Search Market Research Report

Diaper Market Size, Share Global Analysis Report, 2024 – 2032

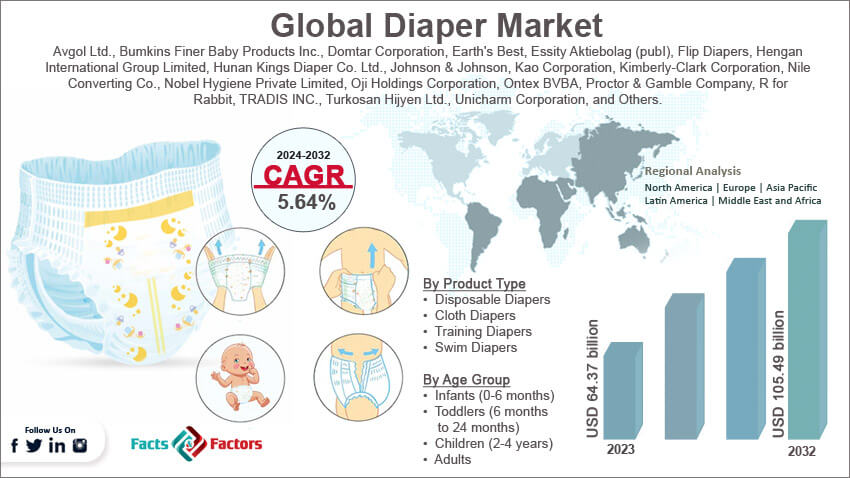

Diaper Market Size, Share, Growth Analysis Report By Product Type (Disposable Diapers, Cloth Diapers, Training Diapers, and Swim Diapers), By Material (Conventional Diapers and Organic Diapers), By Age Group (Infants (0-6 months), Toddlers (6 months to 24 months), Children (2-4 years), and Adults), By Size (Small, Medium, and Large), By Distribution Channel (Supermarkets & Hypermarkets, Online Stores, and Pharmacies), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

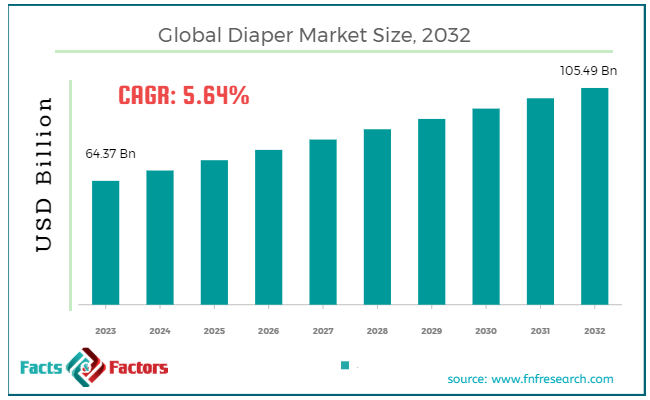

[218+ Pages Report] According to Facts & Factors, the global diaper market size in terms of revenue was valued at around USD 64.37 billion in 2023 and is expected to reach a value of USD 105.49 billion by 2032, growing at a CAGR of roughly 5.64% from 2024 to 2032. The global diaper market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

A diaper is a type of underwear that allows the wearer to defecate or urinate without the use of a toilet, by absorbing or containing waste products to prevent soiling of outer clothing or the external environment. Diapers are primarily worn by infants and toddlers who are not yet toilet trained, and by individuals who suffer from incontinence or other conditions that prevent the control of bowel or bladder movements. Diapers can be made of cloth or synthetic disposable materials. Cloth diapers are washable and reusable, while disposable diapers offer convenience but are more environmentally taxing.

The diaper market is extensive and continues to grow due to factors such as rising global birth rates in developing countries and increasing elderly populations in developed nations. The market is dominated by disposable diapers, which are favored for their convenience and hygiene benefits, although environmental concerns have led to renewed interest in cloth diapers as well as innovations towards more sustainable and biodegradable disposable options.

Key Highlights

Key Highlights

- The diaper market has registered a CAGR of 5.64% during the forecast period.

- In terms of revenue, the global diaper market was estimated at roughly USD 64.37 billion in 2023 and is predicted to attain a value of USD 105.49 billion by 2032.

- The growth of the diaper market is being propelled by rising birth rates, increasing disposable income, and growing awareness of hygiene.

- Based on the product type, the disposable diapers segment is growing at a high rate and is projected to dominate the global market.

- Based on the distribution channel, the online stores segment is projected to swipe the largest market share.

- By region, the Asia-Pacific region currently dominates the global diaper market.

Growth Drivers

Growth Drivers

- Rising Global Population: The increasing birth rates in developing regions contribute significantly to the demand for baby diapers. More births mean a greater need for diapers, driving consistent market growth.

- Aging Populations: In developed countries, the demographic trend towards older populations has led to a rise in demand for adult diapers. As the elderly population grows, issues like incontinence become more prevalent, boosting the market for adult diapers.

- Technological Advancements: Innovations in diaper design, such as improved absorbency, eco-friendly materials, and enhanced comfort, continue to attract consumers and encourage regular purchases.

Restraints

Restraints

- Environmental Concerns: The environmental impact of disposable diapers, which contribute significantly to landfill waste, poses a restraint as consumers become more environmentally conscious. This has led to increased scrutiny and criticism of disposable diaper usage.

- Market Saturation: In developed markets, high levels of competition and market saturation pose challenges. Most families in these regions already use diapers, limiting new market opportunities within these established markets.

- Price Sensitivity: In developing economies, the high cost of disposable diapers can be a significant barrier to market entry. Many families in these regions find it difficult to afford regular purchases, which limits market growth.

Opportunities

Opportunities

- Biodegradable and Eco-Friendly Products: There is a growing opportunity for manufacturers to invest in developing biodegradable and environmentally friendly diaper options. As consumer awareness and preference for sustainable products increase, these innovations can capture a new segment of the market.

- Expansion in Emerging Markets: Developing regions present significant opportunities for market expansion. Increasing disposable incomes, urbanization, and growing awareness about hygiene are contributing to higher demand for diapers in these areas.

- Adult Diaper Market: With the global increase in life expectancy and the aging population, there is a growing market for adult diapers. Expanding product lines to include adult diapers can open new revenue streams for manufacturers.

Challenges

Challenges

- Raw Material Prices: Fluctuations in the prices of raw materials, such as superabsorbent polymers and non-woven fabrics, can affect production costs and profitability. Manufacturers need to manage these costs effectively to maintain competitive pricing.

- Regulatory Compliance: Meeting health and safety standards is crucial in the diaper industry. Compliance with these regulations can be costly and complex, especially when expanding into new geographical markets with different standards.

- Consumer Shift Towards Alternatives: As more consumers become aware of the environmental issues associated with disposable diapers, there is a shift towards alternative products like cloth diapers or more sustainable disposables. This shift requires companies to innovate continuously and adapt their product offerings to retain market share.

Diaper Market: Segmentation Analysis

Diaper Market: Segmentation Analysis

The global diaper market is segmented based on product type, material, age group, size, distribution channel, and region.

By Product Type Insights

By Product Type Insights

Based on Product Type, the global diaper market is bifurcated into disposable diapers, cloth diapers, training diapers, and swim diapers. Disposable diapers are the most commonly used type of diapers, favored for their convenience and availability. They include varieties such as ultra-absorbent, regular, and biodegradable. Disposable diapers dominate the market due to their high convenience factor and widespread acceptance, particularly in developed regions. They exhibit a robust CAGR, driven by ongoing product innovations and disposable income growth in emerging markets.

Cloth diapers are reusable and offer an eco-friendly alternative to disposable types. They are available in various styles such as pre-fold, fitted, and all-in-one. Although smaller in market share, the segment is growing due to rising environmental awareness and cost-effectiveness over time. The growth rate is moderate but increasing as consumer preferences shift towards sustainable products.

Training Diapers designed for toddlers during the toilet training phase, these diapers facilitate easy on-and-off and help children transition to regular underwear. This segment is seeing a steady growth rate as they are a necessary step in child development, especially in markets with high child populations. Swim Diapers are designed for use in pools and beaches to prevent leaks in water. Swim diapers are waterproof and reusable. Growth in this segment is moderate, driven by seasonal demand and the increasing popularity of infant swimming activities.

By Material Insights

By Material Insights

On the basis of Material, the global diaper market is categorized into conventional diapers and organic diapers. Conventional Diapers are cost-effective diapers, made with synthetic materials like polypropylene & absorbent polymers, and hold the largest market share due to affordability and wide availability. Organic diapers made with biodegradable materials like bamboo and cotton are experiencing the fastest growth. Rising consumer interest in natural and chemical-free products is fueling the explosive expansion of organic diapers.

By Age Group Insights

By Age Group Insights

Based on Age Group, the global diaper market is divided into infants (0-6 months), toddlers (6 months to 24 months), children (2-4 years), and adults. Products specifically designed for newborns or Infants (0-6 months) focus on gentleness and high absorbency, considering infants' sensitive skin and frequent changes.

Diapers for toddlers (6 months to 24 months) group are designed to offer mobility for active babies and varying levels of absorbency for different stages of baby growth. Diapers include training pants designed to facilitate potty training with features that enable children (2-4 years) to manage them independently. Adult diapers cater to incontinence issues in the elderly and those with medical conditions. Variants include overnight and discreet styles for active users.

By Size Insights

By Size Insights

On the basis of Size, the global diaper market is categorized into small, medium, and large. Small size diapers targeted at newborns and small infants, these diapers are designed for comfort and to prevent leaks for smaller body sizes. This segment shows a steady growth rate, consistent with global birth rates.

Medium size diapers cater to infants who are growing out of small sizes but are not yet large enough for the next size up. This is a significant segment in the market with a stable growth rate, as it captures a broad age range of infants. Large size diapers for older and larger infants, these diapers provide greater coverage and absorbency. As children are wearing diapers for longer periods in some regions, this segment's growth is solid, supported by the trend of extended diaper usage.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the global diaper market is divided into supermarkets & hypermarkets, online stores, and pharmacies. Supermarkets & hypermarkets remain the dominant distribution channels due to their widespread accessibility and the ability to offer a wide range of products. This segment has a high CAGR, benefiting from one-stop shopping convenience and consumer preferences for brick-and-mortar shopping experiences.

Online stores are rapidly growing as consumers appreciate the convenience of home delivery and often lower prices. The online stores segment exhibits the highest CAGR within distribution channels, propelled by technological advancements and changing consumer shopping habits. Pharmacies are a crucial distribution channel, especially for specialty diapers like biodegradable or cloth diapers. Moderate growth is observed in this segment, supported by consumer trust in purchasing from health-focused outlets.

Recent Developments:

Recent Developments:

- In 2023, Kimberly-Clark Corporation revitalized its popular Huggies brand in India with the introduction of the 'Huggies Complete Comfort' range. This new line emphasizes enhanced comfort for infants through improved design features.

- In the same year, Kao Corporation initiated a collaborative project with Kyoto University and the local government of Saito City, Ehime Prefecture, Japan, to test a pioneering recycling system for used disposable diapers. This 'Used Disposable Diaper Carbonization Recycling System' aims to address waste management and sustainability concerns within the industry.

- Procter & Gamble Company expanded its production capabilities in March 2023 by launching a new P864-million manufacturing line for Pampers diapers in Cabuyao, Laguna. This expansion is part of the company's strategy to meet growing demand and enhance supply efficiency in the region.

- Pampers, another major brand under Procter & Gamble, introduced a novel hybrid diaper model, the Pure Protection Hybrid Diaper, which combines reusable and disposable elements. This innovative product leverages Pampers' established technology to offer superior dryness and leak protection while reducing disposable material use by 25%.

- R for Rabbit, primarily known for manufacturing baby gear, ventured into the premium diaper market in February 2022. They launched 'Feather Diapers,' which are touted for their breathability and comfort. Alongside this, the company also introduced diaper bins in India to facilitate easier disposal of used diapers, enhancing convenience for parents.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 64.37 Billion |

Projected Market Size in 2032 |

USD 105.49 Billion |

CAGR Growth Rate |

5.64% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Avgol Ltd., Bumkins Finer Baby Products Inc., Domtar Corporation, Earth's Best, Essity Aktiebolag (pubI), Flip Diapers, Hengan International Group Limited, Hunan Kings Diaper Co. Ltd., Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Nile Converting Co., Nobel Hygiene Private Limited, Oji Holdings Corporation, Ontex BVBA, Proctor & Gamble Company, R for Rabbit, TRADIS INC., Turkosan Hijyen Ltd., Unicharm Corporation, and Others. |

Key Segment |

By Product Type, By Material, By Age Group, By Size, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Diaper Market: Regional Analysis

Diaper Market: Regional Analysis

The Asia-Pacific region is the fastest-growing market for diapers, with the highest CAGR among all regions. This growth is fueled by high birth rates in populous countries such as India and China, coupled with increasing disposable incomes and urbanization. The region is experiencing a surge in demand for both baby and adult diapers, with a growing awareness of personal hygiene and the availability of disposable income. Companies are increasingly investing in localized production facilities to cater to this booming demand.

North America, particularly the United States, is a mature market for diapers, characterized by high product penetration and advanced consumer preferences towards eco-friendly and premium products. The region is known for its competitive landscape with leading companies like Procter & Gamble and Kimberly-Clark.

Although the birth rate in North America is relatively stable, the increasing demand for adult diapers boosts the market due to an aging population. The region exhibits a steady Compound Annual Growth Rate (CAGR) driven by innovations in product functionality and sustainability.

Europe holds a significant share of the global diaper market, with a strong emphasis on environmental sustainability driving demand for biodegradable and organic products. Western Europe is particularly dominant, with a high adoption rate of advanced diaper technologies and substantial market saturation. Eastern Europe presents faster growth potential due to rising disposable incomes and increasing market penetration. The European market's CAGR reflects steady growth with a strong push towards innovation in diaper recycling and waste management.

Latin America's diaper market is growing due to increasing urbanization and health awareness. Countries like Brazil and Mexico lead the region in diaper consumption. The market is characterized by a growing middle class and increasing accessibility to disposable income, which drives the demand for disposable diapers. The region shows a promising CAGR, propelled by economic improvements and a younger population base.

The Middle East and Africa (MEA) present a smaller, yet rapidly developing market for diapers. Economic development, particularly in the Gulf Cooperation Council (GCC) countries, along with rising standards of living and health awareness, contribute to market growth. The region's market is expanding as multinational companies increase their investments and as local populations become more accustomed to disposable diapers. The CAGR in MEA is expected to rise as market awareness and acceptance grow.

Diaper Market: List of Key Players

Diaper Market: List of Key Players

Some of the main competitors dominating the global diaper market include;

- Avgol Ltd.

- Bumkins Finer Baby Products Inc.

- Domtar Corporation

- Earth's Best

- Essity Aktiebolag (pubI)

- Flip Diapers

- Hengan International Group Limited

- Hunan Kings Diaper Co. Ltd.

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Nile Converting Co.

- Nobel Hygiene Private Limited

- Oji Holdings Corporation

- Ontex BVBA

- Proctor & Gamble Company

- R for Rabbit

- TRADIS INC.

- Turkosan Hijyen Ltd.

- Unicharm Corporation

The global diaper market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Disposable Diapers

- Cloth Diapers

- Training Diapers

- Swim Diapers

By Material Segment Analysis

By Material Segment Analysis

- Conventional Diapers

- Organic Diapers

By Age Group Segment Analysis

By Age Group Segment Analysis

- Infants (0-6 months)

- Toddlers (6 months to 24 months)

- Children (2-4 years)

- Adults

By Size Segment Analysis

By Size Segment Analysis

- Small

- Medium

- Large

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Supermarkets & Hypermarkets

- Online Stores

- Pharmacies

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Avgol Ltd.

- Bumkins Finer Baby Products Inc.

- Domtar Corporation

- Earth's Best

- Essity Aktiebolag (pubI)

- Flip Diapers

- Hengan International Group Limited

- Hunan Kings Diaper Co. Ltd.

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Nile Converting Co.

- Nobel Hygiene Private Limited

- Oji Holdings Corporation

- Ontex BVBA

- Proctor & Gamble Company

- R for Rabbit

- TRADIS INC.

- Turkosan Hijyen Ltd.

- Unicharm Corporation

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors