Search Market Research Report

Dimethyl Ether (DME) Market Size, Share Global Analysis Report, 2022 – 2028

Dimethyl Ether (DME) Market By Source (Natural Gas, Coal, and Bio-based Products), By Application (Propellants, LPG Blending, Fuel, and Other Applications.), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022 – 2028

Industry Insights

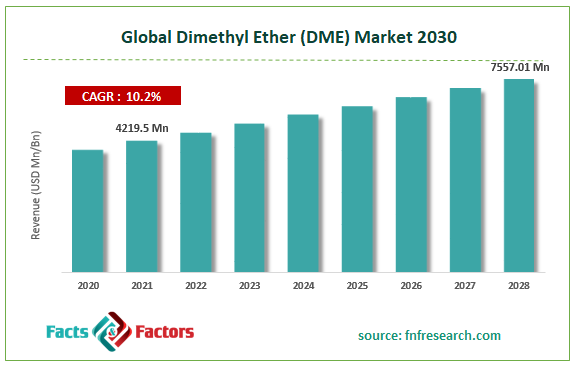

[217+ Pages Report] According to Facts and Factors, the Global Dimethyl Ether (DME) Market was worth around USD 4219.5 million in 2021 and is estimated to grow to about USD 7557.01 million by 2028, with a compound annual growth rate (CAGR) of approximately 10.2% over the forecast period. The report analyzes the Dimethyl Ether (DME) Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the private hospital market.

Market Overview

Market Overview

Dimethyl ether (DME) is a clean energy source made from fossil fuels such as petroleum waste, coal bed methane, natural gas, and coal. Dimethyl ether derived from fossil fuels is collected from the dead remnants of plants and animals, whereas bio-based dimethyl ether is produced as synthetic gas, also known as syngas, from renewable materials such as biomass, waste, and agricultural products, and then converted to DME. The considerable growth in the automotive industry, coupled with rapid industrialization worldwide, is one of the major factors driving the growth of the market in the forecast period. In addition, growing environmental consciousness among the population is also propelling the growth of the market.

Due to rigorous governmental regulation, automobile manufacturers are rapidly replacing transportation fuels such as diesel, gasoline, and LPG with cleaner fuels that have a high ignition value and low levels of carbon emissions into the environment, propelling the market in the future years. The growing requirement of DME for enhanced oil recovery and improved efficiency of various drilling and fracturing processes is also contributing to the growth of the market. Moreover, the widespread adoption of DME as an aerosol propellant in the manufacturing process of pharmaceuticals, paints, coatings, and personal care products, such as perfumes and hair sprays, is driving the market further.

COVID-19 Impact:

COVID-19 Impact:

The global impact of COVID-19 has been unusual and alarming, with dimethyl ether facing a negative demand shock in all domains as a result of the pandemic. Due to the pandemic situation, demand for DME-based LPG fuel from the automobile market has declined, since people are not traveling as frequently. Due to lower consumer spending and corporate closures, the country's severe COVID-19 epidemic hindered economic development. Due to the sudden pandemic-lockdown worldwide in the wake of Covid-19, the supply-demand chain for the DME got disturbed as a result of the market facing a slowdown in the pandemic period. The worldwide lockdown reduced global oil production by 15-20 million barrels per day (MBPD). As a result of which, there was a decline in oil consumption worldwide, which in turn, caused a decline the dimethyl ether consumption.

Growth Drivers

Growth Drivers

- Global Demand for Blended DME & LPG Substituted DME to Aid Growth

In recent years, liquefied petroleum gas (LPG) mixing has arisen as a key application. Because of its low toxicity, high cetane number, and superior flammability, DME is also a viable substitute for LPG. DME may be manufactured using a variety of raw sources, including methanol, wood, and syngas, allowing for greater output and demand. Because of its great combustion qualities, DME is being promoted as a modern and renewable synthetic fuel by companies all over the world. It may be used to replace liquefied petroleum gas (LPG) or mixed into a fuel combination. The property of DME is that it is a gas at average temperatures and pressures, but it can be liquefied at moderate pressure makes it a suitable choice. DME, like LPG, may be used for cooking and heating.

Dimethyl ether’s resemblance to LPG and simplicity of processing from multiple feedstocks give many opportunities again for ultra-clean fuel to enter new markets throughout the world as an LPG substitute. Blending is becoming increasingly prevalent in the huge and expanding LPG sector, particularly in developing nations where portable (bottled) fuel provides a cooler, healthier, and more ecologically friendly fuel for cooking and heating, and its usage for such home applications is quickly increasing. The use of DME as an alternative energy source has sparked great interest in a number of nations, with several governments launching programs. The market for "greener" energy sources in developing economies has sparked interest in blends containing products made from renewable feedstock.

Private Hospital Market: Restraints

Private Hospital Market: Restraints

- Regulations & Cost May Hamper the Market Growth

The International Organization for Standardization is expected to issue international guidelines on the use of DME, which is expected to hamper the growth of the market. In addition, official regulation governing the quantity, storage, and percentages of Dimethyl Ether (DME) that may be used in the blending process as a necessary next step toward market expansion, as well as the creation of globally recognized safety and handling practices, would provide a barrier to market growth. According to a dimethyl ether market analysis, the key market limitation would be the price of automobile-based gasoline.

As a consequence, it is realistic to expect it to continue growing in the foreseeable future. This may have an effect on the total price of fuel, causing people to avoid purchasing it. Raw material price volatility can be a significant concern for producers. Because dimethyl ether (DME) is less efficient than diesel fuels, its market development may be hampered. It might also gradually lower the typical growth rate of the same.

Private Hospital Market: Segmentation

Private Hospital Market: Segmentation

The global dimethyl ether (DME) market is segregated based on source, application, and region.

Based on the Source, the Dimethyl Ether (DME) market can be further segmented into Natural Gas, Coal, and Bio-based Products. The increasing supply of natural gas is considered to be the major factor driving the sector's growth. In addition, it can be used for a variety of uses, including propellants, LPG mixing, and aerosol. However, the growth of coal-based applications will accelerate significantly during the forecast period, due to the ongoing shortage of coal.

By application, the market is segmented into Propellants, LPG Blending, Fuel, and Other Applications. LPG blending segment acquired the largest share during the forecast period. The various advantages offered by DME such as smooth less combustion, ultra-low emissions, high cetane, low-cost LPG-compatible equipment and logistics, and high energy density, make it an alternative choice. DME is also being widely used in aerosol propellants as an organic compound such as dimethyl sulfate, acetic acid, ammonium nitrate, ammonium phosphate, and ammonia production. In addition, DME can be used as a green refrigerant, as it has a significantly smaller global warming risk than chlorofluorocarbons and has no ozone depletion potential.

Dimethyl Ether (DME) comes from a variety of sources, including natural gas, biomass, waste from pulp and paper mills, forest products, agricultural by-products, construction waste, and devoted fuel crops like switchgrass. It can also be made from synthesis gas produced by coal or biomass gasification, as well as natural gas reforming. Direct synthesis is the most efficient of the various processes for the chemical conversion of natural gas.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4219.5 Million |

Projected Market Size in 2028 |

USD 7557.01 Million |

CAGR Growth Rate |

10.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Air Products Inc., DME-AEROSOL, Grillo Werke AG, Jiutai Energy Group, KOREA GAS CORPORATION, Mitsubishi Corporation, Nouryon, Oberon Fuels, Royal Dutch Shell PLC, The Chemours Company, Zagros Petrochemical Company., and Others |

Key Segment |

By Source, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

With the availability of raw materials at reasonable prices in the Asia Pacific, the region dominates the global dimethyl ether market. The increasing use of dimethyl ether in a variety of applications, including transportation fuel, aerosol propellant, LPG blending, and others, is expected to help this region generate significant revenue in the coming years. Dimethyl ether is an excellent alternative for use as an energy fuel, and the market for it is expected to grow profitably in the coming years. As a result of strict environmental regulations imposed on the transportation and power industries, the dimethyl ether market is expected to grow significantly. China is the most profitable country in the dimethyl ether market in the region.

North America is estimated to be the fasting growing region in the market, and in North America, the United States is expected to be the largest market which is expected to drive the market in the forecast period. DME is used in the Propane autogas in vehicles for LPG blending. Following gasoline and diesel, propane autogas is the most popular alternative fuel in the United States and the third most commonly used vehicle fuel. More than 90% of the propane autogas produced in the United States is made in the country. The regional market is expected to be driven by this factor.

Recent Developments

Recent Developments

- In 2020, Air Products and Topsoe sign a global agreement for collaboration on large-scale ammonia, methanol, and/or dimethyl ether projects around the world. The two companies will work together to develop potential projects by combining their expertise in large-scale ammonia, methanol, and/or dimethyl ether plants to be developed and built around the world.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the Dimethyl Ether (DME) Market include-

- Air Products Inc.

- DME-AEROSOL

- Grillo Werke AG

- Jiutai Energy Group

- KOREA GAS CORPORATION

- Mitsubishi Corporation

- Nouryon

- Oberon Fuels

- Royal Dutch Shell PLC

- The Chemours Company

- Zagros Petrochemical Company.

The dimethyl ether (DME) market is segmented as follows:

By Source Segment Analysis

By Source Segment Analysis

- Natural Gas

- Coal

- Bio-based Products

By Application Segment Analysis

By Application Segment Analysis

- Propellants

- LPG Blending

- Fuel

- Other Applications

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Air Products Inc.

- DME-AEROSOL

- Grillo Werke AG

- Jiutai Energy Group

- KOREA GAS CORPORATION

- Mitsubishi Corporation

- Nouryon

- Oberon Fuels

- Royal Dutch Shell PLC

- The Chemours Company

- Zagros Petrochemical Company

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors