Search Market Research Report

Travel Insurance Market Size, Share Global Analysis Report, 2022 – 2028

Travel Insurance Market Size, Share, Growth Analysis Report By Coverage Type (Single-Trip Travel Insurance and Annual Multi-Trip Travel Insurance), By Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), By End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

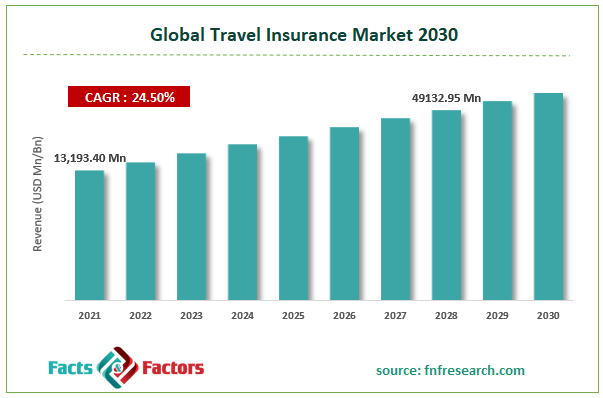

[235+ Pages Report] According to the report published by Facts & Factors, the global travel insurance market size was worth USD 13,193.40 million in 2021 and is estimated to grow to USD 49,132.95 million by 2028, with a compound annual growth rate (CAGR) of approximately 24.50% over the forecast period. The report analyzes the travel insurance market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the travel insurance market.

Market Overview

Market Overview

Travel insurance is a type of insurance that provides coverage for any unanticipated or unpleasant losses that may occur while traveling (either internationally or domestically). While more thorough travel insurance plans might also cover trip cancellation, lost luggage, public liability, delayed flights, and other unforeseen expenses, standard travel insurance plans typically only cover medical emergencies. It is in effect from the day of departure till the insured person gets home. Nowadays, many companies provide travel insurance with 24/7 emergency services, such as replacing lost passports, assisting with money wires, and rebooking postponed flights. They also offer customization options based on the requirements of the insured persons and their geographical location. Rising tourism demand following the pandemic is one factor driving the growth of the global travel insurance market. Another is the overall increase in insurance coverage. During the projected period, new technology advancements in the travel insurance sector are anticipated to offer a wide range of chances for the market's growth.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic-related slowdowns in the travel and hospitality sectors contributed to a considerable decline in the global travel insurance market during that time. The travel insurance business is anticipated to expand in the upcoming years despite the average travel scene reverting to pre-pandemic levels.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global travel insurance market value is expected to grow at a CAGR of 24.50% over the forecast period.

- In terms of revenue, the global travel insurance market size was valued at around USD 13,193.40 million in 2021 and is projected to reach USD 49,132.95 million by 2028.

- Rising tourism demand following the pandemic is one factor driving the growth of the travel insurance market. Another is the overall increase in insurance coverage.

- By coverage type, the single-trip travel insurance category dominated the market in 2021.

- By end-user, the business traveler category dominated the market in 2021.

- North America dominated the global travel insurance market in 2021.

Growth Drivers

Growth Drivers

- Rising tourism demands to drive the global market growth

The global travel insurance market is expanding due to the increase in tourism brought on by the ease with which travelers can book flights online using smartphones and websites that offer a wide selection of vacation packages. The rise in tourism may cause several incidents, including flight disruptions, lost luggage, and medical issues. Customers choose travel insurance to reduce these risks, a major element fueling the market's expansion. Furthermore, solution providers should benefit greatly during the forecast period by integrating cutting-edge technologies like Artificial Intelligence (AI), data analytics, and machine learning with GPS to improve the current travel insurance platform.

Restraints

Restraints

- Lack of awareness about insurance policies may hinder the market growth

During the anticipated time, the lack of knowledge about insurance products could significantly impede the expansion of the travel insurance market. Further, the low penetration of insurance policies restrains the market's expansion.

Segmentation Analysis

Segmentation Analysis

The global travel insurance market has been segmented into coverage type, distribution channel, end-user, and region.

Based on the coverage type, the travel insurance market is segregated into single-trip travel insurance and annual multi-trip travel insurance. Among these, the single-trip travel insurance segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Due to the increase in business travel and disposable cash, safe travel is becoming more and more necessary. However, more readily available and less expensive travel has made it possible for many families and completely autonomous travelers to take multiple trips in a year, leading to a significant increase in the need for yearly multi-trip travel insurance, fueling the expansion of this market.

Based on the distribution channel, the travel insurance market is segregated into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. Among these, the insurance companies segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Insurance companies provide insurance with many offers and discounts to customers.

Based on end users, the travel insurance market is segmented into senior citizens, education travelers, business travelers, family travelers, and others. Among these, the consumer electronics segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Many businesses purchase travel insurance to protect their employees who travel internationally on business. As more individuals are immunized, and travel restrictions are loosened, business travel is gradually recovering across the globe. Corporate travelers feel more at ease returning to their regular work life, which assists the market's expansion.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 13,193.40 Million |

Projected Market Size in 2028 |

USD 49,132.95 Million |

CAGR Growth Rate |

24.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ALLIANZ, AXA, Insure and Go Insurance Services Limited, Seven Corners Inc., AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., Trip Mate Inc., Travel Insured International, Travel Safe Insurance, USI INSURANCE SERVICES LLC. , and Others |

Key Segment |

By Coverage Type, Distribution Channel, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the travel insurance market in 2021

In 2021, North America dominated the global travel insurance market due to the growing trend of travelers acquiring yearly travel insurance packages to avoid the hassle of doing so for each trip. The market will experience tremendous expansion spurred by the easing of travel restrictions and government lockdown. For those traveling domestically, the domestic travel insurance plan provides substantial coverage. Domestic travel insurance policies are created expressly for various U.S. cities and places to make travel hassle-free. Spending on travel protection plans is rising, which supports domestic market expansion as its coverage provides full compensation in unforeseen circumstances. Business trips are rising as this country's market participants become more numerous. A single comprehensive solution and multiple trip insurance eliminate the hassle of getting a new plan for each trip. These insurance contracts offer straightforward renewal, financial assistance, and document clearance.

Competitive Landscape

Competitive Landscape

- ALLIANZ

- AXA

- Insure and Go Insurance Services Limited

- Seven Corners Inc.

- AMERICAN INTERNATIONAL GROUP INC.

- Assicurazioni Generali S.P.A.

- Trip Mate Inc.

- Travel Insured International

- Travel Safe Insurance

- USI INSURANCE SERVICES LLC.

Global Travel Insurance Market is segmented as follows:

By Coverage Type

By Coverage Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

By Distribution Channel

By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End-User

By End-User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ALLIANZ

- AXA

- Insure and Go Insurance Services Limited

- Seven Corners Inc.

- AMERICAN INTERNATIONAL GROUP INC.

- Assicurazioni Generali S.P.A.

- Trip Mate Inc.

- Travel Insured International

- Travel Safe Insurance

- USI INSURANCE SERVICES LLC

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors