Search Market Research Report

Supply Chain Management Market Size, Share Global Analysis Report, 2024 – 2032

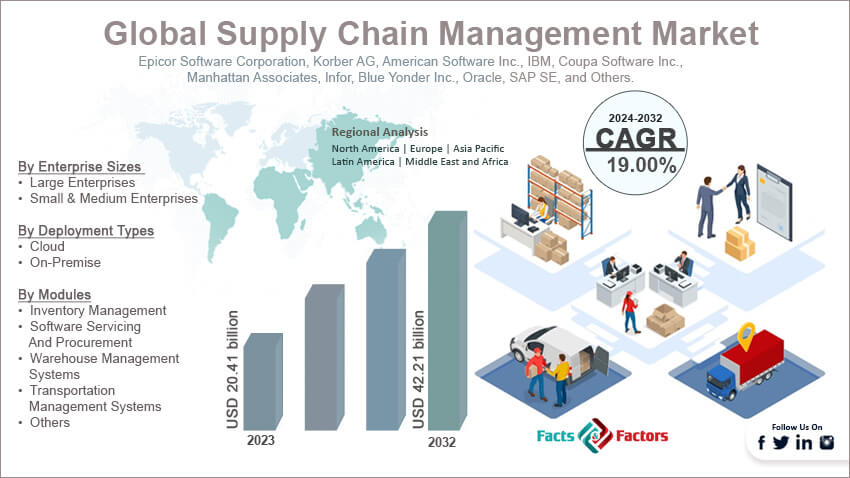

Supply Chain Management Market Size, Share, Growth Analysis Report By Industries (Process, Discrete, And Others), By Enterprise Sizes (Large Enterprises And Small & Medium Enterprises), By Deployment Types (Cloud And On-Premise), By Modules (Inventory Management, Software Servicing And Procurement, Warehouse Management Systems, Transportation Management Systems, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

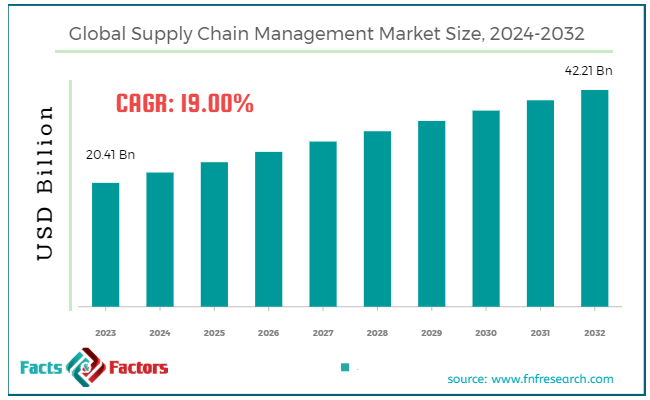

[218+ Pages Report] According to Facts & Factors, the global supply chain management market size was valued at USD 20.41 billion in 2023 and is predicted to surpass USD 42.21 billion by the end of 2032. The supply chain management industry is expected to grow by a CAGR of 19.00% between 2024 and 2032.

Market Overview

Market Overview

Supply chain management refers to the comprehensive management of goods, operations, finances, and services. It involves planning, sourcing, manufacturing, logistics, delivery, return management, and many others. Supply chain management helps organizations to coordinate with all departments regarding the supply chain activities to fulfill the orders efficiently on time. It also helps businesses get transparency across the entire supply chain.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global supply chain management market size is estimated to grow annually at a CAGR of around 19.00% over the forecast period (2024-2032).

- In terms of revenue, the global supply chain management market size was valued at around USD 20.41 billion in 2023 and is projected to reach USD 42.21 billion by 2032.

- Rising demand for cloud-based solutions is driving the growth of the global supply chain management market.

- Based on the industries, the discrete segment is growing at a high rate and is projected to dominate the global market.

- Based on enterprise sizes, the small & medium enterprises segment is anticipated to grow with the highest CAGR in the global market.

- Based on the deployment types, the cloud segment is projected to swipe the largest market share.

- Based on modules, the transportation management system segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Rising demand for cloud-based solutions is driving the growth of the global market.

Cloud-based supply chain management solutions are in demand because they offer high flexibility and cost efficiency. It also helps organizations get real-time insights on entire supply chain activities, thereby enhancing decision-making capabilities and maintaining transparency across the chain.

However, the global expansion of e-commerce is another major factor in the high growth rate of the global supply chain management market. Companies are adopting advanced SCM solutions to navigate the complexity of logistics and inventory management. Additionally, integrating machine learning and artificial intelligence with these SCM solutions platforms is further helping companies in demand management, forecasting, and planning.

Companies all around the globe are undergoing a digital transformation, which is expected to revolutionize the industry. Organizations are also looking forward to tools and solutions to eliminate human error, streamline operations, and improve supply chain efficiency, which is another major factor fueling the demand for SCM solutions in the market.These help improve productivity and lower overall costs. The rising trend of emphasizing sustainability is further expected to accelerate the growth of the market.

There are growing concerns over the environmental impact of these activities, which is further encouraging businesses to adopt sustainable practices like SCM management, lower carbon emissions, and comply with regulatory standards. For instance, Kinaxis came up with Planning.AI in 2022. It is expected to be a breakthrough in advanced analytics in the field of supply chain planning.

Restraints

Restraints

- High implementation cost is expected to hamper the growth of the global market.

Deploying advanced SCM solutions involves huge capital investments in infrastructure and technologies, which is expected to hinder the growth of the supply chain management industry. However, organizations depend on outdated legacy systems that are not compatible with advanced SCM tools and solutions, which in turn further pose difficulty in integration.

Opportunities

Opportunities

- Globalization is expected to foster growth opportunities in the global market.

An increasing number of businesses are expanding their supply chain globally, which is making the process more complex and challenging. Therefore, organizations are adopting advanced SCM solutions to comply with trade agreements, international regulations, and tariff fulfillment.

Additionally, surging global disruption is another major factor positively impacting the growth of the industry. There is a rising need for real-time visibility for businesses to navigate complex scenarios quickly, which, in turn, is also expected to support the growth of the industry. Real-time visibility improves decision-making capabilities and eliminates the possible chances of risk.

Therefore, all these factors are expected to foster growth opportunities in the global supply chain management market. For instance, Oracle came up with Supplier Rebate Management in 2022 to automate the trade program processes and settlement in the cloud.

Challenges

Challenges

- Lack of skilled workforce is a big challenge in the global market.

Managing advanced SCM solutions requires a proficient staff or workforce who can handle technologies like big data, AI, and automation. However, the lack of such professionals, particularly in the given areas, is a big challenge in the supply chain management industry.

Segmentation Analysis

Segmentation Analysis

The global supply chain management market can be segmented into industries, enterprise sizes, deployment types, modules, and regions.

On the basis of industries, the market can be segmented into process, discrete, and others. Discrete segment accounts for the largest share of the supply chain management industry during the forecast period. The discrete segment deals with producing and distributing items that can be counted individually.

Advancements in automation and robotics are the major factors fueling the growth of the segment. Many organizations use automated manufacturing processes and robotics to boost productivity and operational efficiency. However, it also leads to fewer errors. Also, IoT devices offer real-time visibility, thereby attracting end-users. Therefore, these factors are expected to contribute immensely towards the growth of the segment.

On the basis of enterprise sizes, the market can be segmented into large enterprises and small & medium enterprises. Small and medium enterprises are the fastest-growing segment in the global supply chain management market during the period. SMEs face many challenges in managing the supply chain because of the lack of expertise and resources, which further makes them more inclined towards supply chain management solutions.

Increasing affordability and availability of supply chain management solutions is likely to foster more growth opportunities in the market. The growth of e-commerce is also likely to support the growth of the segment. SMEs are trying to reach global markets with a widening scope of e-commerce. Supply chain solutions are more agile and flexible in nature, and therefore, they help businesses to quickly adapt to market changes.

These solutions help with real-time traceability & data analytics and, therefore, help businesses act accordingly. Additionally, these solutions help businesses work closely with suppliers, partners, and logistic providers, which further helps eliminate the risk associated with supply chain disruptions.

On the basis of deployment types, the market can be segmented into cloud and on-premise. The cloud segment is likely to dominate the supply chain management industry during the forecast period. Growing demand for real-time data insights in supply chain operations is fostering demand for cloud models in the market. The ongoing digital transformation initiatives to improve efficiency and streamline processes are further expected to support the growth of the segment. Cloud-based models integrate well with cloud applications like CRM and ERP, which is another major factor fueling the growth of the segment.

On the basis of modules, the market can be segmented into inventory management, software servicing & procurement, warehouse management systems, transportation management systems, and others. The transportation management system segment is anticipated to witness significant developments in the global supply chain management market in the coming years. The boom of e-commerce is leading to a high demand for efficient transport management solutions in the market.

Also, businesses are more inclined towards these solutions to offer better customer satisfaction, manage last-mile delivery, and optimize logistics operations. Also, organizations are looking forward to lowering logistic costs, managing carriers, optimizing routes, and improving load planning. The ongoing technological advancements like machine learning and artificial intelligence are further improving the capabilities and functioning of these solutions, which is expected to widen the scope of the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 20.41 Billion |

Projected Market Size in 2032 |

USD 42.21 Billion |

CAGR Growth Rate |

19.00% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Epicor Software Corporation, Korber AG, American Software Inc., IBM, Coupa Software Inc., Manhattan Associates, Infor, Blue Yonder Inc., Oracle, SAP SE, and Others. |

Key Segment |

By Industries, By Enterprise Sizes, By Deployment Types, By Modules, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global supply chain management market during the period. The rising attention of people in the region towards sustainability is one of the major factors boosting the market growth in North America. Organizations in the region are adopting different tools for demand forecasting, supply chain optimization, and many others, which is further fostering demand for supply chain management solutions in the region.

Also, businesses are collaborating with their supply chain partners for better coordination and communication across the supply chain, which is also likely to support the growth of the regional market. The rising trend of reassuring the operations to eliminate risk because of supply chain disruptions and political factors is further boosting demand for supply chain management solutions in North America.

Countries like the US witness upgrading regulatory requirements associated with trade transportation and environmental sustainability, which can cause financial loss to the organizations, and therefore, it is further leading to the high adoption rate of SCM solutions in the market.

Asia Pacific is another major region in the supply chain management industry that is likely to witness considerable growth in the coming years. Countries like China, India, Japan, and other Southeast Asian nations are driving the fast expansion of manufacturing and service sectors, which is a major factor in the high growth rate of the regional market.

Also, the presence of strong market players in the region is expected to push the market's growth in APAC. The ongoing industrialization in APAC is also a major reason for boosting the manufacturing and logistic solution requirements in the market.

Also, there is a rising trend of e-commerce, which further encourages organizations to adopt supply chain solutions to manage inventory and distribution processes. Rising regional trade agreements are also creating opportunities in APAC. Therefore, all these factors are likely to fuel the growth of the regional market in the coming years. For instance, Blue Yonder and Snowflake collaborated in 2022 to disparate data for supply chain management.

Competitive Analysis

Competitive Analysis

The key players in the global supply chain management market include:

- Epicor Software Corporation

- Korber AG

- American Software Inc.

- IBM

- Coupa Software Inc.

- Manhattan Associates

- Infor

- Blue Yonder Inc.

- Oracle

- SAP SE

For instance, Descartes unveiled a ShipRush multi-carrier parcel and less than truckload in 2022. This integration helps customers enhance their warehouse and shopping performance.

The global supply chain management market is segmented as follows:

By Industries Segment Analysis

By Industries Segment Analysis

- Process

- Discrete

- Others

By Enterprise Sizes Segment Analysis

By Enterprise Sizes Segment Analysis

- Large Enterprises

- Small & Medium Enterprises

By Deployment Types Segment Analysis

By Deployment Types Segment Analysis

- Cloud

- On-Premise

By Modules Segment Analysis

By Modules Segment Analysis

- Inventory Management

- Software Servicing And Procurement

- Warehouse Management Systems

- Transportation Management Systems

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Epicor Software Corporation

- Korber AG

- American Software Inc.

- IBM

- Coupa Software Inc.

- Manhattan Associates

- Infor

- Blue Yonder Inc.

- Oracle

- SAP SE

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors