Search Market Research Report

Dental Charting Software Market

Dental Charting Software Market Size, Share, Growth Analysis Report By Practice Type (General Dentistry, Specialized Dentistry, Dental Laboratories), By Practice Size (Solo Practitioners, Group Practices, Dental Chains), By Deployment Mode (Cloud-based, On-premises), By End-User (Dental Clinics, Hospitals, Dental Schools), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

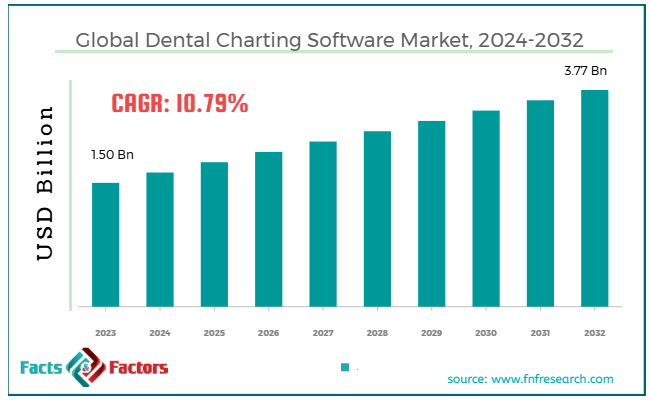

[225+ Pages Report] According to Facts & Factors, the global dental charting software market size was worth around USD 1.50 billion in 2023 and is predicted to grow to around USD 3.77 billion by 2032, with a compound annual growth rate (CAGR) of roughly 10.79% between 2024 and 2032.

Market Overview

Market Overview

Dental charting software is a tool for dental professionals to track, record, and manage patients' oral health details. It enables effective documentation of the complete dental history, diagnosis, patient procedures, and treatment plans. The software usually comprises features such as tooth numbering systems, visual charts, treatment advice, and condition annotations.

The global dental charting software market is anticipated to progress considerably, impacted by the growing demand for improved patient care, growing digitalization in healthcare, and rising adoption of modernized tools in the dental market.

The inclination towards digital tools and EHR or electronic health records from paper-based records in medicine is increasing remarkably. Dental charting software is a major component of this transformation, increasing the efficiency of practices, enhancing overall care delivery, and reducing inaccuracies.

Moreover, the integration of ML, AI, and advanced analytics is fueling the market. These solutions improve treatment planning, and diagnostic capabilities, and forecast patient requirements, thus enhancing outcomes.

Nevertheless, the global market is hampered by significant initial costs and data privacy and security issues. The upfront cost of installing the said software, comprising hardware and software installation and training, could pose a barrier, mainly for small dental practitioners in emerging nations.

Moreover, digitally managing and storing confidential patient information increases concerns about data breaches, cybersecurity threats, and patient privacy violations.

Also, the growth of tele-dentistry and telemedicine offers key opportunities for providers of dental charting software to incorporate remote consultation abilities.

Enabling dentists to access this data irrespective of location, the software improved the reach and convenience of dental care. The rising trend for cloud-based software offers remote accessibility, scalability, and decreased infrastructure costs. Cloud-based tools allow dental practices to store data safely while promising accessibility from different locations and devices.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global dental charting software market is estimated to grow annually at a CAGR of around 10.79% over the forecast period (2024-2032)

- In terms of revenue, the global dental charting software market size was valued at around USD 1.50 billion in 2023 and is projected to reach USD 3.77 billion by 2032.

- The dental charting software market is projected to grow significantly owing to the growing use of digital dentistry, integration of innovative technologies, supportive government regulations and initiatives, and elevated demand for integrated healthcare systems.

- Based on practice type, the general dentistry segment is expected to lead the market, while the specialized dentistry segment is expected to register considerable growth.

- Based on practice size, the group practices segment is the dominating segment among others, while the solo practitioner segment is projected to witness sizeable revenue over the forecast period.

- Based on deployment mode, the cloud-based segment is expected to lead the market compared to the on-premises segment.

- Based on end-user, the dental clinics segment is expected to register a major market share compared to the hospitals segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Growing awareness of preventive care and oral health propel the dental charting software market growth

Increasing public awareness of the significance of oral health has majorly increased dental clinic visits. Patients are increasingly becoming proactive in availing regular checkups, thus increasing the demand for technologies that aid dental practitioners in managing the data of patients effectively. The global dental charting software market is projected to progress at a considerable CAGR, touching $ 4.63, owing to the growing emphasis on general dental wellness and preventive care.

As per a 2024 survey by the ADA (American Dental Association), nearly 74% of individuals are rigorously seeking digital health services, such as electronic charting, to effectively manage their dental health. The rising interest in preventive care has encouraged dental practices to implement tools that accurately track oral health.

- Improved engagement and experience among patients fuel the market growth

Dental charting software performs beyond just record-keeping. It enhances patient engagement and allows dentists to develop interactive experiences for individuals, like tracking progress, visualizing treatment plans, and offering educational resources.

As per a survey conducted in 2024, approximately 67% of patients choose access to their online dental records, impacting dental practices to use tools that enable better patient engagement.

Curve Dental recently declared a novel upgrade to charting software that enables patients to easily access their previous treatment and impending appointments through a smartphone. This shift complies with the rising trend of patient-centric care, wherein individuals demand better engagement in planning treatment.

Restraints

Restraints

- Resistance to technical change to hinder the dental charting software market progress

Most dental experts are hesitant to shift from former paper-based solutions to digital technologies owing to issues regarding reliability, learning curve, and the alleged complexity of novel technologies.

A study conducted in 2023 reveals that 30% of dentists were hesitant to use digital charting software, citing comfort with the current manual processes and unfamiliarity with the new ones.

In 2023, a survey stated that nearly 40% of conference attendees reported concerns regarding the resources and time needed to educate their workforce on novel dental software solutions.

Opportunities

Opportunities

- Incorporation with adoption of cloud-based solutions and EHR to impact the dental charting software market growth

Incorporating dental charting software with electronic health records may enhance communication among medical and dental professionals and simplify data management. They can also effectively improve overall patient wellness.

Carestream Dental launched a novel software update that smoothly incorporates diverse electronic health records. This enables various dental practices to gain access to exhaustive patient records and enhance interdisciplinary care.

Moreover, cloud-based software provides remote access, scalability, and decreased IT infrastructure costs. This increases its appeal for different sizes of dental practices, thus impacting the global dental charting software industry.

- Increasing number of government initiatives and rising awareness of oral health drive the global market

A majority of governments are applying initiatives to enhance oral healthcare standards and accessibility. These efforts mostly comprise funding for procuring dental software, thus creating prospects for growth in the dental charting software market.

Furthermore, growing awareness of oral health is fueling the demand for effective dental care solutions. This trend is projected to drive the adoption of the said software as practices aim to satisfy more patients' problems and expectations.

Challenges

Challenges

- Integration issues with current systems restrict the growth of the dental charting software market

Integrating novel dental charting software with the current practice management software, EHR, and other tools may be challenging and result in workflow disturbances and data inconsistencies.

A 2022 report stated that approximately 25% of dental services witnessed incorporation problems while adopting novel software, leading to operational efficiencies.

Moreover, in 2023, a dental clinic stated major data differences and workflow disturbances after incorporating a novel charting system with their present systems, resulting in the momentary suspension of digital operations.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 1.50 Billion |

Projected Market Size in 2032 |

USD 3.77 Billion |

CAGR Growth Rate |

10.79% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Dentrix, Eaglesoft, Curve Dental, Open Dental, PracticeWorks, Carestream Dental, Planet DDS, DentiMax, SoftDent, ABELDent, MACRA Dental, Easy Dental, Ortho2, DentalXChange, Gendex., and Others. |

Key Segment |

By Practice Type, By Practice Size, By Deployment Mode, By End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global dental charting software market is segmented based on practice type, practice size, deployment mode, end user, and region.

Based on practice type, the global dental charting software industry is divided into general dentistry, specialized dentistry, and dental laboratories. The general dentistry segment held a notable share of the market in 2023 and is anticipated to grow progressively over the estimated period. General dentistry comprises a broad range of services like fillings, regular checkups, preventive care, and cleanings, vital for maintaining optimal oral health. The broad applicability of these practices is contributing to the rising demand for the said software in this domain.

On the other hand, the specialized dentistry segment is the second-leading in the market owing to the rising complexity of dental services in these specialties.

Based on practice size type, the global dental charting software industry is segmented into solo practitioners, group practices, and dental chains. In 2023, the group practices segment held a major share of the market and is expected to dominate in the future as well. Group practices, including numerous dental experts operating under a sole entity, mostly demand scalable and exhaustive dental charting systems to effectively manage huge volumes of complex workflows and patients. The demand for scalable services in group practices has contributed to its dominant share in the global market.

However, the solo practitioners segment is projected to be the second-leading in the dental charting software market. They operate individually and aim for cost-effective and user-friendly dental charting systems to enhance patient care and simplify practice management.

Based on deployment mode, the global market is segmented as cloud-based and on-premises. The cloud-based segment gained a prominent share of the market in 2023 and is projected to lead over the forecast period as well. Cloud-based software offers benefits like scalability, flexibility, cost-effectiveness, and minimum dependency on local hardware. These advantages increase its appeal among SMEs, thus increasing its adoption.

However, the on-premises segment will also hold a substantial share of the market in the coming years. This mode offers better control of data and tailored opportunities, which is an attractive option for most dental practices.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America registered a considerable share of the global dental charting software industry in 2023 and is projected to continue its dominance over the forecast years as well, owing to the high adoption of enhanced dental technologies, the presence of prominent dental software companies, and significant investment in healthcare.

North America presents a strong shift towards using superior dental technologies, comprising digital charting systems to improve patient care and simplify practice management. The region is home to most of the leading software firms, supporting competition and innovation and fueling industry growth.

Moreover, the region distributes a major share of its GDP to the healthcare sector, aiding the implementation and acquisition of dental charting software.

Europe is projected to progress as the second-leading region in the dental charting software market owing to the rising adoption of digital technologies, growing healthcare expenses, and the presence of prominent dental software providers. European dental practices are actively integrating digital solutions like dental charting software to streamline operations and improve patient care and experience.

European nations distribute key resources to healthcare, thus supporting the acquisition of modernized dental software services. The region is also home to numerous key dental software companies, aiding competition and advancements that fuel the industry's growth.

Competitive Analysis

Competitive Analysis

The global dental charting software market is led by players like:

- Dentrix

- Eaglesoft

- Curve Dental

- Open Dental

- PracticeWorks

- Carestream Dental

- Planet DDS

- DentiMax

- SoftDent

- ABELDent

- MACRA Dental

- Easy Dental

- Ortho2

- DentalXChange

- Gendex

Key Market Trends

Key Market Trends

- Incorporation with practice management software:

Dental charting software is actively being incorporated with practice management systems. This allows smooth sharing of scheduling, patient data, billing, and most administrative functions. This incorporation improves workflow efficacy and decreases manual efforts.

- Growth of teledentistry services:

The growth of tele-dentistry has significantly developed dental charting software that aids virtual consultations, allowing dental experts to offer remote care to patients. This growth facilitates access to dental care, mainly for patients with mobility challenges and who are in rural areas.

The global dental charting software market is segmented as follows:

By Practice Type Segment Analysis

By Practice Type Segment Analysis

- General Dentistry

- Specialized Dentistry

- Dental Laboratories

By Practice Size Segment Analysis

By Practice Size Segment Analysis

- Solo Practitioners

- Group Practices

- Dental Chains

By Deployment Mode Segment Analysis

By Deployment Mode Segment Analysis

- Cloud-based

- On-premises

By End User Segment Analysis

By End User Segment Analysis

- Dental Clinics

- Hospitals

- Dental Schools

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Dentrix

- Eaglesoft

- Curve Dental

- Open Dental

- PracticeWorks

- Carestream Dental

- Planet DDS

- DentiMax

- SoftDent

- ABELDent

- MACRA Dental

- Easy Dental

- Ortho2

- DentalXChange

- Gendex

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors