Search Market Research Report

Global Whipped Topping Market Size, Share Global Analysis Report, 2019–2026

Global Whipped Topping Market By Type (100% dairy, Dairy blend and non-dairy), By Sales Channel(Bakery, Beverage, Casual Dining and HORECA), By application (Food Service (B2B) and Retail): China Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the Whipped Topping industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the Whipped Topping market. The report study analyzes the market statistics at the global as well as the regional levels to gain an in-depth perspective of the overall Whipped Topping market.

The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volume (K Units) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

- Our primary respondents believed the market to witness a steady growth of 6.8% over the forecast period on account of rising demand from the Bakery and confectionery industry across China and.

- Some of the CXOs predict the population in China is growing rapidly; this has also increased the average disposable income of households, driving the sales of whipped toppings in China. Furthermore, they also conveyed that whipped cream producers are now partnering with local players to increase their goodwill in the ever-competitive market ecosystem in China.

- Some of the industry experts interviewed in China revealed that the bakery segment in the sales channel category is expected to generate considerable revenues for the Whipped Topping industry in China.

- Whipped cream producers across China are focused on introducing nutritional creams which are low in saturated fat, to cater to healthier food category.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend focusing on China’sWhipped Topping market since their calculations revealed that this region turned out to be the top investment pocket across the globe.

- The major reason behind the upsurge growth and lucrative opportunities underlying in this China is the growing consumption of bakery products in China.

- The non-dairy segment led the China Whipped Topping market by accounting a share of almost 48% owing to the advantages provided by non-dairy products such as low fat, low carbohydrates, and others Increasing digitization has widened the range of application of Whipped Toppings.

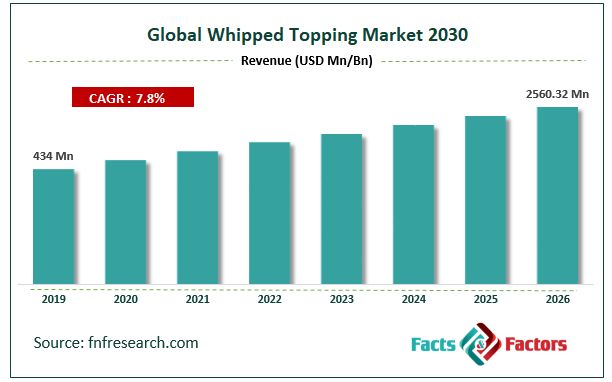

- Furthermore, the bakery segment in the sales channel category led the market by accounting to 434 million in 2019. The beverage segment under the sale channel category is expected to grow with a CAGR of 7.8% during the forecasted time period.

- The executive summary of the report reads the total market opportunity underlying in the ChinaWhipped Topping market is nearly USD 2560.32 million during the forecast period.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the Whipped Topping market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the Whipped Topping market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the Whipped Topping market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the Whipped Topping market.

The research study provides a critical assessment of the Whipped Topping industry by logically segmenting the market on the basis of type, sales channel, and application. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026.

Whipped topping is a type of food topping that is prepared by blending cream with whisks or mixers. Whipped topping is generally made of dairy as well as vegetable oils with or without added flavors. The food industry is one of the most rapidly growing industries in China.

The whipped toppings market in China is experiencing an upsurge with an increasing number of cafes and bakery products across the country. Whipped toppings are frequently used to top coffee, milkshakes, fruits, and others. With an increasing number of organized retail outlets such as Starbucks, Chanel’s Coco Café, Costa Coffee and others in China the demand for whipped toppings is increasing steadily. The increasing population has also led to an increase in the average disposable income of people in China; this is expected to be one of the driving forces of China’s whipped topping market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 434 million |

Projected Market Size in 2026 |

USD 2560.32 million |

CAGR Growth Rate |

7.8% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

China include Rich Products Corporation, Westland Co-operative Dairy Company Limited, Fonterra Co-operative Group, Nestlé SA, Fuji Oil Holdings Inc., GranaroloS.p.A., Bi Lei International (Shanghai) Co Ltd., Lactalis China, China Mengniu Dairy Company Limited, Inner Mongolia Yili Industrial Group Co. Ltd., Savencia SA, Qingdao Kesong Food Co. Ltd., and others. |

Key Segment |

By Type, By Application, By Sales Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The Whipped Topping market is categorized by type, sales channel and by application. Furthermore, by type, the market is divided into 100% dairy, dairy blend, and non-dairy. On the basis of the sales channel, the market is classified into bakery, beverage, casual dining and HORECA. In addition, based on application type the market is dived into food services (B2B) and Retail.

Some of the key players operating in the Whipped Topping market:

Some of the key players operating in the Whipped Topping market:

- China include Rich Products Corporation

- Westland Co-operative Dairy Company Limited

- Fonterra Co-operative Group

- Nestlé SA

- Fuji Oil Holdings Inc.

- GranaroloS.p.A.

- Bi Lei International (Shanghai) Co Ltd.

- Lactalis China

- China Mengniu Dairy Company Limited

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Savencia SA

- Qingdao Kesong Food Co. Ltd.

- and others.

The taxonomy of the Whipped Topping Market by its scope and segmentation is as follows:

China Whipped Topping Market: By Type Segmentation Analysis

China Whipped Topping Market: By Type Segmentation Analysis

- 100% dairy

- Dairy blend

- Non-dairy

China Whipped Topping Market: By Application Segmentation Analysis

China Whipped Topping Market: By Application Segmentation Analysis

- Food Service (B2B)

- Retail

China Whipped Topping Market: By Sales Channel Segmentation Analysis

China Whipped Topping Market: By Sales Channel Segmentation Analysis

- Bakery

- Beverage

- Casual Dining

- HORECA

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and application Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- China include Rich Products Corporation

- Westland Co-operative Dairy Company Limited

- Fonterra Co-operative Group

- Nestlé SA

- Fuji Oil Holdings Inc.

- GranaroloS.p.A.

- Bi Lei International (Shanghai) Co Ltd.

- Lactalis China

- China Mengniu Dairy Company Limited

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Savencia SA

- Qingdao Kesong Food Co. Ltd.

- and others.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors