limitations and difficulties may prevent the market from expanding. The market is projected to be constrained by technological advancements that combine technology and metal mining.

Covid-19 Impact:

Covid-19 Impact:

Due to the COVID-19 pandemic, the ceramic matrix composites market is anticipated to experience a drop in 2021. This terrible illness has negatively impacted the entire world, particularly North America and Europe. Due to the pandemic, the aerospace and military, and automobile industries have seen very challenging conditions. Companies shut down operations and industrial facilities while the government curtailed production activities to stop the virus from spreading further. As a result, ceramic matrix composites have decreased across all industries.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global ceramic matrix composites market value is expected to grow at a CAGR of 10.70% over the forecast period.

- In terms of revenue, the global ceramic matrix composites market size was valued at around USD 8,492.40 million in 2021 and is projected to reach USD 15628.45 million by 2028.

- The ability to withstand high temperatures, superior mechanical qualities, and increased demand from the aerospace & military, automotive, and energy & power end-use sectors are anticipated to propel the market for ceramic matrix composites.

- By fiber type, the continuous category dominated the market in 2021.

- The SiC/SiC category dominated the market by matrix type in 2021.

- North America dominated the global ceramic matrix composites market in 2021.

Growth Drivers

Growth Drivers

- The growing need for ceramic matrix composites in emerging economies drives the market growth

Market expansion will be fueled by the rising demand for ceramic matrix composites in developing nations, particularly in Asia Pacific (including China, India, Singapore, and Thailand). Developing nations are using ceramic matrix composite-based, fuel-efficient airplane engines. The ceramic matrix utilizes other aviation engine components, such as nozzles, combustor liners, blades, and shrouds. The aircraft operating costs are reduced due to the improved fuel economy. These nations' rapid economic development, high urbanization rates, industrialization, and rising standards of life, are also key factors in adopting machinery that uses less fuel.

Restraints

Restraints

- Costlier than those other metals and alloys may hinder the market growth

Comparatively more expensive than other metals and alloys utilized for the same range of applications are ceramic matrix composites. The cost of ceramic fibers significantly impacts the cost of ceramic matrix composites. Due to the massive manufacturing of carbon fibers to fulfill the rising demand for C.F. and CFRP products globally, the costs of carbon/carbon ceramic matrix composites are significantly cheaper than those of silicon carbide/silicon carbide and oxide/oxide ceramic matrix composites. Alumina and silicon carbide fiber manufacturing is still quite low worldwide.

Opportunity

Opportunity

- More lightweight components are being used, which presents market opportunities

Lightweight armors are one of the main uses for ceramic matrix composites. Ceramic matrix composites are used in these armors because of their lightweight nature and excellent strength-to-weight ratio. Due to the advancement of fuel-efficient automobiles and aircraft, there is also a significant need. This market will be driven by the creation of sports automobiles and fuel-efficient airplanes. The primary barrier is the high cost of raw materials and manufactured goods. However, new methods are being created to produce ceramic matrix composites with a wide variety of improved qualities and an expanded capability of offering structural efficiency at lower weights than the present technology.

Challenges

Challenges

- Recyclability and repairability lead to limited use and may hinder the market growth

Ceramic matrix composites are special for various applications because of their unique features. However, it might be challenging to spot interior cracks or signs of wear and tear in components composed of a ceramic matrix. Brittleness is the main flaw in ceramic matrix composites, which can cause catastrophic component failure. There is a shortage of expertise and qualified labor applying effective repair methods. This makes reparability an even bigger problem. The components of ceramic matrix composites cannot be recycled for use in the same application with a lengthy lifespan.

Segmentation Analysis

Segmentation Analysis

The global ceramic matrix composites market is segregated based on fiber type, matrix, and end-use industry.

Based on fiber type, the market is segmented into continuous, woven, and others (chopped, felt/mat, twills, and braided). Depending on the fiber type, the continuous fiber segment held the majority of the market share in 2021 due to an increase in the use of continuous fiber in gas turbines needed to make fighter jet engines, which is due to their advantages over other fiber types in terms of their ability to withstand high temperatures, increased toughness, and longer durability. The growth of the aerospace and defense sector, as well as the increased production and export of military aircraft to both developed and developing nations, including the U.S., the UK, France, China, and Russia, increases the demand for continuous fiber, which is expected to drive the market for ceramic matrix composites.

Based on matrix type, the market is segmented into C/C, C/SiC, Oxide/Oxide, and SIC/SIC. The silicon carbide reinforced silicon carbide (SiC/SiC) segment dominated the composite type market in 2021. Due to its characteristics, including resilience to high temperatures and oxidation, SiC/SiC is frequently utilized in high-temperature applications. The demand for SiC/SiC has risen due to an increase in the manufacturing and export of aerospace and defense equipment, such as fighter planes, from developed nations like the U.S., Germany, France, and the U.K. to emerging nations.

Based on the end-use industry, the market is classified into aerospace & defense, automotive, energy & power, industrial, and others (electrical & electronics, medical, and marine). In terms of application, the aerospace and defense sector dominated in 2018. Due to its qualities like reduced weight, improved fuel efficiency, and longer durability, ceramic matrix composites are increasingly used in aerospace and defense equipment. Additionally, rising military aircraft production and R&D in aerospace and defense technologies have increased demand for ceramic matrix composites, propelling the market for these materials.

Recent Development:

Recent Development:

- November 2020: The Senate authorized a USD 1.7 billion pledge to buy 17 more F-35 fighter planes for the military in F.Y. 2021. 96 jets—12 F-35As for the Air Force and five F-35Cs for the Navy and Marine Corps—will be delivered in F.Y. 2021. Growing investments in the defense and aerospace industries in the area are helping to expand the ceramic matrix composite industry in the nation.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 8,492.40 Million |

Projected Market Size in 2028 |

USD 15628.45 Million |

CAGR Growth Rate |

10.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

General Electric Company, Rolls-Royce, Axiom Materials Inc., SGL Carbon, United Technologies, 3M Company, COI Ceramics, Lancer Systems, CoorsTek, Applied Thin Films, Ultramet, CFC Carbon Co. Ltd., and Others |

Key Segment |

By Fiber Type, Matrix Type, End-use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the ceramic matrix composites market in 2021

In 2021, North America dominated the market and generated the biggest portion of worldwide revenue. Some key elements anticipated to drive the CMC demand in North America include significant aviation industries, their investment in developing ceramic matrix components for manufacturing aviation components, and their collaborations with government agencies to upgrade defense equipment. Excessive oil consumption in this region has increased the demand for energy security, emphasizing obtaining energy from other sources, such as natural gas. Thus, ceramic matrix composites will probably be quite important in this market. Additionally, the market will rise due to the increasing need for aircraft engines that use less fuel.

Competitive Landscape

Competitive Landscape

- General Electric Company

- Rolls-Royce

- Axiom Materials Inc.

- SGL Carbon

- United Technologies

- 3M Company

- COI Ceramics

- Lancer Systems

- CoorsTek

- Applied Thin Films

- Ultramet

- CFC Carbon Co. Ltd.

Global Ceramic Matrix Composites Market is segmented as follows:

By Fiber Type

By Fiber Type

- Continuous

- Woven

- Others (chopped, felt/mat, twills, and braided)

By Matrix Type

By Matrix Type

- C/C

- C/SIC

- Oxide/Oxide

- SIC/SIC

By End-use industry

By End-use industry

- Aerospace & Defense

- Automotive

- Energy & Power

- Industrial

- Others (Electrical & Electronics, Medical, and Marine)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- General Electric Company

- Rolls-Royce

- Axiom Materials Inc.

- SGL Carbon

- United Technologies

- 3M Company

- COI Ceramics

- Lancer Systems

- CoorsTek

- Applied Thin Films

- Ultramet

- CFC Carbon Co. Ltd.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors