Search Market Research Report

Cosmetic Tubes Market Size, Share Global Analysis Report, 2021 – 2026

Cosmetic Tubes Market By Material (Glass, Paper & Board, Plastic, Metal, & Others), By Application (Skin Care, Hair Care, Makeup, & Nail Care), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

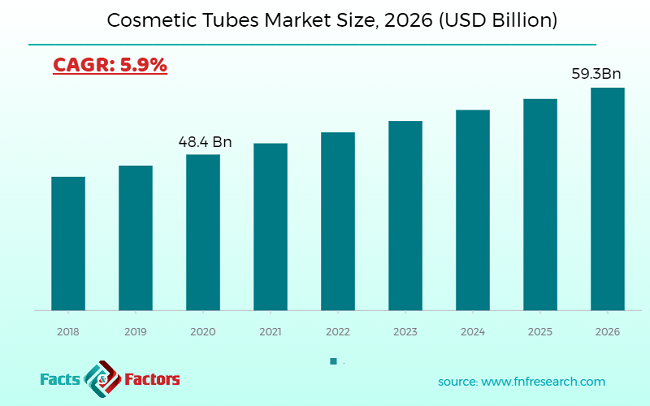

[197+ Pages Report] The latest finding surrounding the “Global Cosmetic Tubes Market” published by Facts & Factors offers a neatly packaged and comprehensive read. We at Facts & Factors estimate that the global cosmetic tubes market will reach a projected value of USD 59.3 Billion by 2026 growing at a CAGR of 5.9% from an initial value of USD 48.4 Billion in the year 2020.

Market Overview

Market Overview

Cosmetic tubes are the protection that is applied for the protection of products and their offset branding measures that further provide an additional layer from all the wear and tears during handling and transportation measures. This packaging can take various forms such as tubes, pouches, jars, and others and a variety of packaging materials such as plastic, paper, metal, and glass among others. Cosmetic tubes protect products from dust, dirt, moisture, heat, and sunlight.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the cosmetic tubes market will benefit more from the skincare and the hair care sector.

- According to our experts, in the Asia Pacific region major growth rate is anticipated from China which will exceed 5% during the forecast time period.

- As the U.S. holds the majority of popular cosmetic brands under its roof it implies that there is a strong retail network in this country thus the market gaining the foremost share from it.

- The majority of our primary respondents concluded that the dominant region for the cosmetic tubes market will be Europe.

- From our primary research, the CO-EX category in the type segment held around 2,200 Million Units in 2018.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per the analyst, cosmetic tubes produced from low-density Polyethylene (LDPE) are semi-rigid and translucent the tubes delivered will be more flexible, which in turn will increase its demand in the forecast period.

- In terms of volume, MDPE anticipates registering a growth rate of above 4% during the forecast period.

- The analysis confirms that in the type segment, the HDPE category held more than 20% of the market share in the year 2018.

- The increasing trend among the young population for natural and organic skincare products accounted for the skincare category more than 40% of the market share in 2018.

- The make-up category gained more than 15% of the market share in terms of volume in 2018.

Market Attractiveness in 2018 – By Product

Market Attractiveness in 2018 – By Product

Industry Growth Factors

Industry Growth Factors

The factors fuelling the global cosmetic tubes market include the rising share for the global cosmetic tubes market during the advent of the forecast are the rising demand for cosmetic products coupled with a higher demand from the cosmetic sector in terms of innovations, attractive, and sustainable packaging methods to name a few. Additionally, rising packaging requirements from the sectors of personal care, healthcare, and food coupled with increasing consumer awareness regarding personal health and wellness is expected to increase the footprint of the global cosmetic tubes market during the advent of the forecast period. Moreover, the rising demand for organic products coupled with rising environmental has led to innovations in bioplastics, aluminum, and others which will further overhaul the withstanding boundaries for the global cosmetic tubes market during the advent of the forecast period.

The global cosmetic tubes market is expected to be driven by the rising number of reliable vendors which distribute end products to users at a rapid rate coupled with a direct approach of manufacturers for users through the use of B2B commerce to name a few. The increasing disposable income among consumers coupled with rising digitalization measures is expected to fuel the growth of the global cosmetic tubes market during the advent of the forecast period. However, changing raw material prices coupled with rising environmental concerns about excessive usage is expected to decrease the market share during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global cosmetic tubes market is segmented into material, application, and region.

The global cosmetic tubes market is divided into glass, paper & board, plastic, metal, and others on the basis of material. The segment pertaining to glass is expected to witness the largest market share during the advent of the forecast owing to increasing adoption in the luxurious packaging segment coupled with the latter being a highly environment-friendly solution when compared to its counterpart to name a few. Additionally, increased functionality in terms of protection against moisture, light, and air coupled with added benefits of combining properties of metal and plastic is expected to cement the dominated market position of the latter during the advent of the forecast period. Based on application, the global cosmetic tubes market is categorized into skincare, haircare, makeup, and nail care. The segment pertaining to skincare is expected to witness the largest market share during the advent of the forecast owing to rising usage of makeup-related products coupled with rising penetration of multi-purpose skin-care products in the form of face creams, moisturizers, and others to name a few. Additionally, increased integration of hair care products coupled with increasing disposable income among the millennial population is expected to occupy the largest market share of the segment during the advent of the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 48.4 Billion |

Projected Market Size in 2026 |

USD 59.3 Billion |

CAGR Growth Rate |

5.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Amcor, Sealed Air Corporation, ALPLA Group, Aptar, Inc., HCP Packaging, Berry Global, Berlin Packaging, Albea SA, BIG SKY PACKAGING, DS Smith, Essel Propack Limited, Clariant, Unette Corporation, Romacco Group, and Hoffman Neopac AG, among others. |

Key Segments |

Materials, Applications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast owing to the rapid increase of disposable income among consumers coupled with an increasing number of the young population to name a few. Additionally, increasing digitization solutions coupled with the rising integration of social media platforms to reach a wider bunch of consumers will further increase the footprint of the cosmetic tubes market during the advent of the forecast period. Moreover, increasing concerns about environmental packaging solutions have led to rising adoption of sustainable and green packaging measures which will push the existing boundaries of the current cosmetic tubes market during the advent of the forecast period. North America is expected to occupy a substantial market share owing to the rising export figures coupled with an increasing number of consumers switching to post-consumer recycled (PCR) packaging to name a few.

Competitive Players

Competitive Players

The key market participants for the global cosmetic tubes market are:

- Amcor

- Sealed Air Corporation

- ALPLA Group

- Aptar Inc.

- HCP Packaging

- Berry Global

- Berlin Packaging

- Albea SA

- BIG SKY PACKAGING

- DS Smith

- Essel Propack Limited

- Clariant

- Unette Corporation

- Romacco Group

- Hoffman Neopac AG

By Material Segment Analysis

By Material Segment Analysis

- Glass

- Paper & Board

- Plastic

- Metal

- Others

By Application Segment Analysis

By Application Segment Analysis

- Skin Care

- Hair Care

- Makeup

- Nail Care

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Amcor

- Sealed Air Corporation

- ALPLA Group

- Aptar Inc.

- HCP Packaging

- Berry Global

- Berlin Packaging

- Albea SA

- BIG SKY PACKAGING

- DS Smith

- Essel Propack Limited

- Clariant

- Unette Corporation

- Romacco Group

- Hoffman Neopac AG

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors