Search Market Research Report

Packaging Automation Market Size, Share Global Analysis Report, 2024 – 2032

Packaging Automation Market Size, Share, Growth Analysis Report By End-User (Food & Beverages, Chemicals, E-Commerce & Logistics, Automotive, Healthcare & Pharmaceuticals and Others), By Applications (Capping, Palletizing, Wrapping, Form Filling & Sealing (FFS), And Others), By Types (Automated Conveyors, Packaging Robots, and Automated Packages), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

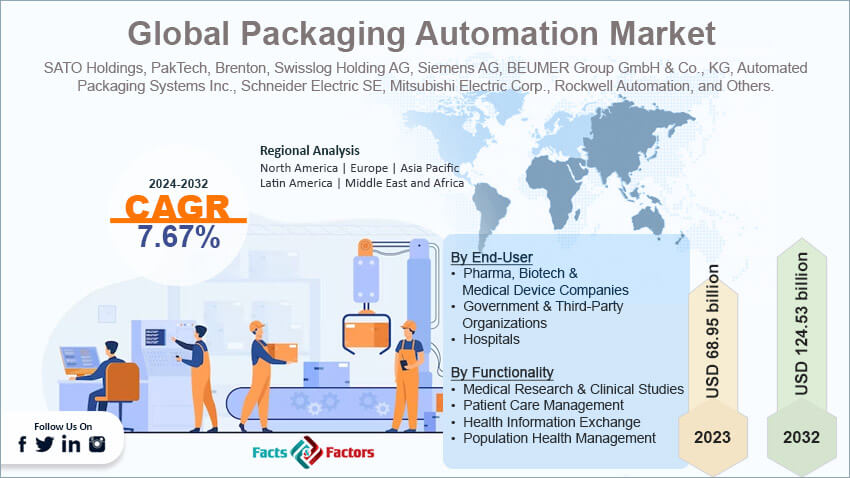

[215+ Pages Report] According to Facts and Factors, the global packaging automation market size was valued at USD 68.95 billion in 2023 and is predicted to surpass USD 124.53 billion by the end of 2032. The packaging automation industry is expected to grow by a CAGR of 7.67% between 2024 to 2032.

Market Overview

Market Overview

Packaging automation is the use of automated systems, technologies, and machinery to execute different tasks associated with the packaging of products. The major goal of packaging automation is to align and optimize the packaging processes. It helps companies to increase the efficiency of their work at an affordable rate.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global packaging automation market size is estimated to grow annually at a CAGR of around 7.67% over the forecast period (2024-2032).

- In terms of revenue, the global packaging automation market size was valued at around USD 68.95 billion in 2023 and is projected to reach USD 124.53 billion by 2032.

- Growing demand for increased efficiency is driving the growth of the global packaging automation market.

- Based on the end-user, the food and beverage segment is growing at a high rate and is projected to dominate the global market.

- Based on the application, the capping segment is projected to swipe the largest market share.

- Based on the type, the packaging robots segment is projected to witness a high CAGR during the forecast period.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for increased efficiency is driving the growth of the global market.

Businesses are looking forward to different ways to increase their operational efficiency in packaging processes. Also, automation packaging has emerged as an ideal method to handle bulk orders at higher production speed and less lead time. Packaging automation helps increase overall efficiency, which in turn, is expected to propel the growth of the global packaging automation market.

Also, automation packaging helps companies decrease their dependence on manual labour, thereby saving costs. Automated systems help companies perform more tasks consistently for an extended period, which is way more than human workers. For instance, Ranpak came up with an all-new ‘Flap it’ in July 2023. It is a highly effective device that helps companies automate packaging processes for small units.

Restraints

Restraints

- High initial investment is expected to hamper the growth of the global market.

The upfront cost of packaging automation is quite high, which deters price-sensitive consumers. Integrating machinery and purchasing the raw material is a complex task for small businesses with limited capital. Therefore, such a landscape is expected to hinder the growth of the global packaging automation market.

Opportunities

Opportunities

- Rise of e-commerce is expected to foster growth opportunities in the global market.

The growth of e-commerce has significantly led to an increased demand for automated packaging solutions. Also, people's growing interest in online shopping is leading to high volumes of water, which needs an efficient system to process the packaging of the items.

Therefore, packaging automation has emerged as an ideal method to help companies. Therefore, such a landscape is expected to foster growth opportunities in the packaging automation industry. For instance, ULMA packaging is said to come up with their new product named TSA 400, a compact tray sealer, in May 2023.

Challenges

Challenges

- Integrating systems is a big challenge in the global market.

Integrating new machinery into the existing manufacturing processes is complex. Compatibility issues are also a big challenge in the packaging automation industry, which is further expected to slow down the growth of the industry.

Segmentation Analysis

Segmentation Analysis

The global packaging automation market can be segmented into end-users, applications, types, and regions.

On the basis of end-users, the market can be segmented into food & beverages, chemicals, e-commerce and logistics, automotive, healthcare and pharmaceuticals, and others. The food and beverage segment is expected to dominate the packaging automation industry during the anticipated period. The food and beverage sector operates at high production volumes, and therefore, automation has become an indispensable process in handling such large quantities of products. The sector is subjected to strict quality and safety standards.

Therefore, automation helps companies align with consistency and lower the risk of contamination. Also, the food and benefits sector deals with diverse packaging formats and the versatility of the automated system helps companies achieve their goal easily.

Moreover, the automated packaging solutions help in extending the shelf life of the food products. It is crucial for lowering food waste and maintaining the product's freshness. Automation also helps companies comply with the regulatory requirements associated with packaging, standard traceability, and labelling.

On the basis of application, the market can be segmented into capping, palletizing, wrapping, form, filling, & sealing (FFS), and others. Capping is the fastest-growing segment in the packaging automation industry. Capping is a crucial step in packaging across major industries. The demand for packaging automation solutions is increasing significantly, and therefore, there is a growing need for capping, too.

The healthcare and pharmaceutical sectors need secure packaging, and capping helps ensure the integrity and safety of these products, which in turn is also likely to propel the growth of the segment. The requirement for different kinds of capping solutions is also expected to foster developments in the segment.

Industries are innovating with packaging formats, and therefore, there is a high requirement for more versatile and adaptable capping solutions to align with the surge in demands. Capping is also important in packaging consumer goods like household items, personal care products, beverages, and others. The global market is witnessing growth in consumer-oriented industries, which is also likely to accentuate the demand in the segment.

On the basis of type, the market can be segmented into automated conveyors, packaging robots, and automated packages. The packaging robots segment is expected to swipe the largest market share in the global packaging automation market.

Packaging robots are versatile in nature and can be easily adapted to different formats and sizes of products. Their versatility is widening their scope and deployment across different industries. Packaging robots are known for their high-speed operations and efficiency, thereby helping companies easily handle repetitive tasks with increased processes and high output.

The emergence of Industry 4.0 is further boosting the popularity of packaging robots in the market. Packaging robots can also be programmed to handle the customization based on the requirements of products and industries. Therefore, all these factors contribute heavily towards the growth of the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 68.95 Billion |

Projected Market Size in 2032 |

USD 124.53 Billion |

CAGR Growth Rate |

7.67% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

SATO Holdings, PakTech, Brenton, Swisslog Holding AG, Siemens AG, BEUMER Group GmbH & Co., KG, Automated Packaging Systems Inc., Schneider Electric SE, Mitsubishi Electric Corp., Rockwell Automation, and Others. |

Key Segment |

By End-User, By Applications, By Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global packaging automation market because of various factors like improvement in supply chain processes, cost-effectiveness, and several others. The deployment of automation systems across the packaging processes like palletizing, labelling, filling, and other tasks is driving the growth of the regional market.

Several end-user industries are adopting automation solutions to lower operational costs and enhance efficiency, which further drives the need for automated solutions. It is very difficult to manually handle large volumes of orders and, therefore, these automated systems have emerged as an important element in optimizing the packaging processes.

Furthermore, the growing trend of sustainable packaging practices in the region is further contributing towards the growth of the regional market. There is a significant emphasis on eco-friendly packaging by optimizing material usage and minimizing waste. Companies are deploying automated systems to achieve these goals.

The food and beverage sector in the region is expected to foster growth opportunities in the regional market. This sector needs to consistently comply with regulatory standards and ensure efficient and hygienic packaging of its products. Therefore, companies are increasingly deploying packaging automation systems within their organizations.

Asia Pacific is likely to see steady growth in the coming years because growing economies like India and China are witnessing rapid industrialization, thereby increasing the demand for packaging automation in the region. The fast-expanding consumer goods industry is also likely to emerge as a primary factor for the high growth rate of the regional market. The surge in e-commerce activities and online shopping in the region is also creating the requirement for automatic packaging solutions to handle a large volume of orders.

For instance, Honeywell and Walvax Biotechnology said they would partner with each other to offer automated control solutions in February 2023. These solutions are from the mRNA COVID-19 vaccine production plant in China.

Competitive Analysis

Competitive Analysis

The key players in the global packaging automation market include:

- SATO Holdings

- PakTech

- Brenton

- Swisslog Holding AG

- Siemens AG

- BEUMER Group GmbH & Co.

- KG

- Automated Packaging Systems Inc.

- Schneider Electric SE

- Mitsubishi Electric Corp.

- Rockwell Automation

For instance, Maxpack Machinery LLC came up with Leap in August 2023. Leap is a revolutionary piece of packing that permits clients to pay for overtime.

The global packaging automation market is segmented as follows:

By End-User Segment Analysis

By End-User Segment Analysis

- Food & Beverages

- Chemicals

- E-Commerce & Logistics

- Automotive

- Healthcare & Pharmaceuticals

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Capping

- Palletizing

- Wrapping, Form Filling & Sealing (FFS)

- Others

By Types Segment Analysis

By Types Segment Analysis

- Automated Conveyors

- Packaging Robots

- Automated Packages

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- SATO Holdings

- PakTech

- Brenton

- Swisslog Holding AG

- Siemens AG

- BEUMER Group GmbH & Co.

- KG

- Automated Packaging Systems Inc.

- Schneider Electric SE

- Mitsubishi Electric Corp.

- Rockwell Automation

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors