Search Market Research Report

Oil And Gas Analytics Market Size, Share Global Analysis Report, 2020–2026

Oil And Gas Analytics Market By Deployment Platform (On-premises, Hosted), By Application (Upstream Operations, Midstream Operations, and Downstream Operations) and By Service (Professional Services, Integration Services, and Maintenance & Supports): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

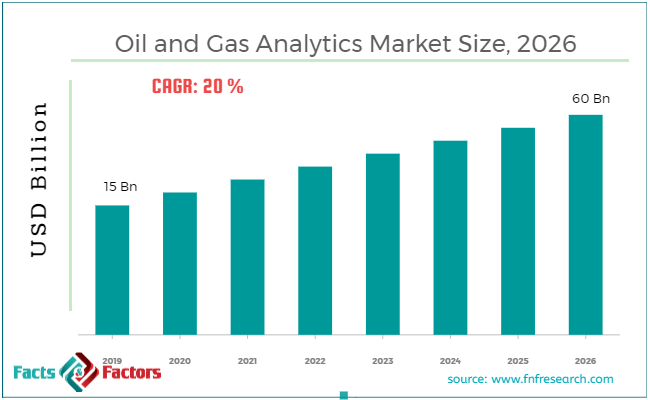

[220+ Pages Report] According to the report published by Facts & Factors, the global oil and gas analytics market size was worth around USD 15 billion in 2019 and is predicted to grow around USD 60 billion by 2026 with a compound annual growth rate (CAGR) of roughly 20% between 2020 and 2026. The report analyzes the global Oil And Gas Analytics market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Oil And Gas Analytics market.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the oil and gas analytics market. The report analyzes and declares the historical and current trends analysis of the oil and gas analytics industry and subsequently recommends the projected trends anticipated to be observed in the oil and gas analytics market during the upcoming years.

The oil and gas analytics market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire oil and gas analytics market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Billion) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- According to the primary research, the global oil and gas analytics market is expected to bolster in the coming years. In 2019, the oil and gas industry was valued at around USD 15 billion.

- The oil and gas analytics market is projected to witness a significant growth of nearly 20% during 2020-2026.

- By deployment platform analysis, the on-premise category accounted for the largest market share of nearly 65% in 2019 and this segment is expected to reach the highest CAGR over the forecast period.

- By application analysis, the upstream operations category dominated the market in 2019, it was valued at around USD 10 billion and is projected to grow over the forecast period.

- On the basis of service analysis, the professional services category is expected to witness the highest growth over the forecast period and it accounted for the largest market share of around 50% in 2019.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend that the upstream operation segment is anticipated to boost the oil and gas analytics market owing to the availability of resources such as natural gas, crude oil, etc., and merger and acquisitions among the players.

- Major companies are tending to make a substantial investments to grow their resources, and adopt innovative technologies, this may boost the professional services category of the oil and gas analytics market.

- The on-premises deployment platform is expected to witness the highest growth over the forecast period owing to ease of accessibility.

- The North American region has the highest share in the oil and gas analytics industry, owing to the early adoption of big data and cloud analytics in their oil and gas sectors.

- Due to the increasing investment in digital technology, growth in oil and gas production activities, and exploration of new oil reservoirs the oil and gas analytics market is anticipated to grow during 2020-2026.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the oil and gas analytics industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the oil and gas analytics industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the oil and gas analytics market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the oil and gas analytics industry. The oil and gas analytics market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market positions in the oil and gas analytics sector. Key strategic developments in the oil and gas analytics market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the oil and gas analytics market are appropriately highlighted in the report.

Oil and gas analytics consists of many strategies of the statistical methods used in other industries to point patterns amid hundreds of variables in constant flow. It uses machine learning algorithms and field data to enable big data insights, which help the managers and operators, to increase their production, surge new innovation and decrease risk.

The use of advanced business intelligence and analytics tools in the oil and gas industry will lead to efficient and effective operations. Major companies are using the analytic tool to obtain real-time data and to improve production costs. These parameters may drive the market in the future years. Increasing demand for petroleum products and growth in the oil and gas refineries is projected to boost the oil and gas analytics market.

Government rules and regulations for safety while performing oil and gas operations, increasing investment in new technology, and growing workforce productivity may drive the market over the forecast period. The operational expansions and increasing production of the oil and gas industry have headed to new explorations into remote areas across the globe. The maintenance costs of oil companies are increasing in order to assist with environmental challenges.

For maintenance and repairs of offshore and deep-water oil rigs, billions of dollars are spent annually. High maintenance costs and hazardous ecological consequences such as loss of marine wealth may hamper the growth of the oil and gas analytics market. Strict regulations, increasing competition, public scrutiny, and high requirement for financial capital may restraints market growth. Numerous companies are adopting advanced analytics solutions to increase productivity, this factor may bring many opportunities in the oil and gas analytics market. Additionally, increasing demand for cloud analytics and developments in digital oilfields may increase lucrative opportunities in the oil and gas analytics market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 15 Billion |

Projected Market Size in 2026 |

USD 60 Billion |

CAGR Growth Rate |

20% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Accenture, Cisco Systems Inc, Hewlett Packard Enterprise Development LP, Microsoft Corporation, EMC Corporation (Dell Inc.), IBM Corporation, SAP SE, Oracle Corporation, Teradata Corporation, and others. |

Key Segment |

By Deployment Platform, Application, Service, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Overview:

Regional Overview:

The oil and gas analytics market research report delivers an acute valuation and taxonomy of the oil and gas analytics industry by practically splitting the market on the basis of deployment platform, service, and application, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

The regional segmentation of the oil and gas analytics industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Further, country-wise data for the oil and gas analytics industry is provided for the leading economies of the world.

On the basis of the deployment platform, the market is classified into on-premises and hosted. On the basis of service, the market is divided into professional services, integration services, and maintenance & supports. In terms of application segmentation, the market is bifurcated into upstream operations, midstream operations, and downstream operations.

Some of the essential players operating in the oil and gas analytics market, but not restricted include:

Some of the essential players operating in the oil and gas analytics market, but not restricted include:

- Accenture

- Cisco Systems Inc.

- Hewlett Packard Enterprise Development LP

- Microsoft Corporation

- EMC Corporation (Dell Inc.)

- IBM Corporation

- SAP SE

- Oracle Corporation

- Teradata Corporation

The taxonomy of the oil and gas analytics market by its scope and segmentation is as follows:

Global Oil and Gas Analytics Market: By Deployment Platform Segmentation Analysis

Global Oil and Gas Analytics Market: By Deployment Platform Segmentation Analysis

- On-premises

- Hosted

Global Oil and Gas Analytics Market: By Application Segmentation Analysis

Global Oil and Gas Analytics Market: By Application Segmentation Analysis

- Upstream Operations

- Midstream Operations

- Downstream Operations

Global Oil and Gas Analytics Market: By Service Segmentation Analysis

Global Oil and Gas Analytics Market: By Service Segmentation Analysis

- Professional Services

- Integration Services

- Maintenance & Supports

Global Oil and gas analytics market: By Regional Segmentation Analysis

Global Oil and gas analytics market: By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table of Content

Industry Major Market Players

- Accenture

- Cisco Systems Inc.

- Hewlett Packard Enterprise Development LP

- Microsoft Corporation

- EMC Corporation (Dell Inc.)

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors