Search Market Research Report

Dietary Fiber Market

Dietary Fiber Market By Type (Soluble Dietary Fibers, Insoluble Dietary Fibers), By Source (Fruits & Vegetables, Legumes, Cereals & Grains), By Application (Food & Beverages, Dietary Supplements, Pharmaceuticals, Animal Feed), and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends and Forecast 2022 – 2028

Industry Insights

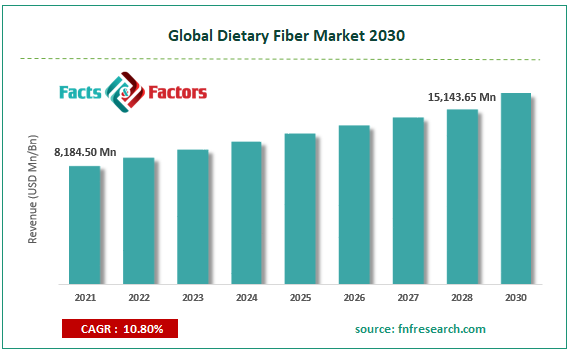

[215+ Pages Report] According to Facts and Factors, the global dietary fiber market was valued at USD 8,184.50 million in 2021 and is predicted to increase at a CAGR of 10.80% to USD 15,143.65 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

Dietary fibers are found in a variety of meals, however, they are mostly found in plant foods including fruits, vegetables, and legumes. These fibers aid in the elimination of waste, the prevention of diabetes and heart disease by lowering blood sugar and cholesterol levels, and the maintenance of a healthy weight. The surge in customer preference for natural products is a major element impacting the market expansion. The market is expected to increase as consumer concerns about preventative healthcare and the health benefits of dietary fibers develop. Demand for dietary fiber foods has risen as a result of an increase in the intake of functional foods, which, in addition to providing basic nutrition, have the potential to promote health.

The vast majority of people suffer from obesity, digestive issues, gastrointestinal infections, and other diseases. Market companies are taking this into account and creating dietary fiber products to aid in the treatment of such ailments. At the moment, the impact of rising health concerns on the dietary fibers market is low, but it is likely to grow in the future. However, too much dietary fiber in the diet can cause diarrhea, poor mineral absorption, and the loss of good cholesterol, which limits dietary fiber market growth. The rise of the foods and drinks industry is likely to be a major driver for the dietary fibers market, thanks to higher consumer spending and positive government backing. Dietary fibers can be found in legumes, whole grains such as cereals, wheat bran, brown rice, and other gluten-related foods. Gluten intolerance is one of the most frequent food sensitivities among today's consumers. Gluten-free diets are becoming increasingly popular among consumers due to the claims of improved health, higher energy, and weight loss. As there is an increasing number of people sensitive to gluten-containing foods such as wheat and other grains, the demand growth for dietary fibers will be hampered.

Legumes, whole grains like cereals, wheat bran, brown rice, and other gluten-related foods are high in dietary fibers. One of the most common food sensitivities among today's customers is gluten intolerance. Gluten-free diets are gaining popularity among consumers due to claims of better health, more energy, and weight loss. The demand for dietary fibers will be impeded as more people become intolerant to gluten-containing foods such as wheat and other grains. Another factor that could slow the growth of the dietary fibers market is the prevalence of diseases linked to gluten consumption, such as infertility, celiac disease, and neurological disorders. Another factor that could slow the growth of the dietary fibers market is the prevalence of diseases linked to gluten consumption, such as infertility, celiac disease, and neurological disorders. Consumption of gluten-free food products is increasing as the prevalence of celiac disease rises, which could slow the growth of the dietary fibers market.

Impact of COVID - 19

Impact of COVID - 19

Dietary fibers can be found in a variety of foods, including vegetables, fruits, legumes, and whole grains. Several governments were obliged to institute strict lockdowns and restrictions on mobility and business during the outbreak. This has a significant impact on the fruit and vegetable trade scenario, stifling market expansion for dietary fibers. The stoppage of production lines hampered a number of enterprises, particularly those in the food and beverage industry. Supply chain disruptions resulted in a scarcity of raw materials and a decline in finished product output. With the reduction of restrictions on travel and the opening up of economies, global demand for dietary fibers is expected to expand significantly in the future years due to its nutritional and health benefits.

The complete research study looks at both the qualitative and quantitative aspects of the dietary fiber market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply-side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Dietary Fiber market is segregated based on type, source, application, and region.

By type, the market is classified into soluble dietary fibers and insoluble dietary fibers. One of the most important categories is water-soluble dietary fibers. Inulin, pectin, polydextrose, beta-glucan, fructooligosaccharides, galactooligosaccharides, and maize fiber are among the ingredients. It slows down stomach emptying and regulates blood sugar levels, as well as lowers cholesterol levels. Its primary function is to increase intestinal viscosity and colonic fermentation.

By application, the market is divided into food & beverages, dietary supplements, pharmaceuticals and animal feed. Dietary fibers are carbohydrate polysaccharides that, when consumed, are not entirely digested by gastrointestinal enzymes, allowing them to absorb water and ferment, allowing beneficial bacteria to proliferate in the intestine. This is beneficial for improving immunity and ensuring smooth bowel motions. Fiber consumption, whether in the form of food or supplements, has been linked to a reduction in gastrointestinal problems such as duodenal ulcers, appendicitis, constipation, and colon cancer.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 8,184.50 Million |

Projected Market Size in 2028 |

USD 15,143.65 Million |

CAGR Growth Rate |

10.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Archer Daniels Midland Company, Kerry Group, Ingredion Incorporated, DuPont, Cargill, Incorporated, CP Kelco, Roquette Frères, UNIPETonsIN Ingredients AG, BENEO, Tereos S.A., Advocare International, L.P., RETTENMAIER & SÖHNE GmbH + Co KG, Tate & Lyle, Yugen Chemicals, Grain Processing Corporation, Grain Millers, Inc., COSUCRA, Nexira, Drytech Industries, Lonza Group, and Others |

Key Segment |

By Type, Source, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The market for dietary fibers in North America is expected to rise due to the rising demand for fiber supplements as a result of increased health awareness and a significant increase in exports to other nations. Furthermore, innovation in the fiber supplement market, such as fiber supplement products available in a variety of flavors and combinations (such as cinnamon oatmeal raisin and cranberry lemon drizzle), benefits cholesterol reduction and supports better heart health. Furthermore, the FAO claims that dietary fiber reaches the large intestine and is digested by the colonic bacteria, resulting in the generation of SCFA, hydrogen, carbon dioxide, and biomass.

List of Key Players in the Global Dietary Fiber Market:

List of Key Players in the Global Dietary Fiber Market:

- Archer Daniels Midland Company

- Kerry Group

- Ingredion Incorporated

- DuPont

- Cargill, Incorporated

- CP Kelco

- Roquette Frères

- UNIPETonsIN Ingredients AG

- BENEO

- Tereos S.A.

- Advocare International, L.P.

- RETTENMAIER & SÖHNE GmbH + Co KG

- Tate & Lyle

- Yugen Chemicals

- Grain Processing Corporation

- Grain Millers, Inc.

- COSUCRA

- Nexira

- Drytech Industries

- Lonza Group

The Global Dietary Fiber Market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Soluble Dietary Fibers

- Insoluble Dietary Fibers

By Source Segment Analysis

By Source Segment Analysis

- Fruits & Vegetables

- Legumes

- Cereals & Grains

By Application Segment Analysis

By Application Segment Analysis

- Food & Beverages

- Dietary Supplements

- Pharmaceuticals

- Animal Feed

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Archer Daniels Midland Company

- Kerry Group

- Ingredion Incorporated

- DuPont

- Cargill, Incorporated

- CP Kelco

- Roquette Frères

- UNIPETonsIN Ingredients AG

- BENEO

- Tereos S.A.

- Advocare International, L.P.

- RETTENMAIER & SÖHNE GmbH + Co KG

- Tate & Lyle

- Yugen Chemicals

- Grain Processing Corporation

- Grain Millers, Inc.

- COSUCRA

- Nexira

- Drytech Industries

- Lonza Group

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors