Search Market Research Report

India Herbal Products Market Size, Share Global Analysis Report, 2024 – 2032

India Herbal Products Market Size, Share, Growth Analysis Report By Source Type (Sandalwood, Basil, Mint, Neem, Henna, Ashwagandha, Aloe-vera, and Others), By Product (Herbal Cosmetics, Herbal Medicines, Herbal Supplements, Herbal Essential Oils, and Others), By Application (Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, and Others), By Distribution Channel (Offline Channel and Online Channel), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

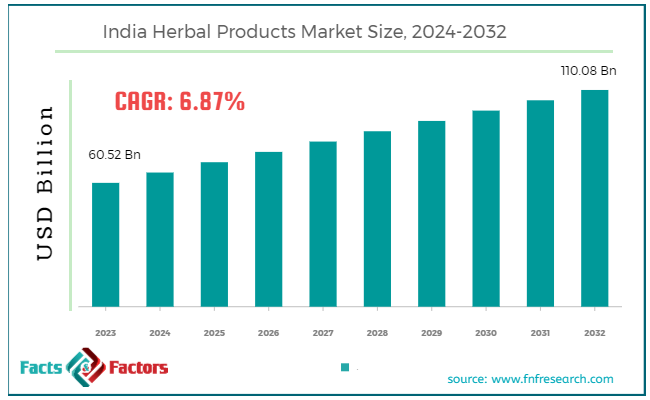

[218+ Pages Report] According to Facts & Factors, the India herbal products market size in terms of revenue was valued at around USD 60.52 billion in 2023 and is expected to reach a value of USD 110.08 billion by 2032, growing at a CAGR of roughly 6.87% from 2024 to 2032. The India herbal products market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India herbal products refer to a wide range of natural and plant-based products used for health, beauty, and wellness purposes. These products include herbal medicines, skincare, haircare, dietary supplements, and personal care items made from traditional Indian herbs and natural ingredients such as neem, turmeric, aloe vera, and tulsi. The India herbal products market has seen significant growth due to increasing consumer awareness about the benefits of natural and organic products, rising health consciousness, and a growing preference for sustainable and eco-friendly products. The market is characterized by a mix of well-established domestic brands and emerging players offering innovative herbal formulations.

Additionally, the influence of Ayurveda and traditional Indian medicine systems, coupled with government support for promoting herbal and natural products, further boosts market growth. As a result, the India herbal products market is poised for continued expansion, driven by urbanization, evolving consumer preferences, and increasing demand for natural and holistic wellness solutions.

Key Highlights

Key Highlights

- The India herbal products market has registered a CAGR of 6.87% during the forecast period.

- In terms of revenue, the India herbal products market was estimated at roughly USD 60.52 billion in 2023 and is predicted to attain a value of USD 110.08 billion by 2032.

- Rising health consciousness, fueled by a rich Ayurvedic tradition and government initiatives promoting natural remedies, coupled with increasing disposable income and urbanization, is creating a perfect storm for India's herbal product market to flourish.

- On the basis of product, the herbal medicines segment is growing at a high rate and is projected to dominate the market.

- Based on the application, the cosmetics & personal care segment is projected to swipe the largest market share.

- By region, South India is expected to dominate the market during the forecast period.

Growth Drivers:

Growth Drivers:

- Rising health consciousness: Indians are increasingly concerned about their well-being, leading to a preference for natural remedies and herbal products perceived as safer than synthetic alternatives.

- Rich Ayurvedic tradition: India's long history with Ayurveda, a holistic medicinal system emphasizing herbal ingredients, fosters trust and familiarity with these products.

- Government support: Government initiatives promoting Ayurveda and traditional medicine create a favorable environment for herbal product manufacturers.

- Growing disposable income: A rising middle class with more spending power allows for greater investment in personal healthcare and wellness products.

- Increasing urbanization: Urban lifestyles often lead to increased stress and health concerns, making natural remedies more appealing.

Restraints:

Restraints:

- Lack of standardization: Limited standardization in product quality, formulation, and labeling can create confusion and raise concerns about product efficacy.

- Limited scientific validation: While traditional knowledge exists, more scientific research and clinical trials are needed to validate the effectiveness of some herbal products.

- Availability of substitutes: Allopathic medicines remain widely available and often preferred for specific ailments, posing a challenge for herbal alternatives.

- Price sensitivity: While some consumers prioritize natural products, price remains a concern, especially for premium herbal offerings.

Opportunities:

Opportunities:

- Innovation and product development: Developing evidence-based herbal formulations and innovative product formats (e.g., capsules, teas, cosmetics) can attract new consumers.

- Focus on organic and sustainable practices: Consumers increasingly seek organic and ethically sourced ingredients, presenting an opportunity for responsible manufacturers.

- Expanding online retail: The growing popularity of e-commerce platforms creates a convenient avenue for wider product reach and distribution.

- Targeting specific needs: Developing herbal products addressing specific health concerns like stress, sleep issues, or skin conditions can attract new customer segments.

Challenges:

Challenges:

- Counterfeiting and adulteration: The presence of counterfeit and adulterated products can erode consumer trust and harm the reputation of the industry. Stricter quality control measures are crucial.

- Competition from established brands: Large pharmaceutical companies may enter the herbal product market, posing a competitive threat.

- Regulations and legal hurdles: Navigating complex regulations and obtaining necessary permits can be challenging for smaller players in the market.

Segmentation Analysis

Segmentation Analysis

The India herbal products market is segmented based on source type, product, application, and region.

- By Source Type Insights

Based on Source Type, the India herbal products market is divided into sandalwood, basil, mint, neem, henna, ashwagandha, aloe-vera, and others. Sandalwood is renowned for its aromatic properties and is widely used in skincare and personal care products. Sandalwood-based products are in high demand due to their premium status and effectiveness in skincare. The segment is expected to see steady growth as consumers continue to seek natural and luxurious skincare solutions.

Basil, commonly known as Tulsi, is revered in Ayurveda for its medicinal properties. It is used in a variety of products, including herbal teas, supplements, and skincare items, for its anti-inflammatory, antibacterial, and adaptogenic benefits. The Basil segment is driven by its widespread use in traditional medicine and growing popularity as a natural remedy for stress, respiratory issues, and skin problems. Increasing consumer awareness about its health benefits supports its strong market presence.

Mint is widely used for its refreshing properties and is a common ingredient in personal care products, oral care items, and herbal teas. It is valued for its cooling effect, digestive benefits, and antimicrobial properties. The Mint segment is expected to grow steadily due to its versatility and the growing demand for natural, refreshing ingredients in personal care and wellness products.

Neem is a cornerstone of traditional Indian medicine and is used extensively in skincare, haircare, and health products for its antifungal, antibacterial, and anti-inflammatory properties. It is known for treating skin conditions like acne, dandruff, and eczema. The Neem segment is poised for significant growth due to its effectiveness in treating a wide range of health and skincare issues. The increasing consumer preference for natural and therapeutic products drives the demand for neem-based products.

Henna is traditionally used as a natural dye for hair and skin. It is known for its conditioning properties and is often included in hair care products to provide natural color and shine. The Henna segment benefits from its cultural significance and the growing trend of using natural hair dyes. As consumers become more aware of the potential side effects of chemical dyes, the demand for henna-based products is expected to rise.

Ashwagandha is an adaptogenic herb widely used in supplements and wellness products for its stress-relieving, energy-boosting, and immune-enhancing properties. It is a staple in Ayurvedic medicine for promoting overall health and vitality. The Ashwagandha segment is experiencing rapid growth as consumers seek natural remedies for stress and overall wellness. The increasing adoption of supplements and functional foods containing Ashwagandha supports its expanding market.

Aloe Vera is known for its soothing, moisturizing, and healing properties. It is a popular ingredient in skincare, haircare, and health products, providing hydration and treatment for various skin conditions. The Aloe Vera segment is expected to see robust growth due to its widespread use and proven benefits in maintaining skin and hair health. The demand for Aloe Vera-based products is driven by the trend towards natural and effective skincare solutions.

- By Product Insights

On the basis of Product, the India herbal products market is bifurcated into herbal cosmetics, herbal medicines, herbal supplements, herbal essential oils, and others.

Herbal cosmetics include a wide range of skincare, haircare, and personal care products formulated with natural and herbal ingredients. The herbal cosmetics segment is driven by increasing consumer awareness about the harmful effects of synthetic chemicals and a growing preference for natural and organic beauty products. The segment includes products such as herbal shampoos, conditioners, face creams, lotions, and makeup items. With the rising trend of clean beauty, this segment is expected to see robust growth as consumers continue to prioritize natural ingredients in their personal care routines.

Herbal medicines comprise traditional and modern formulations that use plant-based ingredients to treat various health conditions. These products are rooted in Ayurvedic, Unani, and other traditional Indian medicine systems and are used for their therapeutic benefits. The herbal medicines segment is driven by a growing interest in alternative and holistic healthcare solutions. Consumers are increasingly turning to herbal medicines for their efficacy and fewer side effects compared to conventional pharmaceuticals. This segment includes products for common ailments like digestive issues, respiratory problems, and chronic conditions such as diabetes and arthritis.

Herbal supplements are dietary supplements that contain herbal extracts and natural ingredients aimed at enhancing overall health and well-being. These products are available in various forms, including tablets, capsules, powders, and teas. The herbal supplements segment is experiencing rapid growth due to the rising health consciousness among consumers and the increasing focus on preventive healthcare. Supplements for boosting immunity, improving digestion, enhancing energy levels, and promoting mental well-being are particularly popular. The segment is also supported by the growing popularity of Ayurveda and other traditional health practices, as well as the expanding market for functional foods and nutraceuticals.

Herbal essential oils are concentrated plant extracts used for their aromatic and therapeutic properties. These oils are widely used in aromatherapy, skincare, haircare, and wellness products for their calming, rejuvenating, and healing effects. The herbal essential oils segment is growing due to the increasing adoption of aromatherapy and natural wellness practices. Essential oils such as lavender, peppermint, eucalyptus, and tea tree are popular for their diverse applications in relaxation, stress relief, and skincare. The demand for essential oils is driven by the rising interest in holistic and natural health remedies, as well as their inclusion in various personal care and wellness products.

- By Application Insights

Based on Application, the India herbal products market is categorized into pharmaceuticals, cosmetics & personal care, food & beverages, and others.

The pharmaceuticals segment is driven by increasing consumer preference for natural and holistic treatment options. Herbal medicines and supplements are valued for their efficacy and fewer side effects compared to conventional pharmaceuticals. This segment includes products for digestive health, respiratory issues, pain management, and chronic conditions such as diabetes and hypertension. The integration of traditional herbal knowledge with modern medical practices is expected to support strong growth in this segment as consumers seek safe and effective health solutions.

The cosmetics & personal care application includes a wide range of products formulated with herbal ingredients for skin, hair, and overall personal grooming. The cosmetics & personal care segment is one of the fastest-growing areas in the herbal products market. Increasing awareness about the harmful effects of synthetic chemicals and a rising preference for natural and organic beauty products are driving this growth. This segment encompasses herbal shampoos, conditioners, face creams, lotions, soaps, and makeup items. The trend towards clean beauty and the demand for sustainable and eco-friendly products are expected to continue fueling growth in this segment.

The food & beverages application includes the use of herbal ingredients in the formulation of dietary supplements, herbal teas, health drinks, and functional foods. The food & beverages segment is experiencing rapid growth due to the increasing focus on preventive healthcare and wellness. Consumers are becoming more health-conscious and are seeking out food and beverage products that offer functional benefits beyond basic nutrition. Herbal teas, fortified beverages, and herbal-infused foods are gaining popularity for their health-promoting properties. The rising trend of functional foods and the growing popularity of Ayurveda and other traditional health practices are expected to support robust growth in this segment.

Recent Developments:

Recent Developments:

- Himalaya Goes Global (2023): Leading herbal brand Himalaya expands its research footprint with the inauguration of a 55,000 sq. ft. Global Research Center in Dubai. This state-of-the-art facility houses over 100 scientists and boasts the company's first Consumer Experience Center for product testing.

- Neem Extract Shows Promise Against Cancer (2022): Researchers at Banaras Hindu University achieved a breakthrough discovery. Their study suggests nimbolide, an extract from the neem plant, demonstrates effectiveness against T cell lymphoma (a cancer affecting immune cells). This discovery holds promise for the treatment of various blood cancers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 60.52 Billion |

Projected Market Size in 2032 |

USD 110.08 Billion |

CAGR Growth Rate |

6.87% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Ayur Herbals, Baidyanath, Dabur India, Emami Limited, Hamdard Laboratories, Himalaya, Jovees Herbal Care, Khadi Natural Healthcare, Lotus Herbals, Patanjali Ayurved, Shahnaz Husain Group, Sri Sri Tattva, Vicco Laboratories, VLCC, and Others. |

Key Segment |

By Source Type, By By Product, By Application, By Distribution Channel, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

The India herbal products market exhibits significant regional variations influenced by cultural preferences, local availability of herbs, economic conditions, and consumer awareness.

- South India leads the India herbal products market

South India dominates the market, particularly in states like Kerala and Karnataka, where the tradition of Ayurveda is deeply rooted. Kerala, known as the cradle of Ayurveda, attracts both domestic and international consumers with its strong heritage of herbal medicine and wellness tourism. The region benefits from a robust network of Ayurvedic practitioners and wellness centers, making it the leading market for herbal products with the highest growth prospects.

North India, including states such as Delhi, Punjab, Haryana, and Uttar Pradesh, also shows strong demand for herbal products. The region benefits from high awareness of Ayurveda and traditional remedies, driven by cultural practices and educational initiatives. Urban areas like Delhi and Chandigarh have a growing inclination towards natural and organic products, supported by a well-developed retail infrastructure and numerous Ayurvedic clinics and wellness centers.

West India, particularly Maharashtra and Gujarat, is another significant market for herbal products. Mumbai, with its large urban population and higher disposable incomes, drives demand in this region. The cosmopolitan consumer base in West India increasingly favors health and wellness products, supported by a strong distribution network and the presence of many herbal product manufacturers. Gujarat’s robust pharmaceutical and herbal products manufacturing industry also contributes to the market's growth.

East India, with Kolkata as a major urban center, is an emerging market for herbal products. The region is gradually catching up with other parts of the country in terms of consumer awareness and acceptance of herbal and natural products. Cultural inclinations towards traditional medicine in rural areas further support market growth. As consumer awareness about the benefits of herbal products increases, East India is expected to see steady growth.

Central India, encompassing states like Madhya Pradesh and Chhattisgarh, represents a smaller market for herbal products but is witnessing gradual growth due to rising urbanization and increasing consumer awareness. The region has significant potential as local consumers become more health-conscious and aware of the benefits of herbal remedies. The growth in Central India is driven by the increasing availability of herbal products in both urban and rural markets and efforts to promote Ayurveda and natural health practices.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India herbal products market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India herbal products market include;

- Ayur Herbals

- Baidyanath

- Dabur India

- Emami Limited

- Hamdard Laboratories

- Himalaya

- Jovees Herbal Care

- Khadi Natural Healthcare

- Lotus Herbals

- Patanjali Ayurved

- Shahnaz Husain Group

- Sri Sri Tattva

- Vicco Laboratories

- VLCC

The India herbal products market is segmented as follows:

By Source Type

By Source Type

- Sandalwood

- Basil

- Mint

- Neem

- Henna

- Ashwagandha

- Aloe-vera

- Others

By Product

By Product

- Herbal Cosmetics

- Herbal Medicines

- Herbal Supplements

- Herbal Essential Oils

- Others

By Application

By Application

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages

- Others

By Distribution Channel

By Distribution Channel

- Offline Channel

- Online Channel

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Table of Content

Industry Major Market Players

- Ayur Herbals

- Baidyanath

- Dabur India

- Emami Limited

- Hamdard Laboratories

- Himalaya

- Jovees Herbal Care

- Khadi Natural Healthcare

- Lotus Herbals

- Patanjali Ayurved

- Shahnaz Husain Group

- Sri Sri Tattva

- Vicco Laboratories

- VLCC

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors