Search Market Research Report

Clear Brine Fluids Market Size, Share Global Analysis Report, 2022 – 2028

Clear Brine Fluids Market By Product Type (Calcium Chloride, Sodium Chloride, Zinc Calcium bromides, Cesium Formate, Potassium Chloride, and Other Product Types), By Application (Oil and Gas Exploration, and Enhanced Oil Recovery), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022 – 2028

Industry Insights

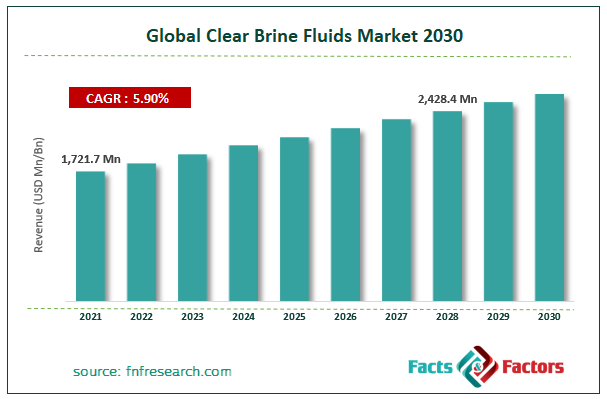

[210+ Pages Report] According to Facts and Factors, the Global Clear Brine Fluids Market was worth around USD 1,721.7 million in 2021 and is estimated to grow to about USD 2,428.4 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.9% over the forecast period. The report analyzes the Clear Brine Fluids Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the clear brine fluids market.

Market Overview

Market Overview

Clear brine fluids are salt solutions used in the oil and gas industry as drilling and well completion fluids. It's a solid-free aqueous solution made up of chloride, bromide, and formate salts. Drilling, shale gas, oil, and deep-sea operations are all popular uses for it. On the market, these fluids come in a variety of densities. As a completion, drill-in, workover, and packer fluid, it's frequently used in the oilfield. The growing preference for hydraulic fracturing and horizontal drilling techniques that use transparent brine fluids to increase operational efficiency is projected to drive the worldwide clear brine fluids market. In addition, the clear brine fluids are used by good operators to improve well life efficiency, minimize lifting costs, and address environmental concerns, which is driving the market’s growth.

The recovery in oil prices in recent years has benefited the global oil and gas industry, thus boosting the growth of the market. Deepwater and ultra-deepwater exploration operations are likely to rise the market demand during the projection period. The global drilling activity saw a significant increase, in recent years due to the increased demand for the end-users, which is expected to fuel the clear brine fluids market. Moreover, to strengthen the fossil-fuel business, government across the globe has engaged in a variety of unconventional oil and gas exploration operations, which resulted in an increase in drilling activities and had a direct impact on the growth of drilling and completion fluids, which in turn has a positive impact on the market.

COVID-19 Impact:

COVID-19 Impact:

Clear Brine Fluids businesses all around the world have been hit hard in recent months. This is due to major disruptions in their separate manufacturing and supply-chain operations as a result of numerous precautionary lockdowns and other limitations imposed by governing bodies around the world. Additionally, consumer demand has subsequently decreased as people are now more focused on minimizing non-essential expenses from their separate budgets as the general economic condition of the majority of people has been badly impacted by this outbreak.

The COVID-19 pandemic reduced demand for crude oil and natural gas over the world, lowering consumption of clear brine fluids used in upstream oil and gas activities. These factors are projected to weigh on the revenue trajectory of the worldwide Clear Brine Fluids market throughout the forecast period. However, as the individual governing bodies begin to relax these imposed lockdowns, the global Clear Brine Fluids market is likely to recover.

Growth Driver

Growth Driver

- Demand for crude oil and natural gas from end users

The rise in global demand for crude oil and natural gas is one of the primary drivers driving the use of clear brine fluids. Major crude oil products such as gasoline, diesel, and natural gas are the primary source of energy in both developed and emerging economies. As a result, the whole oil and gas industry, beginning with upstream activities, is vital for both developed and emerging economies worldwide. Exploration for oil and natural gas resources is never-ending and results in the discovery of new oilfields. Once these fields have been geographically surveyed, they are ready for drilling and other production-related activities. As a result, new onshore and offshore well building, particularly in Asia-Pacific and the Middle East, is likely to fuel demand for clear brine fluids throughout the projection period.

Furthermore, the utilization of clear brine fluids is required for decreased operating costs and greater oilfield production. Clear brine fluids are utilized for drilling, well completion, and workover fluids. All of the aforementioned aspects drive clear brine fluids market expansion, hence growing clear brine fluids market size.

Restraint

Restraint

- The increased emphasis on renewable energy sources

The increased emphasis on renewable energy sources such as solar and wind poses a significant threat to the oil and gas industry. Europe, for example, has been an active seeker of alternative energy sources, and European Union (EU) countries such as Germany and France are transitioning toward energy obtained from solar, wind, and tidal energy. As a consequence, the use of petroleum and natural gas has decreased. As a result, as countries transition to renewable energy generation, demand for oilfield chemicals is likely to fall over the projection period. During the forecast period, this is projected to be a restraint for the worldwide clear brine fluids market.

Segmentation Analysis

Segmentation Analysis

The Clear Brine Fluids Market is segregated based on Product Type, and Application.

By Product Type, the market is classified into Calcium Chloride, Sodium Chloride, Zinc Calcium bromides, Cesium Formate, Potassium Chloride, and Other Product Types. In terms of revenue, zinc calcium bromide has the greatest share and is predicted to maintain its dominance over the forecast period. Zinc calcium bromide is a multi-salt fluid consisting of zinc bromide, calcium bromide, and calcium chloride. In the oil and gas industry, multi-salt formulations are utilized as completion and workover fluids to operate at higher densities at lower prices than other competitors. Zinc calcium bromide solution is used in the completion and workover of oil and gas wells. This brine fluid is hazardous to aquatic life and has long-term impacts; nonetheless, due to its great efficiency, the product category has a substantial market share.

The product has very efficient properties, and the blend may be tailored to meet high-density requirements. Compatibility with completion and formation fluids is demonstrated by these high-density fluids. Sodium chloride is the least expensive of the components and is a readily available inexpensive brine product used for inhibition and density. The product is commonly utilized in low-pressure wells, but it can also be used to alter the density of other unsaturated brine such as potassium chloride, ammonium chloride, and saltwater. It also lowers the freezing point of water-based solutions and minimizes salt dissolution while drilling halite salt sections.

By Application, the market is classified into Oil and Gas Exploration, and Enhanced Oil Recovery. Over the projection period, Oil and Gas Exploration Activity will dominate the market sector. Clear brine fluids are salt-based solutions that are used in extraction and drilling activities in the petroleum and gas industries. These fluids also help to regulate high temperatures and pressures in the reservoir during conventional drilling techniques, reducing damage and dangers. The proliferation of the oil and gas sector, as well as increased drilling of rigs for gas extraction, will contribute considerably to industry expansion throughout the predicted period.

The depletion of readily available natural gas and crude oil sources is causing energy businesses to seek out unconventional energy sources, which is being accompanied by an increase in the use of efficient procedures, which will grow the clear brine fluids markets even further. Energy products derived from unconventional resources, such as gas hydrates, coal bed methane, shale gas/oil, and tight gas sands, are being developed by industry participants. Clear brine fluids will be required for the discovery and extraction of such energy sources from reserves, which will drive the market growth in these segment in the future

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,721.7 Million |

Projected Market Size in 2028 |

USD 2,428.4 Million |

CAGR Growth Rate |

5.9% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Albemarle Corporation, Baker Hughes Company, Cabot Corporation, Clements Fluids, EMEC, Halliburton, ICL, LANXESS, Schlumberger Limited, TETRA Technologies Inc., and Others |

Key Segment |

By Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Middle East and Africa gained a large proportion of the market

The Middle East and Africa acquired a significant share in the market over the forecast period, Middle East and Africa accounted for a significant share, due to many crude oil reserves in nations such as Saudi Arabia, Iran, and Kuwait. The presence of large oil corporations such as Saudi Aramco, Arabian American Oil Company, and Exxon Saudi Arabia will increase industry share. Drillers in this region can now drill and complete distinct, multiple, pressure-isolated, and accessible laterals from any single initial wellbore with ease. As a result, the completion and drilling fluids sector will have a larger growth potential. Furthermore, rising exports from the region will drive the production of crude oil and unconventional energy sources, boosting product growth over the research period.

North America will witness considerable growth in the clear brine fluids market because of the increasing shale gas industry in nations such as the United States and Canada. Drilling rig advancements, such as hydraulic fracturing and horizontal drilling for gas exploration, will significantly support the product share over the study timeframe. Furthermore, increased product utilization in shale gas reserves will contribute to the volume size. Industry participants also spend in R&D for the creation of petroleum-based products to meet the diverse needs of end-user industries.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the Clear Brine Fluids Market include -

- Albemarle Corporation

- Baker Hughes Company

- Cabot Corporation

- Clements Fluids

- EMEC

- Halliburton

- ICL

- LANXESS

- Schlumberger Limited

- TETRA Technologies Inc.

Clear Brine Fluids Market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Calcium Chloride

- Sodium Chloride

- Zinc Calcium bromides

- Cesium Formate

- Potassium Chloride

- Other Product Types

By Application Segment Analysis

By Application Segment Analysis

- Oil and Gas Exploration

- Enhanced Oil Recovery

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Albemarle Corporation

- Baker Hughes Company

- Cabot Corporation

- Clements Fluids

- EMEC

- Halliburton

- ICL

- LANXESS

- Schlumberger Limited

- TETRA Technologies Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors