Search Market Research Report

Power EPC Market Size, Share Global Analysis Report, 2022 – 2028

Power EPC Market Size, Share, Growth Analysis Report By Power Generation (Nuclear, Hydroelectric, Renewables, and Thermal), By Power Status (Transmission, and Distribution), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

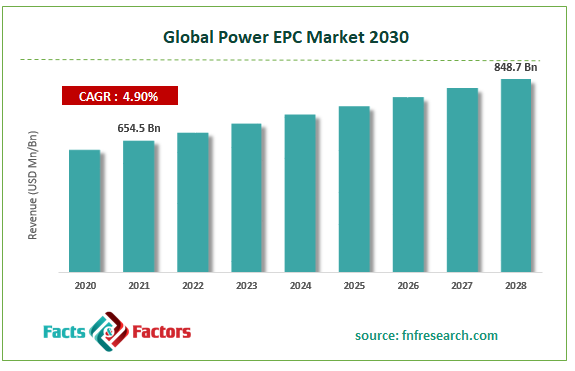

[223+ Pages Report] According to the report published by Facts Factors, the global power EPC market size was worth around USD 654.5 billion in 2021 and is predicted to grow to around USD 848.7 billion by 2028 with a compound annual growth rate (CAGR) of roughly 4.9% between 2022 and 2028. The report analyzes the global power EPC market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the power EPC market.

Market Overview

Market Overview

EPC refers to engineering, procurement, and construction contracts, which are a type of turnkey contract, and is generally undertaken by private companies that cater to the necessary deliverables on a large scale. A turnkey contract or operation is a project built to be sold as a whole unit, unlike build-to-order projects that are built depending on the customer’s specifications or are sold while only partly manufactured assuming that the rest will be completed by the buyer or the client. Under such a contract, the contractor or the service provider is obliged to deliver a fully functional and complete facility so that the buyer has to only turn a key to start the operations. The contractor is also supposed to deliver the facility at a pre-determined and fixed rate, at a specified time along with the specified level of quality or quantity. The failure to adhere to contract details could lead to the service provider bearing monetary losses. Some issues that EPC contracts cover include engineering functions including basic, advanced, planning, and construction engineering. Logistics support, receiving, procurement, invoicing, and purchasing fall under procurement activities, while electrical, civil, and mechanical activities fall under construction functions

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global power EPC market is estimated to grow annually at a CAGR of around 4.9% over the forecast period (2022-2028).

- In terms of revenue, the global power EPC market size was valued at around USD 654.5 billion in 2021 and is projected to reach USD 848.7 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on power generation segmentation, thermal was predicted to show maximum market share in the year 2021

- Based on power status segmentation, transmission was the leading revenue-generating status in 2021.

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021.

Covid-19 Impact:

Covid-19 Impact:

The global market cap was severely impacted during the 1st and 2nd quarters of 2020 owning the lockdown impositions. The global market saw a further decline during 2021 because of a rise in fuel prices including oil & gas resulting in higher transportation and construction cost. There were delays in finishing projects on time due to manpower availability. However, during the long run, the global market may register high growth barring a few challenges.

Growth Drivers

Growth Drivers

- Growing contractual businesses to propel market growth

The global power EPC market is projected to grow owing to the rising trend of incorporating contract-based businesses to complete large-scale projects. In many cases, a billion-dollar client undertakes a certain power-related project and incorporates other relatively smaller businesses with specific specialization to hand over sections of the project to these subunits. The division of contract is beneficial not only to the main client but to other companies and businesses that come along with expertise in the field, benefiting all parties involved while also delivering quality outputs. Since the power sector is an exponentially growing segment driven by the needs of the growing population as well as rampant industrialization, that practically functions entirely powered by external sources of energy. The power sector is further propelled by the intense measures undertaken by country governments to meet the expanding demand. For instance, in the financial year 2022, India’s electricity generation capacity reached 1490.27 billion units as per official reports.

Restraints

Restraints

- Phasing out of coal-based power to restrict the market growth

The global market cap size may witness growth restrictions owing to the slow but steady phasing out of coal-based power owing to its non-renewable properties. Power generated from coal forms a major part of the global market share and unless revenue from other sectors increases, the dip caused by coal-based power may not be filled anytime soon.

Opportunities

Opportunities

- Growing investments in wind energy to provide excellent growth opportunities

With growing needs for power, international and domestic players along with government agencies are focusing heavily on finding more renewable sources of energy, wind energy being one of them. As per an August 2022 report, China has doubled its wind energy-related investment amounting to over USD 58 billion, while USD 41 billion were invested in large-scale solar energy projects.

Challenges

Challenges

- Fluctuating oil & gas prices to challenge the market expansion

The recent Ukraine-Russia war and other political situations are the key factors impacting the oil & gas supply and its prices across the globe. The pricing of these non-renewable sources of energy is extremely sensitive to external factors and is a challenging factor for the global power EPC market growth as it impacts the overall cost of the project, which in EPC contract cases is predetermined, causing contractors to incur losses.

Segmentation Analysis

Segmentation Analysis

- The global power EPC market is segmented based on power generation, power status, and region.

Based on power generation, the global market is divided into nuclear, hydroelectric, renewables, and thermal. Currently, the global market is dominated by thermal sources of power generation however, renewables are projected to lead the global market growth in the next few years owing to the efficiency achieved in delivering the required units of power supply. As per a July 2022 report by World Economic Forum, India’s investment in renewable energy reached a record landmark with a total of USD 14.5 billion in the financial year 2021-2022.

Based on power status, the global market is divided into transmission and distribution. The global market generates the highest revenue from the transmission segment since transmission lines generally require high investment and providers incorporate third-party to help them build the unit. For instance, out of 20,000 circuit miles transmitting high power lines, the operation of over two-thirds is undertaken by utilities owned by investors.

Recent Developments:

Recent Developments:

- In May 2022, Mitsubishi Heavy Industries Ltd (MHI), a Japan-based multinational corporation dealing in engineering, electronics, and electrical equipment, and SEPCOIII, a Chinese engineering and construction company, signed an agreement with Bahrain BSC (Alba) to aid the expansion of Power Station 5 situated in Alba, along with the addition of combined cycle gas turbine power block exhibiting a power of 680.9 megawatts (MW).

- In June 2022, the Indian market witnessed an EPC contract undertaken by Tata Power Solar Systems for its client, Vibrant Energy. The project is claimed to generate an energy of 110.029 units while also helping in reducing carbon emissions by up to 9 lakh tonnes.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 654.5 Billion |

Projected Market Size in 2028 |

USD 848.7 Billion |

CAGR Growth Rate |

4.9% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

McDermott International Ltd, Bechtel Corporation, Fluor Corp., Kiewit Corporation, KBR Inc, and others. |

Key Segment |

By Power Generation, Power Status, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to lead global market growth during the forecast period

The global power EPC market is projected to be dominated by Asia-Pacific in the coming years owing to the high requirement and demand for constant power supply in economies like China, India, Japan, South Korea, and others. Asia-Pacific is home to over 60% of the world's largest cities that have either undergone an industrial revolution or are in the process of creating more industrialized centers. More than 50% of the world’s population resides in the countries of China and India. This is an indication of the power requirements in the countries. The recent political scenario between the western and Asian countries has led to more regions in Asia-Pacific becoming self-reliant and collaborating with neighboring countries for power supply to reduce dependence on western countries. These factors will contribute to regional growth in the coming years.

Competitive Analysis

Competitive Analysis

- McDermott International Ltd

- Bechtel Corporation

- Fluor Corp.

- Kiewit Corporation

- KBR Inc.

The global power EPC market is segmented as follows:

By Power Generation

By Power Generation

- Nuclear

- Hydroelectric

- Renewables

- Thermal

By Power Status

By Power Status

- Transmission

- Distribution

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- McDermott International Ltd

- Bechtel Corporation

- Fluor Corp.

- Kiewit Corporation

- KBR Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors