Search Market Research Report

Procurement as a Service Market Size, Share Global Analysis Report, 2024 – 2032

Procurement as a Service Market Size, Share, Growth Analysis Report By End-Users (Healthcare, IT & Telecom, Retail Manufacturing, BFSI, And Others), By Enterprise Sizes (Large Enterprises And SMEs), By Components (Transaction Management, Contract Management, Category Management, Process Management, And Strategic Sourcing), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

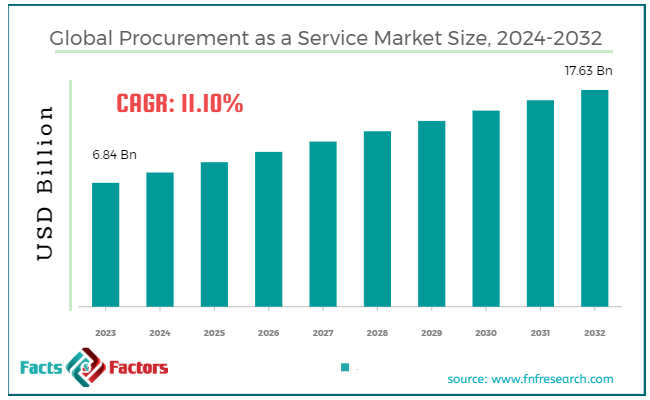

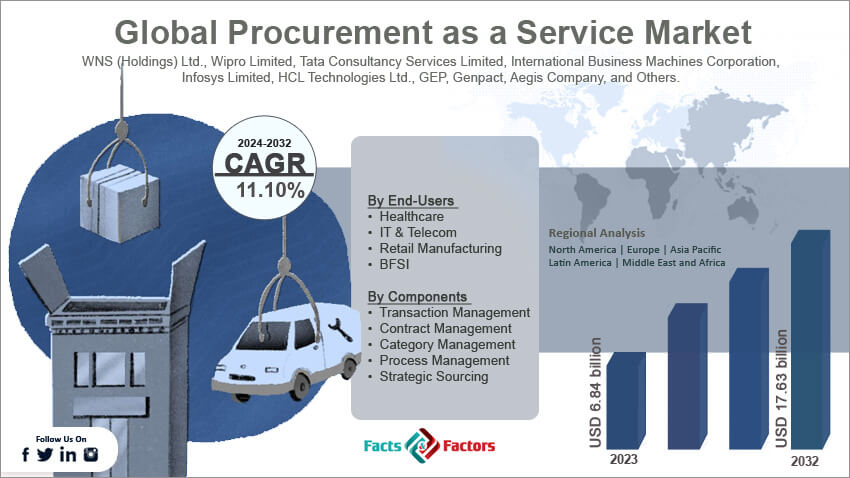

[218+ Pages Report] According to Facts & Factors, the global procurement as a service market size was valued at USD 6.84 billion in 2023 and is predicted to surpass USD 17.63 billion by the end of 2032. The procurement as a service industry is expected to grow by a CAGR of 11.10% between 2024 and 2032.

Market Overview

Market Overview

Procurement as a service is a business model where companies outsource their processes like purchasing, sourcing, and managing suppliers. The rising requirement to manage technology, expertise, and strategic insights to optimize procurement operations is also leading to a demand for a PaaS business model.

However, the key components of procurement as a service include contract management, supplier management, procurement analytics, transaction management, category management, and strategic sourcing. The PaaS business model works by using the company's expertise and technology, which further leads to cost savings in the procurement process.

PaaS providers manage the procurement activities, thereby lowering the time and effort needed from internal resources. Outsourcing procurement activities facilitate businesses' focus on core activities and improve performance & productivity.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global procurement as a service market size is estimated to grow annually at a CAGR of around 11.10% over the forecast period (2024-2032).

- In terms of revenue, the global procurement as a service market size was valued at around USD 6.84 billion in 2023 and is projected to reach USD 17.63 billion by 2032.

- Digital transformation is driving the growth of the global procurement as a service market.

- Based on the end-users, the manufacturing segment is growing at a high rate and is projected to dominate the global market.

- Based on the enterprise sizes, the large enterprises segment is projected to swipe the largest market share.

- Based on components, the strategic sourcing segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Digital transformation is leading to the growth of the global market.

Companies are largely transforming their business operations to digital solutions to lower manual efforts and improve efficiency. Additionally, companies are also automating their procurement processes to optimize the entire system.

However, the advanced analytics and insights from PaaS solutions help in facilitating better decision-making and strategic sourcing. PaaS solutions also help in lowering operational costs like technology, labor, and infrastructure expenses. PaaS providers can easily negotiate with suppliers on better terms and prices, thereby helping companies to save more.

However, the major advantage of outsourcing procurement activities is that it helps companies to focus on core components. Businesses can use their resources and time to improve productivity and performance by outsourcing procurement. Additionally, companies can focus more strategically on their core services rather than on administrative procurement tasks.

All these factors are likely to contribute to the high growth rate of the global procurement as a service market. For instance, ClearEdge was successfully taken over by Accenture in 2021. Former is a procurement and management firm that is likely to help Accenture undergo digital transformation, offer better visibility to their contracts, and facilitate the effective management of risk.

Restraints

Restraints

- Data security and privacy concerns are likely to hamper the growth of the global market.

The procurement process works on sensitive data like contracts, pricing, and supply information, which creates concerns regarding data security when outsourced to third parties. Additionally, different regions have varying regulations regarding the usage of sensitive data, which further complicates the system. All these factors are likely to hamper the growth of the procurement as a service industry.

Opportunities

Opportunities

- Technological advancements are likely to foster growth opportunities in the global market.

Integration of advanced technologies like AI and machine learning into procurement processes helps in better supplier selection, forecasting, and risk management activities. Moreover, companies are leveraging blockchain technology to facilitate transparency and security in the procurement process, thereby making it more trustworthy.

Globalization is another major factor positively impacting the growth trajectory of the global procurement as a service market. Companies all across the globe are expanding rapidly, and therefore, they need efficient procurement processes that can work in different locations according to diverse regulatory mandates. PaaS helps companies manage complex global supply chains, thereby facilitating cost-effectiveness and timely procurement.

For instance, Accenture successfully took over Xoomworks Group in 2021. The latter company specializes in procurement technology and is expected to enhance the Accenture portfolio to help clients accelerate technology-led businesses.

Challenges

Challenges

- Integration issue is a big challenge in the global market.

Integration of PaaS solutions into the existing infrastructure creates compatibility issues. Also, it leads to more complex processes, which are time-consuming and costly. Moreover, transitioning to the PaaS model is quite disruptive for businesses with complex processes, which need significant time and resources. Such a landscape is expected to slow down the growth of the procurement as a service industry.

Segmentation Analysis

Segmentation Analysis

The global procurement as a service market can be segmented into end-users, enterprise sizes, components, and regions.

Based on end-users, the market can be segmented into healthcare, IT & telecom, retail manufacturing, BFSI, and others. The manufacturing segment accounts for the largest share of the procurement as a service industry during the forecast period. The manufacturing sector deals with extensive procurement activities like components, machinery, and raw materials, which pose a huge requirement for proper procurement services.

Moreover, manufacturers nowadays are more inclined towards outsourcing their procurement function to lower the total operational cost and increase their profit margins. Additionally, the complexities in the global supply chain further boost demand for procurement services to optimize logistic supplier relationships and compliance smoothly.

Moreover, advancements in technology, like the integration of AI, IoT, and machine learning into PaaS solutions, are expected to widen the scope of the segment in the coming years. Advanced procurement solutions can improve the organization's decision-making capability and optimize the entire process. Also, companies are more inclined to focus on their core competencies by outsourcing the procurement functions to achieve their goals. All these factors are likely to foster growth opportunities in the segment.

On the basis of the price size, the market can be segmented into large enterprises and SMEs. The large enterprise segment is likely to dominate the global procurement as a service market in the coming years. Large enterprises have more complex procurement requirements because of the diverse product portfolio, extensive geographic reach, and large size.

Moreover, large organizations also have the financial capacity to afford an advanced PaaS solution. Additionally, these enterprises also have focused strategies where there is scope for outsourcing certain procurement functions to come up with innovation and more advanced business activities. Large enterprises are the early and largest adopters of advanced technologies like PaaS solutions. Also, large enterprises have global supply chains where they need sophisticated procurement solutions to finish their work.

On the basis of components, the market can be segmented into transaction management, contract management, category management, process management, and strategic sourcing. Strategic sourcing is the fastest-growing segment in the procurement as a service industry. Strategic outsourcing helps with cost optimization because it offers suppliers negotiation and demand management.

Also, it helps improve supplier relationship management by offering better innovation, collaboration, and reliability in the supply chain. Strategic sourcing helps organizations to diversify their supplier base and develop contingency plans to mitigate associated risks.

Marketing intelligence tools used in strategic sourcing help companies deliver insights into supplier performance, pricing dynamics, and marketing trends to facilitate more informed decision-making. Organizations emphasize sustainable and ethical sourcing practices to align with the regulatory requirements, which further fosters the need for strategic sourcing.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 6.84 Billion |

Projected Market Size in 2032 |

USD 17.63 Billion |

CAGR Growth Rate |

11.10% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

WNS (Holdings) Ltd., Wipro Limited, Tata Consultancy Services Limited, International Business Machines Corporation, Infosys Limited, HCL Technologies Ltd., GEP, Genpact, Aegis Company, and Others. |

Key Segment |

By End-Users, By Enterprise Sizes, By Components, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global procurement as a service market during the forecast period. The US is the largest growing market in the region because of the presence of a growing number of large enterprises in the region. Moreover, companies in the region are fast adopters of advanced technologies, which in turn also positively impact the growth of the regional market.

Moreover, companies in the region are focusing on improving innovation and cost efficiency, which further have a positive influence on regional market dynamics. Canada is also likely to witness significant growth potential in the coming years because of the growing adoption of digital procurement solutions in the region.

However, the growing interest of the North American market towards sustainable and ethical procurement practices is a crucial factor accentuating the growth of the regional market. Moreover, the increasing complexities in the global supply chain of companies in the region are further fostering demand for sophisticated procurement services solutions to manage operations effectively.

Asia Pacific is another major region in the procurement as a service industry that is expected to witness significant growth in the coming years. China is leading the market in Asia Pacific because of its strong economic growth. The massive industrial base in Japan is also a major reason for the high growth rate of the Chinese market. India is posing immense growth potential in the APAC market because of rising industrialization. Moreover, the growing SME sector extends government support, which is further expected to revolutionize the market in the coming years.

Additionally, many Southeast Asian countries are expanding their industrial base along with their rapidly growing economic status, which in turn is also likely to foster the adoption of PaaS solutions in APAC. For instance, WNS came up with WNS FINISIBLE in 2021. The product is a set of banking solutions that facilitate FinTechs in scaling operations and managing the system efficiently.

Competitive Analysis

Competitive Analysis

The key players in the global procurement as a service market include:

- WNS (Holdings) Ltd.

- Wipro Limited

- Tata Consultancy Services Limited

- International Business Machines Corporation

- Infosys Limited

- HCL Technologies Ltd.

- GEP

- Genpact

- Aegis Company

For instance, Brain & Company successfully took over Proxima in 2022. However, Proxima's expertise in the procurement and supply chain sector can help Brain & Company leverage their procurement portfolio. Additionally, the acquired company is expected to operate independently under the name of Brain & Company.

The global procurement as a service market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Healthcare

- IT & Telecom

- Retail Manufacturing

- BFSI

- Others

By Enterprise Sizes Segment Analysis

By Enterprise Sizes Segment Analysis

- Large Enterprises

- SMEs

By Components Segment Analysis

By Components Segment Analysis

- Transaction Management

- Contract Management

- Category Management

- Process Management

- Strategic Sourcing

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- WNS (Holdings) Ltd.

- Wipro Limited

- Tata Consultancy Services Limited

- International Business Machines Corporation

- Infosys Limited

- HCL Technologies Ltd.

- GEP

- Genpact

- Aegis Company

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors